Interview on CNBC: Discussing the Outlook for Mortgage Rates and Impact of Rising Tenure Length on Housing Supply

By

FirstAm Editor on June 25, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC last week and discussed the outlook for mortgage rates and the impact of rising tenure length on housing supply.

Read More ›

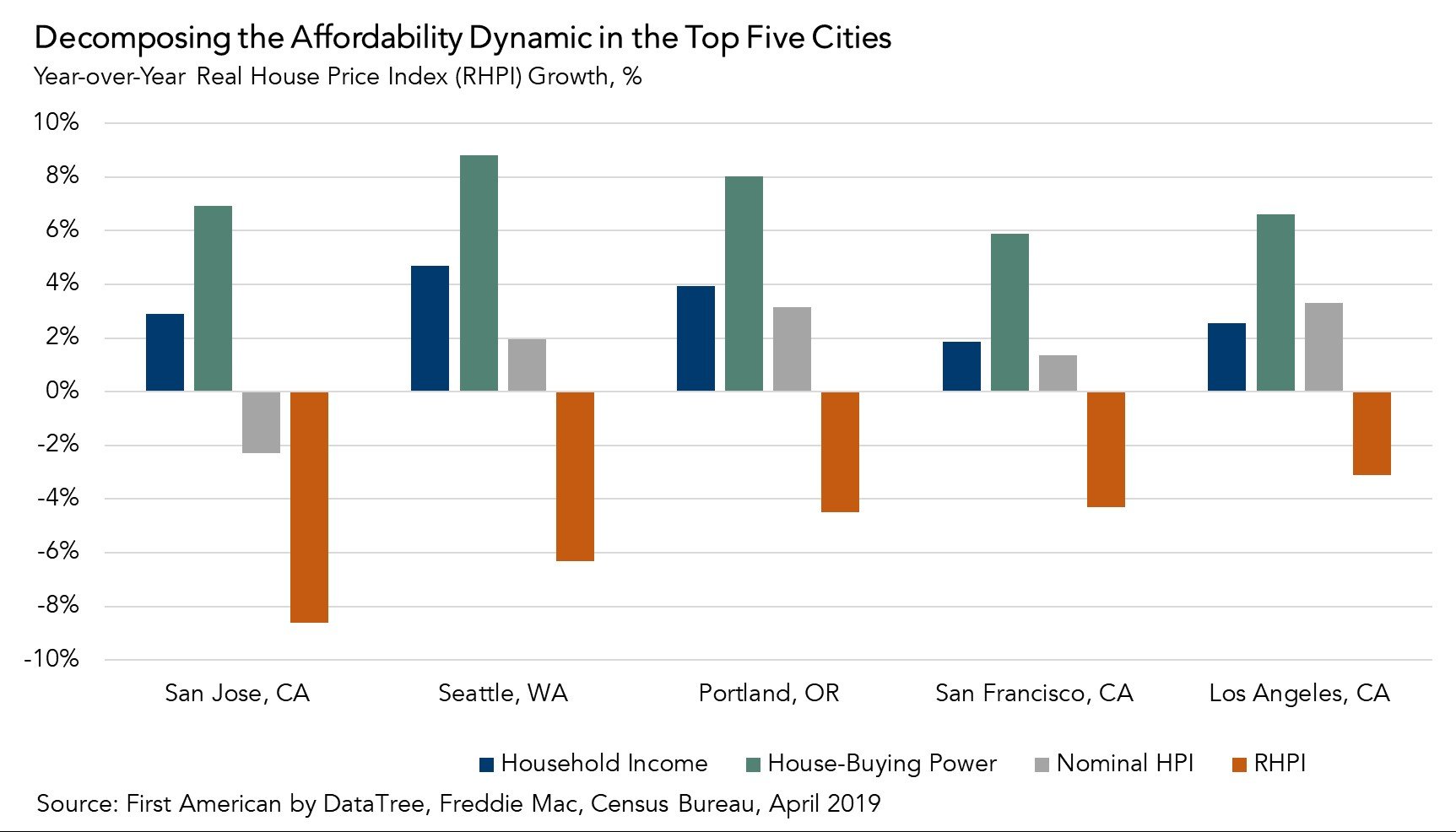

The Five Cities Where Affordability Improved the Most and Why

By

Mark Fleming on June 24, 2019

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in April. The 30-year, fixed-rate mortgage fell by 0.33 percentage points and household income increased 2.7 percent compared to April 2018. When household income rises, consumer house-buying power ...

Read More ›

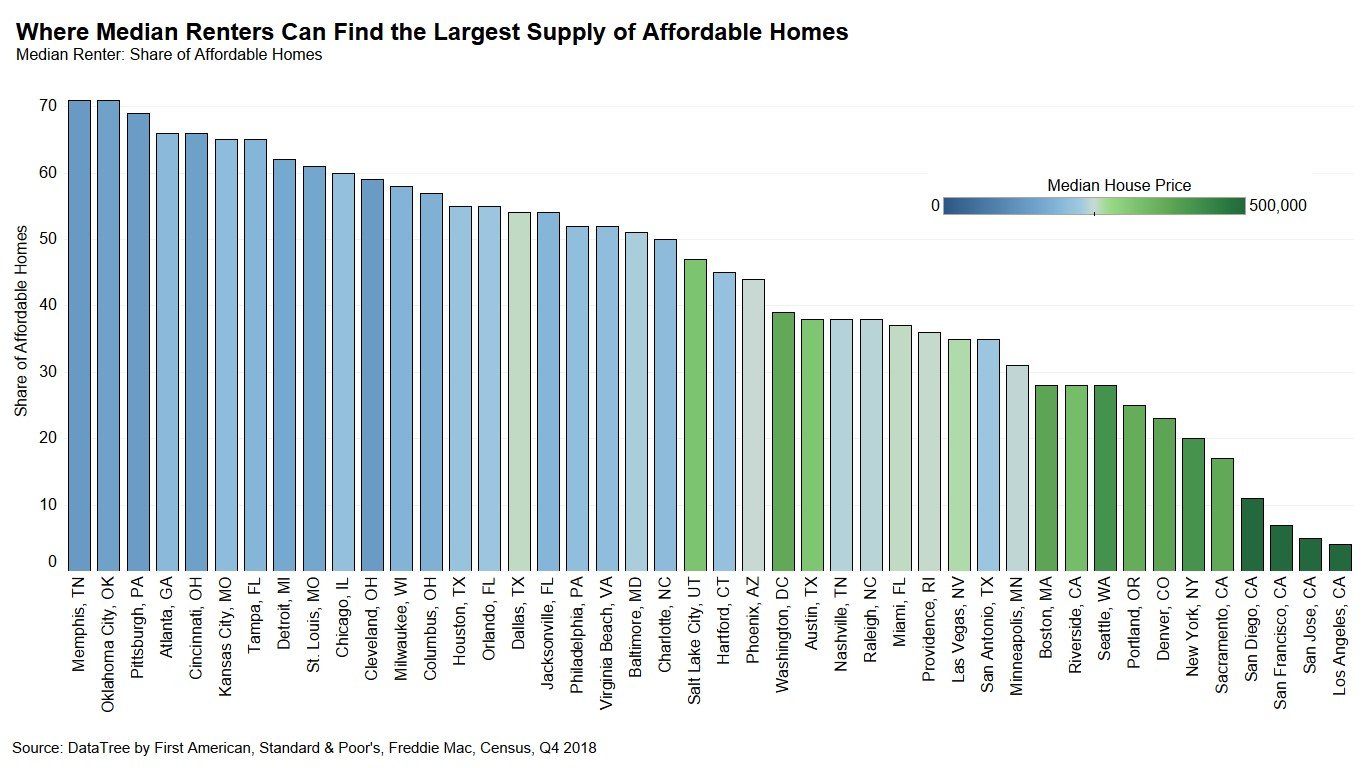

Top 10 Cities with the Largest Supply of Affordable Homes for First-Time Home Buyers

By

Odeta Kushi on June 13, 2019

Faced with often misleading affordability metrics and seemingly challenging housing market dynamics, many renters may underestimate their house-buying power and the supply of homes in their market that they can afford. Potential first-time home buyers can benefit from a more targeted examination of affordability, which begins by accurately ...

Read More ›

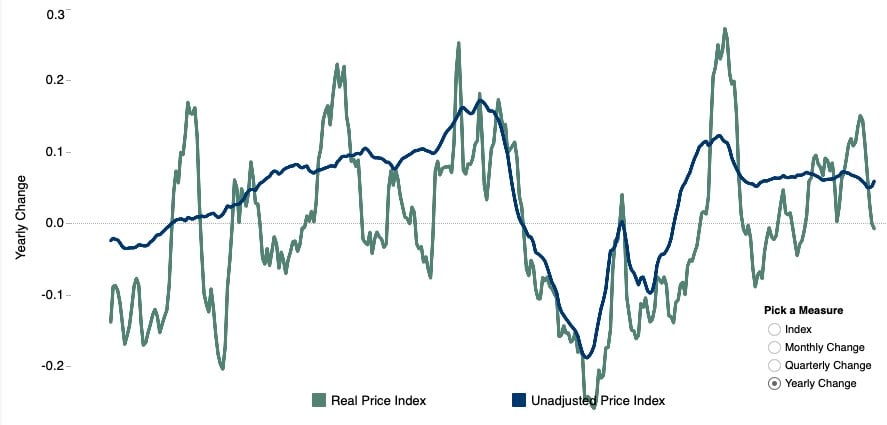

Expect the Unexpected -- Faster House Price Appreciation

By

Mark Fleming on June 6, 2019

In our most recent Potential Home Sales Model analysis, we noted that the housing market’s potential improved in April because falling mortgage rates and rising household income combined to increase consumer house-buying power more than enough than to offset house price appreciation. In other words, house-buying power won the tug of war with house ...

Read More ›

Interviews on Yahoo! Finance and Nightly Business Report: Discussing existing-home sales, the housing supply squeeze and the market forces helping affordability

By

FirstAm Editor on May 24, 2019

First American Chief Economist Mark Fleming was interviewed on Yahoo! Finance and Deputy Chief Economist Odeta Kushi on Nightly Business Report earlier this week and discussed the existing-home sales data for April, the housing supply squeeze and the market forces helping affordability.

Read More ›

Interviews on FOXBusiness and CNBC: Discussing the Outlook for the Housing Market and Economy and the Impact of Tax Law Changes

By

FirstAm Editor on May 22, 2019

First American Chief Economist Mark Fleming was interviewed on FOXBusiness and CNBC on Tuesday and discussed the outlook for the housing market and broader economy as well as the impact of tax law changes on housing.

Read More ›