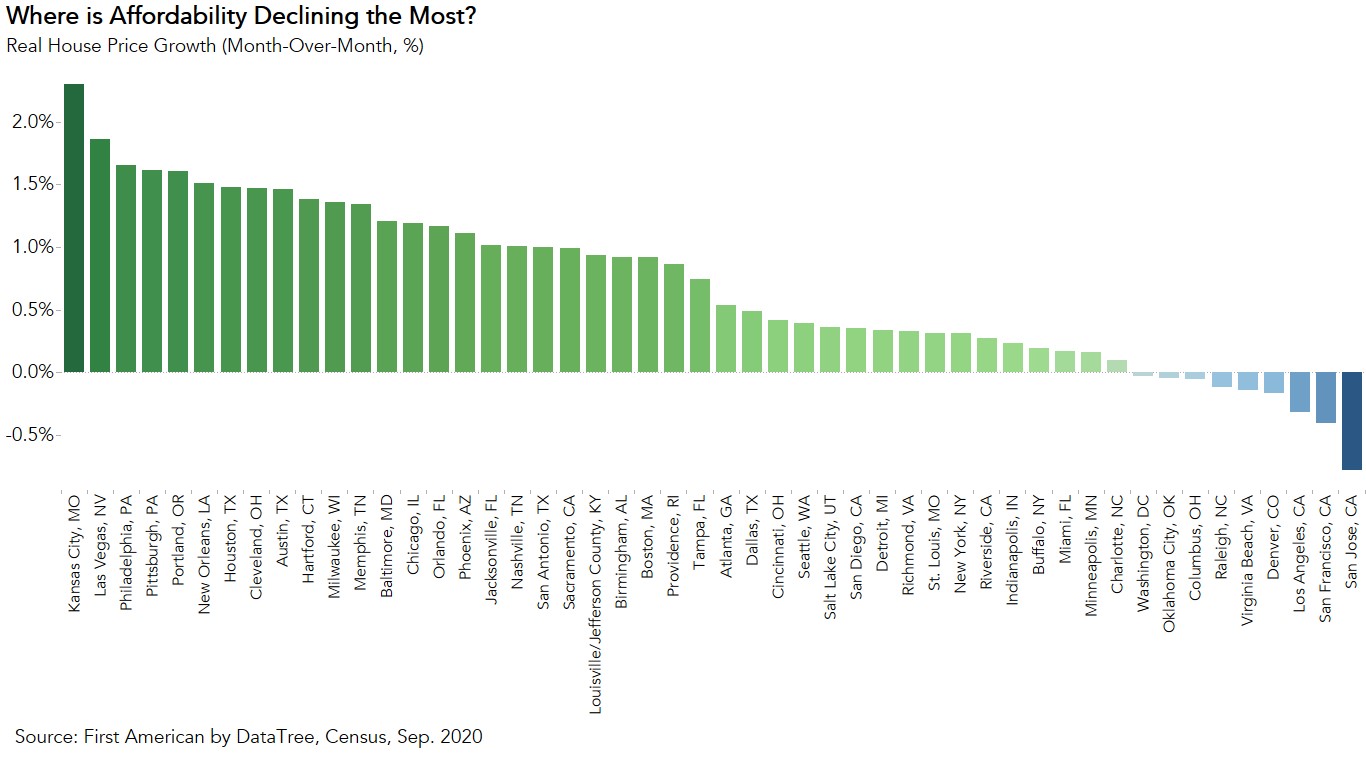

The Five Cities Where Affordability Declined the Most

By

Mark Fleming on November 23, 2020

Affordability declined month over month in September for the second month in a row, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability. The 30-year, fixed-rate mortgage fell by 0.05 percentage points and household income increased 0.2 percent ...

Read More ›

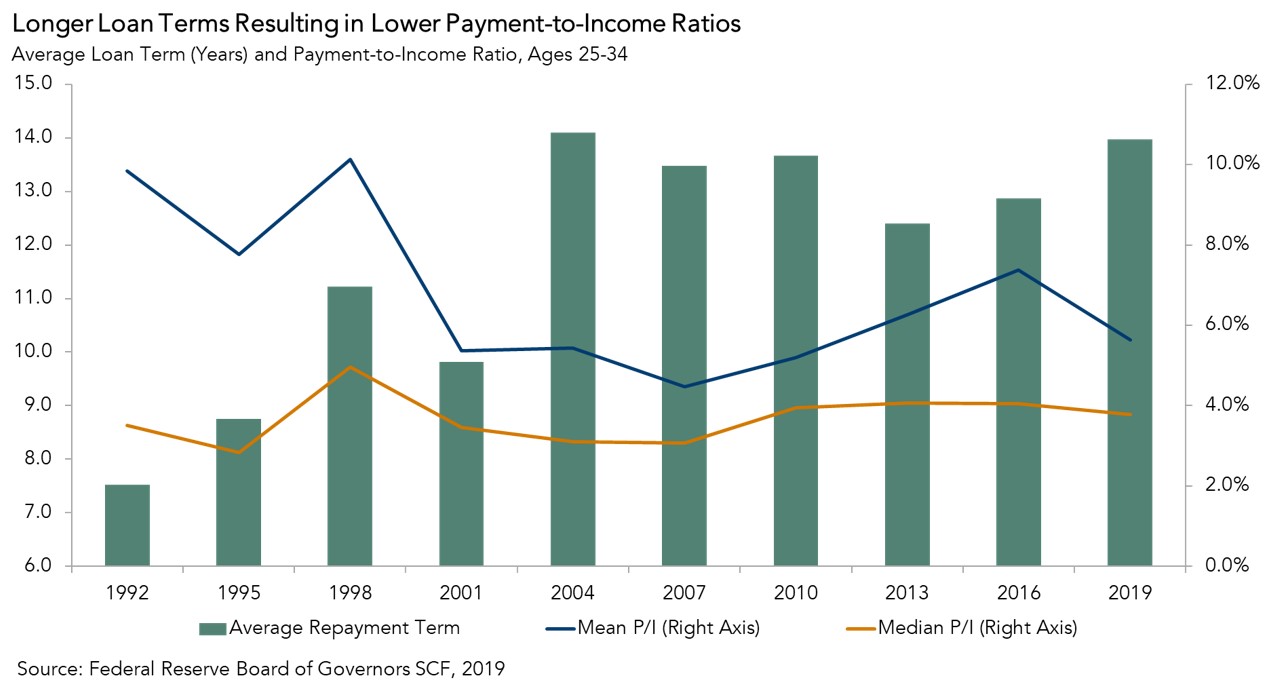

Why the Student Loan Debt Burden is Overstated

By

Odeta Kushi on November 19, 2020

Student loans are often cited as an insurmountable barrier to homeownership for young home buyers. It is true that student loan debt levels are higher today than a generation ago, but is it preventing potential home buyers from saving for a down payment? The recently released 2019 Survey of Consumer Finances data highlights some important trends ...

Read More ›

What Does the Housing Market’s Historic Pandemic Rebound Mean for 2021?

By

Mark Fleming on November 18, 2020

The housing market’s historic rebound since bottoming in the spring has been nothing short of amazing. After falling to a near-decade low in May, existing-home sales hit a 14-year high in September. In October, our measure of market potential for existing-home sales increased 9.0 percent compared with one year ago to a 5.98 million seasonally ...

Read More ›

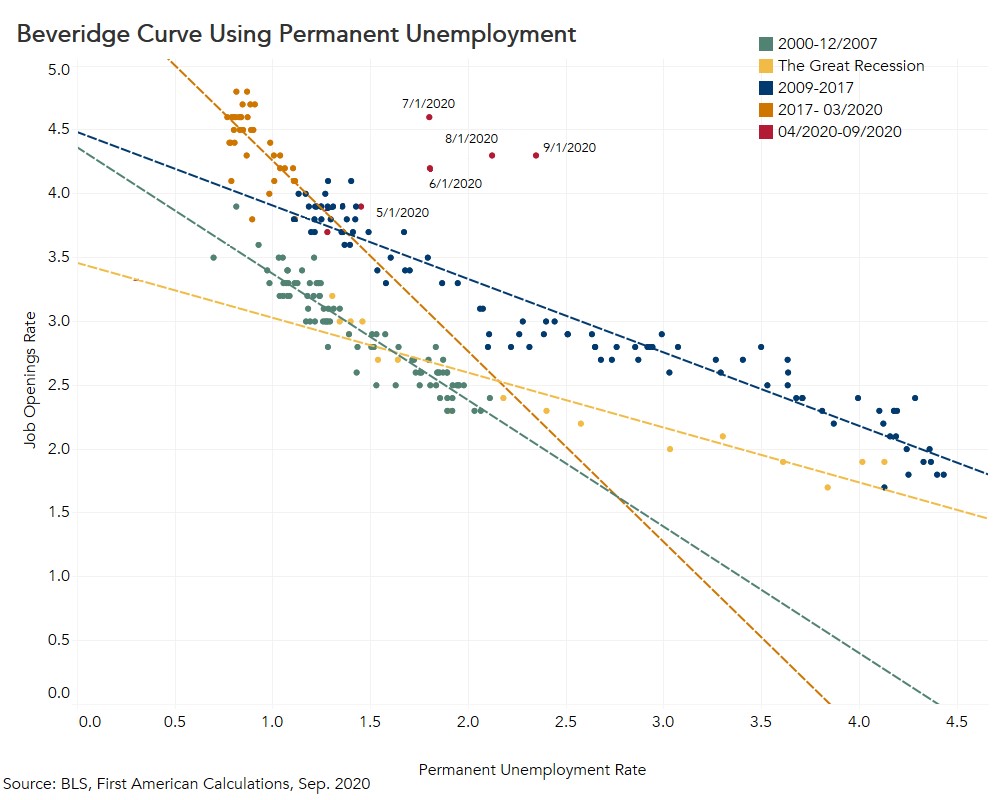

What a Pandemic-Driven Shift in the Labor Market Could Mean for Housing

By

Mark Fleming on November 12, 2020

The October jobs report exceeded consensus expectations for job growth, yet the labor market’s rebound continues to slow. Higher frequency data from weekly jobless claims confirm the slowdown, as the level of new jobless filings is not falling as quickly in recent months. COVID-19 cases are on the rise and there is increasing likelihood of a ...

Read More ›

Interview with Yahoo! Finance: Explaining the Housing Market’s Resilience in the COVID-19 Era

By

FirstAm Editor on November 9, 2020

First American Deputy Chief Economist Odeta Kushi was interviewed on Yahoo! Finance earlier this month, discussing why the housing market is better positioned in this recession than it was heading into the Great Recession, and how low rates and millennials are driving demand.

Read More ›

Homeownership Remains Strongly Linked to Wealth-Building

By

Odeta Kushi on November 5, 2020

Economists study homeownership and policymakers often emphasize it because homeownership is an effective way to build wealth, especially for low-income households. In fact, quantifying the wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

Read More ›