Building Wealth Brick by Brick

By

Ksenia Potapov on December 4, 2023

Homeownership is often touted as one of the most effective ways to build wealth, especially for lower income households, for several reasons. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners. ...

Read More ›

What’s the Outlook for the Housing Market in 2024?

By

Mark Fleming on November 29, 2023

The housing market has been on quite the roller coaster ride since the beginning of the pandemic. While it was strong prior to 2020, the onset of the pandemic and the societal changes it triggered redefined the role of a home. As work-from-home became the new normal, a house was no longer just a dwelling or a vehicle for wealth creation, but also ...

Read More ›

Could the Affordability Crunch Ease in 2024?

By

Mark Fleming on November 28, 2023

In September 2023, the Real House Price Index (RHPI) jumped up by 15 percent on an annual basis, dragging housing affordability to the lowest point in over three decades. Two factors drove the sharp annual decline in affordability – a 6.2 percent annual increase in nominal house prices, according to our First American Data & Analytics House ...

Read More ›

The Blight, the Bright, and What Seems Just Right in 2024

By

Mark Fleming on November 21, 2023

The surge in mortgage rates from mid-2022 through 2023 triggered a housing recession, with the most pronounced impact felt in a steep decline in sales, while prices have remained relatively stable. Specifically, existing-home sales plunged to a more than 12-year low in September of this year. Rising mortgage rates have a dual impact on the housing ...

Read More ›

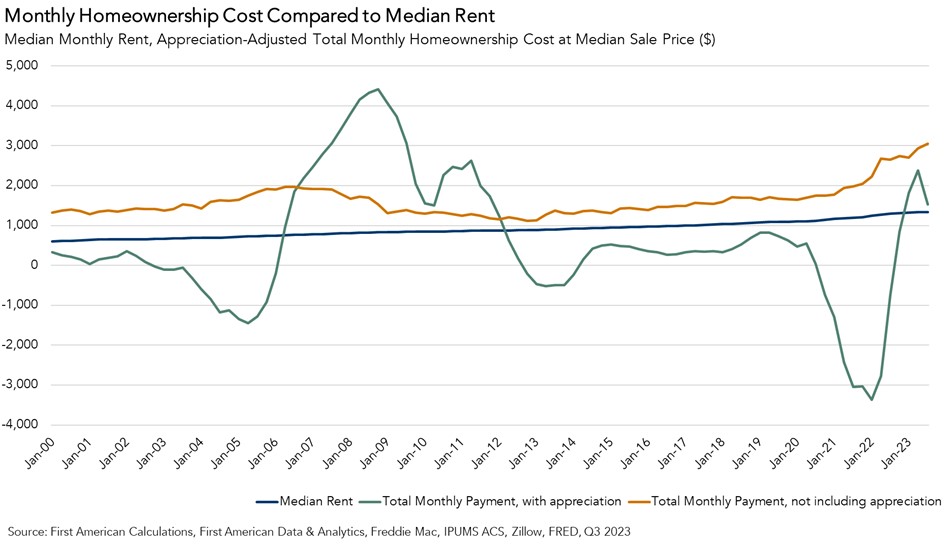

Will Re-Accelerating House Price Appreciation Flip the Rent vs. Own Dynamic Again?

By

Mark Fleming on October 31, 2023

In August 2023, the Real House Price Index (RHPI) jumped up by nearly 25 percent on an annual basis, dragging housing affordability to the lowest point in over three decades. Two factors drove the sharp annual decline in affordability – a 5.4 percent annual increase in nominal house prices, according to our First American Data & Analytics ...

Read More ›

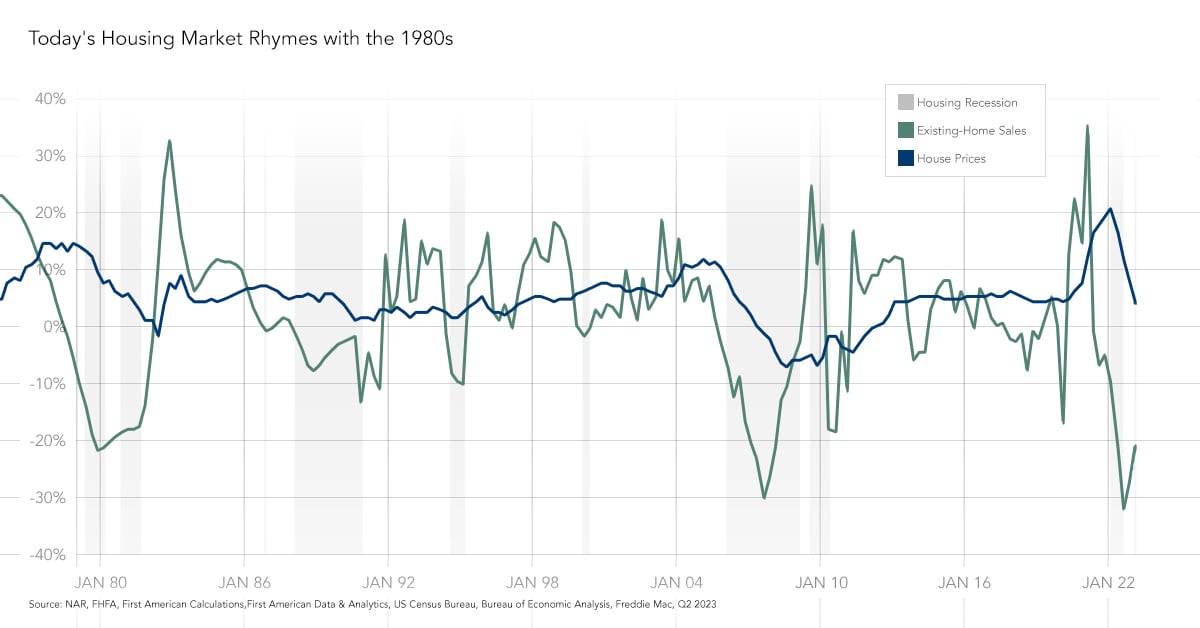

1980s Déjà Vu for the Housing Market

By

Mark Fleming on October 17, 2023

The average 30-year, fixed mortgage rate trended upward throughout September, approaching 8 percent in early October. Higher mortgage rates have a dual impact on the housing market – reducing affordability for buyers and strengthening the rate lock-in effect for potential sellers. The combination of reduced affordability and an even stronger rate ...

Read More ›

.jpg)

.jpg)