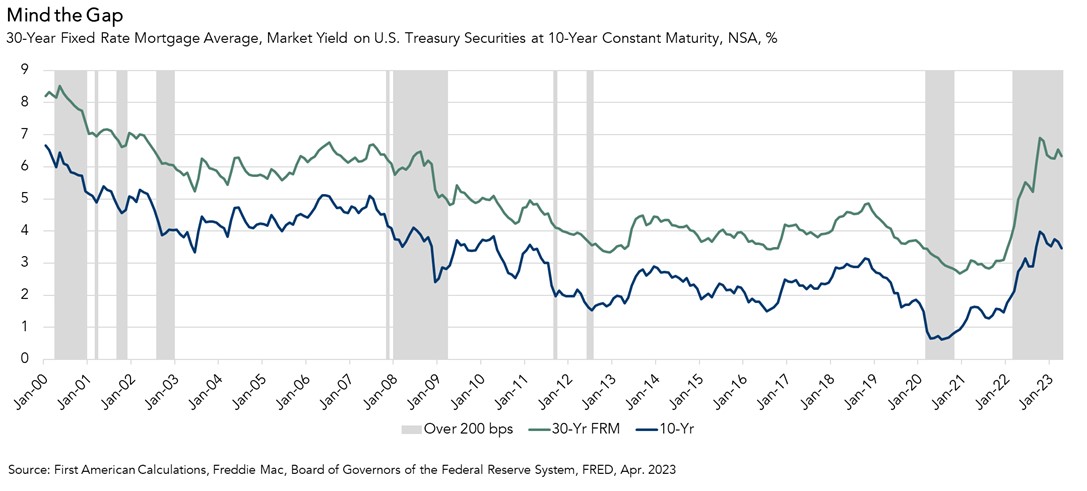

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury bond. Since the end of the Great Recession, the 30-year, fixed mortgage rate has on average remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield. Yet, this spread is not always consistent. It usually widens during periods of economic or geopolitical uncertainty, as is the case in today’s market. Since the year 2000, there have been 59 months, approximately 21 percent of the time, when the average spread was at least 200 basis points.

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Mind the Gap

The spread between the 30-year, fixed mortgage rate and the 10-year yield largely reflects the risks associated with investing in mortgage-backed securities (MBS). An MBS is an investment product consisting of a pool of mortgages. MBS are somewhat like a government bond, and investors looking for a steady return might consider them almost substitute goods. The primary difference is that MBS are riskier than government bonds. The additional risks involved in MBS can be grouped into four primary categories: prepayment risk, duration risk, credit risk, and supply and demand dynamics for MBS.

Prepayment risk: One difference between U.S. Treasury bonds and MBS is that the U.S. Treasury doesn’t pay any principal until the Treasury bond matures. The investor is paid interest for the term of the bond and then the principal value of the bond at the date of maturity. However, MBS work differently, as borrowers have the option to refinance their mortgage or sell their home at any time and pay off the loan. That principal is “passed-through” to the investor and the investor stops receiving the interest payments associated with that paid off loan, reducing cash flows to investors and potentially putting the investor in the position of having to reinvest at current, oftentimes lower, market rates. When an investor buys an MBS, they are not sure exactly how quickly that will happen – this is known as prepayment risk. Investors need to be compensated for that risk relative to the “risk-free” government bond alternative, which contributes to the spread.

Duration risk: The duration of the MBS is tied to the prepayment risk. The faster the prepayments, the quicker the principal is paid back and the shorter the “duration” of the MBS. The slower the prepayments, the longer the duration. The duration of an MBS tends to increase in a rising interest rate environment, as there is less incentive for borrowers to move or refinance. The prepayment rate of the underlying mortgages typically slows down, which extends the life of the MBS and increases its duration. As a result, the spread between the mortgage rate and the 10-year Treasury yield may increase because the MBS investors require more compensation for the increased duration. In the wake of the recent bank turmoil, a duration mismatch between a bank's assets and liabilities, such as having long-duration MBS on their balance sheets and short-term deposits as liabilities, can lead to potential losses and liquidity risk. This may prompt an investor to require a higher yield to compensate for that risk.

Credit risk: Credit risk refers to the risk of default. At any point, borrowers can fail to make a payment on the mortgage underlying an MBS. From the perspective of an MBS investor, the implications of a default depend on whether the MBS is an agency or non-agency MBS. When a borrower defaults, the agency-issuer pays the principal to the investor. However, for non-agency MBS, investors bear the credit losses from a default. Therefore, investors needs to be compensated for the possibility that they won’t get all of their principal back.

Supply and Demand Dynamics: There is an additional factor contributing to the larger-than-usual spread. During the pandemic, the Federal Reserve (Fed) was a large buyer in the secondary market, generating demand for MBS. Strong demand for MBS bids up the price and reduces the return MBS investors expect, so the spread between the mortgage rate and the 10-year Treasury yield decreases because investors are willing to accept a lower yield for the MBS to gain exposure to the mortgage market. Now that the Fed is backing out as a buyer, the spread has widened.

When will the Gap Narrow?

If the spread returned to historic norms, the average 30-year, fixed mortgage rate in April would have been 5.2 percent instead of 6.3 percent. On the one hand, it’s possible that we’ll see a narrowing spread when the Fed finishes its monetary tightening. If the spread narrows, there may be some downward pressure on mortgage rates. On the other hand, the Fed is unlikely to become an MBS buyer again and slower prepayment rates and longer duration are here to stay. It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.