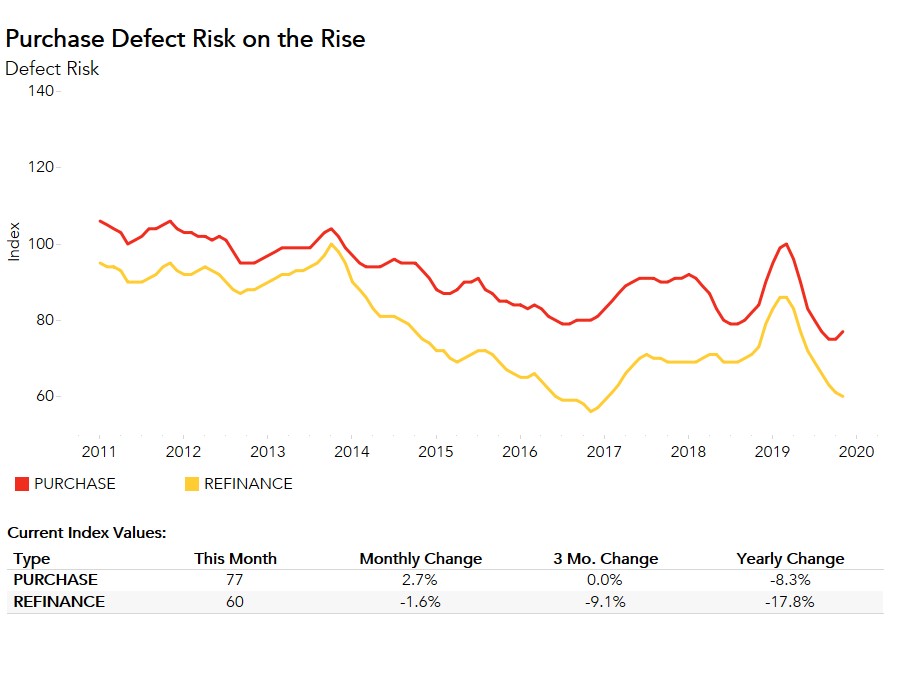

Overall defect risk, as measured by our Loan Application Defect Index, has largely trended down since early 2019 with a few exceptions. In January 2020, this long-run trend continued as overall defect risk reached its lowest level since we began tracking it in 2011. While the Defect Index for purchase transactions remained the same after two months of increasing risk, the Defect Index for refinance transactions fell 5.2 percent compared with the previous month, pulling the overall defect risk levels to this new low point. We can thank the increasing share of less risky refinance transactions for the low levels of defect and fraud risk.

“If the mortgage market composition continues to shift toward refinance transactions in 2020, the risk of defect, fraud and misrepresentation will continue to decline. When refinance transactions boom, fraud risk falls.”

Boom Goes the Fraud Risk

For the majority of 2019, overall fraud risk steadily declined, primarily due to the rising volume of lower risk refinance transactions driven by declining mortgage rates. As mortgage rates fall, the incentive to refinance increases. For many homeowners, the most important consideration of whether to refinance or not is if the mortgage rate is sufficiently lower than their existing rate. In January, with the 30-year, fixed-rate mortgage at its lowest level since November 2016, refinance applications were 146 percent higher than the same week one year ago. Defect, misrepresentation and fraud risk is significantly lower on refinance transactions, so the reduced risk of misrepresentation and fraud is due to the growing share of lower risk refinance transactions within the mortgage market.

This trend has surfaced in previous refinance booms and mini-booms. In 2012, overall fraud risk declined 4.7 percent, as the mortgage rate declined from 3.9 percent to 3.6 percent between the first quarter of 2012 and fourth quarter of 2012 and the share of refinances increased from 68 percent to 72 percent.

Similarly, fraud risk reached a low point in November 2016 amid the refinance boom between the fourth quarter of 2015 and third quarter of 2016, which pushed the share of refinance originations from 46 percent to 51 percent. More recently, between July and August 2019, overall fraud risk fell 4.0 percent month-over-month, as the mortgage rate declined from 3.8 percent to 3.6 percent, triggering a 196-percent jump in refinance volume compared with the same week one year ago. When refinance transactions boom, fraud risk falls.

In February, the 30-year, fixed-rate mortgage fell to its lowest level since October 2016. Refinance mortgage applications in February have already spiked in response, with the industry citing a mini “refinance boom.” If the mortgage market composition continues to shift toward refinance transactions in 2020, the risk of defect, fraud and misrepresentation will continue to decline.

The Defect Index is updated monthly with new data. Look for the next edition of the Defect Index the week of March 30, 2020.

January 2020 Loan Application Defect Index

The First American Loan Application Defect Index showed that in January 2020:

- The frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications decreased by 3.0 percent compared with the previous month.

- Compared to January 2019, the Defect Index decreased by 28.6 percent.

- The Defect Index is down 36.3 percent from the high point of risk in October 2013.

- The Defect Index for refinance transactions decreased by 5.2 percent compared with the previous month, and decreased by 33.7 percent compared with a year ago.

- The Defect Index for purchase transactions remained the same compared with the previous month, and is down 17.9 percent compared with a year ago.

January 2020 State Highlights

- There are no states with a year-over-year increase in defect frequency.

- The five states with the greatest year-over-year decrease in defect frequency are:

- West Virginia (-47.5 percent)

- Indiana (-38.3 percent)

- North Carolina (-37.4 percent)

- Virginia (-37.1 percent)

- Montana (-36.4)

January 2020 Local Market Highlights

- Among the largest 50 Core Based Statistical Areas (CBSAs), there is no market with a year-over-year increase in defect frequency.

- Among the largest 50 Core Based Statistical Areas (CBSAs), the five markets with the greatest year-over-year decrease in defect frequency are:

- Richmond, Va. (-40.7 percent)

- Virginia Beach, Va. (-39.4 percent)

- Indianapolis (-36.7 percent)

- Raleigh, N.C. (-36.5 percent)

- Detroit (-35.8 percent)

Methodology

The First American Loan Application Defect Index estimates the level of defects detected in the information submitted in mortgage loan applications processed by the First American FraudGuard® system. The index is based on the frequency with which defect indicators are identified. The Defect Index moves higher as greater numbers of defect indicators are identified. An increase in the index indicates a rising level of loan application defects. The index, nationally and in all markets, is benchmarked to a value of 100 in January 2011. Therefore, all index values can be interpreted as the percentage change in defect frequency relative to the defect frequency identified nationally in January 2011.