Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

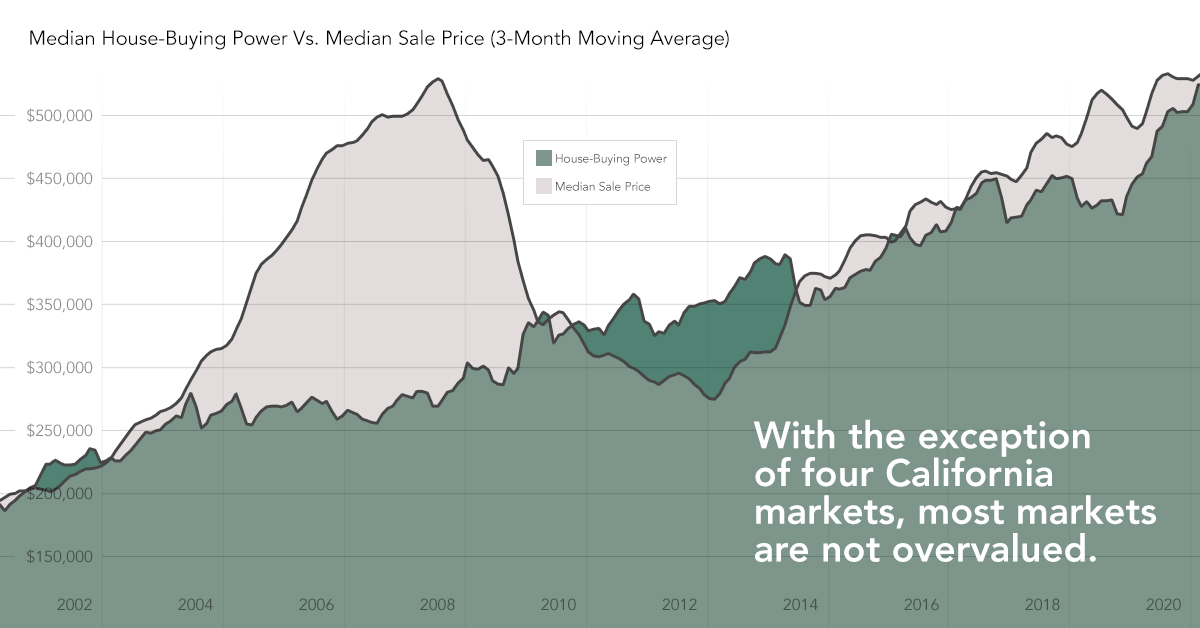

Why Housing Overvaluation is Not as Prevalent as Many Believe

By

Mark Fleming on May 22, 2020

In March, data began to reveal the depth of the impact from the pandemic on the housing market. The number of existing-home sales fell 8.5 percent relative to February, and the number of new listings continued to dwindle. While historically low mortgage rates make it more affordable for those with stable incomes to buy a home, tightening credit ...

Read More ›

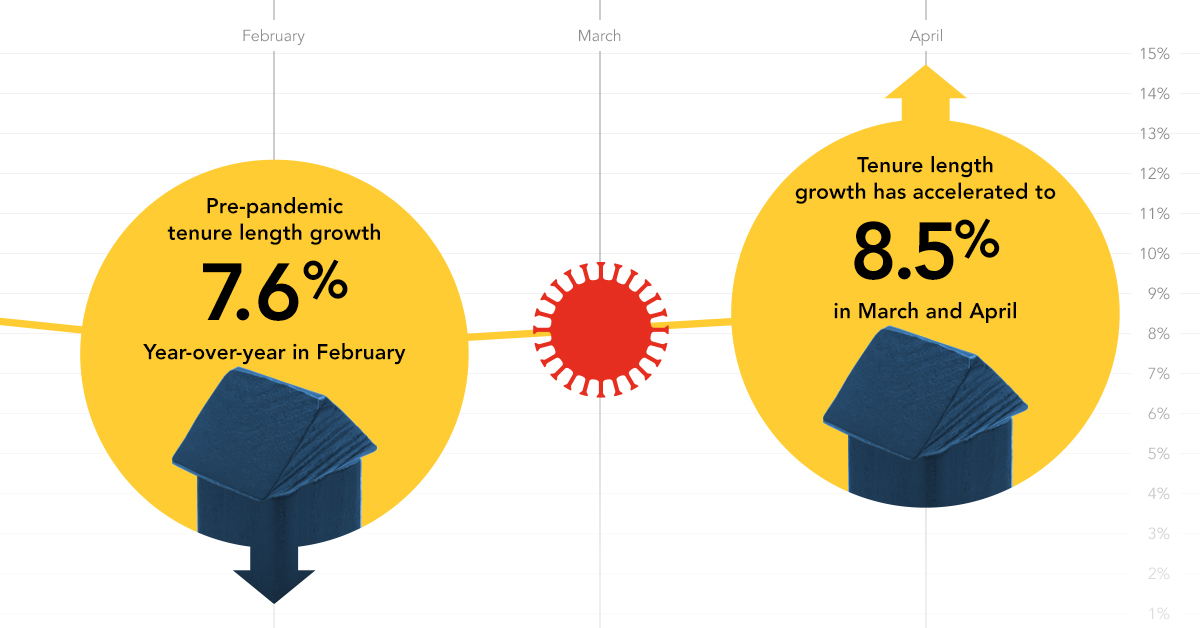

Why the Pandemic Has Worsened the Housing Supply Shortage

By

Mark Fleming on May 20, 2020

The coronavirus pandemic continued its historic assault on the domestic and global economy in April, and the housing market did not go unscathed. Typically, the hot spring home-buying season would be in full swing in April, but pandemic-related impacts, including shelter-in-place orders, the rapid surge in unemployment, and declining consumer ...

Read More ›

Has House Price Appreciation Reached a Tipping Point?

By

Mark Fleming on April 27, 2020

As the coronavirus outbreak continues to affect the domestic and global economy, the housing market has shown that it is not immune to its impact. In March, the number of existing-home sales fell 8.5 percent relative to February, and the number of new listings continued to dwindle. While mortgage rates have fallen due to the current economic ...

Read More ›

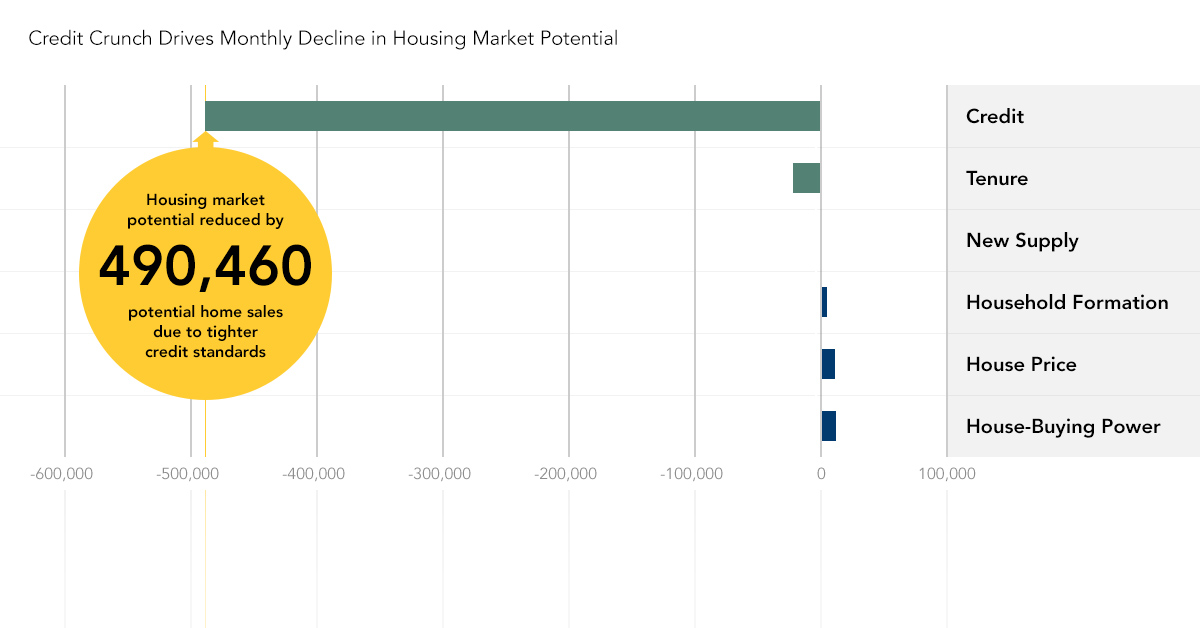

The Impact of the Credit Crunch on Housing Market Potential

By

Mark Fleming on April 17, 2020

The coronavirus pandemic continues to take hold of the domestic and global economy. The housing market, although in a better position than it was at the onset of the last recession, will not be immune to the impact. Weekly unemployment claims have soared to record highs, which has already contributed to declining consumer confidence.

Read More ›

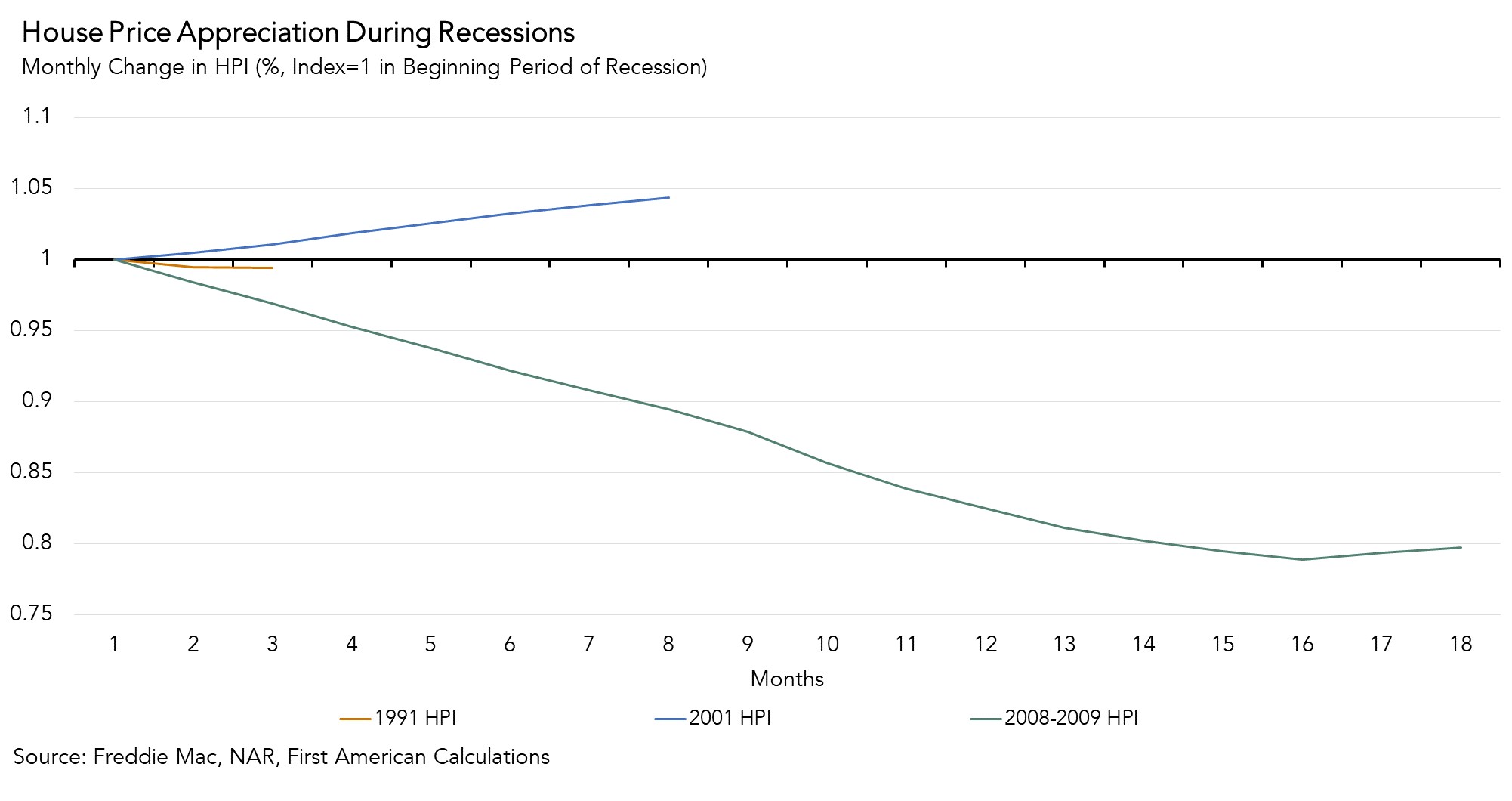

Why the Housing Market May Weather Coronavirus Impact Better Than the Great Recession

By

Mark Fleming on March 31, 2020

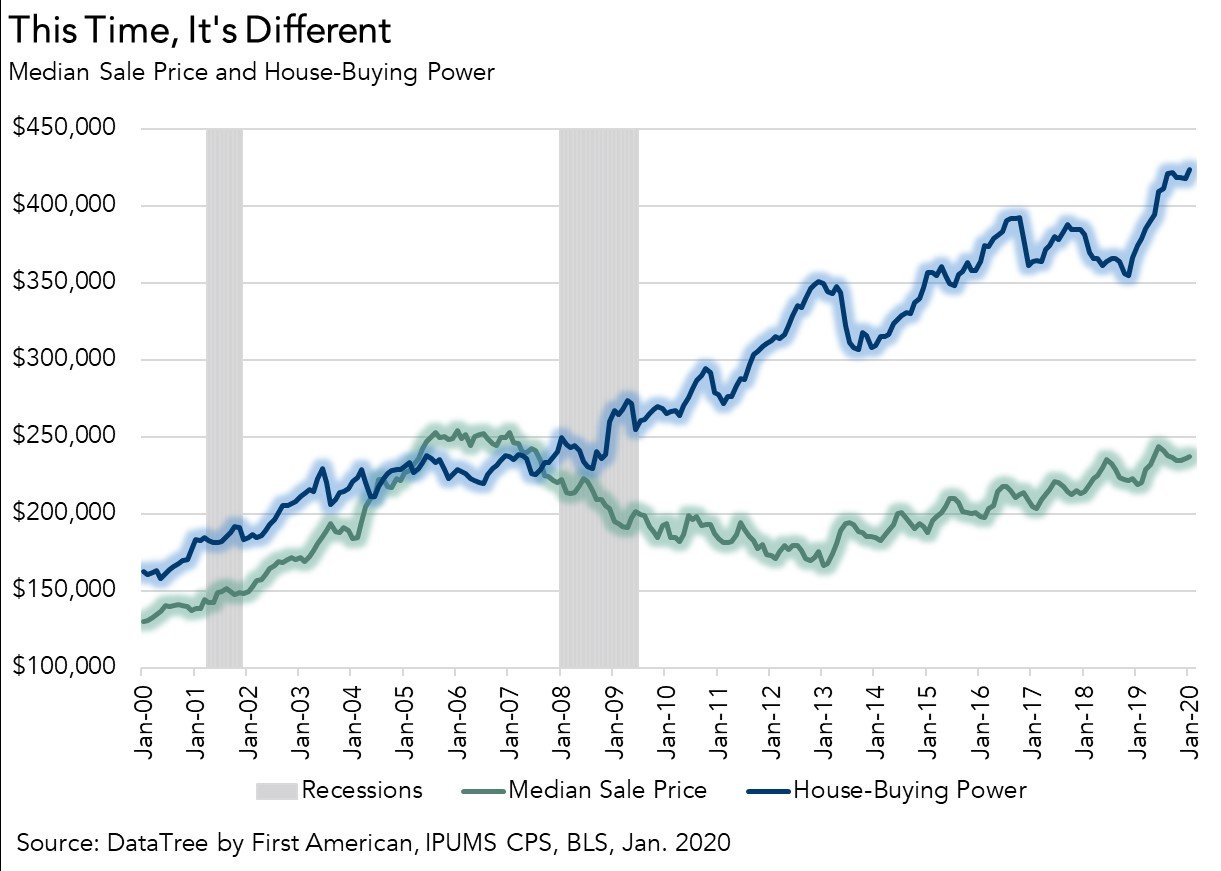

As we are all too aware, the coronavirus outbreak has taken hold of the domestic and global economy. The housing market is not immune to its impact but may be in a better position than many believe. Recent data shows that weekly unemployment claims soared to a record, which will, in turn, work to depress household incomes and consumer confidence. ...

Read More ›

Policy and Fintech Innovations Protect Against Fraud Risk in the Uncertain Days Ahead

By

Mark Fleming on March 30, 2020

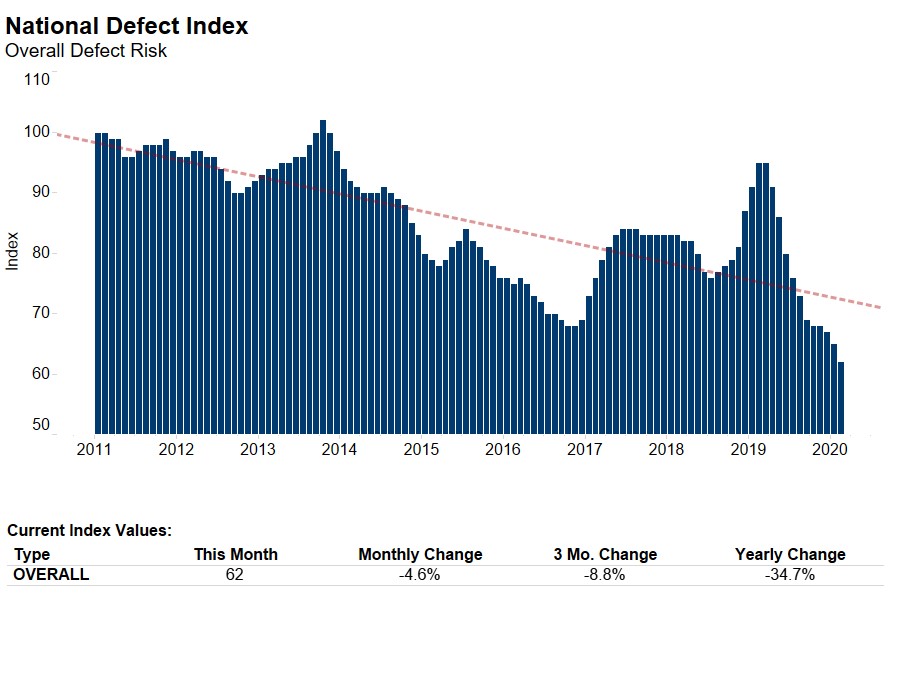

A historical view of overall defect risk, as measured by our Loan Application Defect Index, shows a long-run downward trend since we began tracking defect risk in 2011, with a few exceptions. In February 2020, this long-run trend continued as overall defect risk reached its lowest level in index history. The Defect Index for purchase transactions ...

Read More ›