Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Is it a Good Time to Buy a Home?

By

Mark Fleming on June 28, 2021

In today’s housing market, the power is very clearly in the hands of the seller. In April, First American Data & Analytics’ nominal house price index increased 16.2 percent year over year, the fastest pace since 2005. Rapid appreciation is driving declines in affordability, despite rising incomes and lower mortgage rates. Nationally, according ...

Read More ›

Why Homebodies Versus Pandemic-Fueled Demand Will Determine the Outlook for Housing Market Potential

By

Mark Fleming on June 22, 2021

Housing market potential strengthened again last month, according to our Potential Home Sales Model, despite significant supply headwinds. In May, housing market potential increased 0.8 percent compared with April, and is now nearly 23 percent higher than the pandemic-driven decline last May. Relative to two years ago, housing market potential is ...

Read More ›

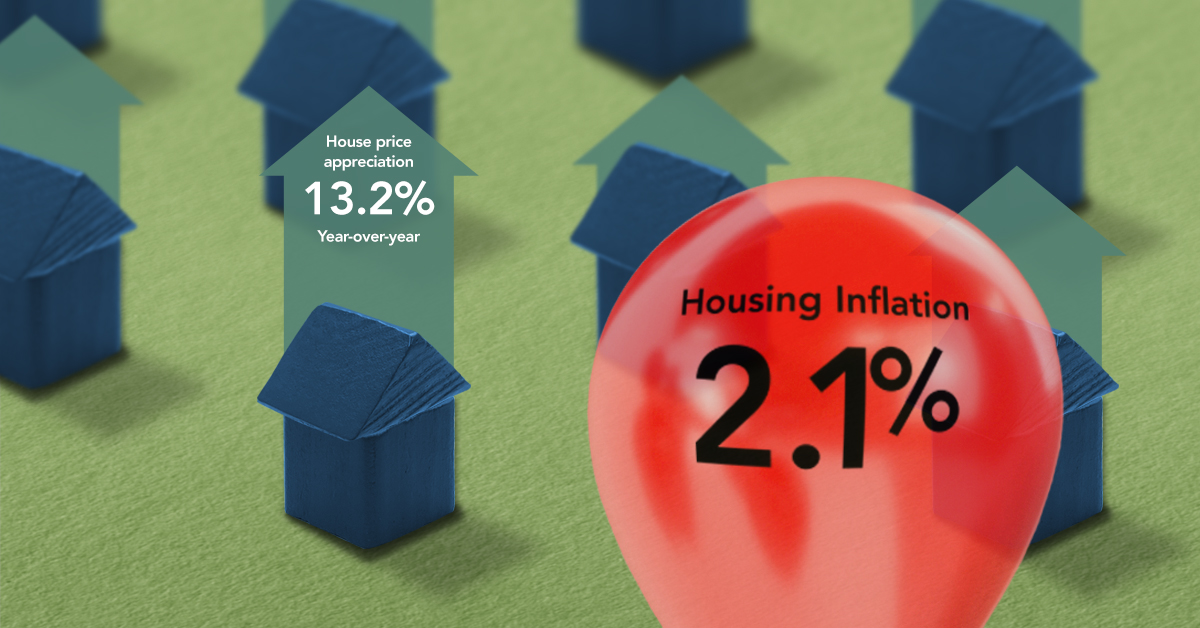

Housing Inflation is Not What You Think It Is

By

Mark Fleming on June 9, 2021

One of the most closely watched indicators of inflation, the Consumer Price Index (CPI), jumped 4.2 percent year over year this April. This is a faster pace than most economists anticipated, and was a result of base effects, combined with the numerous supply chain bottlenecks driving up prices as the economy reopens. One of the most important ...

Read More ›

Why Housing Affordability Sank for the First Time in Over Two Years

By

Mark Fleming on May 24, 2021

Housing affordability on a year-over-year basis declined in March for the first time since January 2019, ending a more than two-year streak of rising affordability. The long run of increasing affordability snapped, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of ...

Read More ›

Why Housing Market Potential Strengthened in April

By

Mark Fleming on May 20, 2021

Housing market potential regained strength in the month of April, according to our Potential Home Sales Model. In April, housing market potential increased 1.3 percent compared with March, and is now nearly 30 percent higher than the pandemic-driven collapse last April. Relative to two years ago, housing market potential is 16.7 percent higher and ...

Read More ›

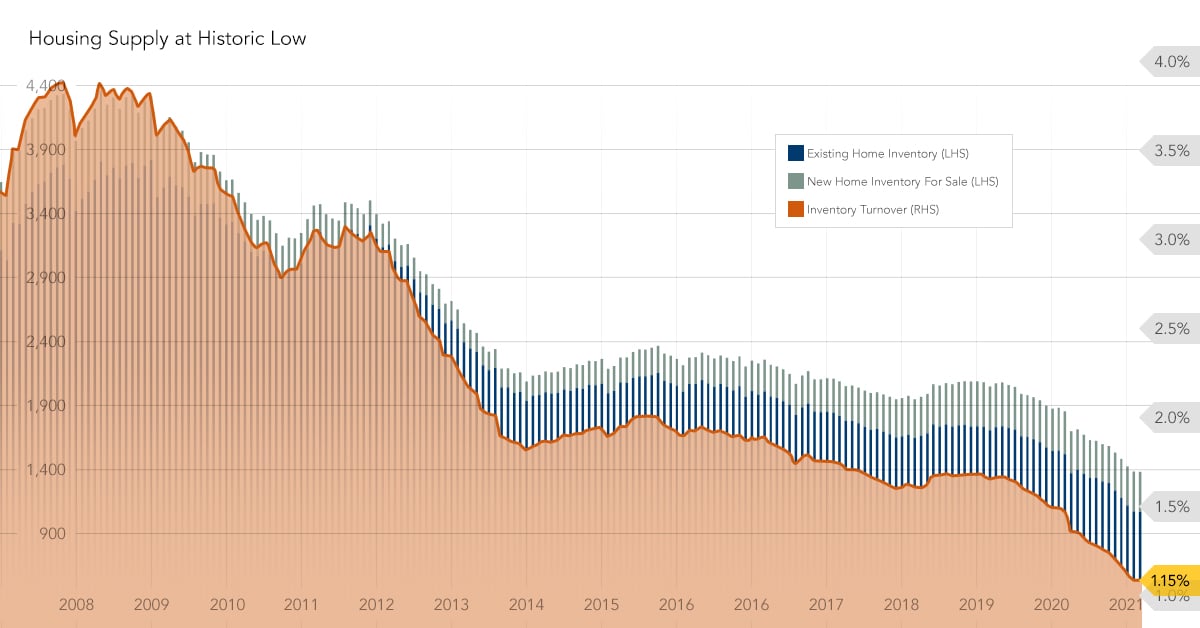

Has the Great Housing Supply Crash Bottomed Out?

By

Mark Fleming on May 19, 2021

More than a year into the pandemic, the housing market continues to run hot. The supply and demand imbalance brewing before the pandemic boiled over in the past year, resulting in record low levels of housing inventory and, consequently, the fastest pace of annual house price appreciation since 2005. With the arrival of the spring home-buying ...

Read More ›