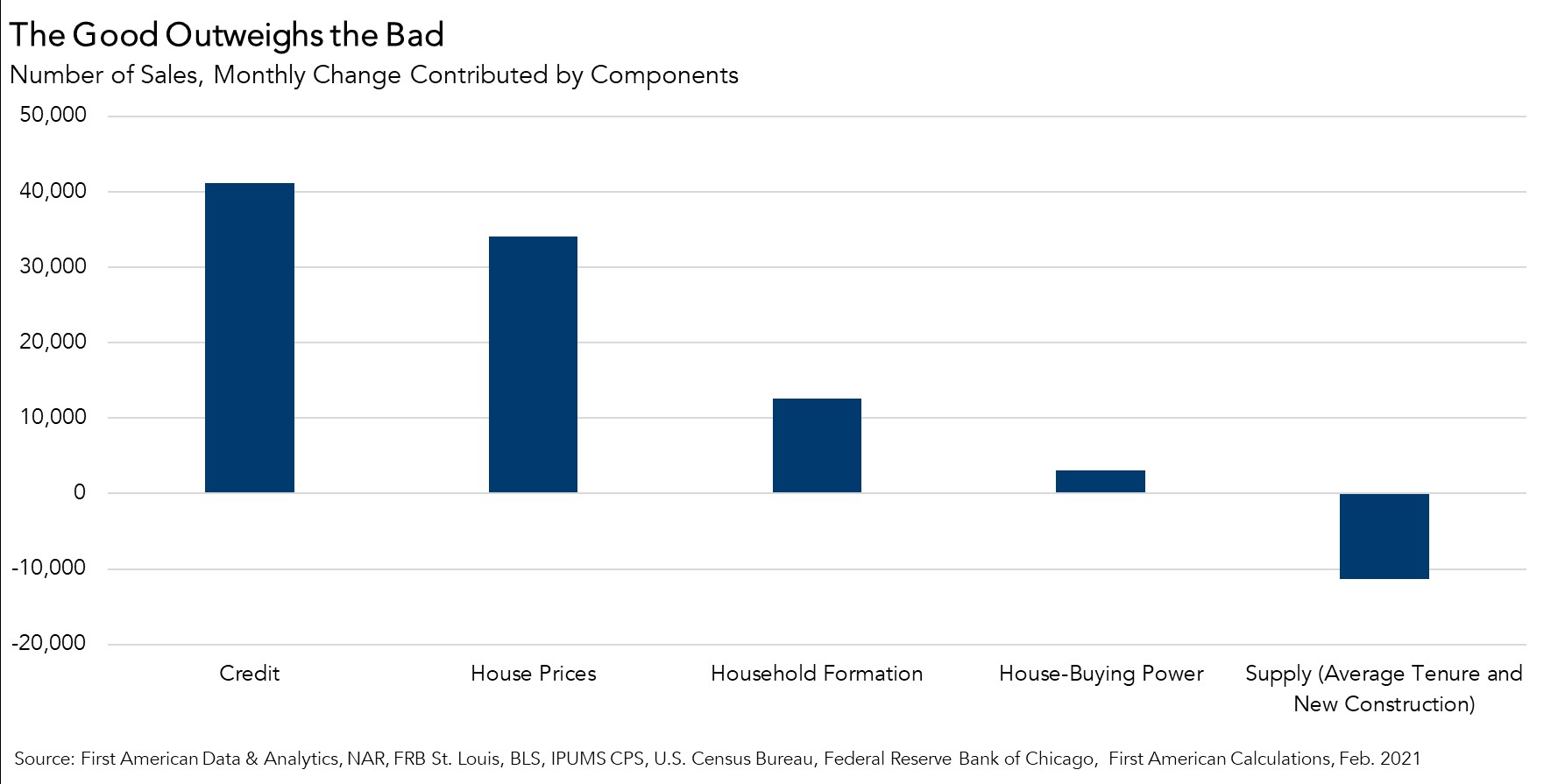

In February 2021, housing market potential increased to its highest level since 2007, despite the largest month-over-month jump in mortgage rates since October 2019. Housing market potential rose 1.3 percent in February relative to the previous month, and 12.2 percent year-over-year. While rising average tenure length was the largest drag on housing market potential this month, the lift from still rising house-buying power, looser credit standards, and strong household formation outpaced the negative impact from limited supply (both new and existing). As we enter the spring-home buying season, these dynamics are poised to support continued strength in the housing market.

“Even if mortgage rates continue to rise, increasing household formation, in conjunction with more favorable market conditions, will keep home-buying demand high.”

The Good: Millennials Reach Peak Home-Buying Age Armed with Record House-Buying Power

Demographics: While mortgage rates increased by a modest 0.08 percentage points in February, house-buying power was modestly higher this month thanks to a rise in median household income. Yet, larger gains in market potential came from household formation. The month-over-month growth in household formation contributed to nearly 13,000 potential home sales. Buying a home is not just a financial choice, but also a lifestyle choice. Millennials are reaching their peak home-buying years in large numbers and have likely been considering buying a home for some time. A slight increase in rates may cause some millennials to adjust their price point, but it will not necessarily deter them from home buying.

The Bad: You Can’t Buy What’s Not for Sale

Rate Lock-In: Most existing homeowners have mortgages with historically low rates, and there is limited incentive to sell if it will cost them more each month to borrow the same amount of money. While rates are only marginally higher today than the rock-bottom rates of 2.68 percent in December of last year, this increase can still leave existing homeowners feeling ‘rate locked-in’, disincentivizing them from selling their homes and preventing more supply from reaching the market.

The Existing Owner’s Dilemma: The other supply constraint is rooted in the uniqueness of the housing market. In most markets, the seller makes the decision to add supply to the market independent of the buyer. Yet, in the housing market, the seller and the buyer are, in many cases, the same person – the existing homeowner. To buy a new home, you must also sell the home you already own, and then find a home you like better. Every home is different, an almost perfectly heterogeneous product, so when supply is constrained as in today’s market, it becomes difficult to find a home better than what you already own. The existing owner faces the dilemma of whether to sell or not when they fear not being able to find something to buy.

Lack of New Construction: One way to solve the supply issue is by building new homes, but construction headwinds have limited the homebuilders’ ability to build enough homes to keep up with housing demand.

The Maybe: The Positive Impacts from Growing Equity and Credit Loosening

Home Equity: Existing homeowners today are sitting on record amounts of equity. As homeowners gain equity in their homes, the temptation grows to list their current home for sale and use the equity to purchase a larger or more attractive home, if they can find one for sale (see their dilemma described above). House price appreciation in January contributed to approximately 34,000 potential home sales in February, but remains uncertain in the days ahead. While homeowners may want to use their equity to buy something bigger and better, they first must find something to buy.

Credit: The other ‘maybe’ is credit because the future of credit is critically dependent on the health of the economy. At the onset of the pandemic, tighter credit was the biggest contributor to the loss of potential home sales, as lenders tightened their credit criteria to account for a higher likelihood of forbearance and delinquency. In February, credit standards loosened due to positive economic news, and had the greatest positive impact on housing market potential on a month-over-month basis, contributing 41,000 potential home sales. The economic recovery is on track to strengthen, but some uncertainty remains.

But the Likeliest Scenario Is…

All factors considered, the market potential for existing-home sales remains well positioned to continue to rise. The economy will likely continue to improve with vaccine rollouts accelerating. With greater vaccination rates will come increased consumer and lender confidence, and a stronger labor market. Even if mortgage rates continue to rise, increasing household formation, in conjunction with more favorable market conditions, will keep home-buying demand high. In addition, the recent increase in housing starts means home builders are pushing through on new construction projects, which will work to alleviate some of the supply shortage in the longer run. But now? Expect continued strong demand and short supply, which means the spring home-buying season will be moving with a sales velocity that has not been seen before.

February 2021 Potential Home Sales

For the month of February, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 6.26 million seasonally adjusted annualized rate (SAAR), a 1.3 percent month-over-month increase.

- This represents a 79.6 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 12.2 percent compared with a year ago, a gain of 682,900 (SAAR) sales.

- Currently, potential existing-home sales is 530,350 million (SAAR), or 7.8 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 3.9 percent or an estimated 243,600 (SAAR) sales.

- The market performance gap increased by an estimated 99,000 (SAAR) sales between January 2021 and February 2021.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.

.jpg)