In the final month of 2020, the market potential for existing-home sales reached its highest point since 2007, rising to a 6.18 million seasonally adjusted annualized rate (SAAR) of sales. While the winter months are traditionally real estate’s slow season, the housing market had one more surprise for us in 2020 as our measure of the market potential for existing-home sales showed the housing market again broke with traditional seasonal patterns during this unprecedented year.

“Twin housing market accelerants -- record low mortgage rates and the demographic boost from millennials, the largest generation in U.S. history, aging into their prime homebuying years – super-charged demand. Yet, the housing market also faces a historic and worsening inventory impasse you can’t buy what’s not for sale.”

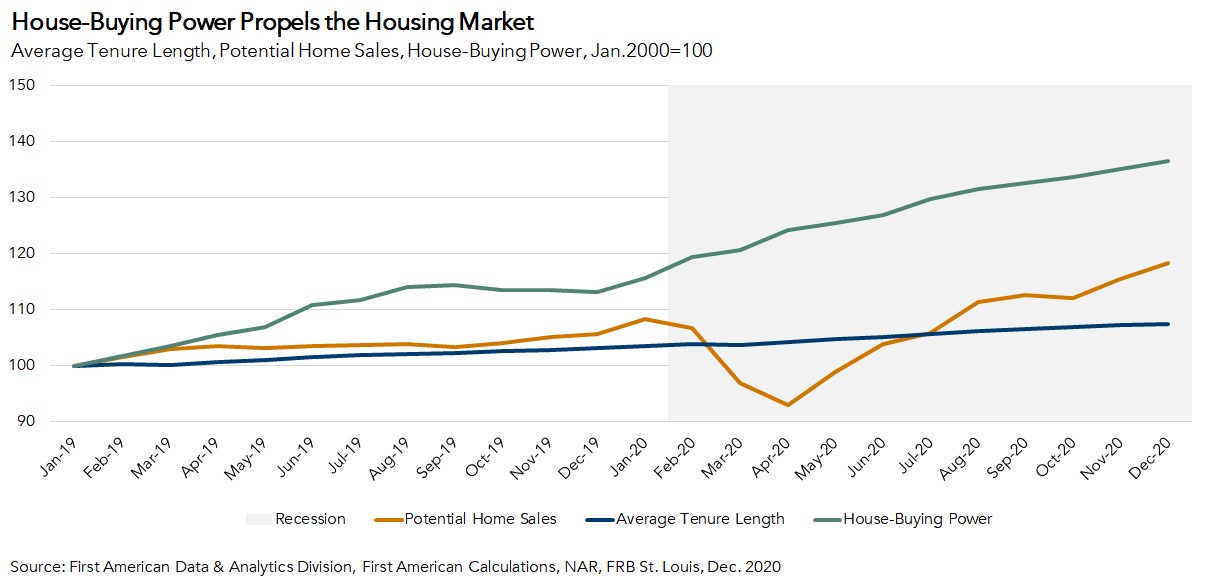

Twin housing market accelerants – record low mortgage rates and the demographic boost from millennials, the largest generation in U.S. history, aging into their prime homebuying years – super-charged demand. Yet, the housing market also faces a historic and worsening inventory impasse - you can’t buy what’s not for sale. In 2020, the growth in house-buying power fueled by low mortgage rates was the primary driver of housing market potential, while existing homeowners choosing not to list their homes for sale was the biggest headwind. Fortunately, the potential sales increase from house-buying power was more than the loss from rising tenure length in 2020.

House-Buying Power, Millennials Super-Charge Housing Market Demand

House-buying power, how much home one can afford to buy given their income and the prevailing mortgage rate, is a key driver of home-buying demand. The primary reason for the increase in house-buying power in 2020 was falling mortgage rates. Since December 2019, the 30-year, fixed-rate mortgage fell by slightly more than one percentage point. Holding household income constant at its December 2019 level, that means potential home buyers gained nearly $60,000 in house-buying power from falling mortgage rates alone. If you factor in the growth in household income, home buyers gained approximately $87,000 of total house-buying power in 2020. Because an increase in house-buying power allows a potential home buyer to purchase more home for the same monthly payment or purchase the same amount of home for a lower monthly payment, increased house-buying power helped super-charge housing market potential. Compared with one year ago, falling mortgage rates and rising incomes for those still employed resulted in nearly 389,000 potential home sales in December.

Rising Tenure Squeezes Housing Market Supply

Existing-home sales make up approximately 90 percent of all sales, so the rising tenure length of existing homeowners means fewer and fewer homes for sale and is the primary reason for the lack of housing supply. As existing homeowners have increasingly chosen not to list their homes for sale during the pandemic, average tenure length – the amount of time someone lives in their home – has soared to a historic high of approximately 10.5 years, up from an average of 10 years just one year ago. In last month’s existing-home sales report, months’ supply hit a historic low of 2.3 months. That means it would take just over two months to run out of homes for sale at the current pace of sales. The lack of homes for sale caused by the increase in tenure length reduced the potential for existing-home sales by 170,200 in December compared with a year ago.

What should we expect in 2021? More of the same, but in a more positive economic environment. The successful dissemination of a vaccine should put an end to the “stop-start” pattern of restrictions imposed on businesses, which should help the economy recover. Low mortgage rates will continue to support strong house-buying power as more and more millennials age into homeownership, keeping demand robust. While the supply-demand imbalance will persist, existing homeowners who were hesitant to sell amidst the worst of the pandemic may be encouraged to bring their homes to market, relieving some of the supply shortage. Swelling demand and the potential for greater supply means housing market potential in 2021 is likely to remain strong and build off a historic 2020.

December 2020 Potential Home Sales

For the month of December, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 6.18 million seasonally adjusted annualized rate (SAAR), a 2.3 percent month-over-month increase.

- This represents a 77.1 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 11.9 percent compared with a year ago, a gain of nearly 658,628 (SAAR) sales.

- Currently, potential existing-home sales is 683,971 million (SAAR), or 10.0 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 1.2 percent or an estimated 73,142 (SAAR) sales.

- The market performance gap increased by an estimated 21,960 (SAAR) sales between November 2020 and December 2020.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.