How Did Affordability Change During the Spring Home-Buying Season?

By

Mark Fleming on September 23, 2019

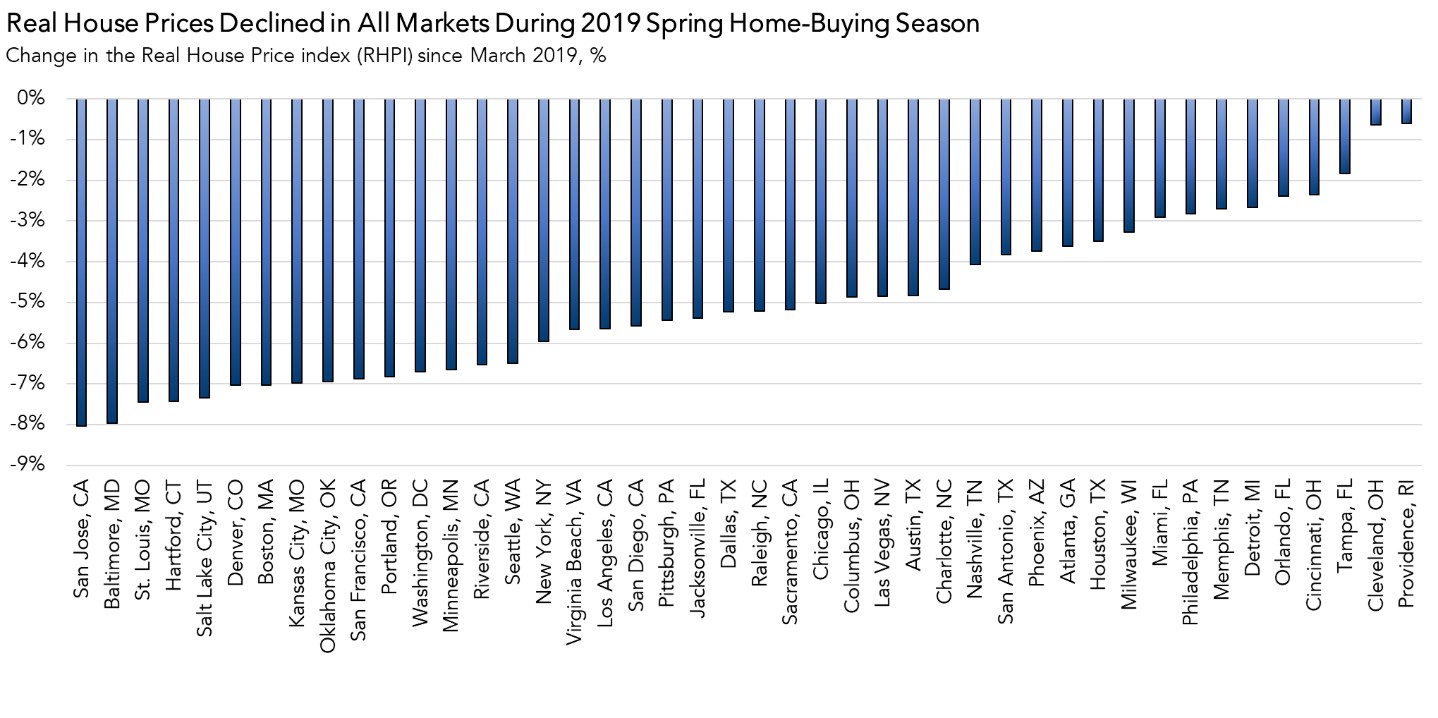

School bells ringing don’t just mark the beginning of a new school year, but for those in housing, they also signal the end of the typical home-buying season, which begins in March. As the school year begins, the housing market is finishing the spring home-buying season with strong marks for affordability. Indeed, two of the three key drivers of ...

Read More ›

How Can Affordability Improve When House Prices are Rising?

By

Mark Fleming on August 27, 2019

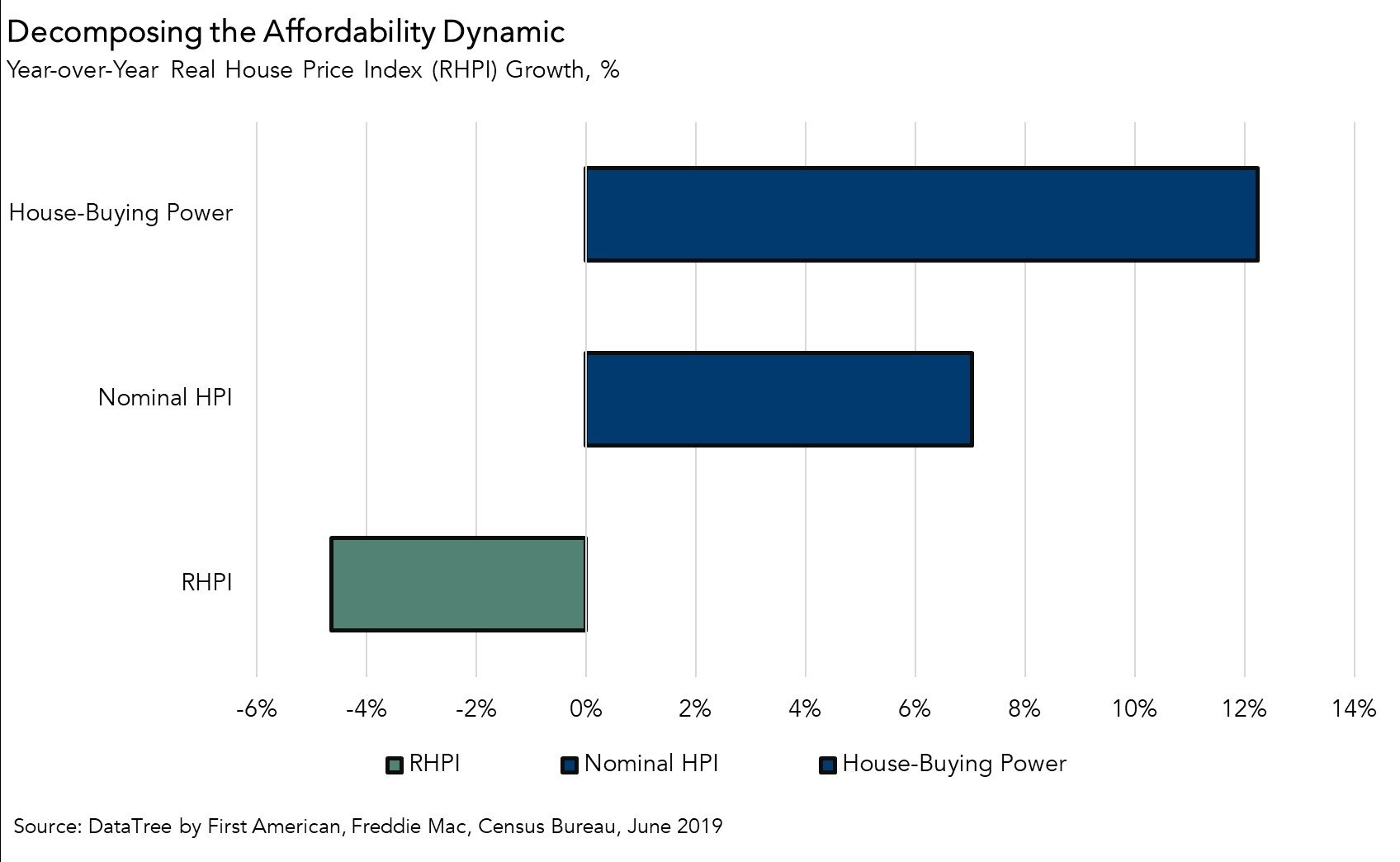

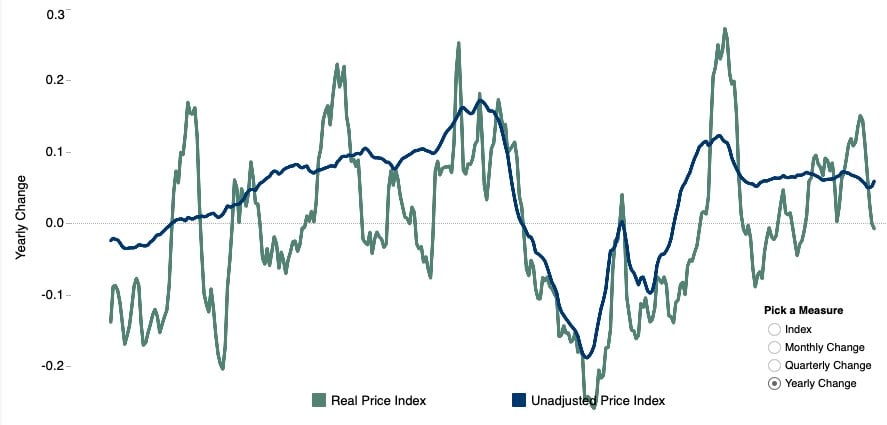

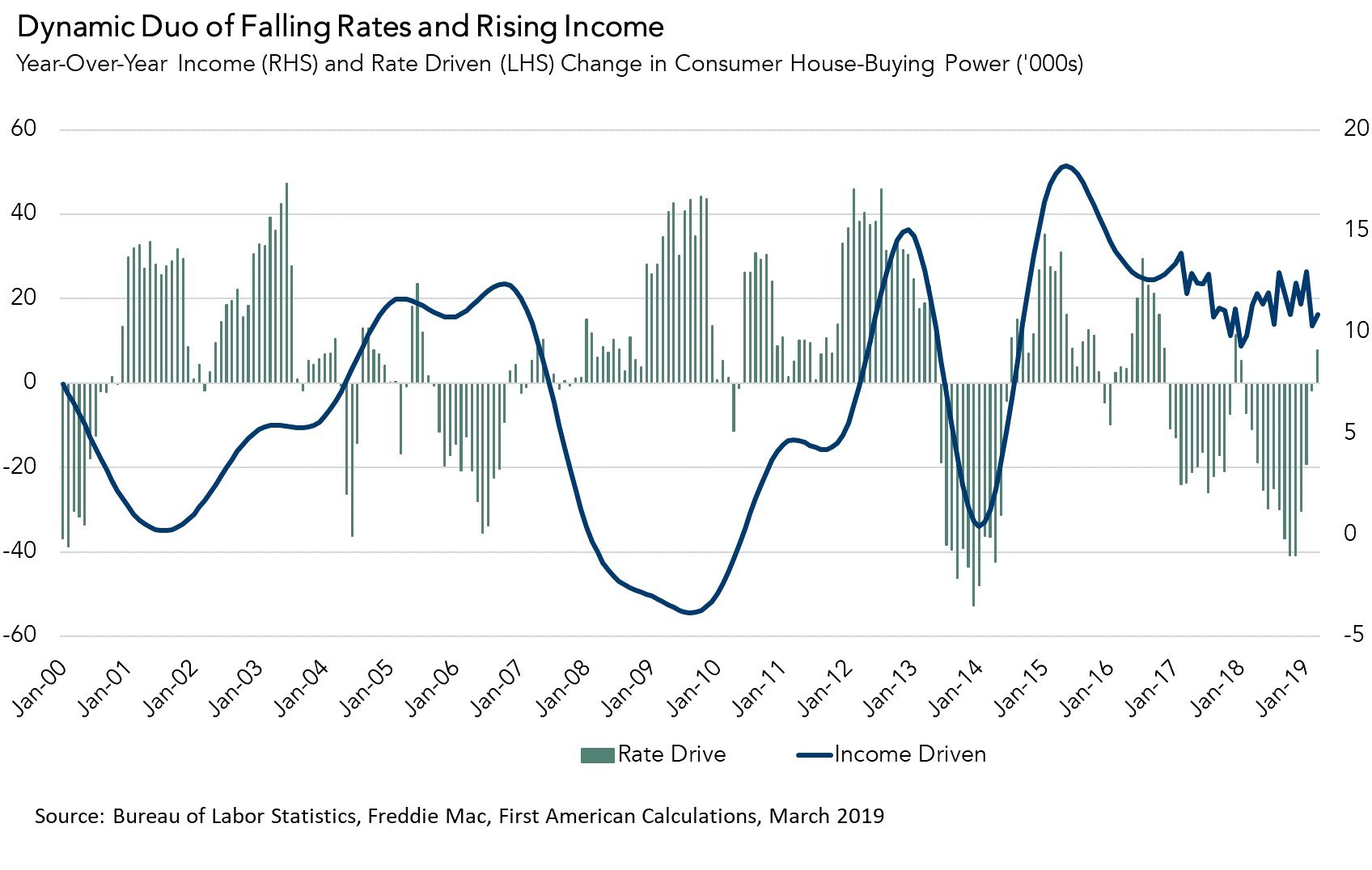

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in June. The 30-year, fixed-rate mortgage fell by 0.8 percentage points and household income increased 2.4 percent compared with June 2018. When household income rises, consumer house-buying power ...

Read More ›

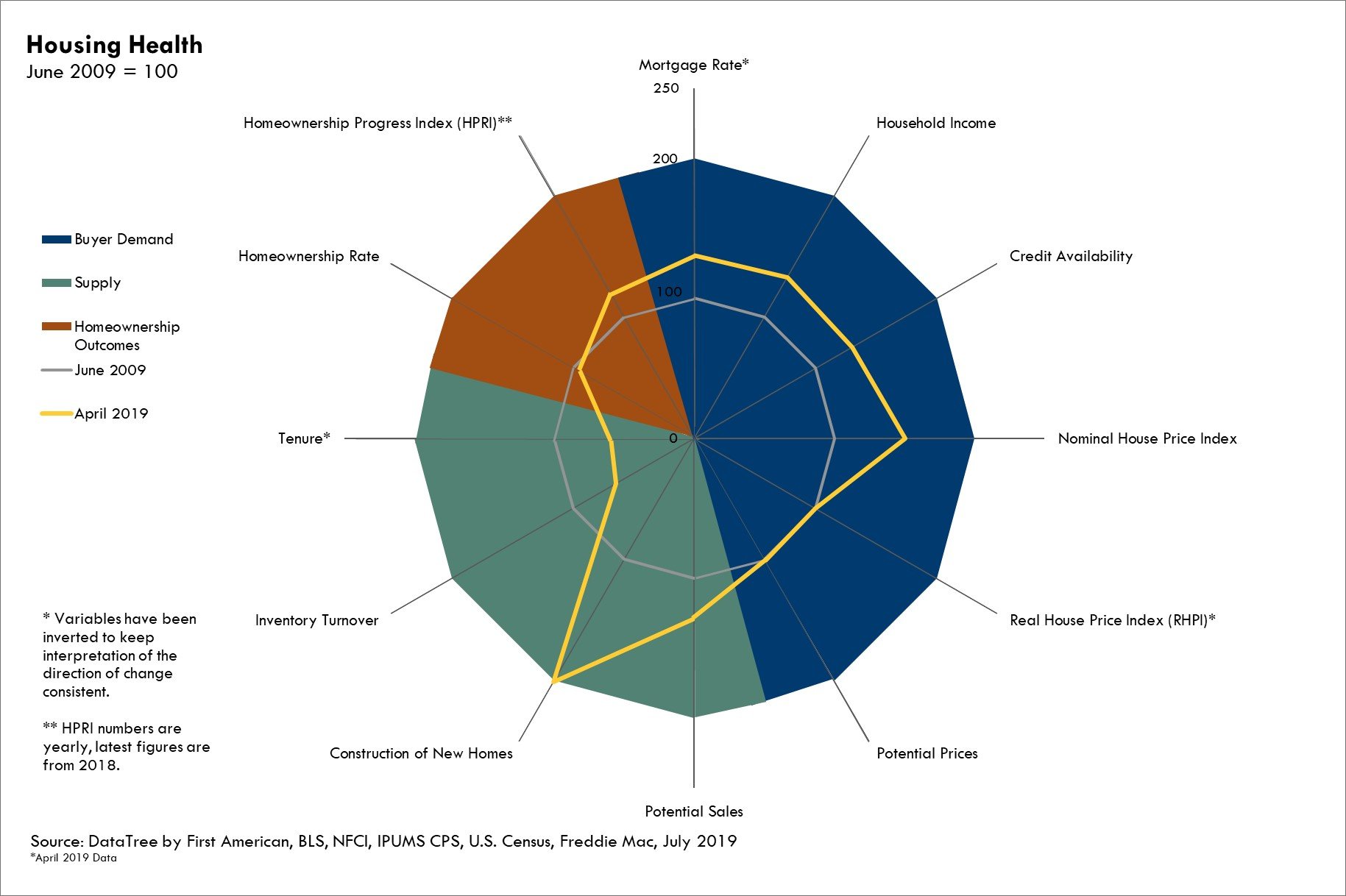

How Has the Housing Market Changed Since the End of the Great Recession?

By

Odeta Kushi on July 3, 2019

June marked the 10-year anniversary of the end of the Great Recession. Amid Independence Day celebrations, assessing how the American dream of homeownership has fared since the recession can provide helpful context for the health of today’s housing market. We have assembled a set of housing metrics and compared their values today with what those ...

Read More ›

Homeownership Progress Index Real House Price Index Affordability Homeownership

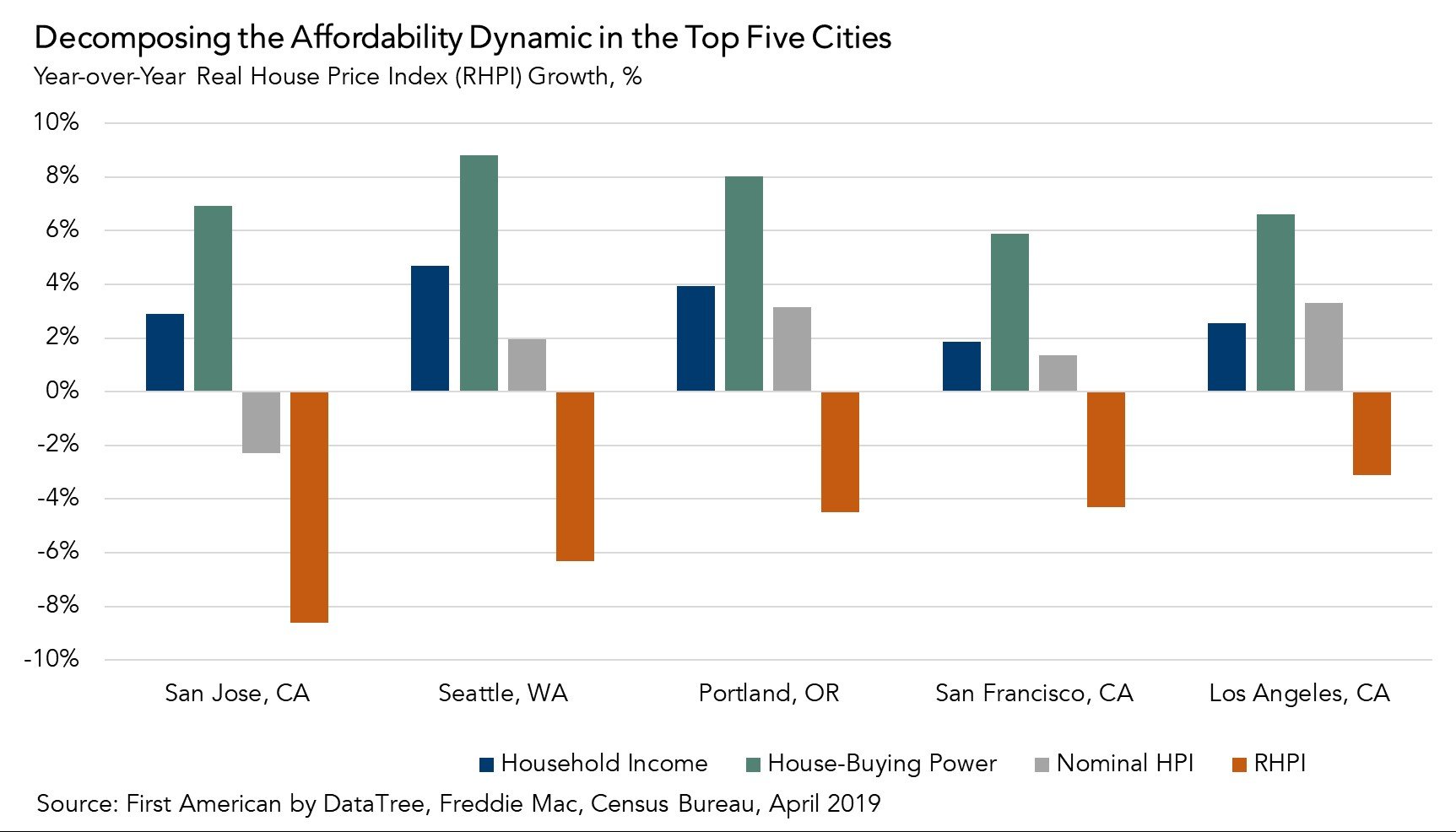

The Five Cities Where Affordability Improved the Most and Why

By

Mark Fleming on June 24, 2019

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in April. The 30-year, fixed-rate mortgage fell by 0.33 percentage points and household income increased 2.7 percent compared to April 2018. When household income rises, consumer house-buying power ...

Read More ›

Expect the Unexpected -- Faster House Price Appreciation

By

Mark Fleming on June 6, 2019

In our most recent Potential Home Sales Model analysis, we noted that the housing market’s potential improved in April because falling mortgage rates and rising household income combined to increase consumer house-buying power more than enough than to offset house price appreciation. In other words, house-buying power won the tug of war with house ...

Read More ›

Why Did Affordability Improve for the First Time Since 2016?

By

Mark Fleming on May 28, 2019

What began as a modest shift toward a buyers’ market in six cities last month has expanded into a national shift in affordability. The shift is a departure from the long-term trend in the Real House Price Index (RHPI), which had been steadily increasing throughout the rising mortgage rate environment that began in 2017 and continued until late ...

Read More ›