Where Wages Grow, Affordability Follows

By

Mark Fleming on February 24, 2020

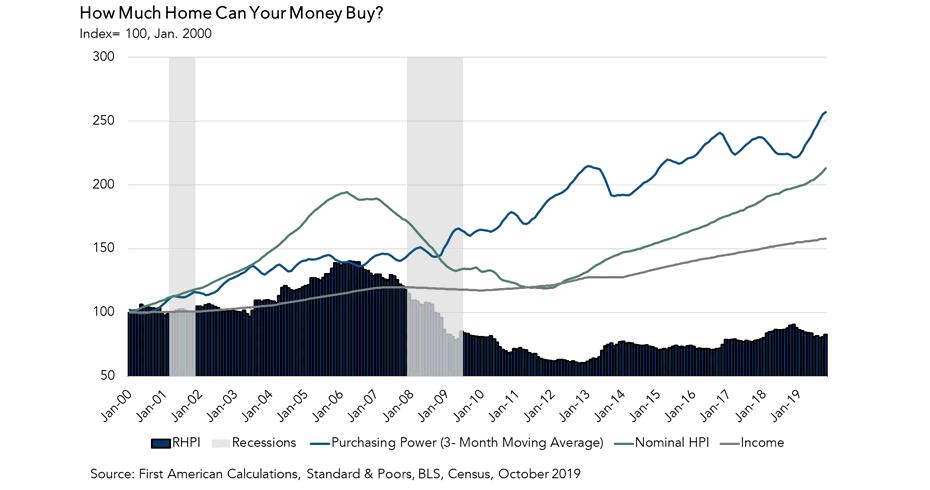

As 2019 came to a close, potential home buyers received a year-end gift as affordability improved relative to one year ago. Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in December.

Read More ›

The Five Cities Where Affordability Improved the Most

By

Mark Fleming on January 27, 2020

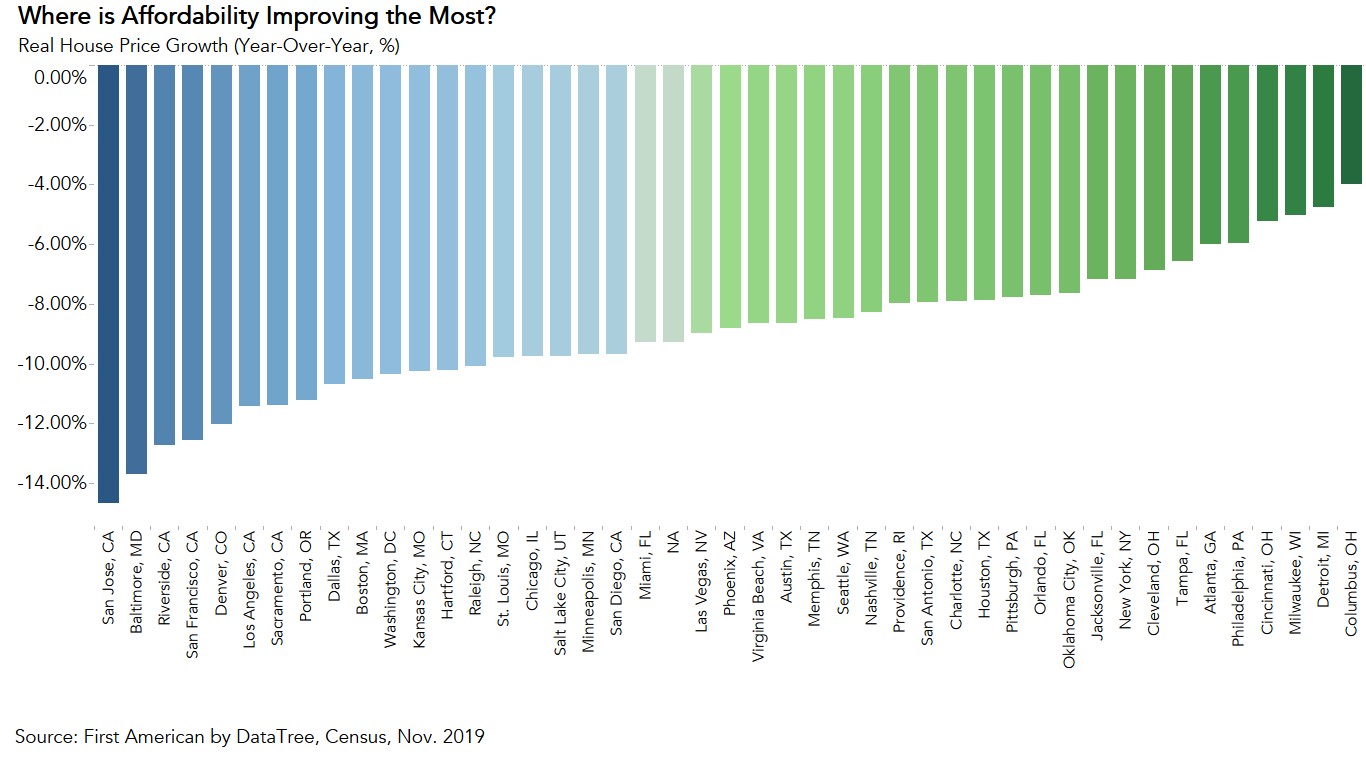

Once again, home buyers benefitted from a year-over-year affordability boost as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in November. Compared with November 2018, the 30-year, fixed-rate mortgage fell by 1.2 percentage points and household ...

Read More ›

What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

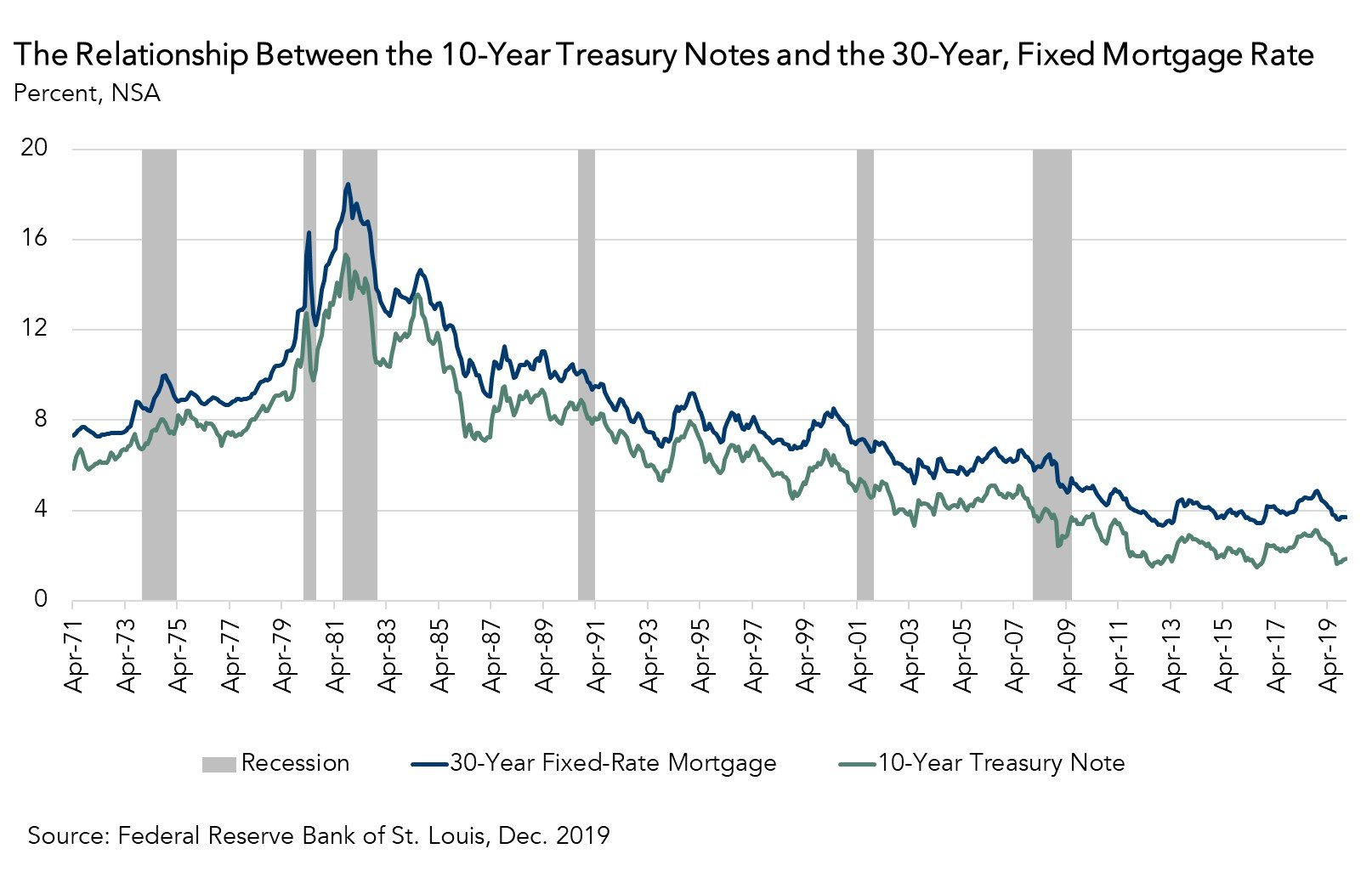

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability

What Will Drive House-Buying Power in 2020?

By

Mark Fleming on December 20, 2019

Affordability improved in October as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability relative to one year ago. The 30-year, fixed-rate mortgage fell by 1.1 percentage points and household income increased 2.6 percent compared with October ...

Read More ›

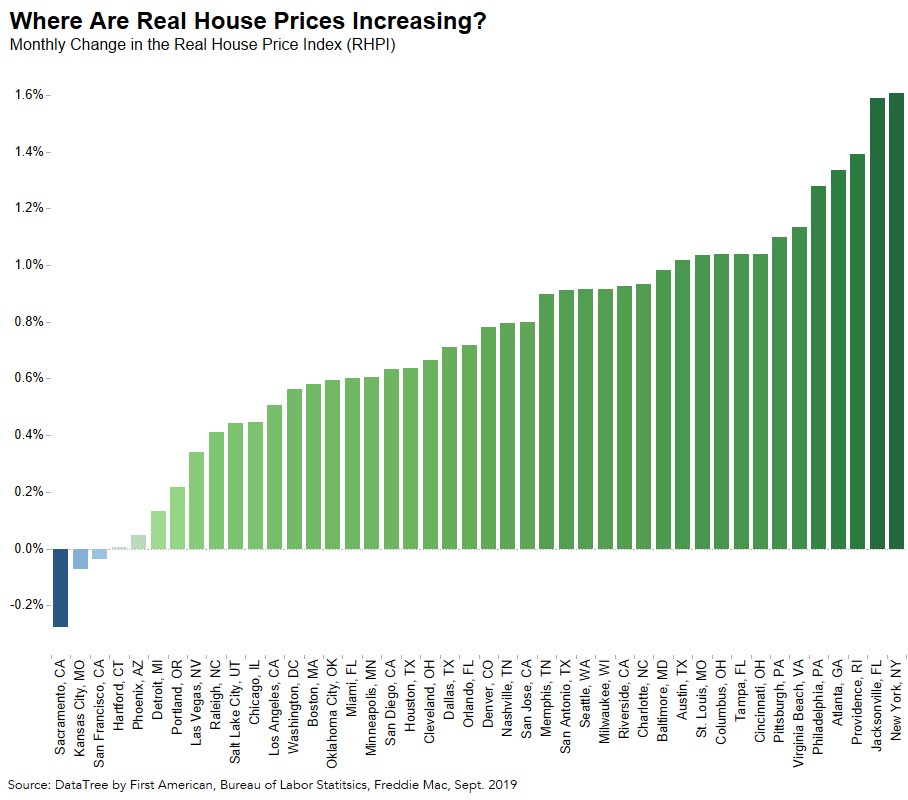

Has Rising House-Buying Power Accelerated House Price Appreciation?

By

Mark Fleming on November 26, 2019

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability in September, yet affordability declined month over month. The 30-year, fixed-rate mortgage fell by 0.01 percentage points and household income increased 0.03 percent compared with August 2019. ...

Read More ›

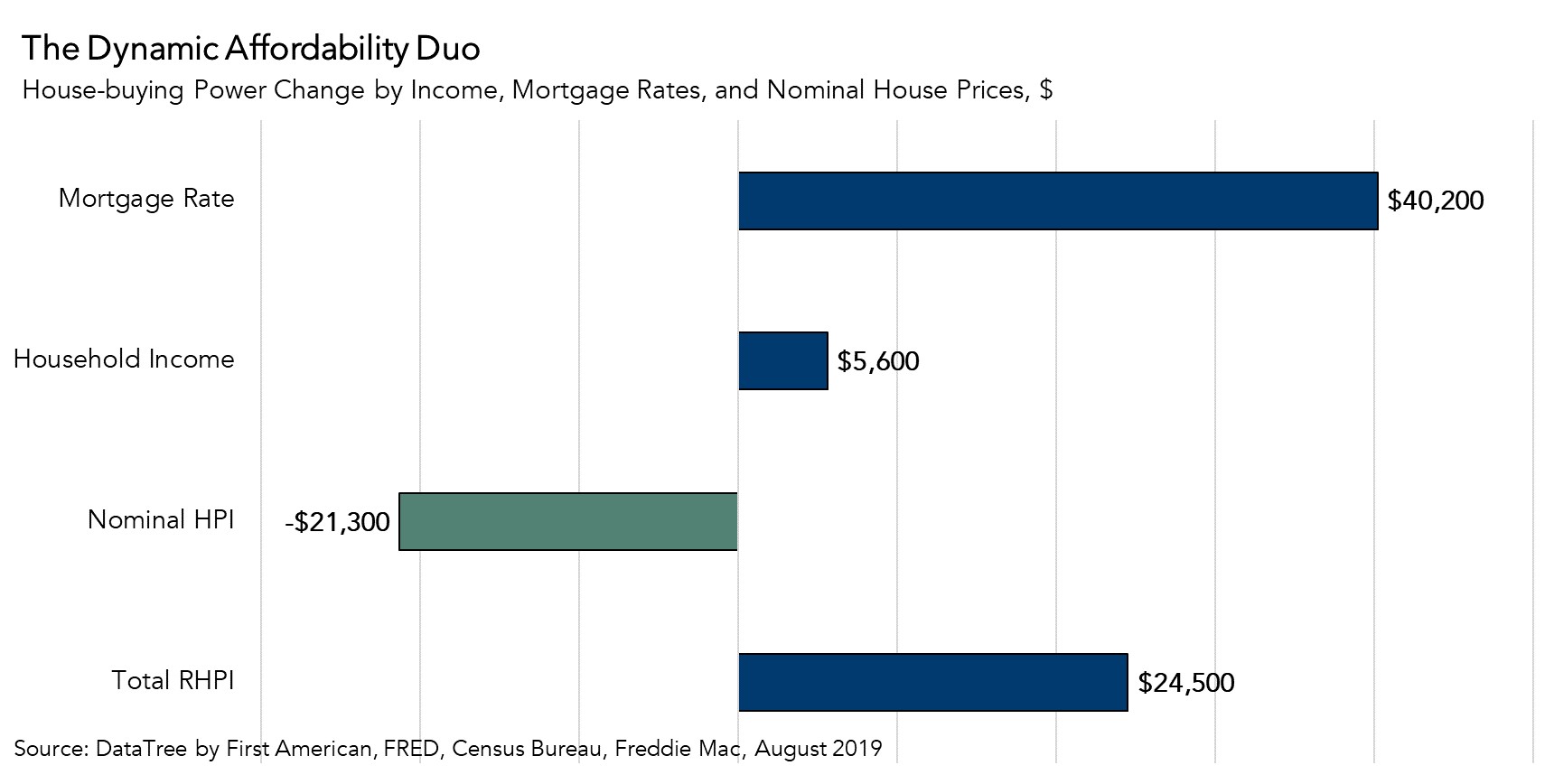

The Dynamic Forces that Re-Shaped Housing Affordability in 2019

By

Mark Fleming on October 28, 2019

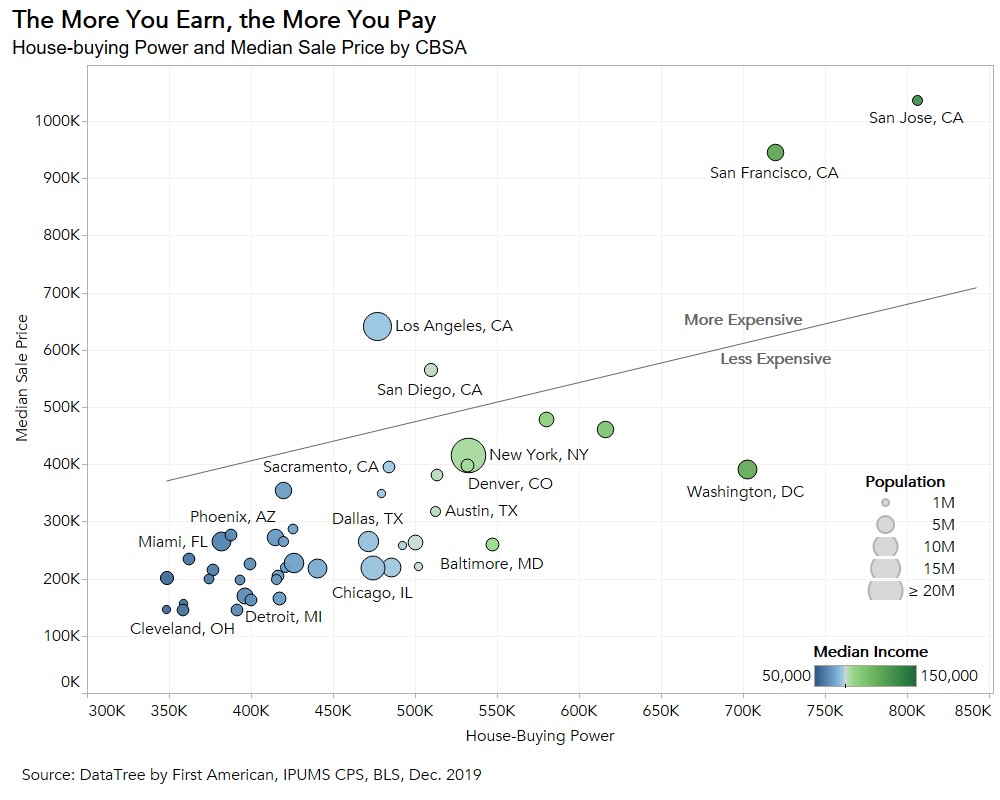

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides a helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›