Six Cities Leading Shift Toward A Buyers' Market

By

Mark Fleming on April 29, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income and unadjusted house prices – defined the housing market. These three factors are also the core elements of the Real House Price Index (RHPI). While household income rose steadily in 2018, rising mortgage rates offset any affordability benefit for home ...

Read More ›

How Will Low Mortgage Rates Impact Housing Affordability This Spring?

By

Odeta Kushi on April 17, 2019

Last year, the over-arching trend in the housing market was the impact of rising rates on affordability. Mortgage rates had been increasing since 2017 and that trend continued in 2018, especially in the second half of the year. Rates were rising largely due to a strengthening economy – the Fed raises rates in a strong economy to encourage ...

Read More ›

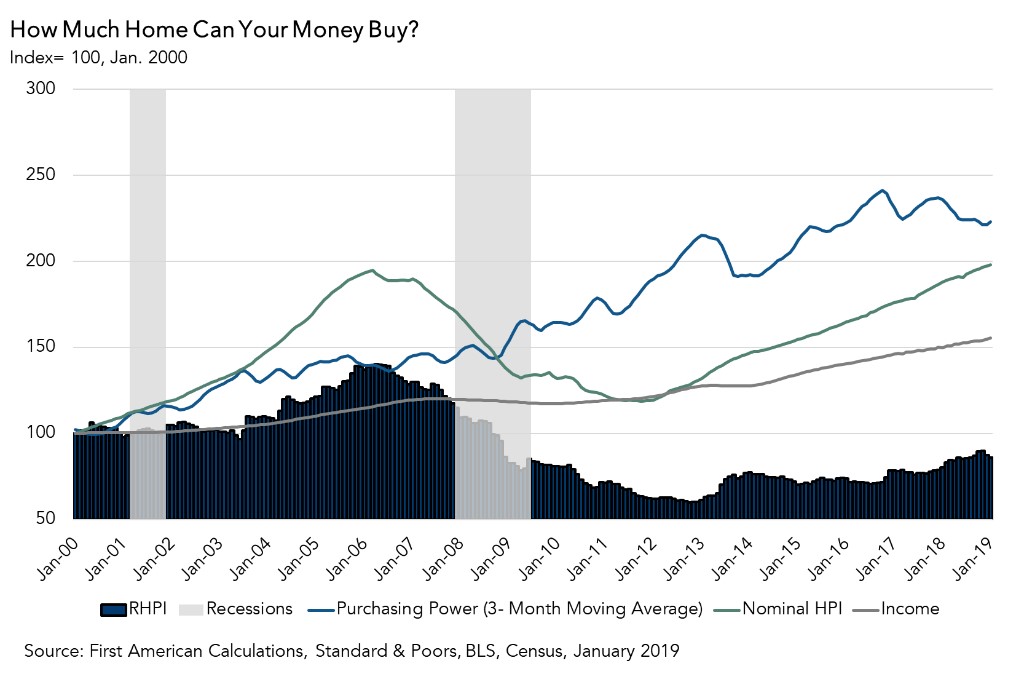

Three Reasons Home Buyers Have More Power This Spring

By

Mark Fleming on March 25, 2019

While 2018 was largely characterized by declining affordability, ending the year with a five percent yearly decline in house-buying power, this trend reversed sharply in early 2019. Moderating home prices, in conjunction with gains in household income and declining mortgage rates, boosted affordability for potential home buyers.

Read More ›

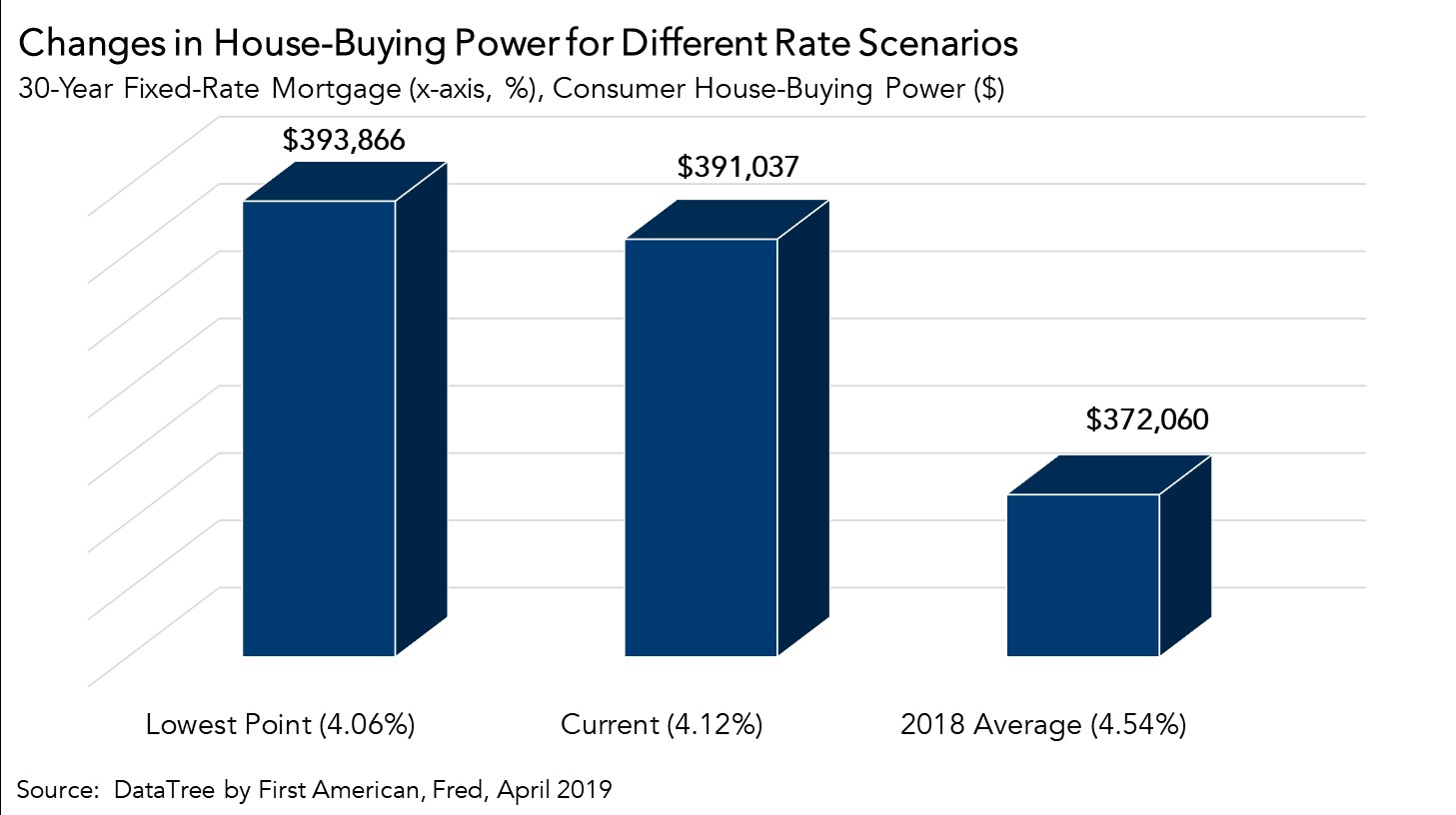

What Triggered the Biggest Increase in House-Buying Power in Five Years?

By

Mark Fleming on February 25, 2019

Housing affordability is a function of three economic drivers: nominal house prices, household income and mortgage rates. When incomes rise, consumer house-buying power increases. Declining mortgage rates or declining nominal house prices also increase consumer house-buying power. Our Real House Price Index (RHPI) uses consumer house-buying power ...

Read More ›

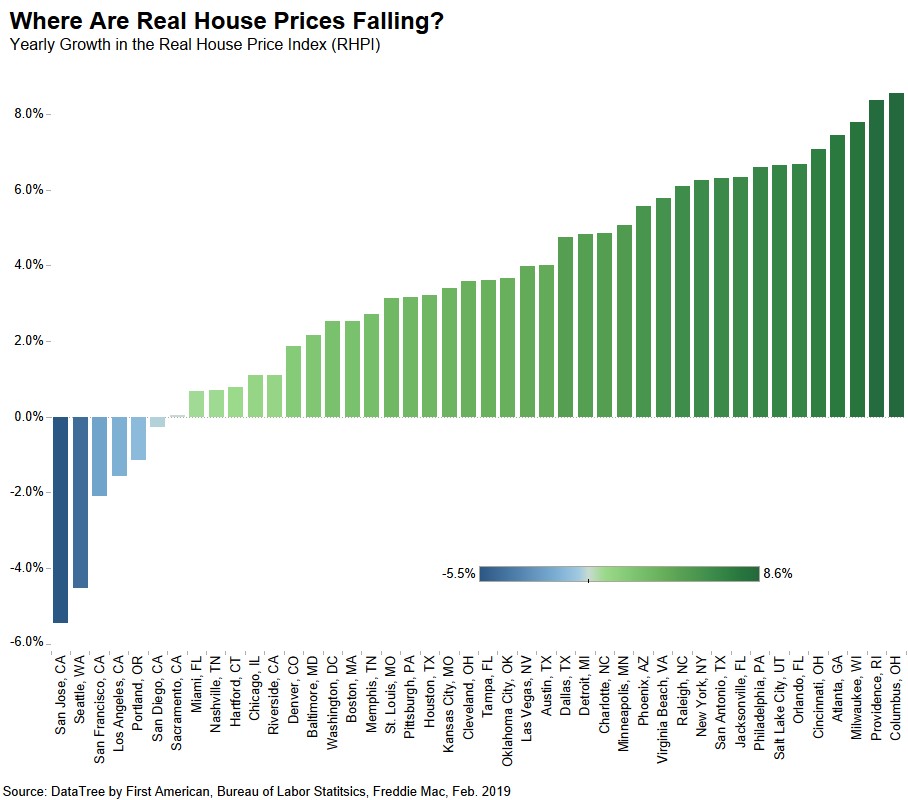

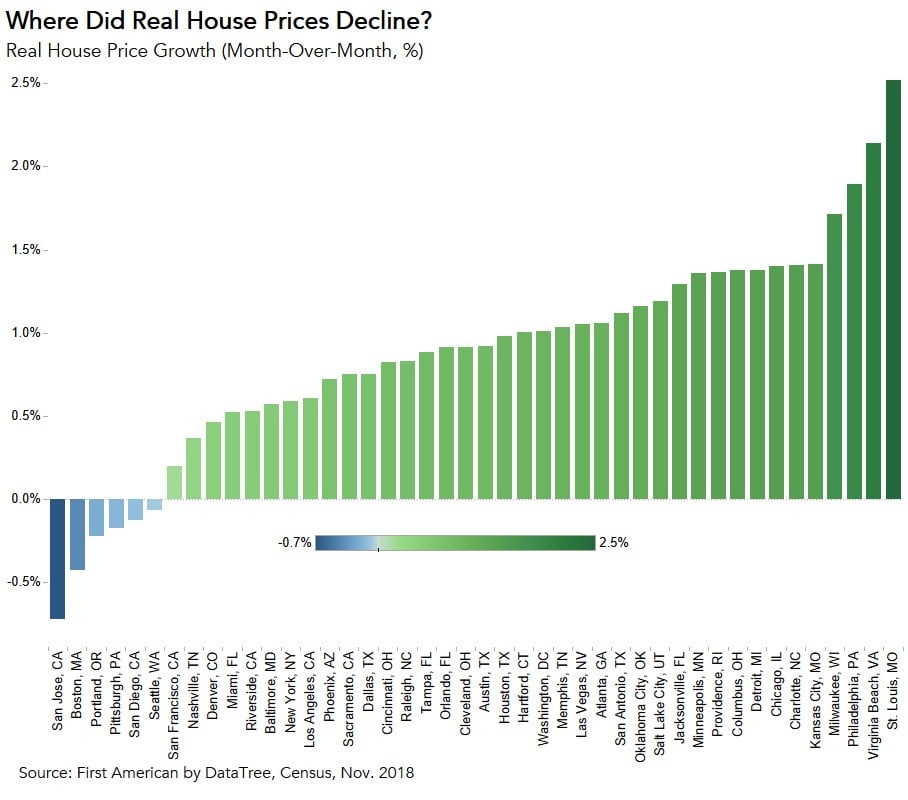

Where is the Housing Market Cooling the Most?

By

Mark Fleming on January 28, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income, and unadjusted house prices – defined the housing market. These three factors are also the core metrics that comprise the Real House Price Index (RHPI). November 2018 was no exception, as household income, mortgage rates, and the unadjusted house ...

Read More ›

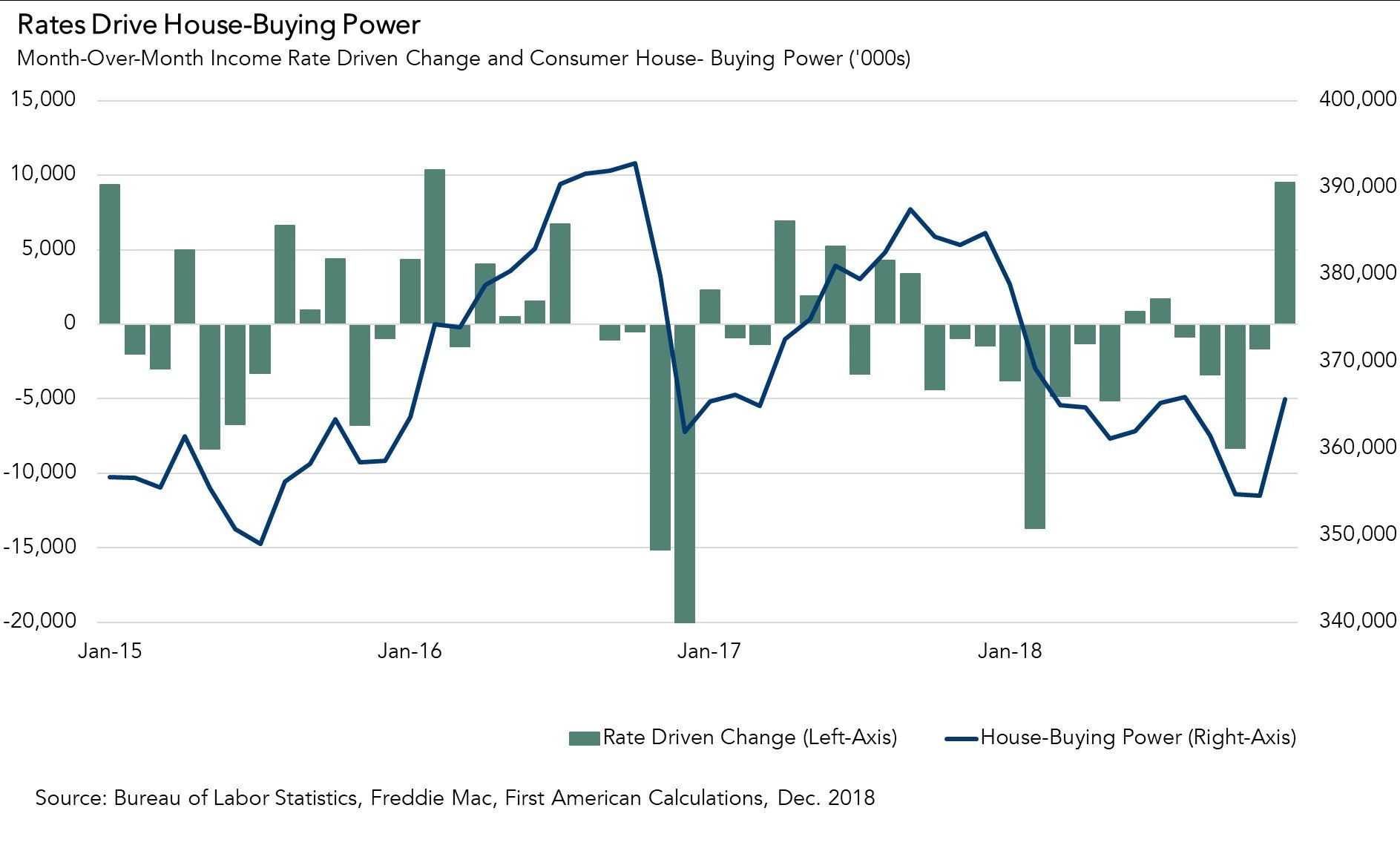

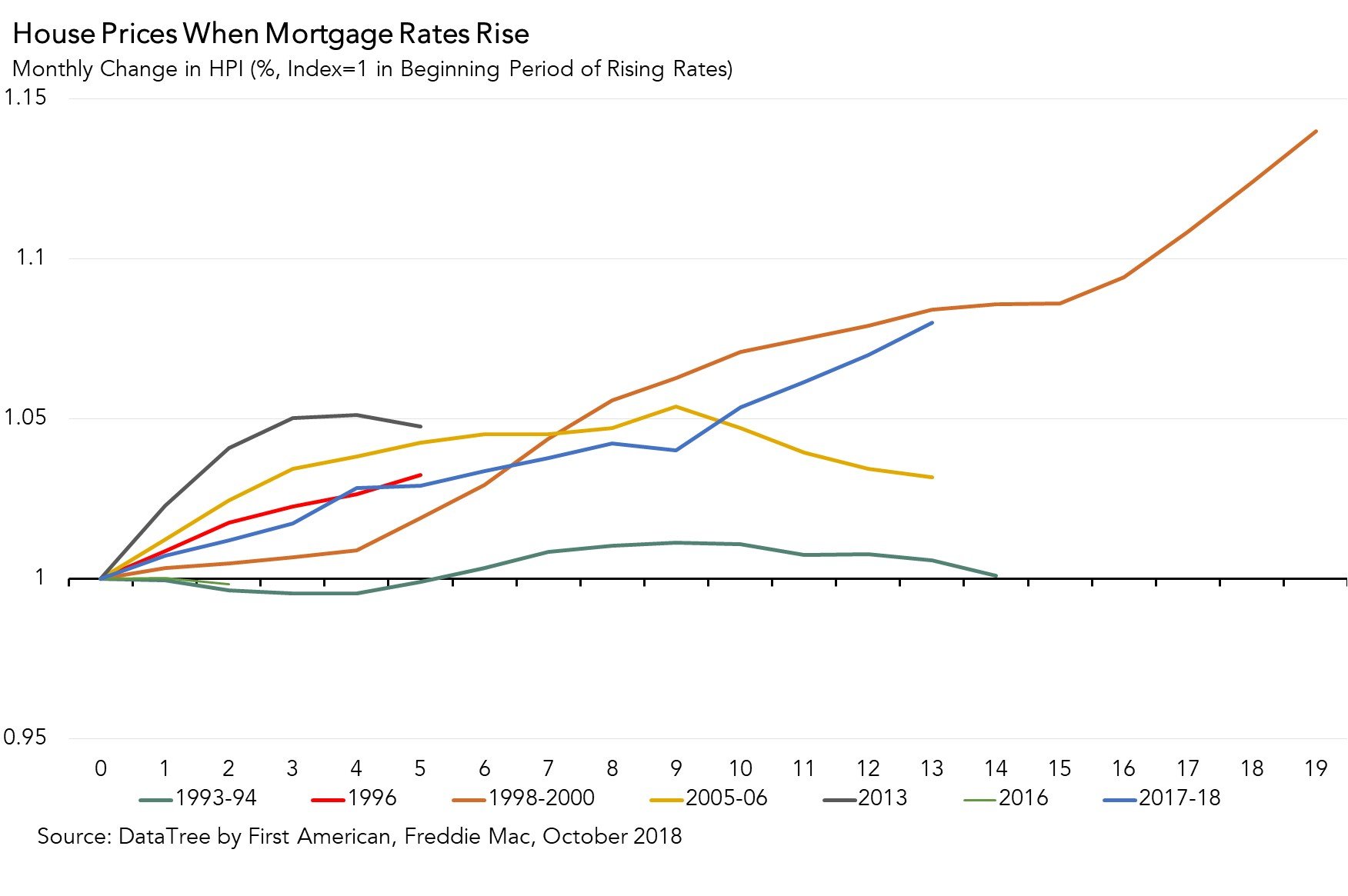

How Does a Strong Economy Slow the Housing Market?

By

Mark Fleming on December 21, 2018

For the second consecutive month, all three key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and the unadjusted house price index, increased compared with a year ago. The 30-year, fixed-rate mortgage and the unadjusted house price index increased by 0.9 percentage points and 7.3 percent respectively. Even though ...

Read More ›