Do Rising Rates Outweigh the Impact of the Strong Economy on Housing Market Potential?

By

Mark Fleming on November 19, 2018

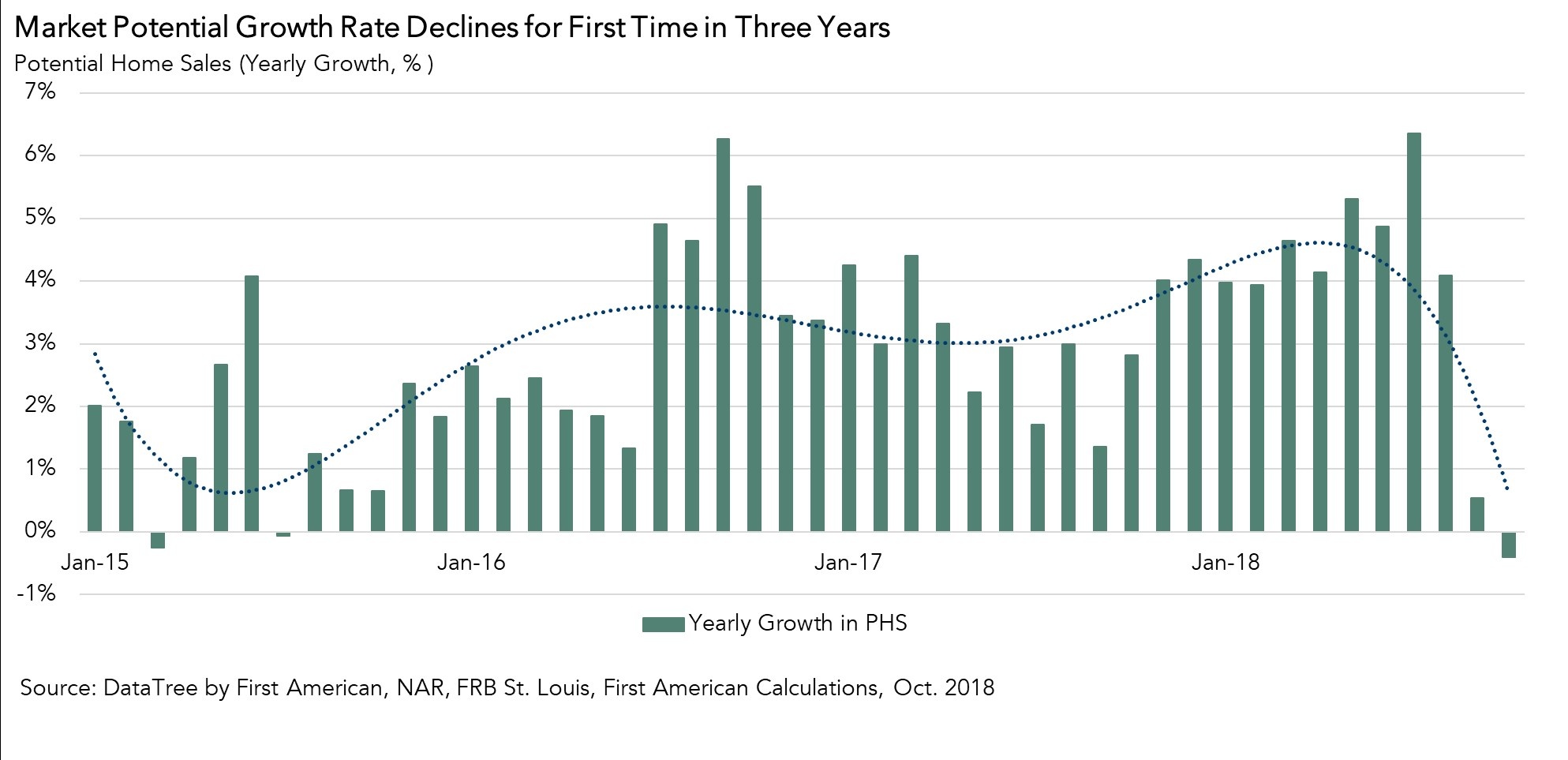

While the housing market continues to underperform its potential by 6.5 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in October compared with September, according to our Potential Homes Sales model. The housing market has the potential to support more than 391,000 additional home ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Why the Housing Market Can Thrive at 5 Percent Mortgage Rates

By

Mark Fleming on November 12, 2018

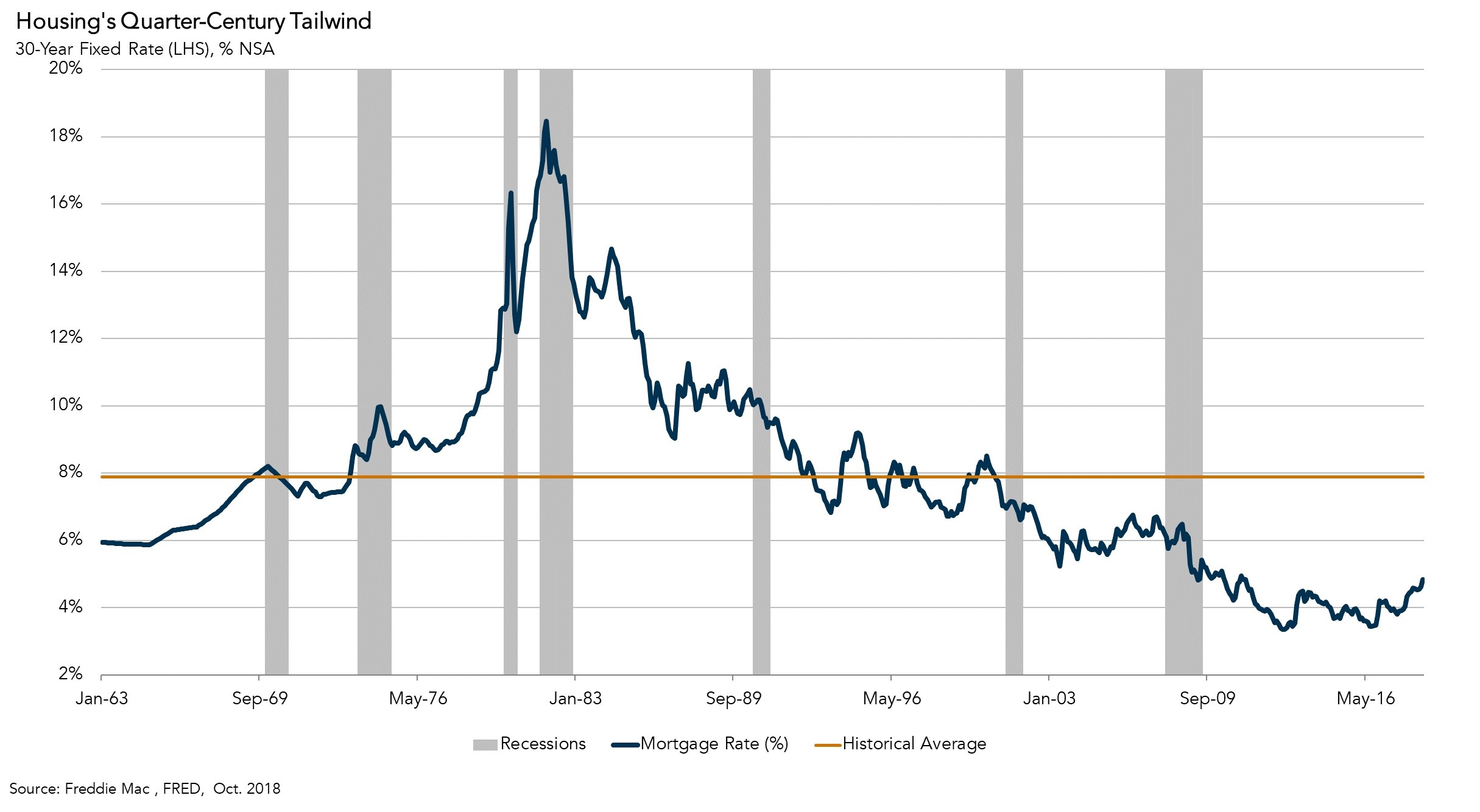

Last week, the 30-year, fixed mortgage rate hit a seven-and-a-half-year high of 4.86 percent. Most experts believe mortgage rates will continue to rise, reaching 5 percent in 2019.

Read More ›

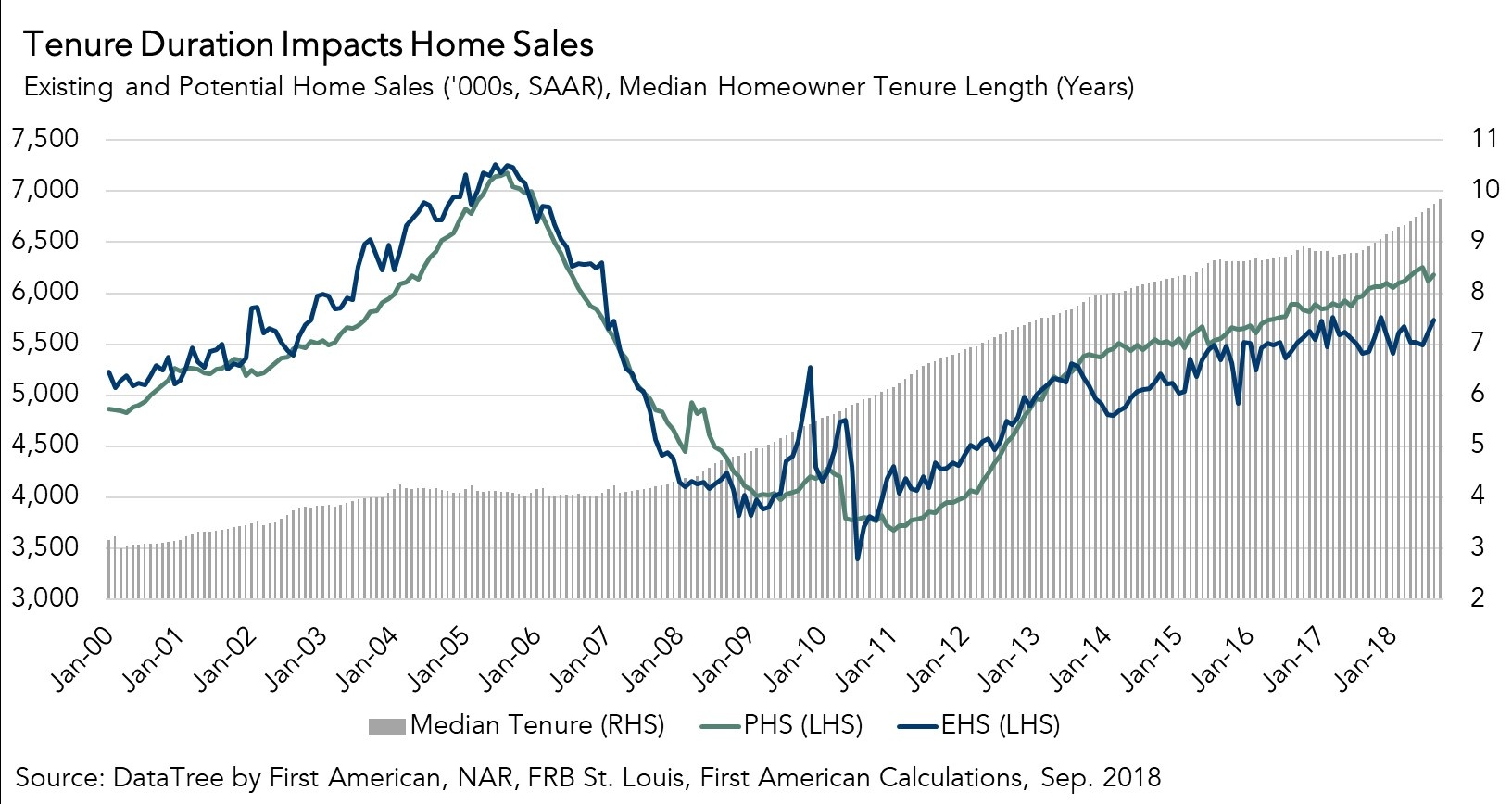

Why Homeowners Staying in their Homes Dampens the Housing Market

By

Mark Fleming on October 18, 2018

While the housing market continues to underperform its potential by 7.2 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in September compared with August, according to our Potential Homes Sales model. However, even though the performance gap narrowed a bit, the housing market still ...

Read More ›

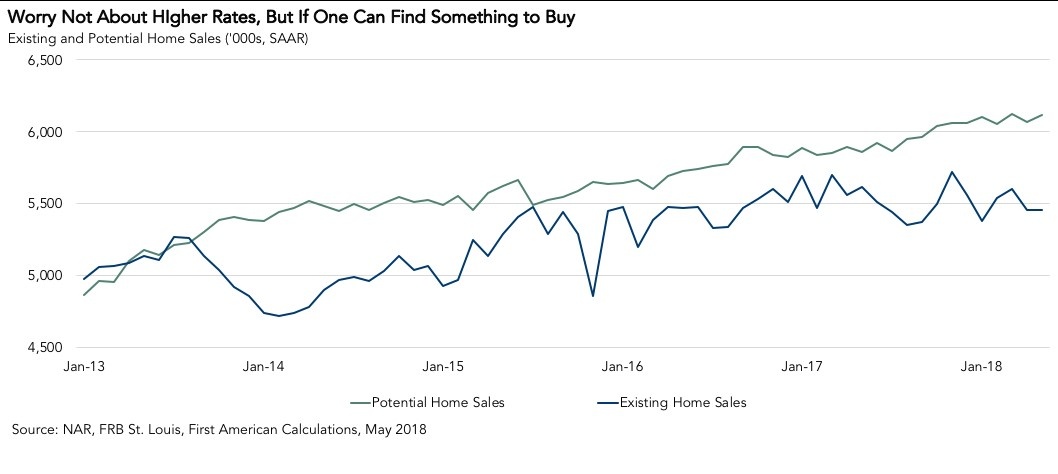

What's the Outlook for Housing Market Potential Amid Rising Mortgage Rates?

By

Mark Fleming on June 18, 2018

With the Federal Reserve Open Market Committee (FOMC) decision to increase the Federal Funds Rate last week, the prospect of higher mortgage rates remains top of mind among real estate professionals and continues to generate headlines. Yet, changes to the short-term rate matter little to the housing market.

Read More ›

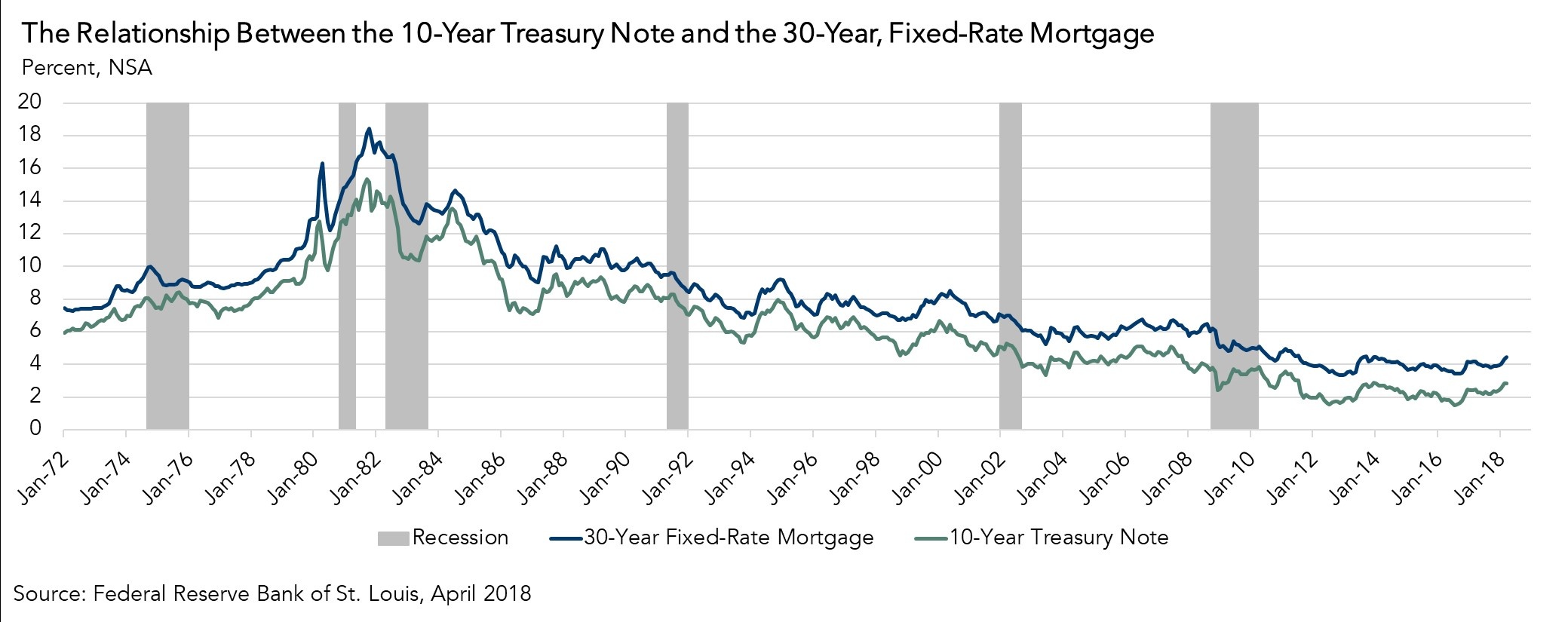

What Does the Change in the 10-Year Treasury Note Mean for Housing Affordability

By

Mark Fleming on May 7, 2018

At the May Federal Reserve (Fed) meeting last week, all eyes were on the 10-year Treasury yield. In late April, that yield topped 3 percent for the first time in more than four years. With yields on the rise, housing market participants expect this to mean higher interest rates from central banks. It’s often overlooked that the popular 30-year, ...

Read More ›

Housing Interest Rates Real House Price Index Federal Reserve Affordability

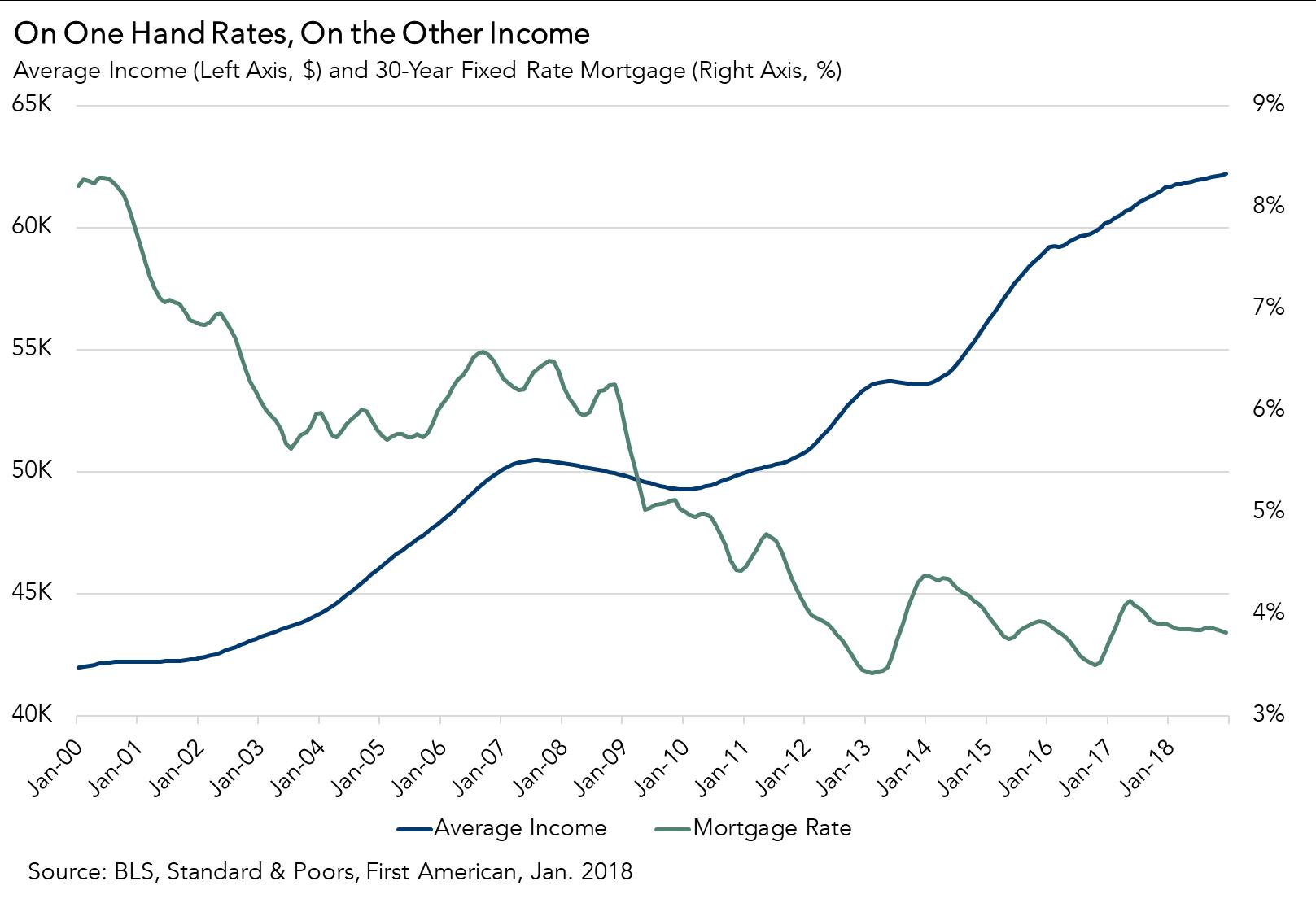

What Does Faster Inflation and Rising Mortgage Rates Mean for Housing?

By

Mark Fleming on March 9, 2018

As the March Federal Reserve (Fed) meeting approaches, overall positive economic conditions are troubling those who follow the Fed closely. Many might pose the question, why would positive economic conditions be troubling?

Read More ›