While the housing market continues to underperform its potential by 6.5 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in October compared with September, according to our Potential Homes Sales model. The housing market has the potential to support more than 391,000 additional home sales at a seasonally adjusted annualized rate (SAAR).

The primary culprit for the housing market’s performance gap remains severe supply shortages – home buyers can’t buy what’s not for sale. While the discussion of rising mortgage rates tends to focus on their impact on the buyer’s affordability, rising mortgage rates create a financial disincentive for existing homeowners with low mortgage rates from selling their homes. This phenomenon impacts both sides of the supply and demand dynamic -- those who don’t sell, don’t buy either.

“Those who don’t sell, don’t buy either and, if you’re a first-time home buyer, it’s hard to buy what’s not for sale.”

It’s Not the Economy, Stupid

The U.S. economy is experiencing its second longest economic expansion in history. Gross domestic product in the third quarter of 2018 increased by 3.5 percent, which exceeded economists’ predictions of 2 percent. Additionally, the economy has added jobs every month for 97 straight months, unemployment is at 49-year lows, and wages are growing at their fastest rate in nine years.

In addition to the benefits of a strong economy, the housing market is experiencing a wave of first-time home buyer demand, as millennials age into homeownership. According to the latest release of the American Enterprise Institute’s first-time home buyer index, more than 50 percent of all homes were purchased by first-time home buyers as of July 2018.

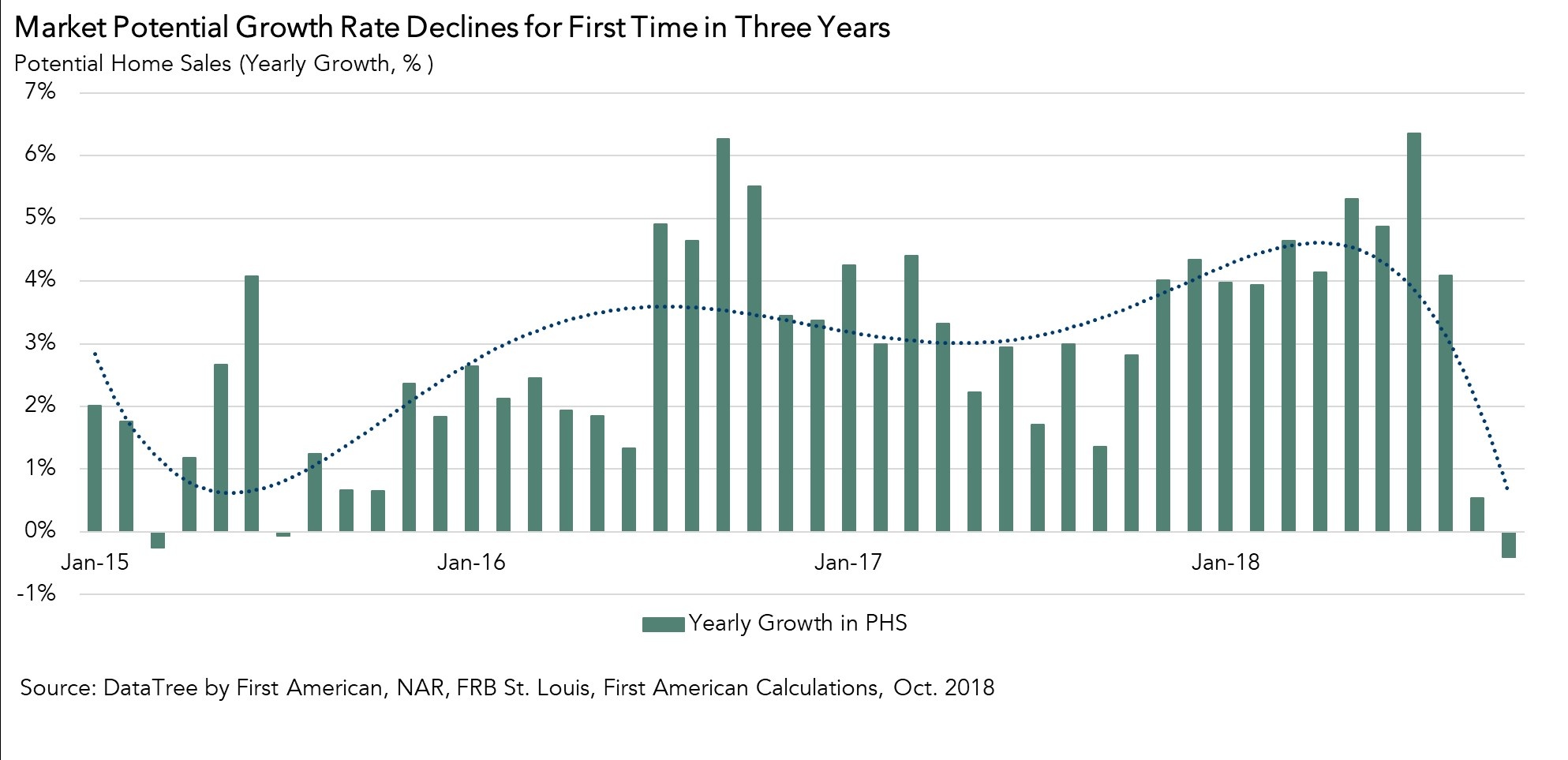

Despite the boost in demand and positive economic environment, the market potential for home sales has outpaced actual existing-home sales for five straight years. However, this month, the market potential for home sales also saw its first year-over-year decline in over three years. It begs the question, what is driving the decline in the market potential for existing-home sales?

Rising Rates Cut Two Ways

Rising mortgage rates have been detrimental to the market potential for existing-home sales, impacting the propensity to sell, as well as the ability to buy. Mortgage rates have risen nearly one percentage point in the past year, and will likely rise to 5 percent in 2019. The 30-year, fixed rate mortgage hasn’t been that high since 2009. Rising mortgage rates create a financial disincentive for existing homeowners with low mortgage rates from selling their homes.

While the housing market benefits from increasing millennial demand for homeownership and a strong economy, rising mortgage rates reduce the propensity of sellers to sell and the buying power of potential buyers. Those who don’t sell, don’t buy either and, if you’re a first-time home buyer, it’s hard to buy what’s not for sale.

October 2018 Potential Home Sales

For the month of October, First American updated its proprietary Potential Home Sales model to show that:

- Potential existing-home sales increased to a 6.04 million seasonally adjusted annualized rate (SAAR), a 0.5 percent month-over-month increase.

- This represents a 61.7 percent increase from the market potential low point reached in February 2011.

- The market potential for existing-home sales decreased by 0.4 percent compared with a year ago, a loss of 24,600 (SAAR) sales.

- Currently, potential existing-home sales is 1.25 million (SAAR), or 17.1 percent below the pre-recession peak of market potential, which occurred in July 2005.

Market Performance Gap

- The market for existing-home sales is underperforming its potential by 6.5 percent or an estimated 391,600 (SAAR) sales.

- The market performance gap decreased by an estimated 64,800 (SAAR) sales between September 2018 and October 2018.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.

First American Senior Economist Odeta Kushi contributed to this blog post.

.jpg)