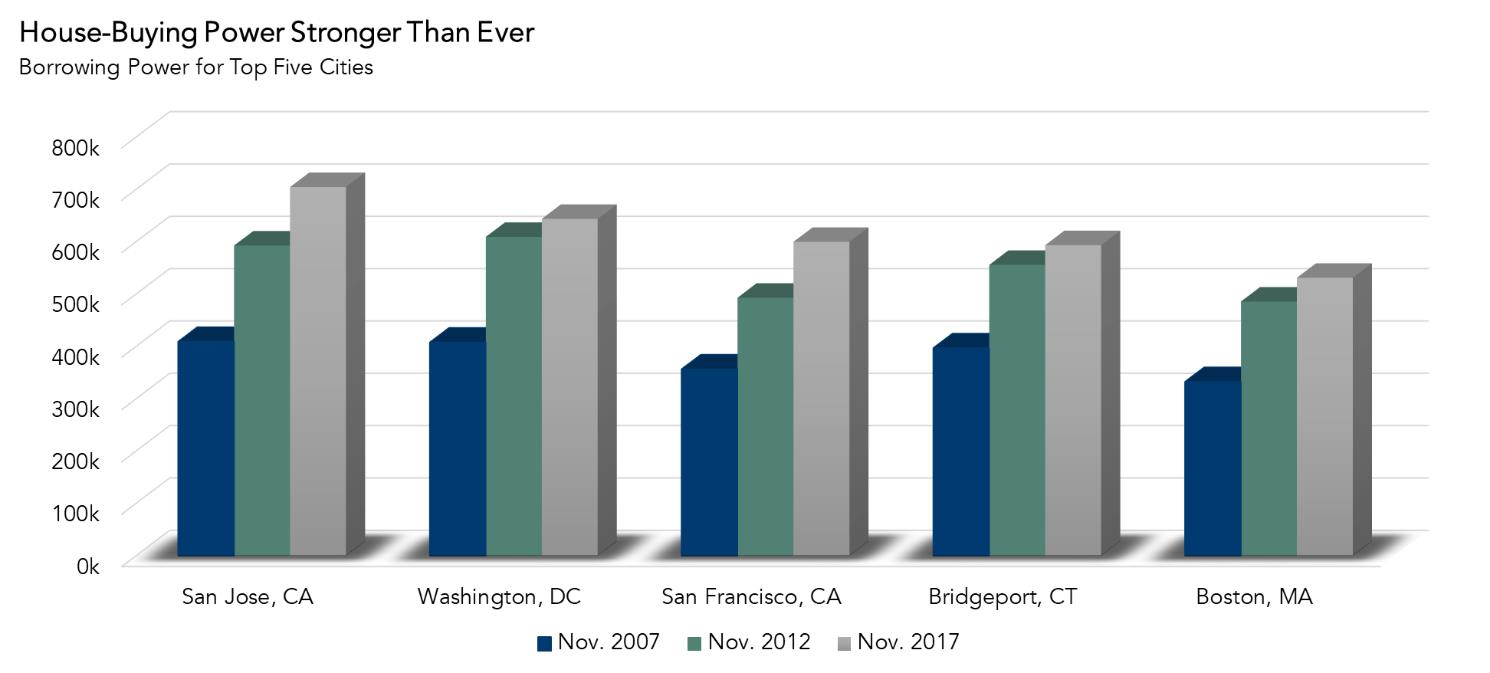

Where is house-buying power the strongest?

By

Mark Fleming on February 14, 2018

Whether you plan to buy a modest studio or a four-bedroom penthouse, how much you can afford to borrow primarily rests on two main factors: income and interest rates. Income growth seems to be increasing, thus increasing affordability. However, the near certainty of future rate hikes will likely be a drag on affordability.

Read More ›

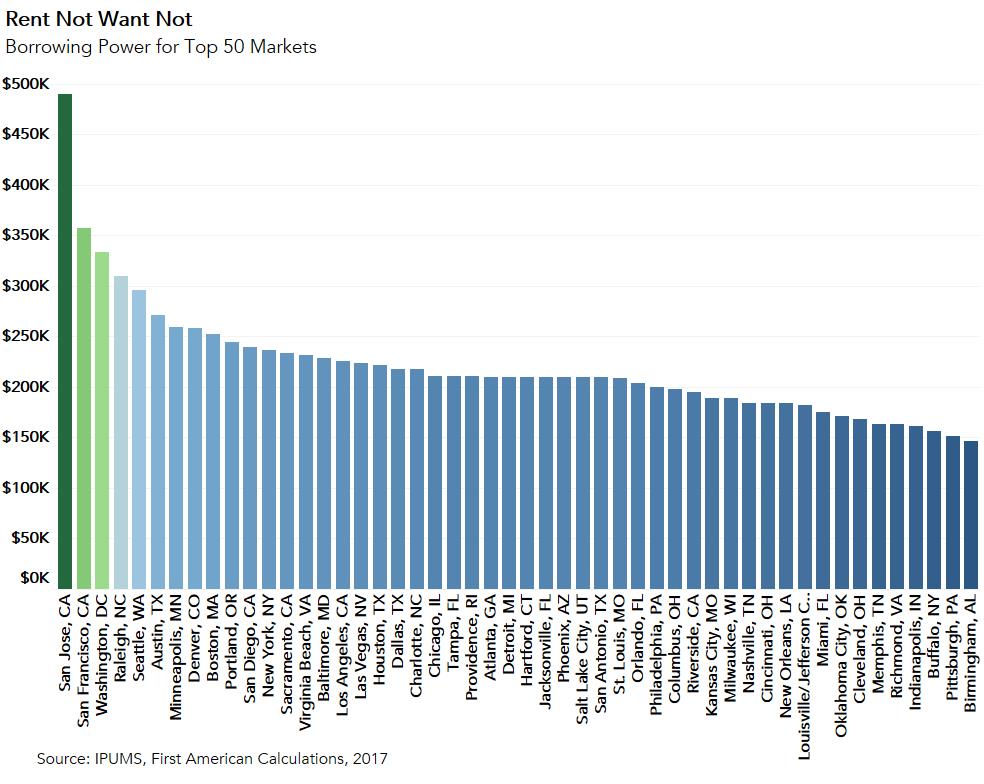

Best Cities to Maximize Borrowing Power for First-Time Home Buyers

By

Mark Fleming on December 11, 2017

It’s a near certainty that the Federal Open Market Committee (FOMC) will raise the short-term Federal Funds rate this week. The CME group estimates the probability of a 25 basis-point increase at 90.2 percent. Some may fret about how this will impact the housing market, but they are missing the point on mortgage rates and affordability for ...

Read More ›

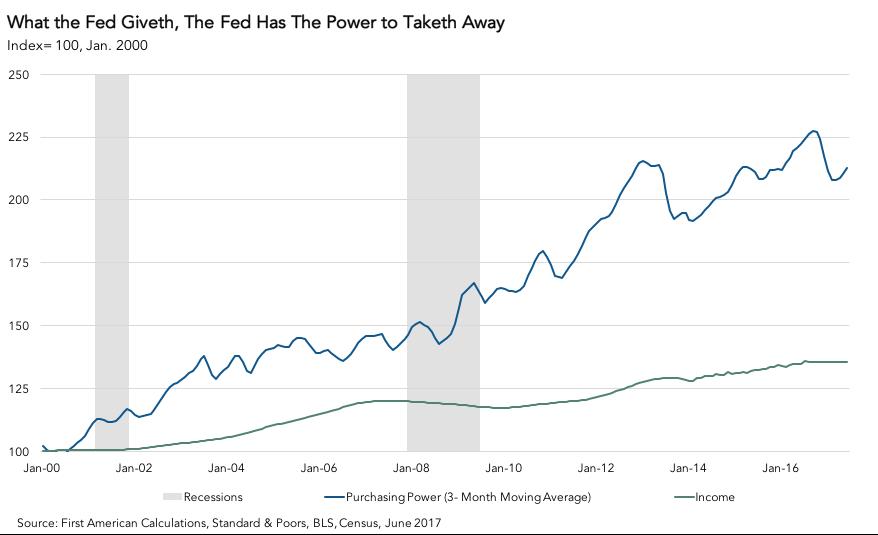

Many Experts Miss the Point on Mortgage Rates and Affordability for First-Time Home Buyers

By

Mark Fleming on November 6, 2017

Last week, the Federal Open Market Committee (FOMC) met for the second to last time this year. As most prognosticators expected, the FOMC decided to leave the short-term Federal Funds rate unchanged. While good news for those with credit card debt, car loans and adjustable rate mortgages, the impact of FOMC inaction, or action for that matter, is ...

Read More ›

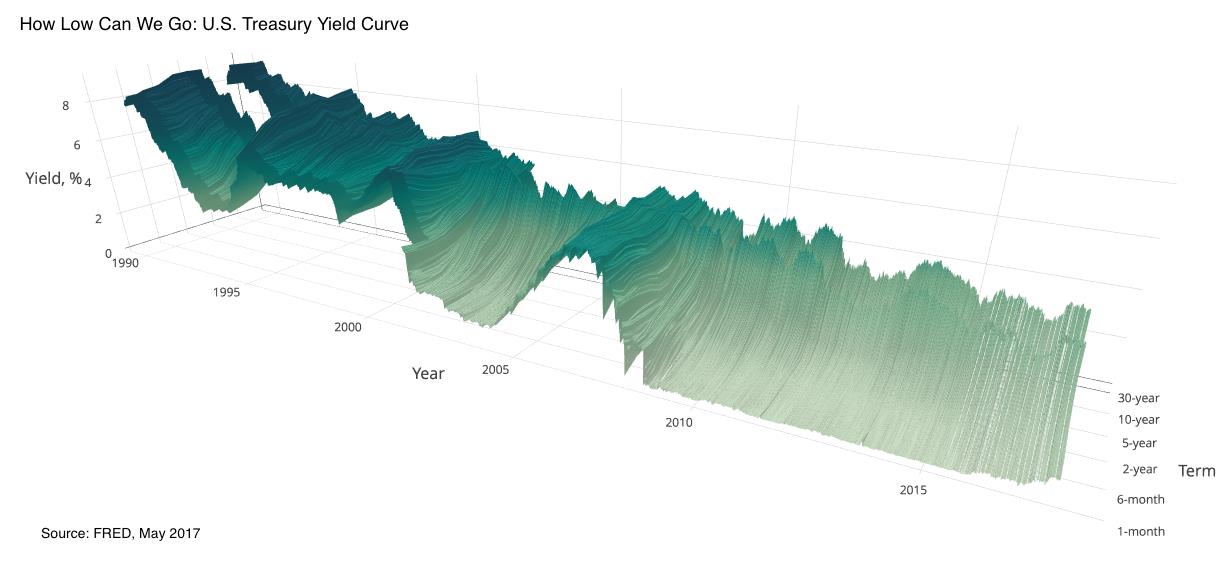

Will Quantitative Un-Easing Make Housing Unaffordable?

By

Mark Fleming on September 20, 2017

This month, the Federal Open Market Committee (FOMC) will consider again whether to increase the benchmark Federal Funds Rate for a third time this year. As I stated when the FOMC was contemplating a rate increase earlier this year, increasing the short-term Federal Funds rate has little impact on longer term rates like the 30-year, fixed-rate ...

Read More ›

Here’s Why a Fed Rate Increase Does Not Matter to the Housing Market

By

Mark Fleming on June 13, 2017

With the Federal Reserve Open Market Committee (FOMC) meeting to decide whether to increase the Federal Funds rate in just a few days, the potential for an increase in mortgage rates dominates the housing news and industry chatter. Yet, changes to the short-term rate matter little to the housing market.

Read More ›

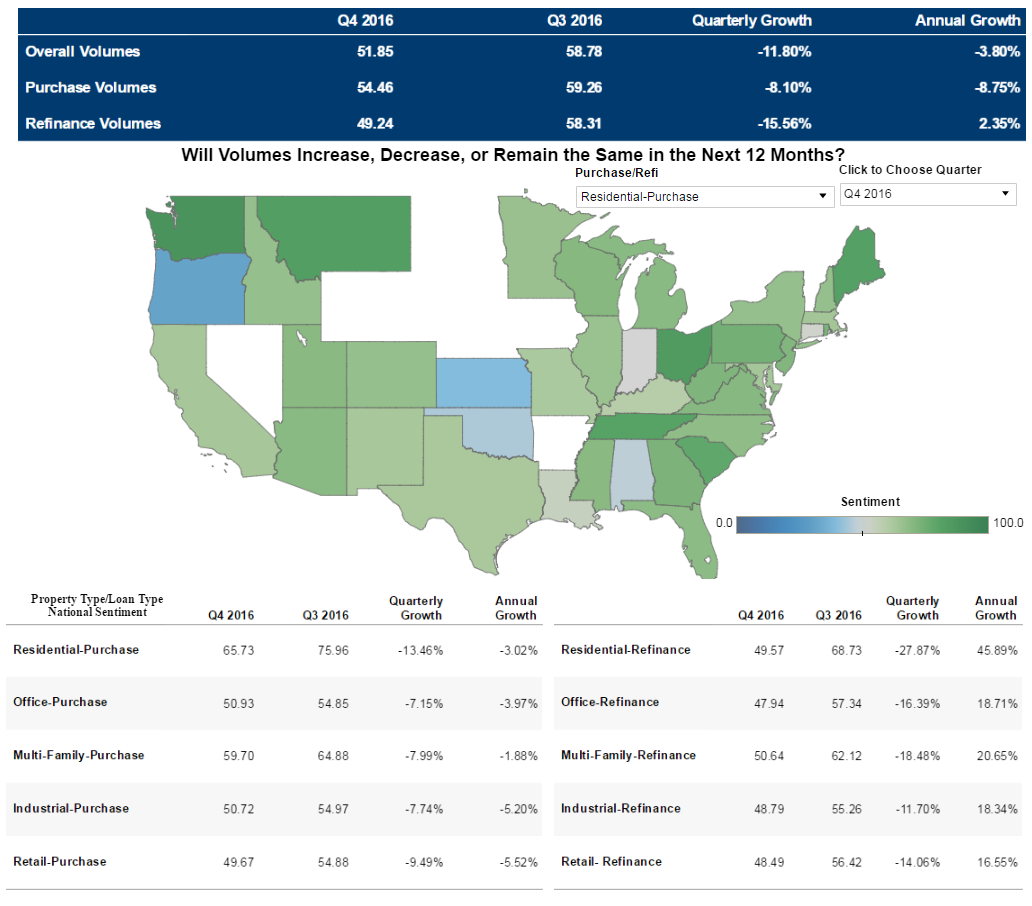

Real Estate Outlook Declines on Election Uncertainty and Heightened Expectations for Fed Rate Hikes

By

FirstAm Editor on December 21, 2016

We invite you to browse the fourth quarter 2016 First American Real Estate Sentiment Index, which is based on a quarterly survey of independent title agents and other real estate professionals, providing a unique gauge on the real estate market using the crowd-sourced wisdom and expertise of real estate experts.

Read More ›