Last week, the 30-year, fixed mortgage rate hit a seven-and-a-half-year high of 4.86 percent. Most experts believe mortgage rates will continue to rise, reaching 5 percent in 2019.

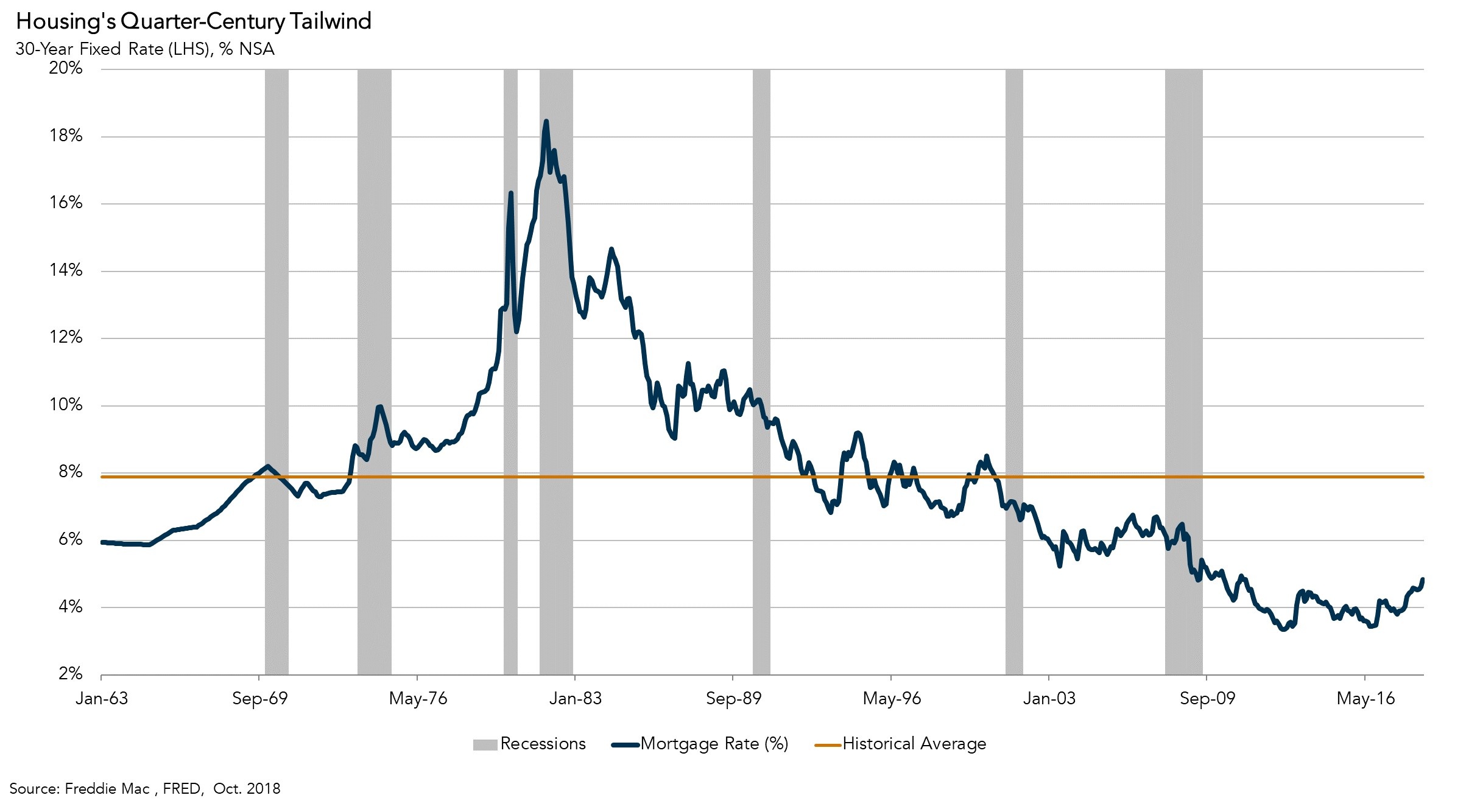

Despite all the talk about rising mortgage rates, it’s important to evaluate this in context. While today’s rates appear higher than the 3 to 3.5 percent rates of 2016, they remain well below the historic average of 8 percent. Yet, the increase in borrowing costs for home buyers, given increasing home prices, has prompted discussion about how the housing market will respond to higher rates.

“Mortgage rates have adjusted in the past in response to high inflation, a technological revolution, a housing crisis and a financial collapse. However, today’s higher mortgage rates are due to a near record-long economic expansion, and a strong labor market.”

Title agents and real estate professionals surveyed by First American believe that the housing market is fairly resilient to rising rates. For example, earlier this year, we asked title agents and real estate professionals what mortgage rates would need to hit before discouraging potential first-time buyers from the market. Their estimate: 5.6 percent. When we asked the same question in the first quarter of 2017, the response was 5.4 percent.

Historically, mortgage rates have exceeded these thresholds and people have still purchased homes, so what can we expect as rates continue to rise in the near term?

The history of mortgage rates may provide some insight. We examined mortgage rates and economic history over the last four decades, and identified four distinct mortgage rate eras that may offer helpful context for today’s home buyers.

The 1980s: The Federal Reserve’s War on Inflation

It’s almost unimaginable for today’s buyers, but home buyers in 1981 were faced with 30-year, fixed-rate mortgages at over 18 percent. Rates declined from the 1981 high point, leveling to around 10 percent at the end of the decade.

At the time, the Federal Reserve, under Chairman Paul Volcker, was waging a war on inflation. In an effort to tame double-digit inflation, the Federal Reserve drove interest rates higher. The Fed raises rates in a strong economy to encourage sustainable economic growth, and cuts rates when the economy needs support.

Today, the economy is strong – unemployment is low, inflation is on target, consumer confidence is high, and wages are rising. To promote further sustainable economic growth, the Federal Reserve today is increasing interest rates.

1990s and Early 2000s: The Information Boom

In the 1990s, inflation calmed down. Mortgage rates tend to follow the same path as long-term bond yields. Rising inflation will push up long-term bond yields to compensate investors for the higher level of inflation, and mortgage rates typically follow suit. The 30-year, fixed mortgage rate averaged 8.4 percent through most of the 1990s, before dipping below 7 percent in 1998.

A major reason for the decline in inflation was strong economic growth due to the arrival of the internet and information technologies, which prompted corporate capital investment, enhanced productivity and spawned investment in new internet-based “Dot Com” businesses.

In the early 2000’s, after the “Dot Com” stock market bubble burst and sparked a mild recession, the Fed lowered interest rates further. The 30-year, fixed-mortgage rate reached what was then a historic low point - below 6 percent in 2003.

2006-2008: Housing Bubble and Bust

House prices always went up, nationally, until they didn’t. The collapse of the housing bubble exposed the financial system’s excessive leverage, contributing to the financial crisis and the Great Recession.

To combat the crisis, the Federal Reserve cut interest rates as much as possible and implemented an unprecedented monetary stimulus policy known as quantitative easing (increasing the money supply by buying government and mortgage bonds). With that, a new era of cheap credit was upon us. As a result, mortgage rates fell below 5 percent in 2009, a level the housing market had not experienced in more than 50 years.

2010-Present: Recovery

Riding the wave of quantitative easing and the Fed’s continued monetary stimulus, mortgage rates entered this decade at 4.7 percent. By 2012, they had fallen to about 3.5 percent. In 2013, rates increased to nearly 4 percent in response to the Fed’s announcement that it would taper quantitative easing. The “taper tantrum” aside, mortgage rates remained near or below 4 percent until 2016.

Since then, the 10-year Treasury yield has risen as the Fed slowly tightened monetary policy, and the economy expanded. The 30-year, fixed-rate mortgage followed suit and increased to the current level of 4.86 percent.

Today’s Rates May Not be as Great, But They are Still Below Eight

What is the lesson from this trip through the “mortgage-rate” past? The recent period of mortgage rates between 3 and 3.5 percent is a historic anomaly, as challenging as it might be to believe so after experiencing it for 10 years.

Historically, the housing market has performed well when mortgage rates were considerably higher than today. Rates averaged 6 percent between 2001 and 2009. In 2000, they averaged 8.05 percent. In the decade between 1980 and 1990, they averaged a whopping 12.5 percent.

However, the key take-away is that people were still buying homes across all of these mortgage rate eras. Mortgage rates have adjusted in the past in response to high inflation, a technological revolution, a housing crisis and a financial collapse. However, today’s higher mortgage rates are due to a near record-long economic expansion, and a strong labor market. If you think 5 percent is high, take a walk down mortgage memory lane.

Senior Economist Odeta Kushi contributed to this blog post.