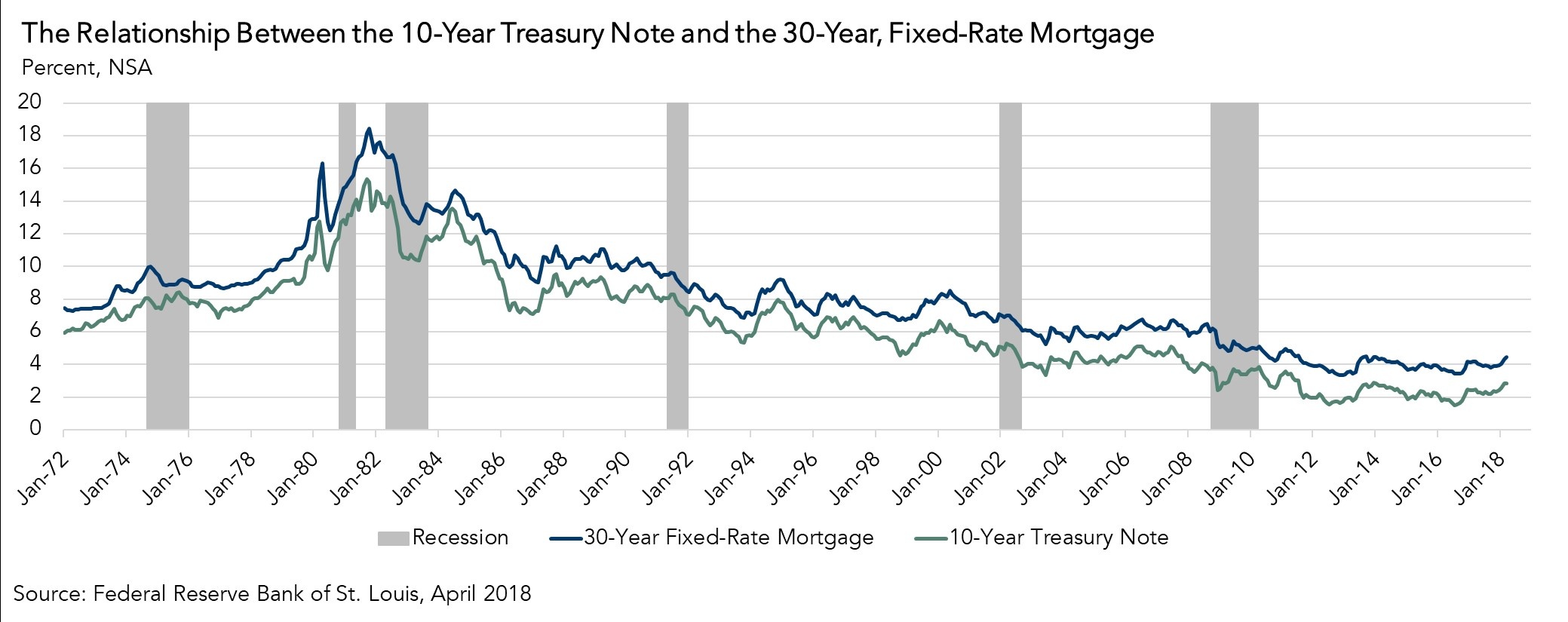

At the May Federal Reserve (Fed) meeting last week, all eyes were on the 10-year Treasury yield. In late April, that yield topped 3 percent for the first time in more than four years. With yields on the rise, housing market participants expect this to mean higher interest rates from central banks. It’s often overlooked that the popular 30-year, fixed-rate mortgage is benchmarked to the 10-year Treasury bond. In fact, as shown in the chart below, since the end of the recession, the 30-year, fixed-rate mortgage has on average remained 1.7 percentage points higher than the 10-year Treasury bond yield. So, if that trend remains consistent, if the 10-year Treasury yield rises above 3 percent, then the 30-year, fixed-rate mortgage rate should also rise to 4.5 percent.

“The recent increase in the 10-year Treasury yield indicates higher mortgage rates are likely in the very near future. But, even as mortgage rates increase, we remain well below the historical average of about 8 percent for a 30-year, fixed-rate mortgage – and house-buying power remains strong.”

Housing Affordability and the 10-Year Treasury

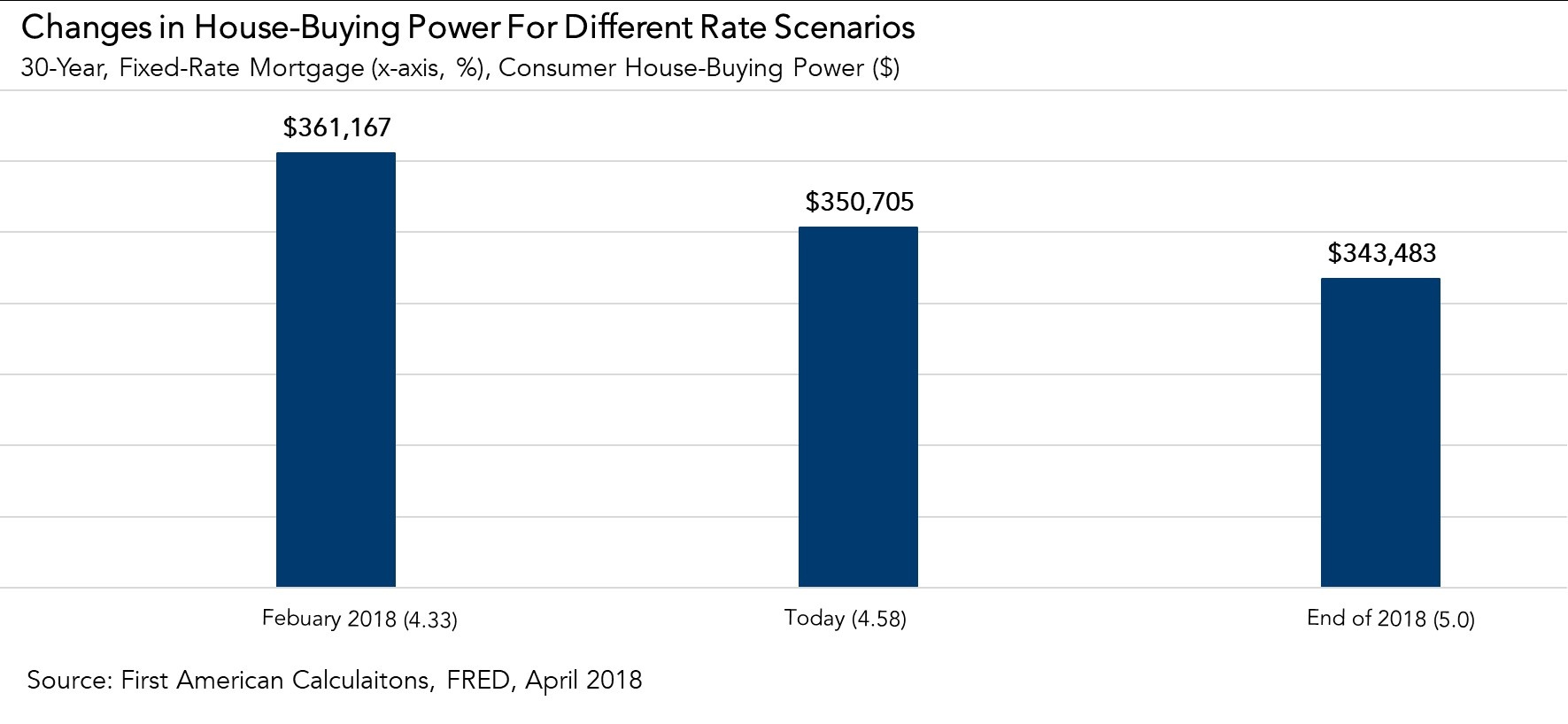

When we published our Real House Price Index last month, the 10-year Treasury yield was 2.44 percent and the 30-year, fixed-rate mortgage rate was 4.33 percent. With an average national household income of approximately $63,000, consumer house-buying power, the combination of one’s income and the prevailing mortgage rate, was $361,000. Now that the yield on the 10-year Treasury is 3 percent, and the 30-year, fixed rate mortgage rate is 4.58 percent, consumer house-buying power has declined to $350,705, a 2.9 percent decrease. While we can’t predict the future yield on the 10-year Treasury, many economists predict that the 30-year, fixed-rate mortgage rate to approach 5 percent by the end of 2018. This forecast seems an increasingly likely outcome as the yield on the 10-year Treasury would only need to reach 3.5 percent for the 30-year, fixed-rate mortgage rate to reach 5 percent.

However, we have noted recently that one of the main reasons that rates are rising is because of positive economic conditions. But, those same economic conditions are also fueling faster income growth. Our current estimate of average household income, based on Census and Bureau of Labor Statistics data, is the highest it has ever been. If average household income continues to rise at the same pace it did from February 2017 to February 2018, we would expect consumer house-buying power to only decline 2 percent to $343,785. For perspective, that remains 43 percent higher than house-buying power was at the end of the Great Recession. It’s true that the recent increase in the 10-year Treasury yield indicates higher mortgage rates are likely in the very near future. But, even as mortgage rates increase, we remain well below the historical average of about 8 percent for a 30-year, fixed-rate mortgage – and house-buying power remains strong.

Odeta Kushi contributed to this blog post.