Where Rent-Burdened Households Declined the Most

By

Odeta Kushi on March 11, 2020

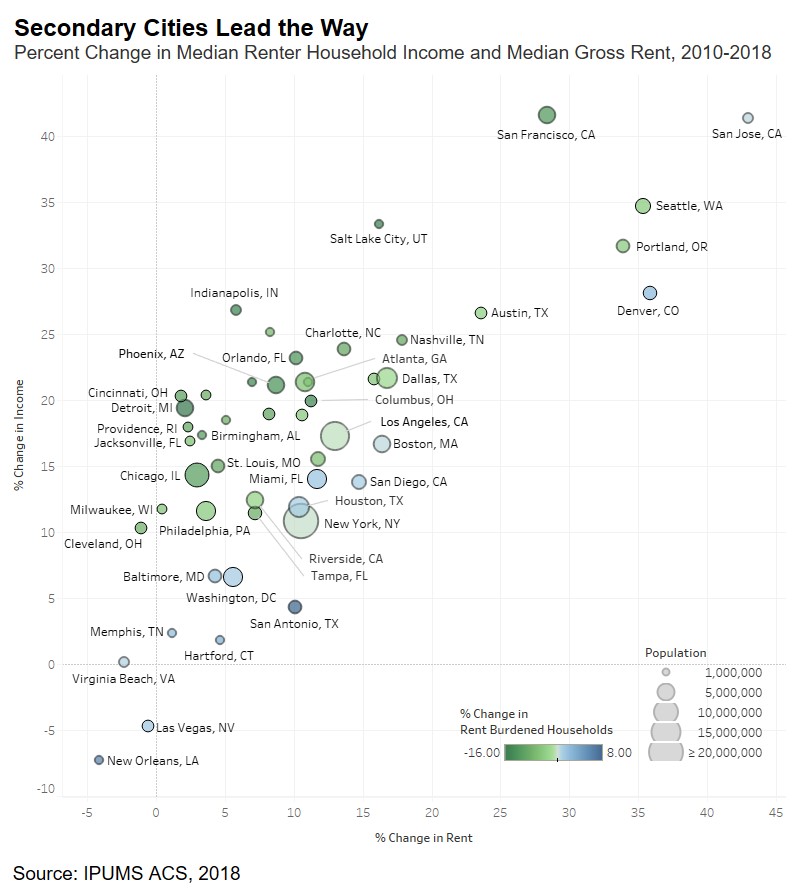

Beginning in 2011 and continuing through 2018, the share of rent-burdened households declined nationally – a trend reversal from the decade between 2000 and 2010. According to the Department of Housing and Urban Development, rent-burdened households spend over 30 percent of their income on rent. However, as the old adage goes, it’s all about ...

Read More ›

Why the Share of Rent-Burdened Households Has Declined in the Post-Recession Era

By

Odeta Kushi on March 2, 2020

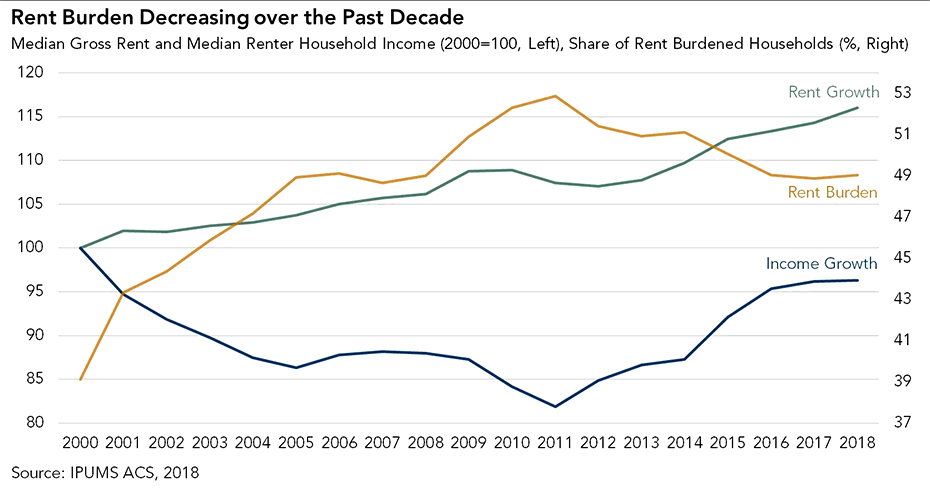

After nearly 20 years of rising rents, renter affordability, or the lack thereof, is a hot topic in housing. The long-running increase in rents has fueled a rise in the share of rent-burdened households, defined by the Department of Housing and Urban Development (HUD) as households that spend over 30 percent of their income on rent.

Read More ›

Where Wages Grow, Affordability Follows

By

Mark Fleming on February 24, 2020

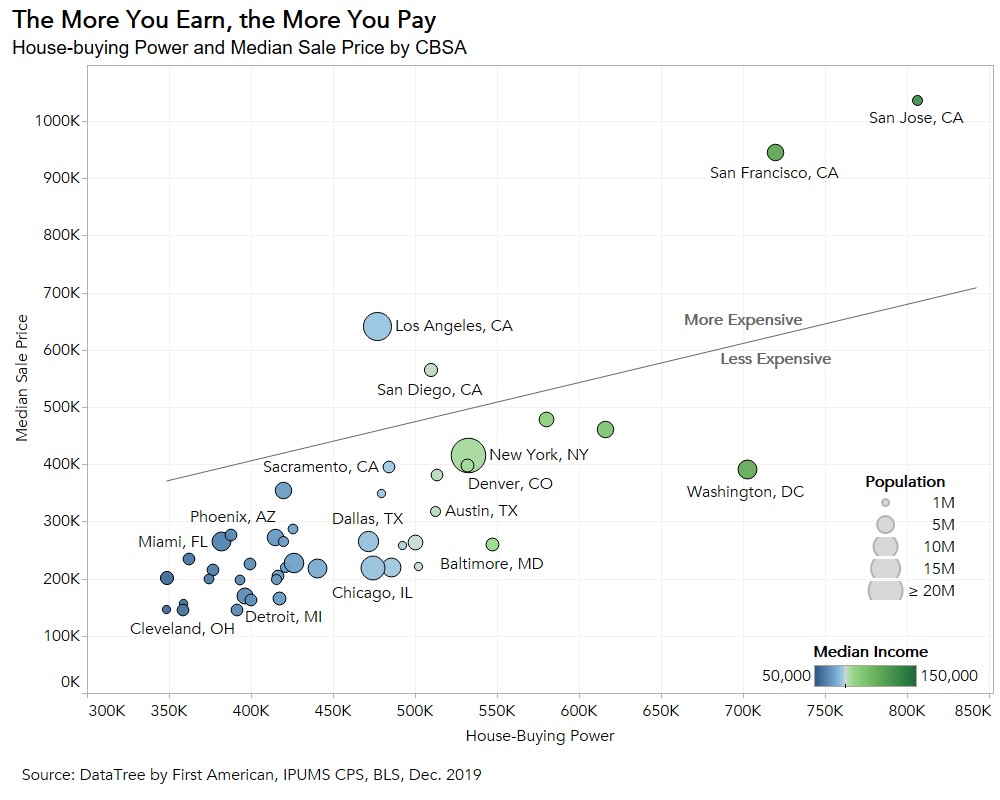

As 2019 came to a close, potential home buyers received a year-end gift as affordability improved relative to one year ago. Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in December.

Read More ›

The Five Cities Where Affordability Improved the Most

By

Mark Fleming on January 27, 2020

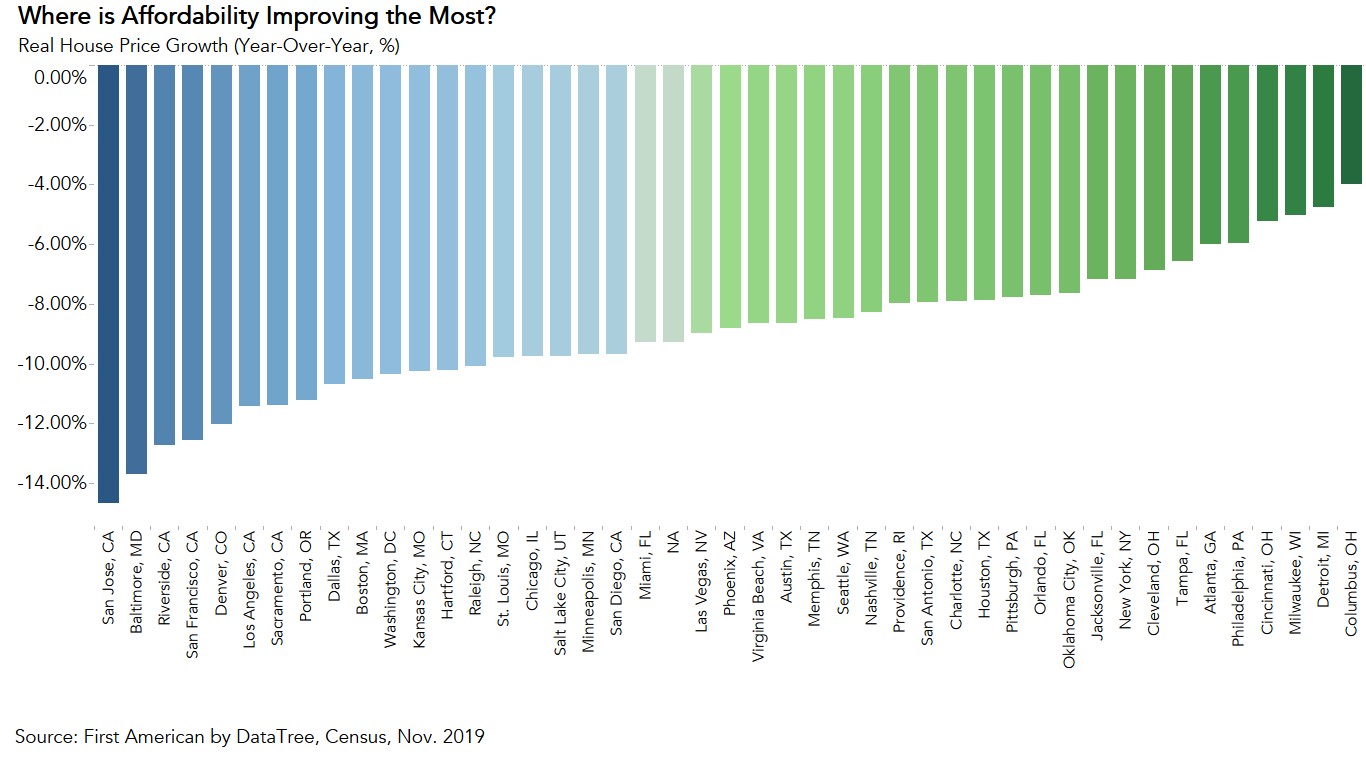

Once again, home buyers benefitted from a year-over-year affordability boost as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in November. Compared with November 2018, the 30-year, fixed-rate mortgage fell by 1.2 percentage points and household ...

Read More ›

What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

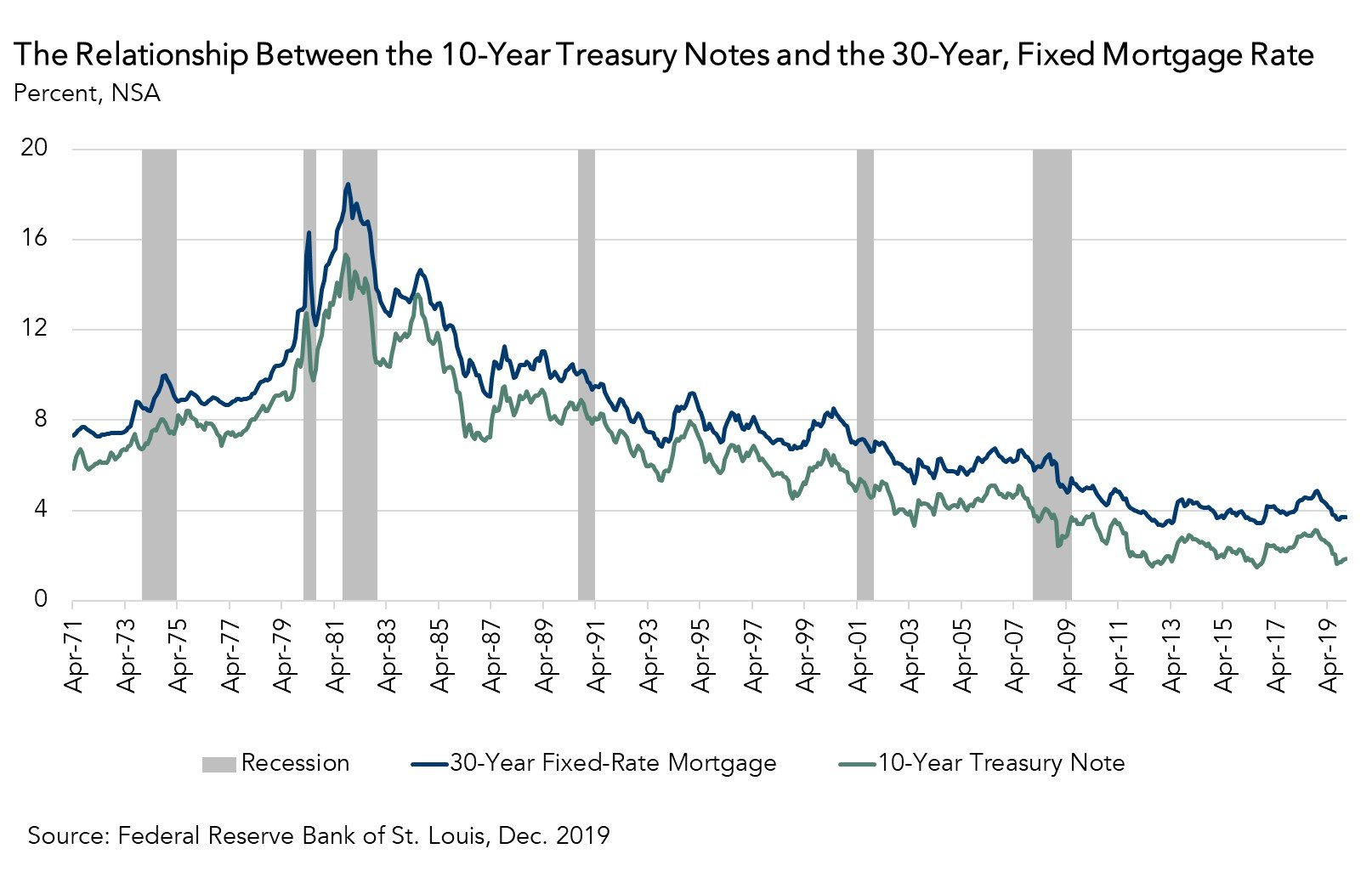

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability

Interviews on CNBC and Yahoo! Finance: 2020 Housing Outlook – Why Persistently Low Mortgage Rates May Help and Hurt Home Buyers

By

FirstAm Editor on December 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Yahoo! Finance last week, discussing the 2020 outlook for the housing market and how persistently low mortgage rates may both help and hurt home buyers in the year ahead.

Read More ›