Interviews on Yahoo! Finance and Nightly Business Report: Discussing existing-home sales, the housing supply squeeze and the market forces helping affordability

By

FirstAm Editor on May 24, 2019

First American Chief Economist Mark Fleming was interviewed on Yahoo! Finance and Deputy Chief Economist Odeta Kushi on Nightly Business Report earlier this week and discussed the existing-home sales data for April, the housing supply squeeze and the market forces helping affordability.

Read More ›

Interviews on FOXBusiness and CNBC: Discussing the Outlook for the Housing Market and Economy and the Impact of Tax Law Changes

By

FirstAm Editor on May 22, 2019

First American Chief Economist Mark Fleming was interviewed on FOXBusiness and CNBC on Tuesday and discussed the outlook for the housing market and broader economy as well as the impact of tax law changes on housing.

Read More ›

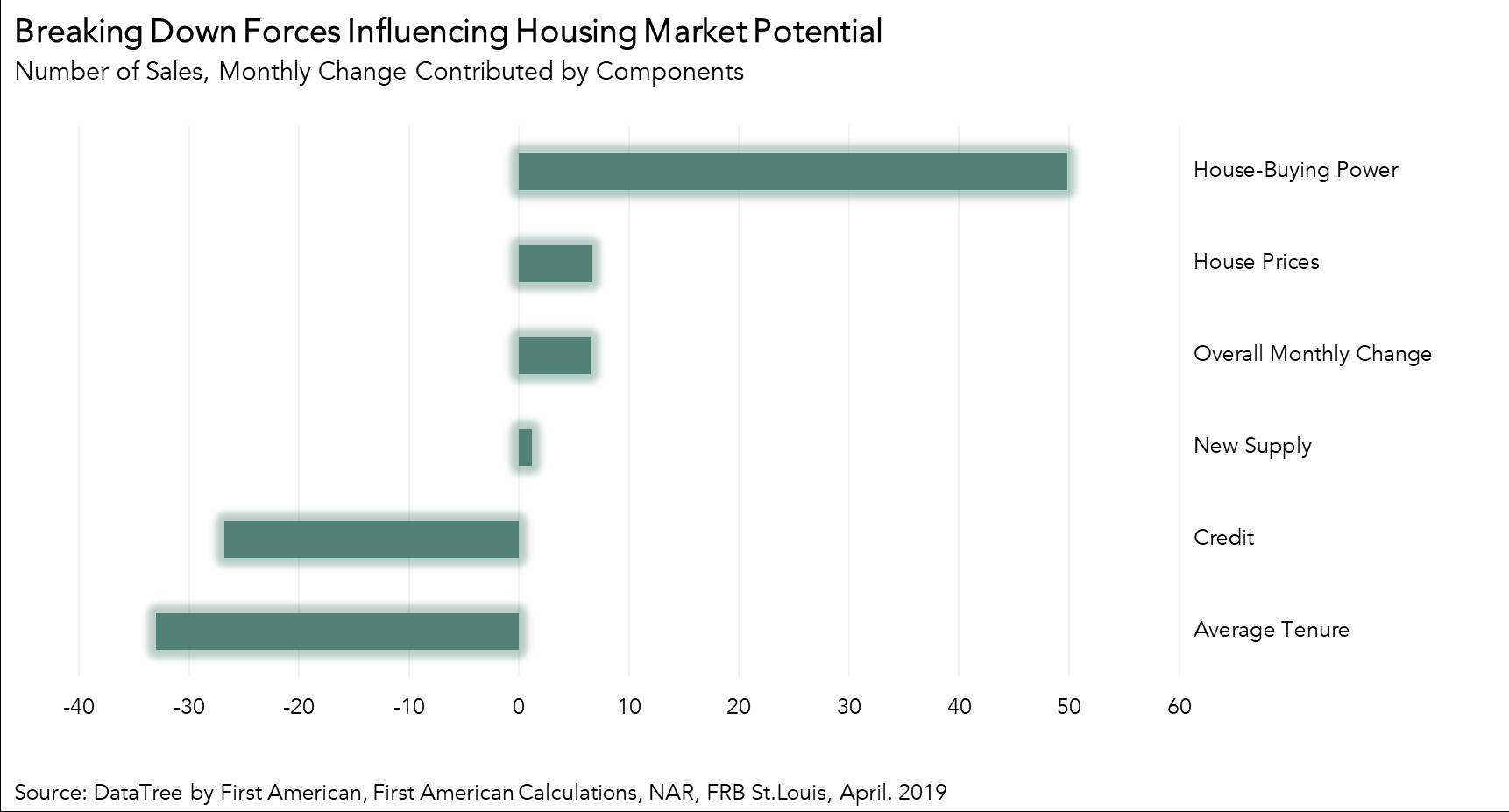

Why Did Housing Market Potential Improve in April?

By

Mark Fleming on May 20, 2019

The housing market continued to underperform its potential in April 2019, but the performance gap shrank compared with March. Actual existing-home sales remain 1.3 percent below the market’s potential, but the performance gap narrowed from 2.0 percent last month, according to our Potential Home Sales model. That means the housing market has the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

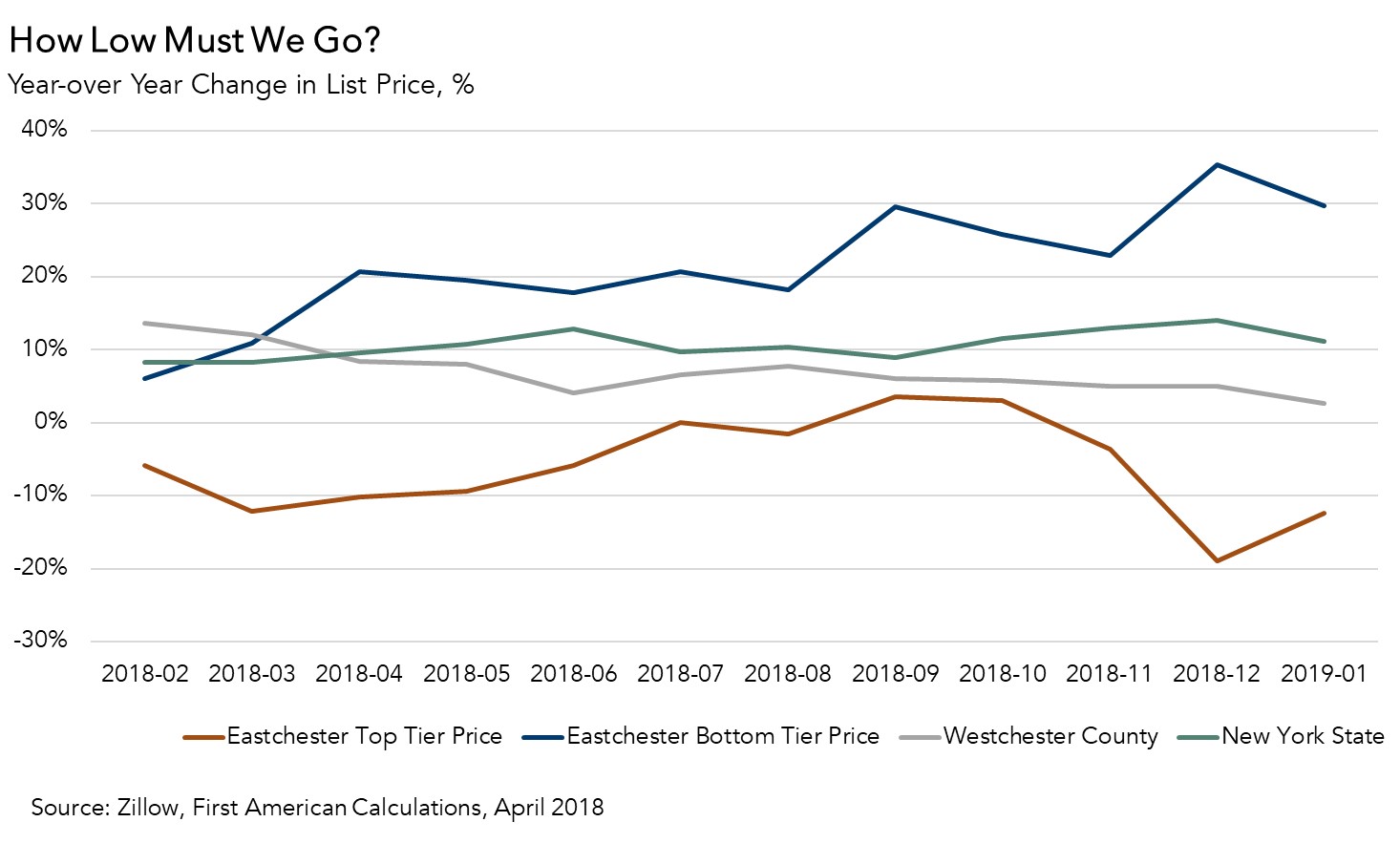

How Have the 2017 Tax Law Changes Impacted Real Estate Prices?

By

Odeta Kushi on May 13, 2019

Enacted in 2017, the Tax Cuts and Jobs Act reduced tax breaks for homeowners. At the time, many in the real estate industry expected the changes to negatively impact the housing market, particularly in high-priced neighborhoods. The industry concern primarily focused on two specific changes included in the bill: the mortgage interest deduction was ...

Read More ›

Why Everything You Know About First-Time Home Buyer Affordability is Wrong

By

FirstAm Editor on May 8, 2019

We’ve published the findings from a new study that provides an in-depth look at the trends shaping affordability, specifically for first-time home buyers, titled “Why Everything You Know About First-Time Home Buyer Affordability is Wrong.” The study, developed by First American Chief Economist Mark Fleming and Deputy Chief Economist Odeta Kushi, ...

Read More ›

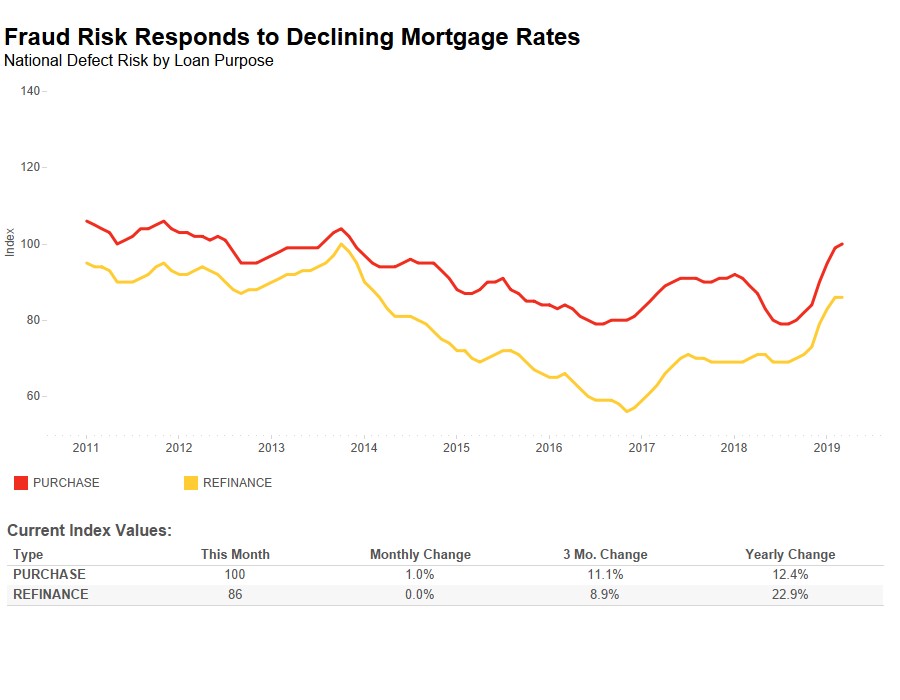

The Two Competing Forces Impacting Fraud Risk

By

Mark Fleming on April 30, 2019

Loan application defect risk for purchase transactions continued its upward trend in March, increasing 1.0 percent month-over-month, according to the Loan Application Defect Index. Defect risk for purchase transactions has risen for seven consecutive months, however, the pace of growth slowed to its lowest point over that time span. Overall, the ...

Read More ›