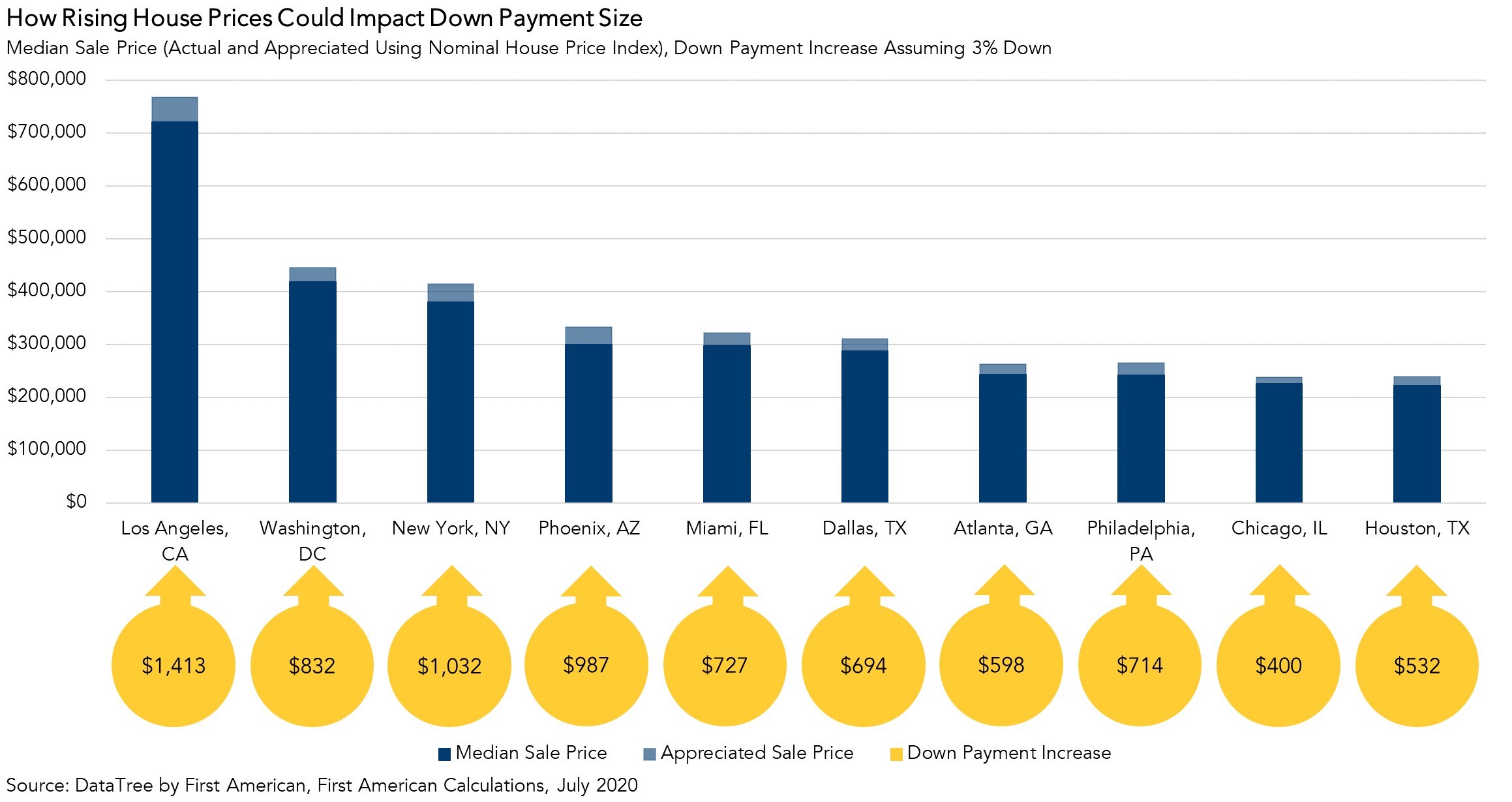

How Rising House Prices Could Impact Down Payment Size

By

Odeta Kushi on September 17, 2020

After hitting a low point in the spring, the housing market has rebounded strongly during the pandemic. Historically low mortgage rates have fueled demand and increased home buyers’ purchasing power amid an ongoing housing supply shortage. The widening imbalance between housing supply and demand has pushed house prices higher. Some now fear that ...

Read More ›

Interview with HousingWire: Economics of the Housing Market’s Recovery and What’s Next

By

FirstAm Editor on September 10, 2020

First American Deputy Chief Economist Odeta Kushi was interviewed on HousingWire’s Housing News podcast earlier this month and discussed her perspective on the forces powering the housing market’s V-shaped recovery and what may be in store for the rest of the year.

Read More ›

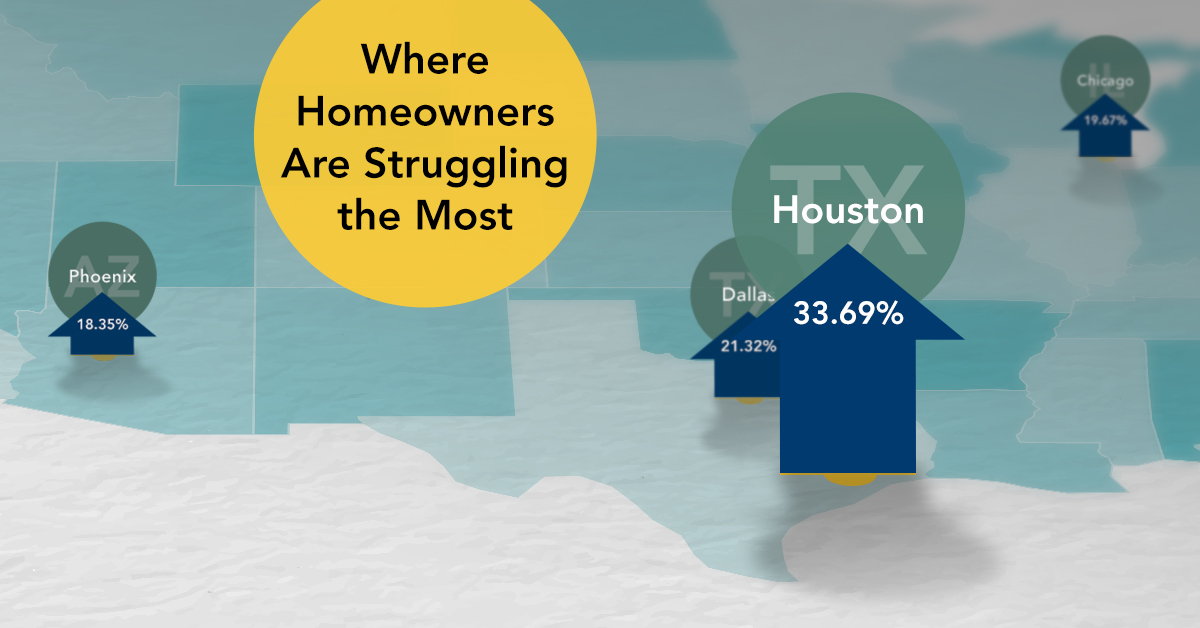

The Silver Lining for Cities with the Most Homeowner Distress

By

Odeta Kushi on September 3, 2020

Based on our analysis last month, a wave of foreclosures similar to levels seen during the Great Recession is unlikely to occur despite the continuing economic hardship caused by the COVID-19 pandemic. Homeowners are in a much better position to weather this crisis, in part because household equity is near a three-decade high, negating one of the ...

Read More ›

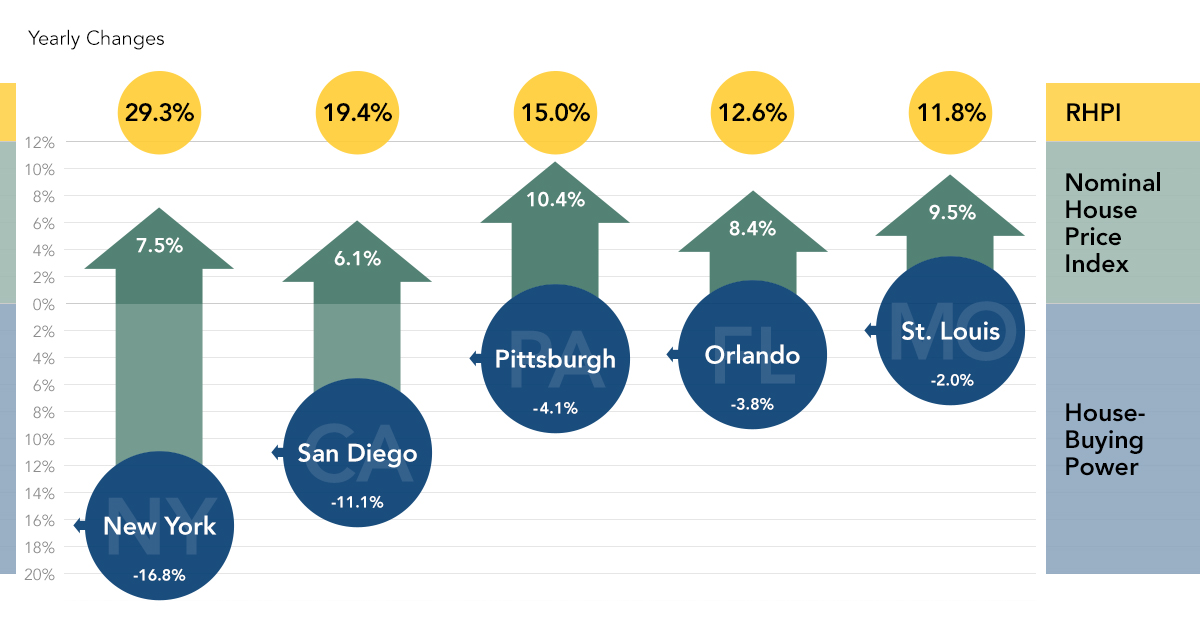

Where Housing Affordability is Declining the Most

By

Mark Fleming on August 24, 2020

The coronavirus pandemic continues to wreak havoc on global and domestic economies, yet housing has thus far managed an impressive V-shaped recovery. Housing’s strong rebound has been driven by several factors that existed before the coronavirus outbreak but have continued or even gained strength amid the pandemic. Mortgage rates are even lower ...

Read More ›

Why has Housing Market Potential Rebounded During the Pandemic?

By

Mark Fleming on August 20, 2020

With a July unemployment rate of 10.2 percent and roughly 30 million Americans claiming unemployment benefits, it’s clear that the domestic economy continues to feel the pain inflicted by the coronavirus pandemic. Yet the housing industry, at least for now, continues its impressive V-shaped rebound. Weekly purchase applications have surpassed ...

Read More ›

This Time it’s Different – Why a Wave of Foreclosures is Unlikely

By

Odeta Kushi on August 10, 2020

Following the rapid contraction in U.S. economic activity as a result of the outbreak of COVID-19, the unemployment rate spiked to 14.4 percent in April and remained elevated in May (13.0 percent), setting the mark for the two highest recorded rates in the post-World War II era. Despite the federal foreclosure moratorium, there were fears that up ...

Read More ›