Economists study homeownership and policymakers often emphasize it because homeownership is an effective way to build wealth, especially for low-income households. In fact, quantifying the wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

"For the majority of households that transition into homeownership, the most recent data reinforces that housing is one of the biggest positive drivers of wealth creation.”

Housing Share of Net Worth

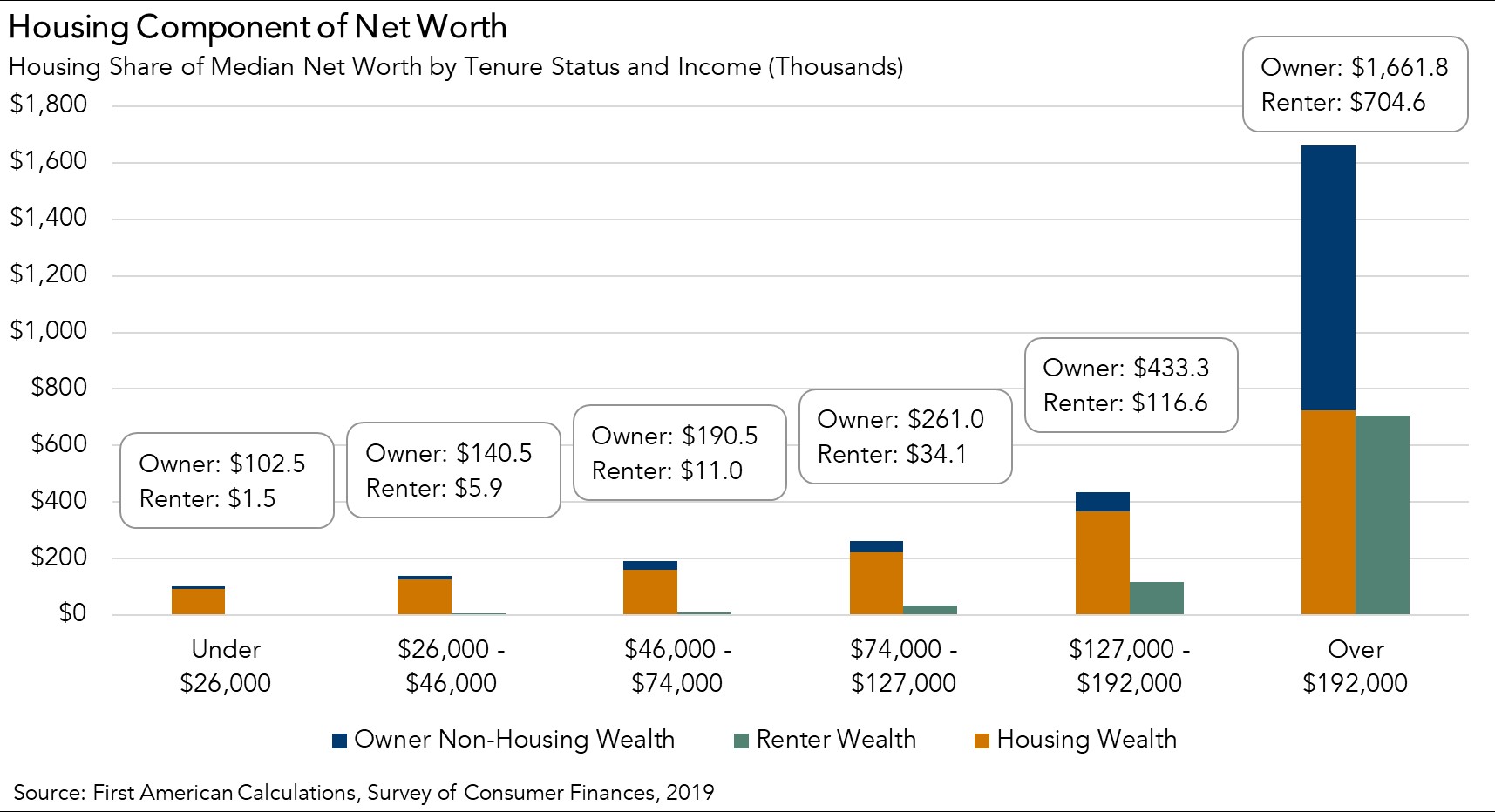

According to the 2019 Survey of Consumer Finances, a triennial survey that collects detailed accounts of households’ finances, the median homeowner has 40 times the household wealth of a renter – $254,900 for the former compared to $6,270 for the latter. However, that does not indicate cause and effect, nor does it provide insight into the distribution of wealth. Analyzing the difference in wealth between renters and homeowners by income level further underscores the wealth-building power of homeownership.

Homeowners are wealthier than renters at every income level, and the majority of homeowner wealth comes from housing for every income category except for the very top earners. For example, for the lowest income group, the median net worth of homeowner households is $102,500, but for renter households it’s only $1,500. At the lowest income category, 92 percent of total homeowner net worth is tied to the value of residential property.

Between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups, accounting for 32 percent of the overall increase. This was especially true of lower income households. For households at the bottom of the income distribution, the value of housing wealth increased by $21,000 – more than all other asset types combined.

For Most, The Largest Asset is Housing

The lower the income of a homeowning household, the greater the share of its wealth coming from homeownership. This pattern has remained consistent over the last three decades, according to the historical Survey of Consumer Finances data. In 2019, housing wealth represented, on average, nearly 75 percent of the total assets of the lowest-income households. For households in the middle of the income distribution, housing wealth represented between 50 and 65 percent of total assets, but for the highest income households that percentage was only 34.

The difference in the composition of wealth means that fluctuations in home prices will have a much bigger impact on the wealth of lower-income families than of those that have a mix of other assets. Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.

There are certainly risks from homeownership, and its benefits are not uniform across all markets. However, for the majority of households that transition into homeownership, the most recent data reinforces that housing is one of the biggest positive drivers of wealth creation.

Ksenia Potapov contributed to this blog post.