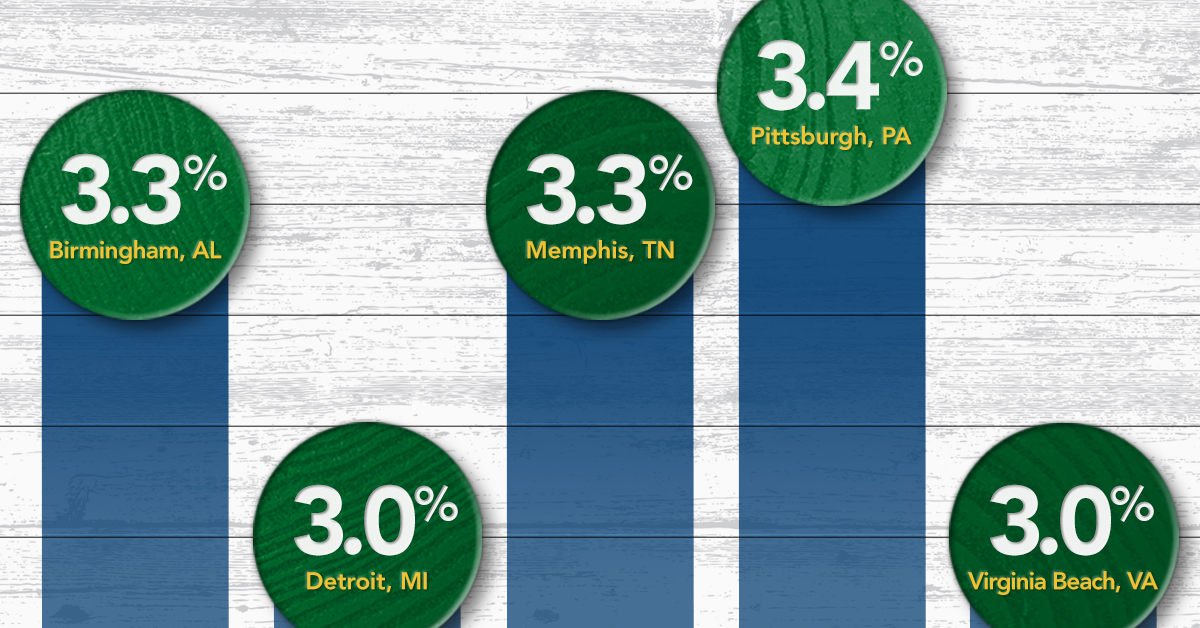

Where Can Residential Real Estate Investors Find the Most Potential ROI?

By

Odeta Kushi on December 15, 2021

Over the past year, increasing investor activity in residential real estate, particularly in single-family homes, has drawn a lot of attention. News of large institutional investors snapping up single-family homes underscored this summer’s historically hot housing market. Investors now own an estimated 2 percent of single-family rental housing ...

Read More ›

Why House Prices Still Have Room to Run

By

Mark Fleming on November 30, 2021

According to the Real House Price Index (RHPI), which measures housing affordability in the context of changes in consumer house-buying power, affordability in September declined to its lowest level since 2008. Two of the three components of consumer house-buying power swung toward declining affordability. Record nominal house price growth and ...

Read More ›

Why Housing Market Potential Keeps Rising

By

Mark Fleming on November 22, 2021

In September 2021, existing-home sales increased to a 6.29 million seasonally adjusted annualized rate (SAAR). Prior to the pandemic, the housing market had not reached this sales pace since 2006. We may see another strong month in October, as housing market potential increased 10.3 percent compared with one year ago to 6.27 million (SAAR), ...

Read More ›

The REconomy Podcast™: The Digital Future of Mortgage Lending and Real Estate Settlement

By

FirstAm Editor on November 18, 2021

In this episode of the REconomy Podcast™ from First American, Chief Economist Mark Fleming and Deputy Chief Economist Odeta Kushi discuss the digital future of mortgage lending and real estate settlement, and the innovative technologies that are making an end-to-end digital home-buying experience a reality with Eddie Oddo, vice president of ...

Read More ›

How will the Housing Market Fare as Rates Rise?

By

Mark Fleming on November 12, 2021

In the month of October, the average 30-year, fixed mortgage rate increased to its highest level since March of this year – 3.07 percent. For context, the historical average of the 30-year, fixed mortgage rate dating back half a century is 7.8 percent. In the history of recorded data on the 30-year fixed mortgage rate, it has never been as low as ...

Read More ›

The REconomy Podcast™: Will Inflation Drive Mortgage Rates Higher?

By

FirstAm Editor on November 4, 2021

In this episode of the REconomy Podcast™ from First American, Chief Economist Mark Fleming and Deputy Chief Economist Odeta Kushi examine rising inflation in today’s economy and what it may mean for mortgage rates.

Read More ›