Single Women Skip the Spouse to Buy a House

By

Odeta Kushi on March 8, 2022

As we celebrate International Women’s Day and Women’s History Month, growing numbers of women, specifically single women, have become homeowners, achieving one of the main tenets of the American Dream. In the aftermath of the Great Recession, the overall homeownership rate reached a low point of 63 percent in 2016, but has since rebounded to 65.5 ...

Read More ›

How the Ability to Work Remotely is Changing Housing Affordability for First-Time Home Buyers

By

Ksenia Potapov on March 2, 2022

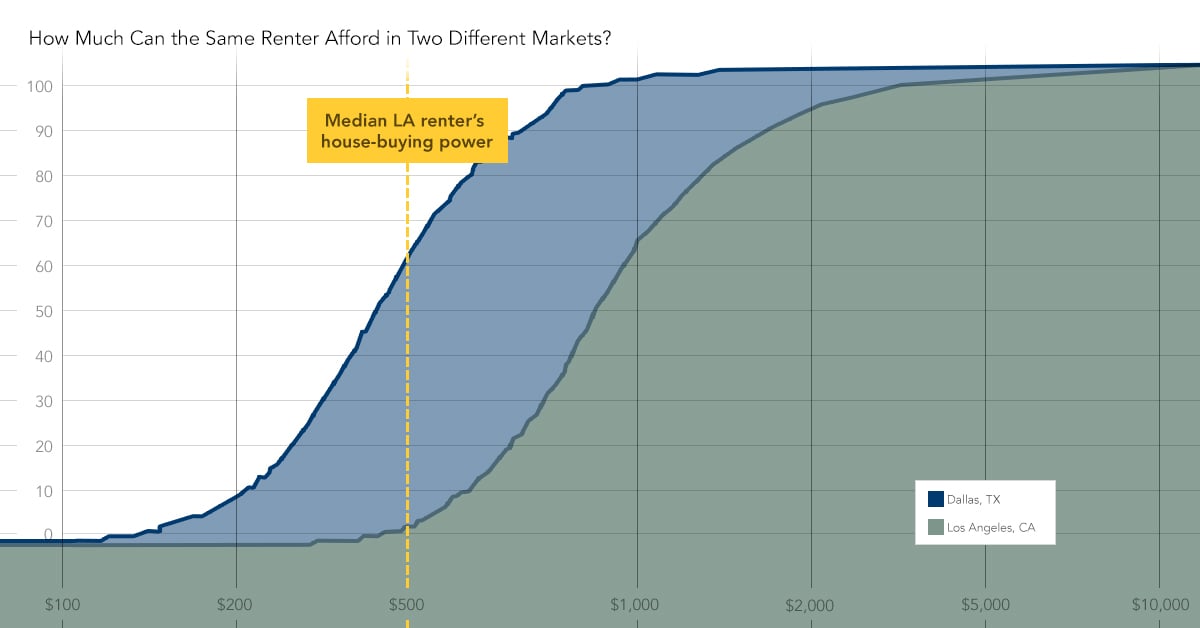

Affordability in the U.S. fell in 2021 on a year-over-year basis, as house-buying power was unable to keep up with red-hot nominal house price growth. The decline in affordability was broad based as affordability fell in most major markets across the U.S., yet some markets remain more affordable than others for potential first-time home buyers. ...

Read More ›

Homeownership First-Time Home Buyer Outlook Report Renter Affordability

Will Rising Rates Bring Balance to the Housing Market?

By

Mark Fleming on February 23, 2022

In December 2021, the Real House Price Index (RHPI) increased 21.7 percent compared with December 2020, the highest annual growth rate since 2014. The record increase was driven by rising mortgage rates and rapid nominal house price appreciation, which make up two of the three drivers of the RHPI. The 30-year, fixed-rate mortgage and the ...

Read More ›

Opposing Supply-Demand Forces Hold Key to Housing Market Potential

By

Mark Fleming on February 22, 2022

While still 4 percent higher than one year ago, the market potential for existing-home sales declined to its lowest level since June 2021, according to the first Potential Home Sales Model report of 2022. Demand for homes will remain strong in 2022, but declining affordability and lack of supply may limit market potential. Potential home buyers ...

Read More ›

How Will Rising Mortgage Rates Impact Spring Home-Buying?

By

Mark Fleming on January 24, 2022

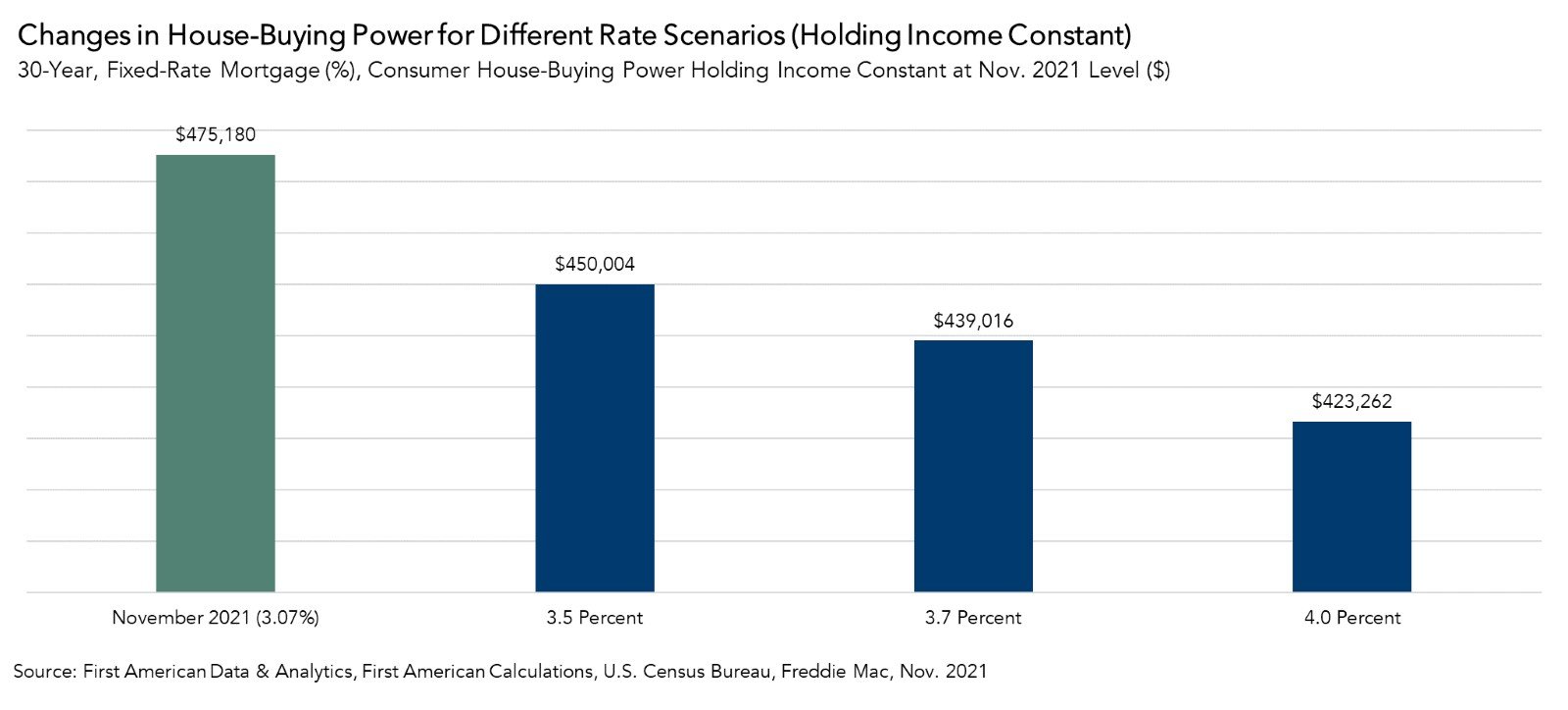

In November, year-over-year nominal house price appreciation reached 21.5 percent, the sixth consecutive month it has set a new record. According to our Real House Price Index (RHPI) - which measures housing affordability based on changes in income, interest rates and nominal house prices - affordability declined 21.0 percent compared with a year ...

Read More ›

Millennials Remain Driving Force in Housing Market Potential

By

Mark Fleming on January 19, 2022

The final Potential Home Sales Model report of 2021 revealed that market potential ended the year on a strong note. While the winter months are traditionally real estate’s slow season, our measure of the market potential for existing-home sales showed the housing market again broke with traditional seasonal patterns by ending the year strong. In ...

Read More ›