When potential first-time home buyers consider making the transition to homeownership, they ask themselves whether it makes more financial sense to keep renting, or to buy. The pandemic has undoubtedly impacted that calculation. Annual house price appreciation skyrocketed during the pandemic, reaching an average of 17.5 percent annual growth in the second quarter of 2021, as demand for homes continued to outpace supply.

“When your home pays you, it makes more sense to buy than to rent.”

Meanwhile, growth in rent prices, which had slowed down in 2020 as rental demand fell, came roaring back in the second quarter of this year. The median rent in the U.S. jumped 4 percent between the first and second quarters of 2021, the highest quarter-over-quarter pace since 2014, according to Zillow data. For potential first-time home buyers making the calculation, how has the monthly cost of renting versus owning a home changed in the second quarter of 2021?

Breaking Down the Cost to Own

What goes into the monthly cost of renting or owning? The cost to rent is relatively straightforward – it is the amount of rent paid by the tenant every month. The cost of owning, on the other hand, is made up of multiple pieces – it includes taxes, repairs, homeowner’s insurance and the monthly mortgage principal and interest payment.

Consider a hypothetical first-time home buyer taking out the average 30-year, fixed-rate mortgage in the second quarter of 2021, with a 5 percent down payment on a home at the 25th percentile sale price. We’re using the 25th percentile because first-time home buyers are much more likely to buy a less expensive home. After accounting for the total monthly homeownership cost and comparing it with the median rent by market, renting was a better financial choice in 35 out of the top 50 markets in the second quarter of 2021. Some of the markets where it was better to rent included Boston, Chicago, and Dallas. It was better to own in markets such as Atlanta, St. Louis, and Miami. This calculation, however, leaves out the main benefit of owning over renting – the accumulation of equity.

The Wealth-Generating Effect of Homeownership

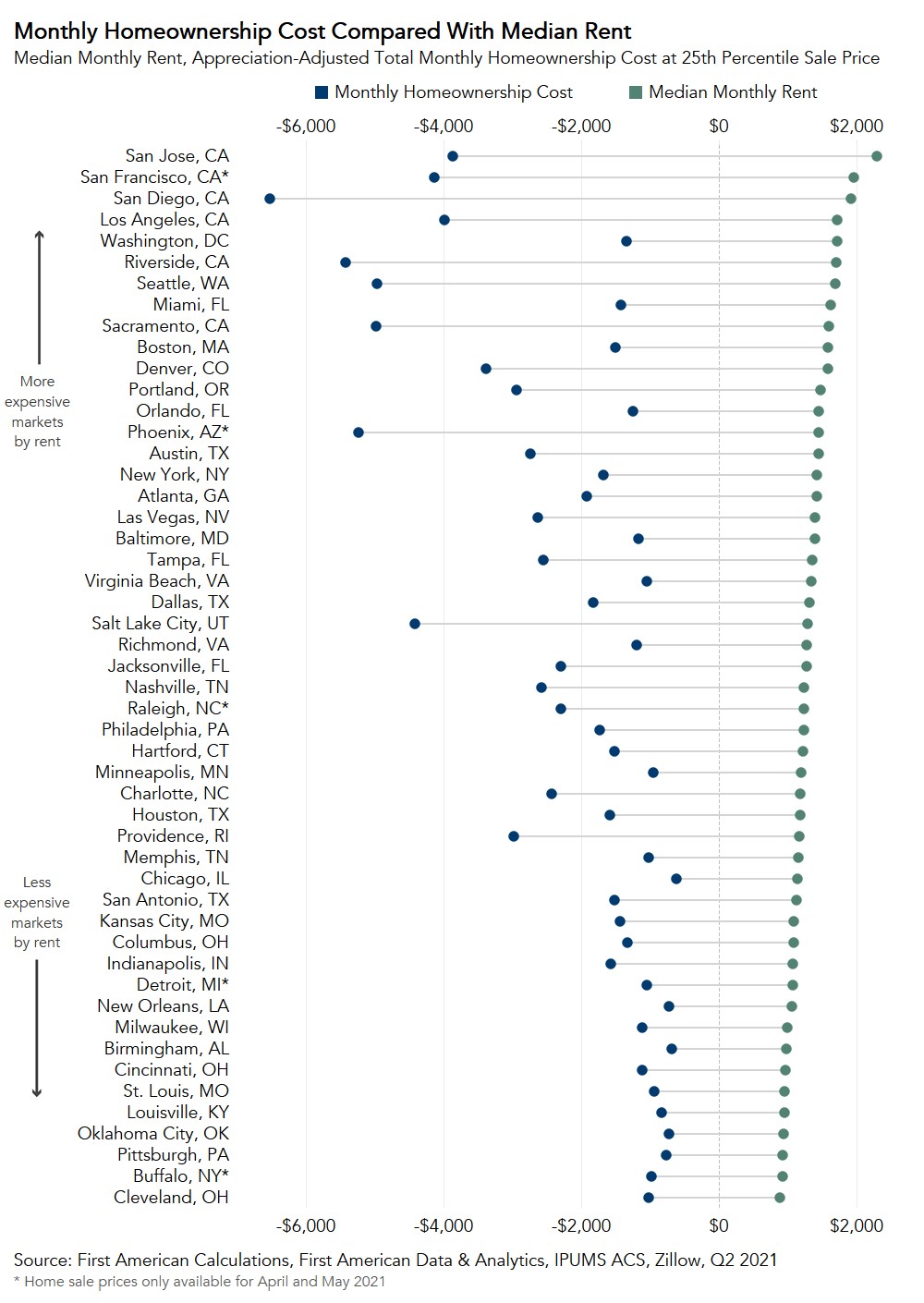

For those trying to buy a home, rapid house price appreciation can be intimidating and makes the purchase more expensive. However, once the home is purchased, appreciation helps build equity in the home, and becomes a benefit rather than a cost. When accounting for the appreciation benefit in our rent versus own analysis, it was cheaper to own in every one of the top 50 markets, including the two most expensive rental markets, San Francisco and San Jose, Calif., where it was more affordable to rent in 2020. The graph below compares by market the cost of renting with the cost of owning adjusted for house price appreciation. The wider the gap between the two points, the more financially advantageous it was to own than rent.

In the second quarter, the monthly homeownership cost was also negative in every market. How is that possible? When the benefit of appreciation is large enough to offset all other homeownership costs, the result is a net gain to the homeowner. In other words, the home pays you to live in it.

Consider a potential first-time home buyer in Dallas, where home prices sat near the median of the top 50 markets. If the home buyer put a 5 percent down payment on a $243,000 home (the 25th percentile home price in the second quarter) with a mortgage rate of 3 percent, the home buyer would have paid roughly $974 monthly in principal and interest, plus an estimated $749 in taxes, repairs, private mortgage insurance, and homeowner’s insurance costs. That brings the home buyer’s total monthly cost of ownership to $1,720. The average house price in Dallas increased 17.5 percent year-over-year in the second quarter of 2021, which is in line with the national pace and equates to an equity benefit of approximately $3,550 each month if the pace remains the same. The resulting total monthly cost is -$1,820, or a net gain. Compared with the median monthly cost of rent in Dallas, $1,310, it made much more financial sense to buy rather than to rent in the second quarter.

Will the Rent Versus Own Dynamic Change?

Though mortgage rates have pulled back in recent weeks, they are expected to rise in the future and that will mean higher monthly payments for the same loan amount. House price appreciation will likely remain elevated in the coming months, but eventually it will moderate from the pace we saw in the second quarter of 2021. Nonetheless, this analysis demonstrates that the wealth-building effect of home equity is a powerful factor in the homeownership decision. When your home pays you, it makes more sense to buy than to rent.

Methodology

The rent-versus-buy analysis compares rent with the cost of ownership in the 50 largest U.S. metropolitan areas. Median rent is derived from the 2019 American Community Survey microdata, the latest year available, and extrapolated to Q2 2021 using the Zillow Observed Rent Index. Home sale prices, property tax rates, and house price appreciation by market are derived from First American Data & Analytics data. The monthly cost of ownership is calculated for mortgage payment, interest, taxes and insurance (PITI), assuming a down payment of 5 percent and an interest rate of 3 percent (the average for a 30-year, fixed-rate mortgage in Q2 2021). Because the down payment assumed is less than 20 percent, private mortgage insurance is added to the cost of ownership at a rate of 0.75 percent of the home value. Annual homeowner’s insurance is assumed to be 0.4 percent of the home value, and annual repair costs are assumed to be 1 percent of the home value. To account for the accumulation of equity, the average rate of house price appreciation between Q2 2020 and Q2 2021 is turned into a dollar amount based on the home sale price and divided across 12 months. This monthly equity gain is subtracted from the monthly cost of homeownership, resulting in the house price appreciation-adjusted monthly homeownership cost.

Ksenia Potapov contributed to this blog post.