Housing Market Potential Increases, Despite Strengthening Rate Lock-In Effect

By

Mark Fleming on August 21, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, increased by 1 percent in July, but remains nearly 2 percent lower than one year ago. The yearly decline in market potential was the smallest since February 2022. The steep decline in ...

Read More ›

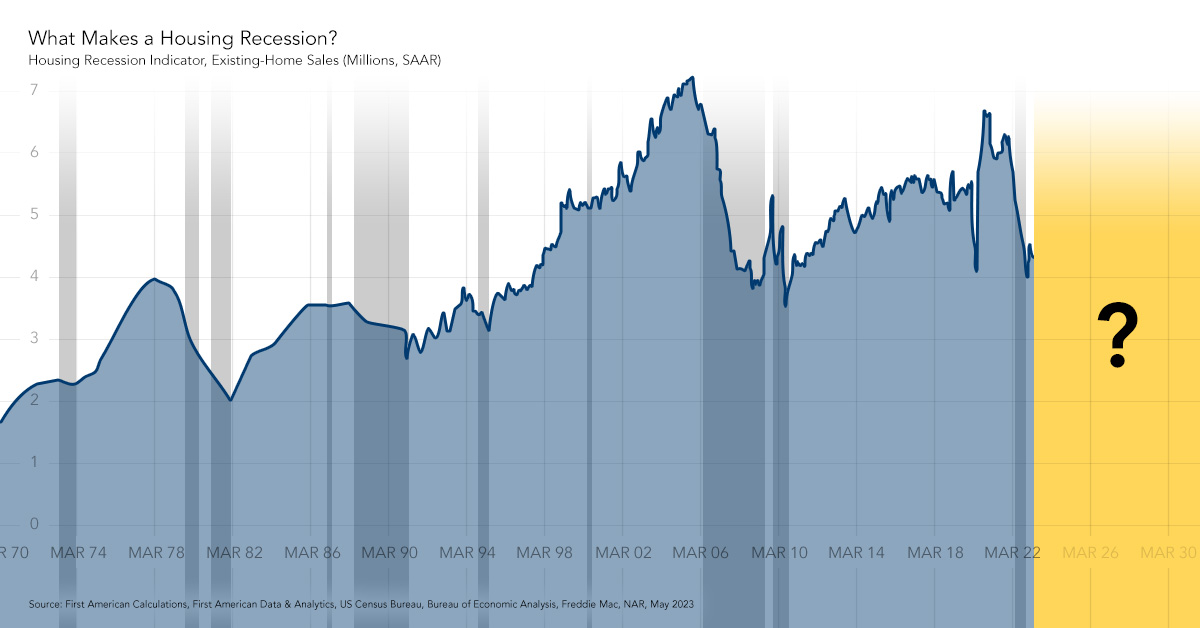

Are we Flirting with a Double-Dip Housing Recession?

By

Odeta Kushi on August 2, 2023

What defines a housing recession? While some rules of thumb exist, there has never been general agreement on a definition. If you look at today’s housing market, existing-home sales have struggled to gain any momentum during what is usually the housing market’s busiest season. New home sales, on the other hand, have exceeded all expectations. So, ...

Read More ›

Does Resurgent House Price Growth Signal a Bottom in the Housing Market?

By

Mark Fleming on July 31, 2023

In May, housing affordability fell relative to one month ago, as two of the three key drivers of the Real House Price Index (RHPI), nominal house prices and mortgage rates reduced house-buying power by 0.7 percent. Nominal house price growth ticked up 0.6 percent compared with one month ago, while the average 30-year, fixed mortgage rate increased ...

Read More ›

Have Existing-Home Sales Bottomed Out?

By

Mark Fleming on July 19, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, decreased modestly in June, and remains 2.8 percent lower than one year ago. Mortgage rates have risen substantially since the spring of 2022, and higher rates have a dual impact on sales ...

Read More ›

Why Higher Mortgage Rates Don't Always Lead to Declining House Prices

By

Mark Fleming on June 26, 2023

In April, housing affordability improved relative to one month ago, as two of the three key drivers of the Real House Price Index (RHPI), income and mortgage rates boosted house-buying power by 2.3 percent. Median household incomes increased by 0.1 percent compared with March, while mortgage rates dipped by 0.2 percentage points. Nominal house ...

Read More ›

Millennials, Walking Around Like They Own the Place

By

Ksenia Potapov on June 22, 2023

Amid the roller coaster housing market of the past few years, National Homeownership Month presents an opportunity to examine a fundamental driver of homeownership and housing demand—demographics. In fact, there’s one generation in particular that will remain a driving force of homeownership demand for years to come—the millennials.

Read More ›