In November 2022, the Real House Price Index (RHPI) increased by 60 percent on an annual basis. This rapid annual decline in affordability was driven by two factors -- a 7.6 percent annual increase in nominal house prices and a 3.7 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though household income increased 3.5 percent since November 2021 and boosted consumer house-buying power, it was not enough to offset the affordability loss from higher mortgage rates and still-strong nominal house price growth. The loss of affordability has prompted buyers to pull back from the market, putting downward pressure on prices. While still elevated by historical standards, nominal house price appreciation has slowed considerably since early 2022. Nationally, annual nominal house price growth peaked in March 2022 at nearly 21 percent, but has since decelerated by more than 13 percentage points to 7.6 percent in November.

"As the housing market rebalances, price declines will continue across many markets, but those declines would have to be substantial to erase all of the equity gains accumulated by homeowners over the last few years.”

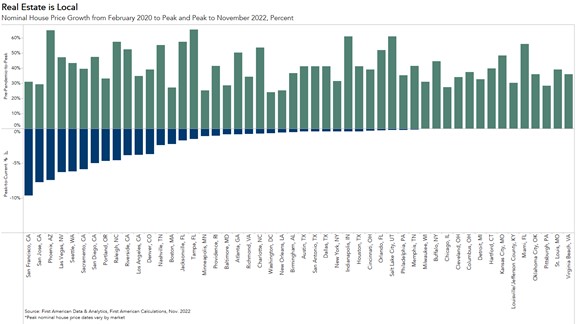

Real estate dynamics are local, yet nearly every market in the country during the pandemic was characterized as a seller’s market. Wherever you turned, multiple-offer bidding wars were the rule, not the exception. However, as house prices adjust to the reality of higher mortgage rates, the pace of adjustment will vary significantly by market.

Real Estate is Local, Again

Nominal house prices declined from their recent peaks in 37 of the top 50 markets we track in November. The market with the biggest decline was San Francisco, where nominal house prices peaked in April 2022, but have since declined by nearly 10 percent as the housing market rebalances. San Jose, Calif. follows closely behind, as nominal house prices have declined 7.8 percent from the recent peak in March 2022. However, house prices have only recently hit their peaks and have yet to decline in markets such as Louisville, Ky., Kansas City, Mo., Hartford, Conn., and several others.

Of course, repeat-sales price indices, such as the one used in this analysis, are based on the prices from closed sales, which are a lagging indicator of price changes in the housing market because the contracted prices for these closed sales were agreed to months earlier. Even so, it’s clear that some markets are weathering the adjustment to higher mortgage rates better than the coastal markets, where price declines are greatest.

Overvalued Markets Correcting Faster

Many of the markets with the largest price declines from peak, such as San Francisco, San Jose, and Phoenix, are also some of the more overvalued markets, meaning the median existing-home sale price exceeded house-buying power in these markets. If housing is appropriately valued, house-buying power should equal or exceed the median sale price of a home. Many of the markets where house prices have not yet declined, such as Louisville, Ky. and Kansas City, Mo., are still considered undervalued, meaning house-buying power exceeded the median existing-home sale price in November. There are exceptions to this relationship, but generally it seems that the most overvalued markets are correcting the fastest.

The Silver Lining

While price changes vary by market, there is one trend that bodes well for all top 50 markets – much of the homeowner equity gained during the pandemic remains. For example, in both San Francisco and San Jose, house prices increased by 31 and 29 percent from February 2020 to their respective peaks in 2022. Kansas City and Hartford gained 48 and 40 percent from February 2020 to their respective peaks in 2022. As the housing market rebalances, price declines will continue across many markets, but those declines would have to be substantial to erase all of the equity gains accumulated by homeowners over the last few years.

For more analysis of affordability, please visit the Real House Price Index. The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of February 27, 2023.

Sources:

November 2022 Real House Price Index Highlights

The First American Real House Price Index (RHPI) showed that in November 2022:

- Real house prices decreased 1.2 percent between October 2022 and November 2022.

- Real house prices increased 59.5 percent between November 2021 and November 2022.

- Consumer house-buying power, how much one can buy based on changes in income and interest rates, increased 1.3 percent between October 2022 and November 2022, and decreased 32.5 percent year over year.

- Median household income has increased 3.5 percent since November 2021 and 78 percent since January 2000.

- Real house prices are 41.7 percent more expensive than in January 2000.

- Unadjusted house prices are now 48 percent above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 0.8 percent above their 2006 housing boom peak.

November 2022 Real House Price State Highlights

- The five states with the greatest year-over-year increase in the RHPI are: Florida (+72.2), Alabama (+65.9 percent), New Hampshire (+64.3 percent), Georgia (+63.7 percent), and Alaska (+63.5 percent).

- There were no states with a year-over-year decrease in the RHPI.

November 2022 Real House Price Local Market Highlights

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are: Miami (+81.1 percent), Indianapolis (+80.0 percent), Salt Lake City (+70.0 percent), Buffalo, N.Y. (+69.2 percent), and Jacksonville, Fla. (+67.2 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, there were no markets with a year-over-year decrease in the RHPI.

This month’s Real House Price Index (RHPI) included a revision to the First American Data & Analytics House Price Index.

About the First American Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American’s proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.