By all respects, 2022 was a tumultuous year for the housing market. Annual house price appreciation remained at a double-digit pace for most of the year, mortgage rates increased by nearly 4 percentage points in less than 12 months and, as a result, affordability plummeted. By October, housing affordability had declined by a record 68 percent year-over-year, according to First American’s Real House Price Index (RHPI). Given the dramatic shift in affordability in 2022, some rebalancing in the housing market is natural. To better understand the ongoing rebalancing in the housing market, it is helpful to analyze the relationship between the components of affordability, specifically whether changes in mortgage rates or prices have a greater influence on affordability.

"A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.”

Affordability Tug-of-War

Housing affordability is the result of the tug-of-war between purchasing power, which is the product of household income and mortgage rates, and nominal house price growth. House price appreciation reduces affordability, while falling mortgage rates and rising incomes increase affordability.

Changes in income play a smaller part in short-term affordability fluctuations, so they’re excluded from this analysis. In the early days of the pandemic, fast-falling mortgage rates were winning the tug-of-war, despite double-digit annual house price appreciation, and, as a result, affordability was improving. But just as fast-falling mortgage rates improved affordability in 2020 and 2021, the fast-rising mortgage rates of 2022 were responsible for nearly 80 percent of the overall decline in affordability. It’s clear that fluctuations in mortgage rates have a much more acute impact on affordability than house price appreciation or depreciation.

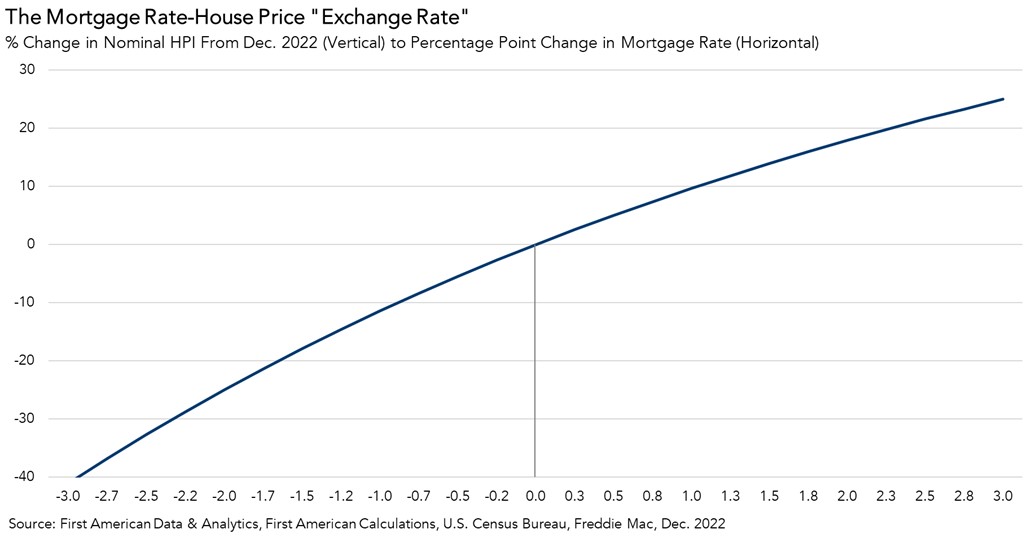

As mortgage rates moderate from their late 2022 high point and house prices decline from their mid-2022 peak nationally and in many top U.S. markets, it is helpful to quantify the tradeoff between mortgage rates and house prices—a rate-price “exchange rate.” According to our RHPI, a one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.

What Does the Rate-Price Exchange Rate Mean for 2023?

Mortgage rate forecasts for 2023 range from the low 5’s to the low 6’s, while annual house price growth forecasts range from modest increases to modest declines, generally between -5 and 5 percent. Using the December 2022 average mortgage rate of 6.36 percent as the baseline, if mortgage rates fall to 5.5 percent from 6.36 percent, but house prices remain flat, affordability would improve by approximately 9 percent relative to December. If mortgage rates remain at December’s average of 6.36 percent while house prices decline 5 percent, affordability would improve by 5 percent. If mortgage rates instead increase to 7.5 percent, even a house price decline of 5 percent would not be enough to offset the impact from higher mortgage rates, and affordability would still fall.

House prices are generally downside-sticky—while they may move up quickly, they do not easily move down. Indeed, considering the consensus range for both mortgage rates and house prices, this rate-price exchange rate suggests that movements in mortgage rates will have the greatest impact on housing affordability in 2023.

Historically, neither mortgage rates under 3 percent, nor house price appreciation in the double-digits is considered normal. Housing affordability is dynamic, and a new affordability equilibrium will emerge as house prices, mortgage rates and household incomes shift. In the short run, however, affordability will be largely dictated by movements in mortgage rates.