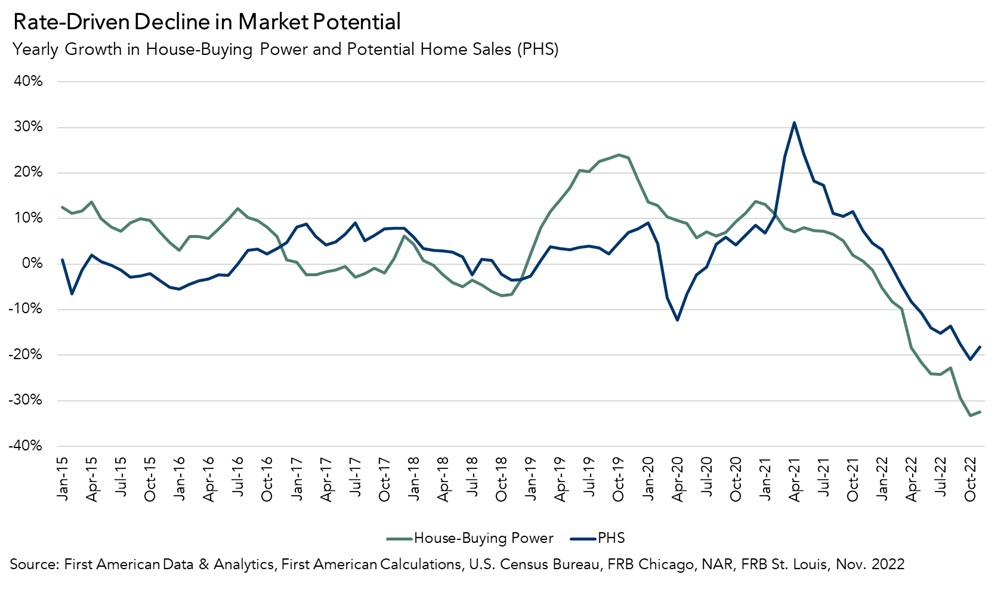

Housing market potential in 2023 will remain largely dependent on the path of mortgage rates, which will be heavily influenced by inflation. In November 2022, housing market potential increased by 2.5 percent relative to October, boosted by a slight month-over-month decline in mortgage rates. Even with the modest monthly increase in housing market potential, year-over-year potential existing-home sales remain down 18 percent, a decline of 1,164,600 potential existing-home sales. The steep annual decline in market potential is largely the result of higher mortgage rates, which prevent both buyer and seller from participating in the market.

“If inflation decelerates toward the Fed’s target range in the second half of 2023 as is currently expected, then it’s possible that mortgage rates may decline modestly in the latter half of the year.”

Rate-Sensitivity is Real

Median house-buying power in November compared with one year ago fell by $158,000 – that’s the second largest annual decline in over 25 years, only exceeded by October’s year-over-year decline. The primary driver of the decline in house-buying power was the extraordinary increase mortgage rates over the last year. The 30-year, fixed mortgage rate jumped from 3.1 percent in November 2021 to 6.8 percent in November of this year, reducing house-buying power by $170,000, holding income constant. However, household income has not remained static, but has risen, helping prevent the loss to house-buying from being more severe. Such a significant rate-driven decline to consumer purchasing power reduced market potential by 772,000 potential home sales compared with a year ago.

Compared with October, mortgage rates eased a bit, boosting house-buying power by a modest $4,000 and increasing market potential by 25,000 potential home sales. The monthly increase in housing market potential due to the modest 0.1 percentage point decline in the 30-year, fixed mortgage rate demonstrates the rate sensitivity of prospective home buyers. Buyers will jump back into the market if they find a home that fits their monthly mortgage budget, and even a modest decline in mortgage rates can help increase their budget.

The Case for Optimism

There is reason to be hopeful that mortgage rates, and thereby the housing market, will stabilize in 2023. The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury bond, so as the Federal Reserve continues tightening monetary policy to combat inflation, we can expect more upward pressure on Treasury bonds and, therefore, mortgage rates. But the Fed will slow the pace of monetary tightening when there is sustained evidence that inflation is receding, and there is good reason to believe that inflation may slow in 2023. Core goods inflation is already cooling, shelter inflation is expected to do the same in the coming months and, in theory, tighter monetary policy should cool services demand.

If inflation decelerates toward the Fed’s target range in the second half of 2023 as is currently expected, then it’s possible that mortgage rates may decline modestly in the latter half of the year. While mortgage rates will remain high compared with pandemic-era lows, stable and potentially modestly lower mortgage rates will elevate housing market potential in 2023.

November 2022 Potential Home Sales

For the month of November, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 5.24 million seasonally adjusted annualized rate (SAAR), a 2.5 percent month-over-month increase.

- This represents a 50.4 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales decreased 18.2 percent compared with a year ago, a loss of 1,164,600 (SAAR) sales.

- Currently, potential existing-home sales is 1,546,000 (SAAR), or 22.8 percent below the pre-recession peak of market potential, which occurred in April 2006.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.