Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time – the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales. But, as mortgage rates increased alongside the Federal Reserve’s monetary policy tightening, the housing market froze up in the second half of 2022, with both buyers and sellers withdrawing from the market. Will the freeze continue well into 2023 or will the housing market begin to thaw?

“The main trend to watch is whether mortgage rates will go any higher and, if so, by how much.”

Three Scenarios for the 2023 Housing Market

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury note, and when investors are concerned about inflation, their appetite for buying bonds diminishes, which puts upward pressure on bond yields and, therefore, mortgage rates. The risk is that rates will continue to increase until we get sustained evidence that inflation is receding. So, the outlook for the housing market is largely dependent on the path of inflation. Below are three possible paths for inflation that are anchored to the Fed’s monetary tightening: the baseline case (the likely), the downside case (the bad), and the upside case (the good).

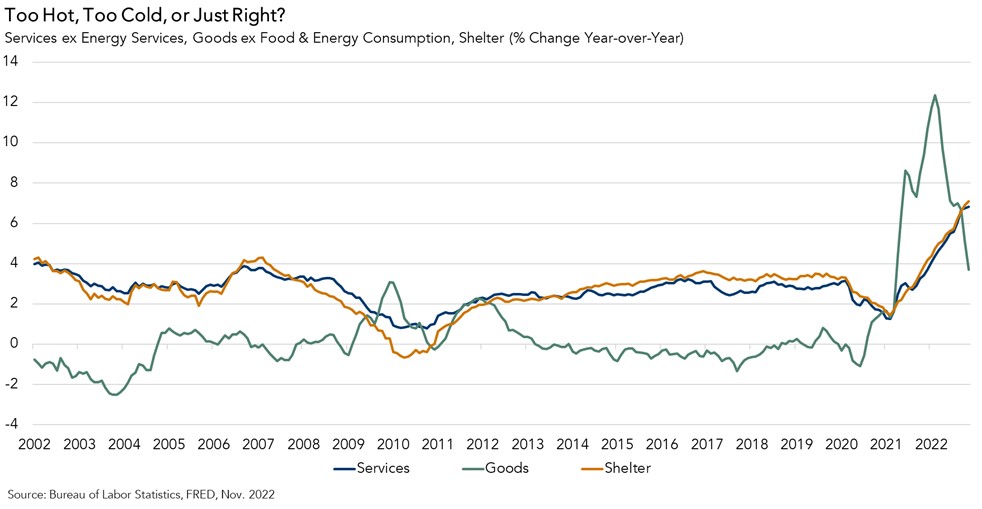

- The Likely: The Fed is focused on the dynamics of inflation in parts, and not all parts are trending in the same direction. Core goods inflation increased dramatically in 2021 due to COVID-related supply disruptions and a demand surge for goods by domestic consumers. However, that inflation surge is now quickly fading.

Service sector inflation is still rising, largely due to the shelter component. Shelter is considered a service and makes up 57 percent of core services in the Consumer Price Index. By virtue of how it is measured, shelter inflation also lags observed rental and house price increases by approximately one year. Rent and price growth are now decelerating, meaning the shelter component of inflation will cool – it’s just a matter of time.

Core services excluding shelter is the last component. Service providers are still struggling to find labor, their primary input. As a result, service sector wages are still growing quickly – faster than the overall rate of wage growth, which is relatively strong itself. The Fed aims to lower consumption demand by setting the federal funds rate at just the right level. The “terminal rate”— the level at which the Fed is expected to stop raising interest rates — for the baseline case is approximately 5 to 5.25 percent, based on FOMC projections. If the Fed reaches this level by mid-2023, then they will likely hold rates at that higher level for the rest of the year.

As the Fed continues to tighten monetary policy, it will put more upward pressure on Treasury bonds and, therefore, mortgage rates in the first half of the year. Higher mortgage rates negatively impact both housing demand and supply, pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Prices will also continue to correct and reflect the new dynamic of less demand relative to slightly more, yet still well below historically normal, levels of supply. If inflation responds as expected in 2023 and the Fed’s terminal rate target is right, mortgage rates may start to decline as inflation expectations ease. Lower house prices and modestly lower mortgage rates would give house-buying power a boost.

- The Bad: The downside scenario reflects an economy that faces stubborn or even worsening inflation, leading the Fed to raise rates beyond the 5 to 5.25 percent terminal rate. This would lead to greater monetary tightness in the market and put even more upward pressure on mortgage rates, raising the probability of a recession. Even higher mortgage rates could further freeze the housing market, prompting even more sellers to stay put than in the base case due to the rate lock-in effect and buyers being further priced out of the market. In this scenario, we will see steeper price declines from the peak, both nationally and across a greater number of markets.

- The Good: The upside case is that the Fed doesn't even need to raise rates to the 5 to 5.25 percent terminal rate because inflation comes down faster than expected. This scenario assumes consumers choose to pull back on spending, despite still sitting on a lot of excess savings built up during the pandemic. As a result, mortgage rates may stabilize sooner than in the base case, and potential buyers and sellers would benefit from the lack of rate volatility. Prices would continue to adjust in response to higher rates, which may provide an affordability boost to potential home buyers. But, even in this scenario, the housing market will still struggle from a lack of supply. Potential sellers would still be locked into record-low mortgage rates and hesitant to sell in a higher interest-rate environment.

What Do all Three Scenarios Have in Common?

In all three cases, the housing market will continue to rebalance as prices adjust to the reality of higher mortgage rates. However, the pace of price deceleration and the decline in home sales will be more severe in the downside, higher inflation scenario. The main trend to watch is whether mortgage rates will go any higher and, if so, by how much. Once mortgage rates peak, home sales volume and price declines will stabilize. That all depends on what the Fed chooses to do in the coming months and whether inflation begins to decline.