Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Mini Refinance Boom Drives Fraud Risk to New Low

By

Mark Fleming on February 28, 2020

Overall defect risk, as measured by our Loan Application Defect Index, has largely trended down since early 2019 with a few exceptions. In January 2020, this long-run trend continued as overall defect risk reached its lowest level since we began tracking it in 2011. While the Defect Index for purchase transactions remained the same after two ...

Read More ›

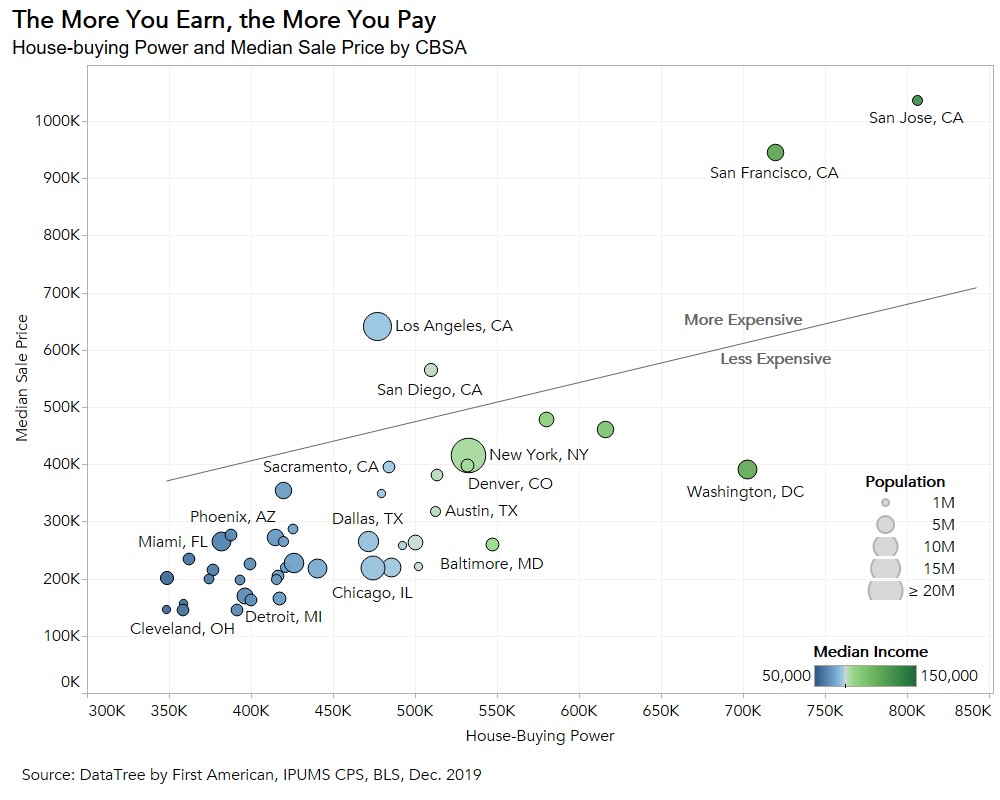

Where Wages Grow, Affordability Follows

By

Mark Fleming on February 24, 2020

As 2019 came to a close, potential home buyers received a year-end gift as affordability improved relative to one year ago. Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in December.

Read More ›

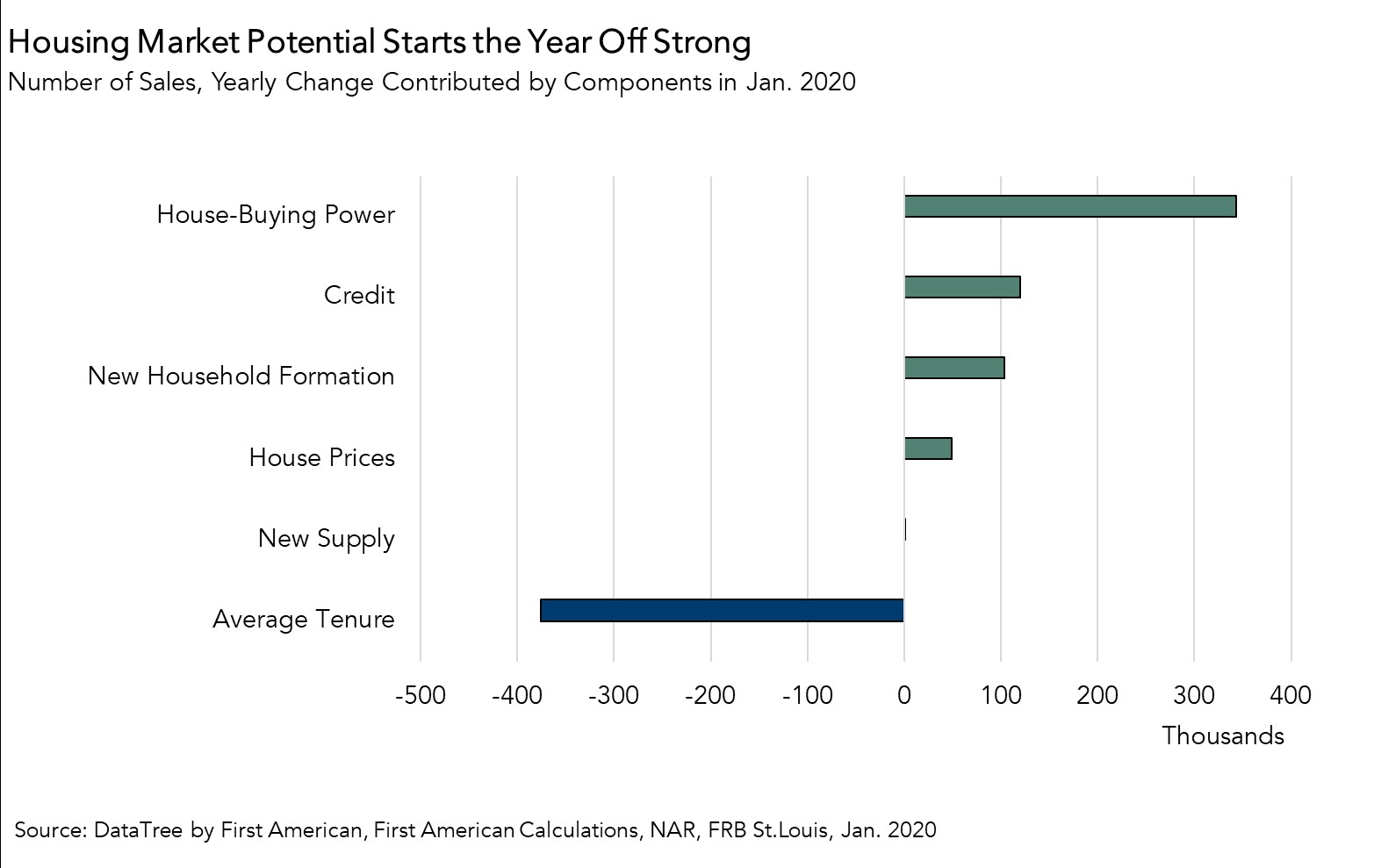

Housing Market Potential Reaches Its Highest Level in Nearly Two Years

By

Mark Fleming on February 20, 2020

The housing market started the year off strong, with the market potential for existing-home sales reaching its highest level since January 2018, according to our Potential Home Sales Model. Housing market potential increased 1.4 percent in January 2020 relative to the previous month, and grew 4.7 percent year over year, an increase of 240,050 ...

Read More ›

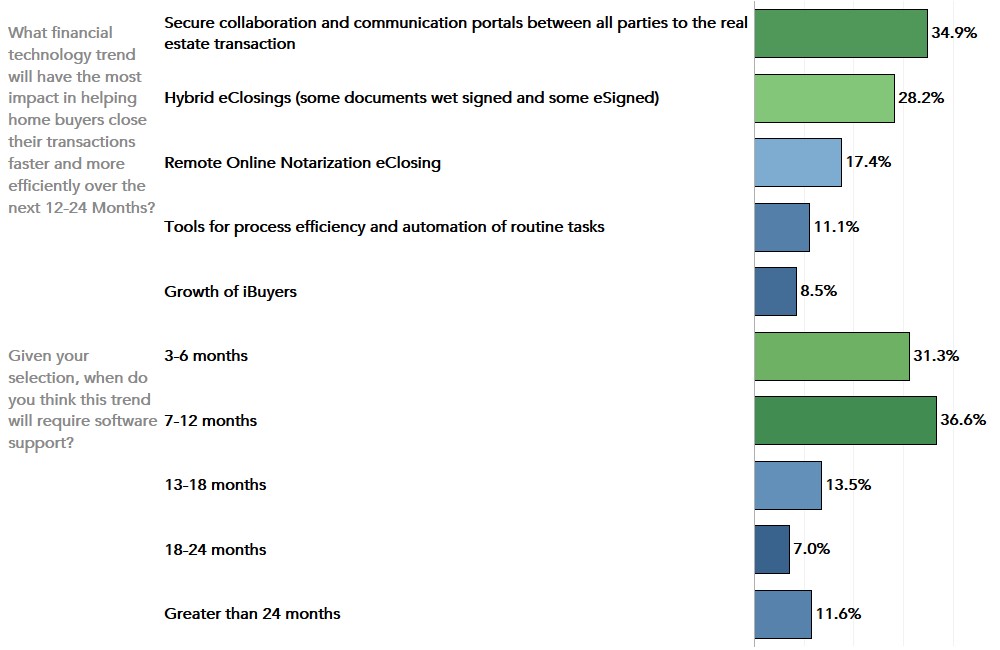

What Will Drive Further Fintech Innovation in Real Estate in 2020?

By

Mark Fleming on February 7, 2020

The 2019 housing market turned out to be surprisingly strong, driven by a variety of favorable dynamics. Millennial-driven, first-time home buyer demand continued to rise, the economy reached its longest expansion in U.S. history in the third quarter of 2019, and rising wages pushed household incomes higher. Mortgage rates, which began their ...

Read More ›

Why the Pace of Fraud Risk Decline Slowed in December

By

Mark Fleming on January 30, 2020

For the majority of 2019, overall fraud risk steadily declined, largely due to the rising volume of lower risk refinance transactions driven by low mortgage rates. After falling since March, overall defect risk stabilized in November, and then declined again in December. The overall Defect Index, which includes both purchase and refinance ...

Read More ›

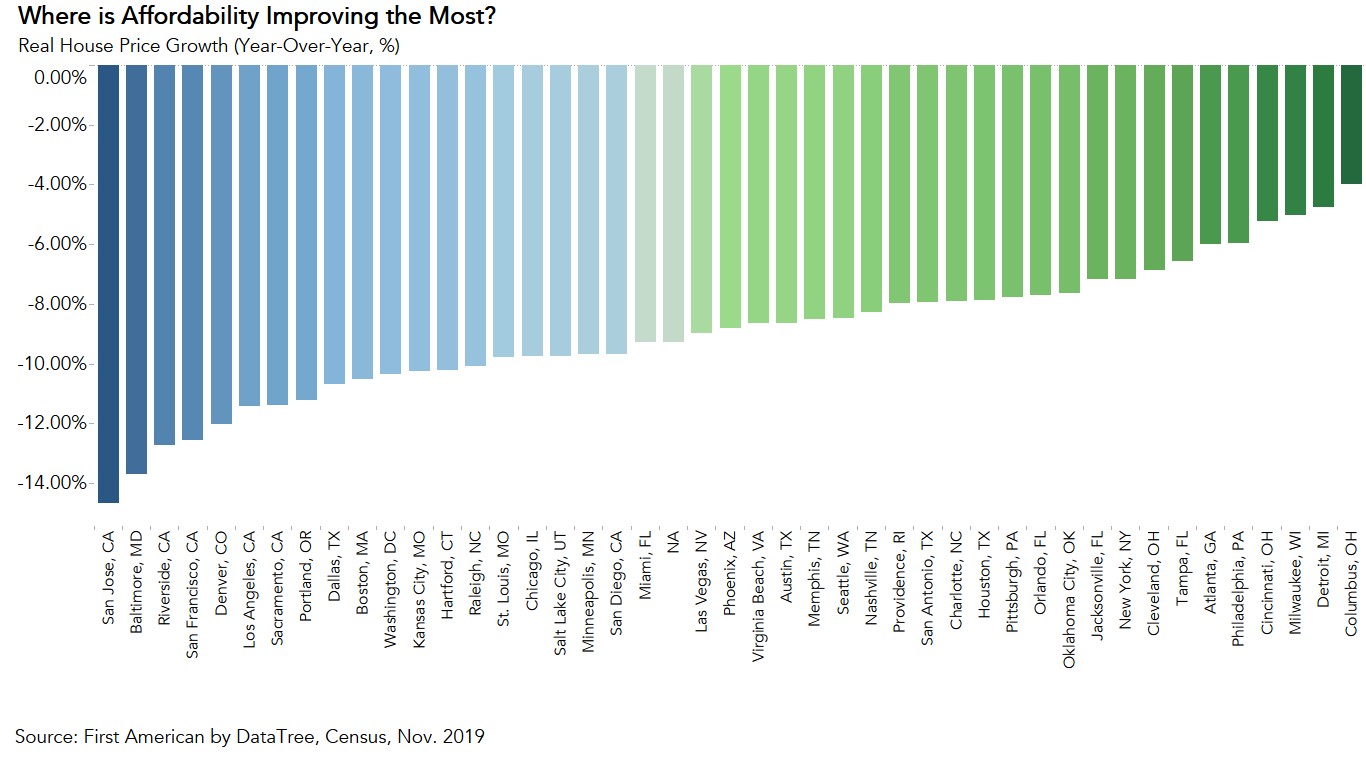

The Five Cities Where Affordability Improved the Most

By

Mark Fleming on January 27, 2020

Once again, home buyers benefitted from a year-over-year affordability boost as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in November. Compared with November 2018, the 30-year, fixed-rate mortgage fell by 1.2 percentage points and household ...

Read More ›