Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Where are House Prices Moderating the Most?

By

Mark Fleming on August 29, 2022

In June 2022, the Real House Price Index (RHPI) jumped up by 53.3 percent on an annual basis, setting a new record for the fifth month in a row for the fastest year-over-year growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by an 18.5 percent annual increase in nominal house prices and a ...

Read More ›

Is this the Great Normalization of the Housing Market?

By

Mark Fleming on August 17, 2022

According to our Potential Home Sales Model, the market potential for existing-home sales in July was estimated to be 5.45 million at a seasonally adjusted annualized rate (SAAR), down 0.2 percent compared with last month, and 14.4 percent lower than one year ago.

Read More ›

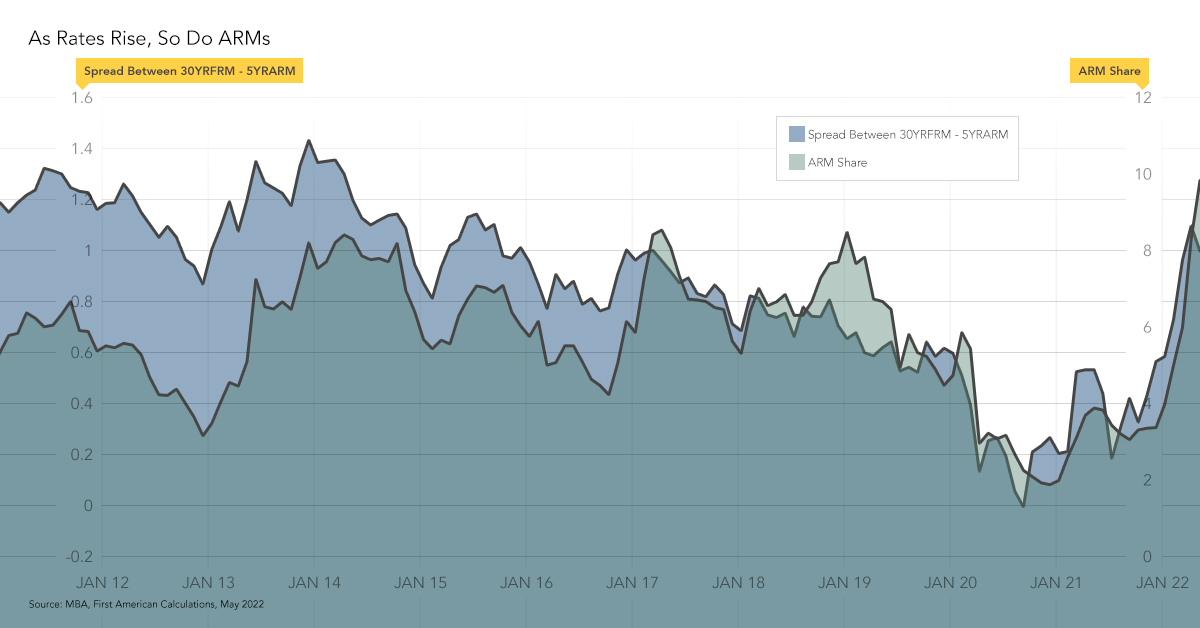

Will Rising Mortgage Rates Trigger an 'ARMs' Race for Home Buyers?

By

Mark Fleming on July 22, 2022

In May 2022, the Real House Price Index (RHPI) jumped up by 50.8 percent year over year, which is the fastest growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by a 20.1 percent annual increase in nominal house prices and a 2.3 percentage point increase in the 30-year, fixed-mortgage rate ...

Read More ›

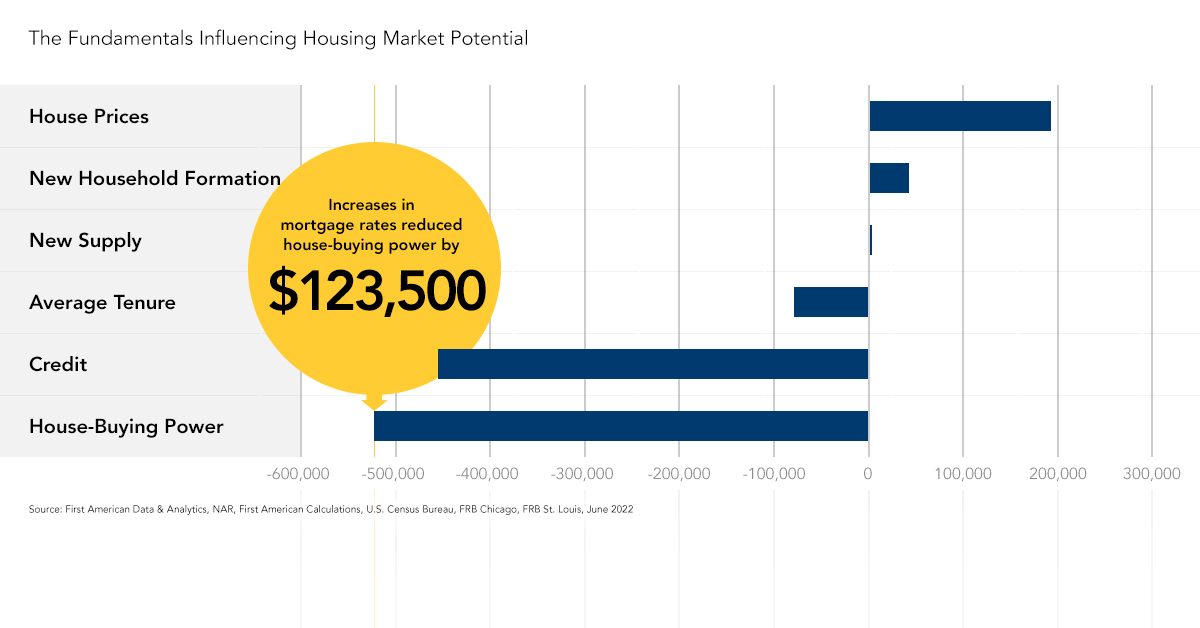

How the Fundamentals Influencing Housing Market Potential Have Changed

By

Mark Fleming on July 20, 2022

The market potential for existing-home sales in June was estimated to be 5.47 million at a seasonally adjusted annualized rate (SAAR), down 2.5 percent compared to last month, and 13.1 percent lower than one year ago, which is near the same level as in early 2019.

Read More ›

Affordability Declines to its Lowest Level since 2007

By

Mark Fleming on June 29, 2022

In April 2022, the Real House Price Index (RHPI) jumped up by 45.6 percent compared with a year ago, accelerating faster than any other point in the 30-year history of the series. This rapid annual decline in affordability was driven by two factors: a 21.2 percent annual increase in nominal house prices and a 1.9 percentage point increase in the ...

Read More ›

Two Trends Slowing Housing Market Normalization

By

Mark Fleming on June 20, 2022

The market potential for existing-home sales in May fell 2 percent to 5.62 million at a seasonally adjusted annualized rate (SAAR), compared with last month, and is 10.5 percent lower than one year ago. Yet, the market potential for home sales remains 2.5 percent higher than May 2019, before the pandemic hit.

Read More ›

.png)