Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Why the Housing Market May Begin to Stabilize in 2023

By

Mark Fleming on November 18, 2022

In October 2022, housing market potential fell by nearly 4 percent relative to last month and dropped 21 percent compared with October of last year, a decline of 1,334,000 potential existing-home sales. The steep annual decline in market potential was largely a result of higher mortgage rates, which discourage both buyers and sellers from jumping ...

Read More ›

Pandemic Boom Markets Cooling the Fastest

By

Mark Fleming on October 21, 2022

Affordability continued its rapid decline in August 2022, as the Real House Price Index (RHPI) soared 49 percent on an annual basis. The ongoing and swift decline in affordability was driven by a 15 percent increase in nominal house prices and a 2.4 percentage point increase in the 30-year, fixed mortgage rate compared with one year ago. As ...

Read More ›

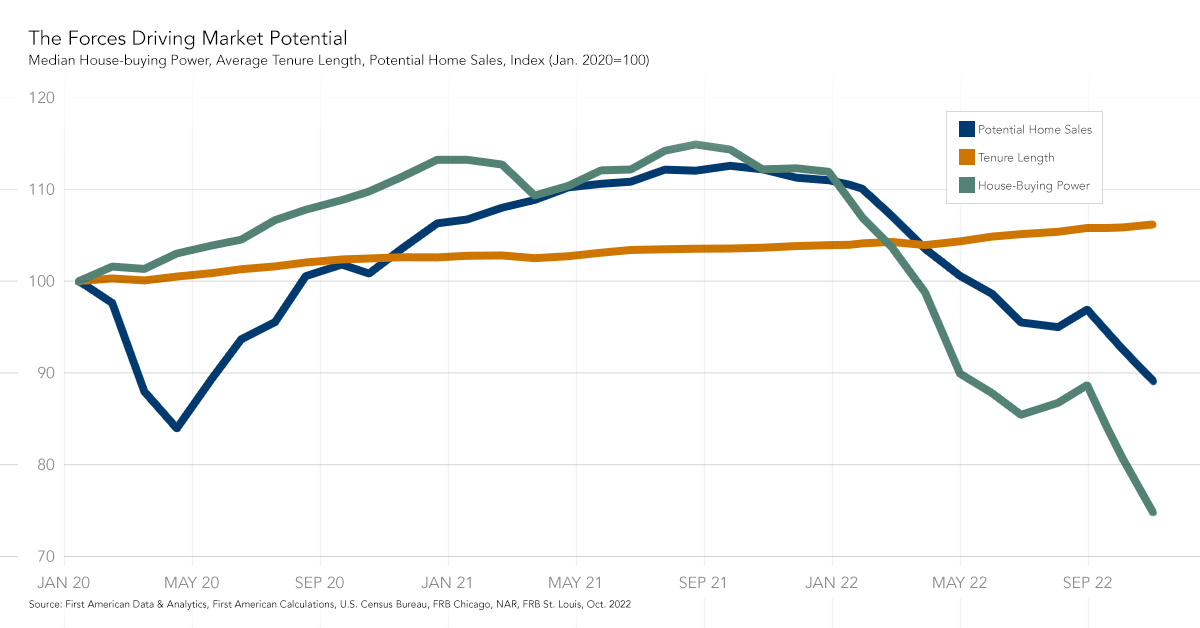

What’s the Outlook for Housing Market Potential for the Rest of 2022?

By

Mark Fleming on October 18, 2022

Housing market potential sagged to its lowest point since May 2020 in September, falling 3.6 percent from August to an estimated 5.38 million at a seasonally adjusted annualized rate (SAAR). Year over year, the market potential for existing-home sales is down 16.7 percent. Market dynamics and the broader economic outlook have changed dramatically ...

Read More ›

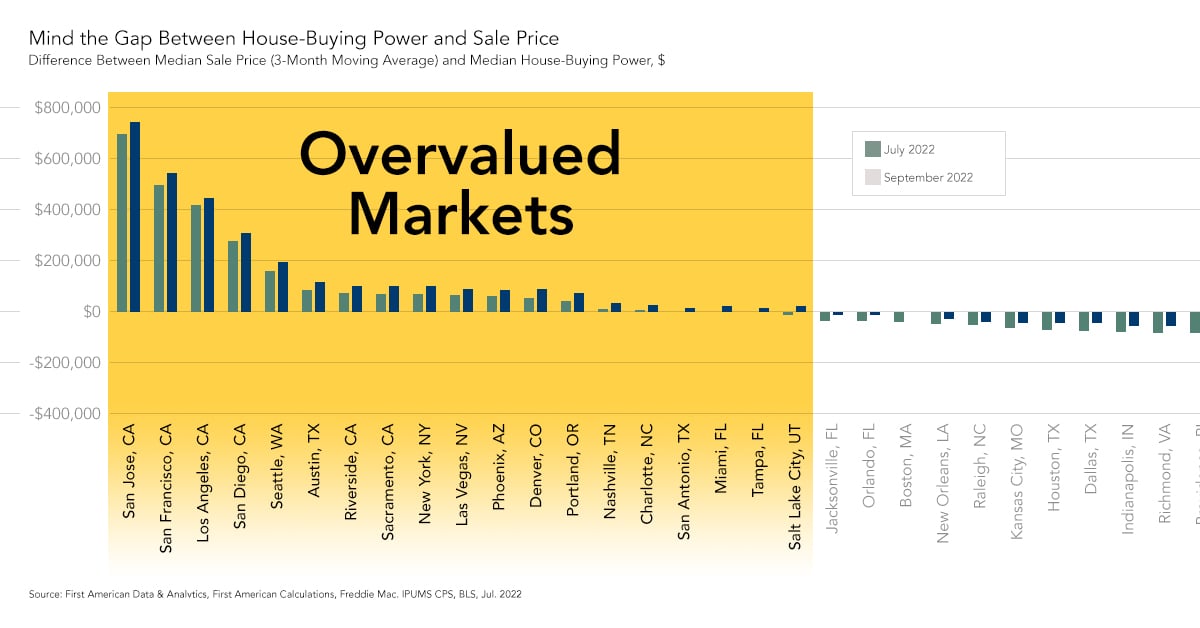

Where is Housing Overvalued?

By

Mark Fleming on September 27, 2022

Housing affordability continued its rapid annual decline in July 2022, as nominal house prices increased 16.7 percent year over year and the 30-year, fixed mortgage rate increased 2.5 percentage points compared with a year ago. The decline in affordability is reflected in the Real House Price Index (RHPI) jumping up by nearly 54 percent on an ...

Read More ›

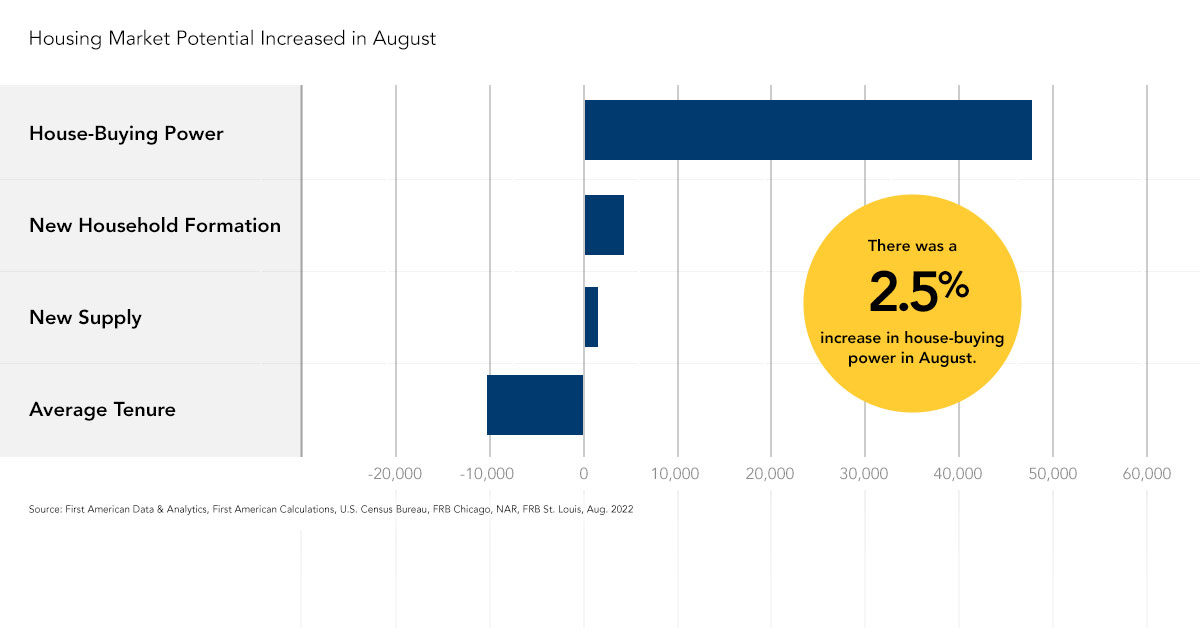

Why Housing Market Potential Increased for the First Time in Nearly a Year

By

Mark Fleming on September 21, 2022

August marked the first time in nearly a year that housing market potential increased on a monthly basis, increasing 2.1 percent compared with July to an estimated pace of 5.61 million at a seasonally adjusted annualized rate (SAAR). The month-over-month increase was also the largest monthly increase in housing market potential since December ...

Read More ›

Where are House Prices Moderating the Most?

By

Mark Fleming on August 29, 2022

In June 2022, the Real House Price Index (RHPI) jumped up by 53.3 percent on an annual basis, setting a new record for the fifth month in a row for the fastest year-over-year growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by an 18.5 percent annual increase in nominal house prices and a ...

Read More ›

.jpg)

.png)