Following nearly two years of a soaring housing market, the 2022 spring home-buying season will be watched closely for signs that more balance may be returning to the housing market. Our Potential Home Sales Model estimates the expected level of existing-home sales based on market fundamentals, providing a helpful tool to assess the state of the housing market as spring home-buying ramps up. In February, the market potential for existing homes sales was estimated to be 6.17 million at a seasonally adjusted annualized rate (SAAR), down 2.8 percent from January, but nearly flat with a year ago. We can use the Potential Home Sales Model to identify the tailwinds propelling the housing market forward, and the headwinds pushing back on market potential. Among the headwinds, there are both long-term and short- term dynamics impacting housing market potential to consider.

“There are many unknowns as the spring home-buying season begins, but one thing is clear – if you sell it, they will buy it.”

Housing Supply Shortage Remains the Housing Market’s Most Significant Long-Term Headwind

- Unrelenting Supply Shortage: The majority of the supply of homes for sale are existing homes, so existing homeowners are critical influencers of housing supply. However, existing homeowners are increasingly staying put. The average length of time someone lives in their home continues to set new records, rising to approximately 10.4 years in February, up from 10.3 years one year ago. When existing homeowners live in their homes longer, fewer and fewer homes are listed for sale, compounding the housing supply shortage – you can’t buy what’s not for sale, and you won’t sell if you can’t find something better to buy. Additionally, mortgage rates increased by the second largest month-over-month total since 2016 in February. Because so many existing homeowners have refinanced into rock-bottom mortgage rates, an increase in mortgage rates can leave existing homeowners feeling ‘rate locked-in.’ When the prevailing mortgage rate is greater than homeowners’ existing rate, it will cost homeowners more each month to borrow the same amount of money, disincentivizing them from selling their homes – why move out, if you can’t move up? Homeowners staying put reduced housing market potential by 8,600 potential home sales compared with one month ago. The lack of supply remains the primary long-run constraint to housing market potential.

The Short-Term Headwinds Holding Back Market Potential

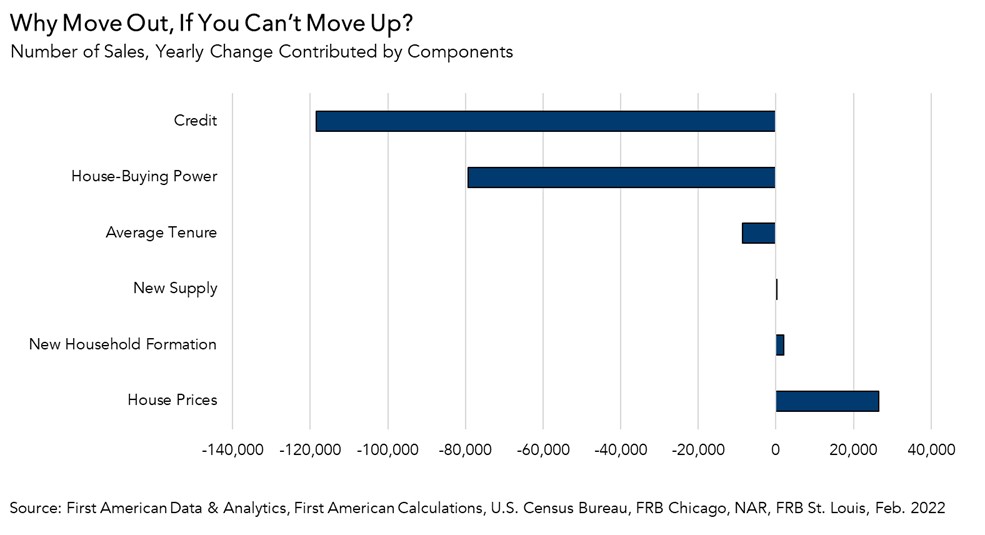

- Credit Standards Tightened: When lending standards are tight, fewer people can qualify for a mortgage to buy a home, thus they are more likely to stay in their current home, limiting the supply of homes for sale. In February, credit tightened compared with the previous month, reducing housing market potential by approximately 118,000 potential home sales compared with one month ago.

- House-Buying Power Declined: House-buying power, how much home one can afford to buy given household income and the prevailing mortgage rate, decreased 3.6 percent compared with one month ago. The monthly decline in house-buying power was due to the 0.3 percentage point increase in the average 30-year, fixed mortgage rate. The decline in house-buying power reduced market potential by nearly 79,000 potential home sales. However, house-buying power may improve heading into spring home-buying. While rates are generally expected to trend upwards in 2022 as the economy continues to improve, geopolitical uncertainty has recently put downward pressure on mortgage rates, at least temporarily. Household income is also expected to increase as the economy continues to improve and employers’ bid up wages to attract workers.

Housing Market Potential Tailwinds – Equity from Price Appreciation and Demographic Demand

Despite the current headwinds, two forces propelled housing market potential forward in February. House price appreciation is expected to remain strong and may encourage more existing homeowners to move. As homeowners gain equity in their homes, they may be more likely to consider using the equity to purchase a larger or more attractive home. The historic imbalance in housing supply relative to demand over the last year fueled faster house price appreciation, which increased housing market potential by nearly 27,000 potential home sales in February compared with one month ago. Annual house price growth has moderated from its peak in recent months, and existing homeowners may fear missing out on selling their homes at historically high prices, prompting them to sell. In addition, household formation, a primary and long-term driver of home-buying demand, continued to rise and contributed a gain of 2,000 potential home sales.

What Does This Mean for the Spring Home-Buying Season?

While the housing market potential headwinds exceeded the tailwinds in February, it’s clear that demographic demand for homes remains robust, and the primary constraint to more sales is the lack of housing supply. There are several unknowns as the spring home-buying season begins, but one thing is clear – if you sell it, they will buy it.

February 2022 Potential Home Sales

For the month of February, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales decreased to a 6.17 million seasonally adjusted annualized rate (SAAR), a 2.8 percent month-over-month decrease.

- This represents a 77.1 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 0.04 percent compared with a year ago, a gain of 2,300 (SAAR) sales.

- Currently, potential existing-home sales is 616,000 (SAAR), or 9.1 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 13.8 percent or an estimated 853,000 (SAAR) sales.

- The market performance gap increased by an estimated 291,400 (SAAR) sales between January 2022 and February 2022.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.