Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

How aggressive will the Fed need to be to get inflation under control?

By

Mark Fleming on June 13, 2022

The dual mandate of the Federal Reserve is to maintain stable inflation and full employment, and while the latter goal has mostly been achieved post-pandemic, the former remains far from target. One of the primary instruments of monetary policy the Fed uses to achieve its dual mandate is controlling the federal funds rate. The Federal Open Market ...

Read More ›

The Housing Market is Slowing by Design, But Don't Expect a Bust

By

Mark Fleming on May 27, 2022

In March 2022, the Real House Price Index (RHPI) increased 32.5 percent year over year, which is the fastest growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by two factors: a 21.6 percent annual increase in nominal house prices and over a full percentage point increase in the 30-year, ...

Read More ›

Will Higher Mortgage Rates Bring Normalcy to the Housing Market?

By

Mark Fleming on May 18, 2022

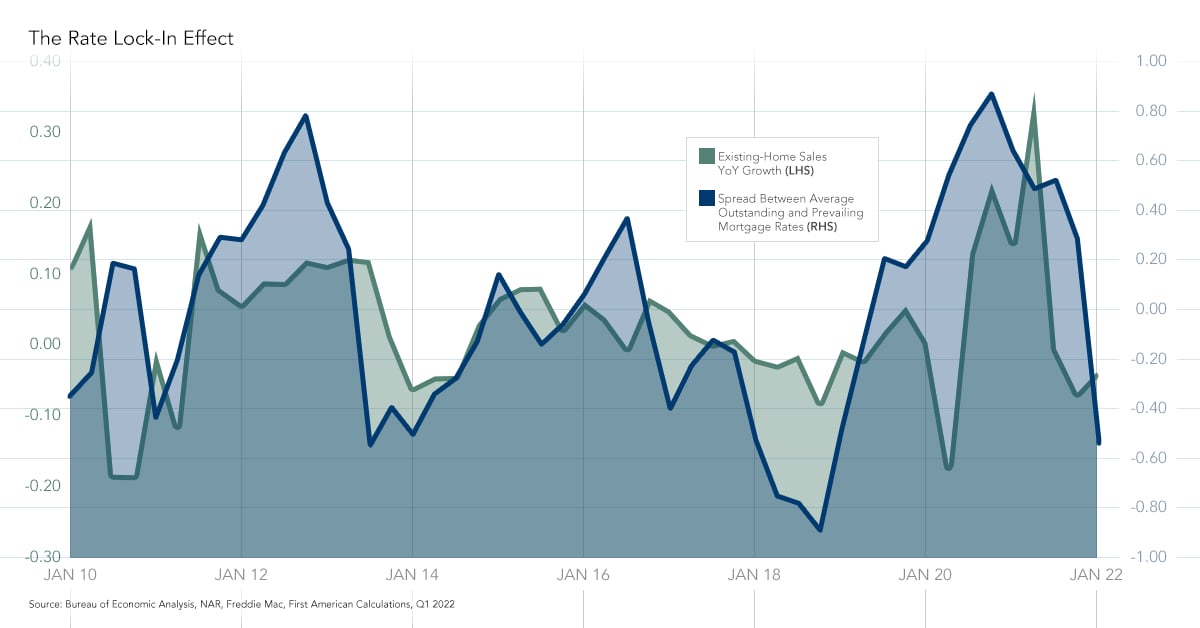

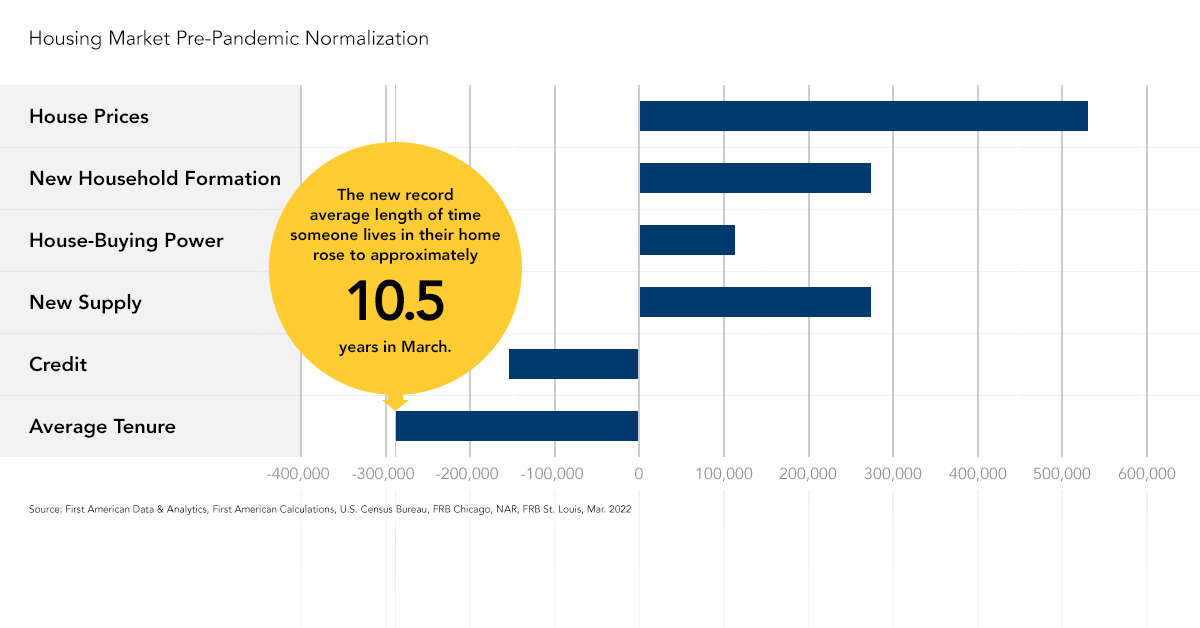

The market potential for existing-home sales in April declined 3 percent compared with last month, falling to 5.74 million at a seasonally adjusted annualized rate (SAAR). Housing market potential is down 8.1 percent, compared with the roaring housing market in April 2021, but today’s housing market is still very 2019, which was the housing ...

Read More ›

How Do Rapidly Rising Mortgage Rates Impact Affordability?

By

Mark Fleming on April 22, 2022

In February 2022, the Real House Price Index (RHPI) jumped up by nearly 31 percent. That’s the fastest growth in the more than 30-year history of the series. This rapid annual decline in affordability was driven by two factors: a 21.7 percent annual increase in nominal house prices and a nearly full percentage point increase in the 30-year, fixed ...

Read More ›

Why the 2022 Housing Market is Very 2019

By

Mark Fleming on April 19, 2022

Since the start of the global pandemic in March 2020, we have weathered unprecedented pandemic-induced changes and the housing market has been no exception. The typically hot spring home-buying season in 2020 was initially frozen by the pandemic’s impacts and shelter-in-place orders. As potential home buyers emerged from the stay-at-home orders, ...

Read More ›

Is Affordability Worse Than the 2006 Housing Boom Peak?

By

Mark Fleming on March 29, 2022

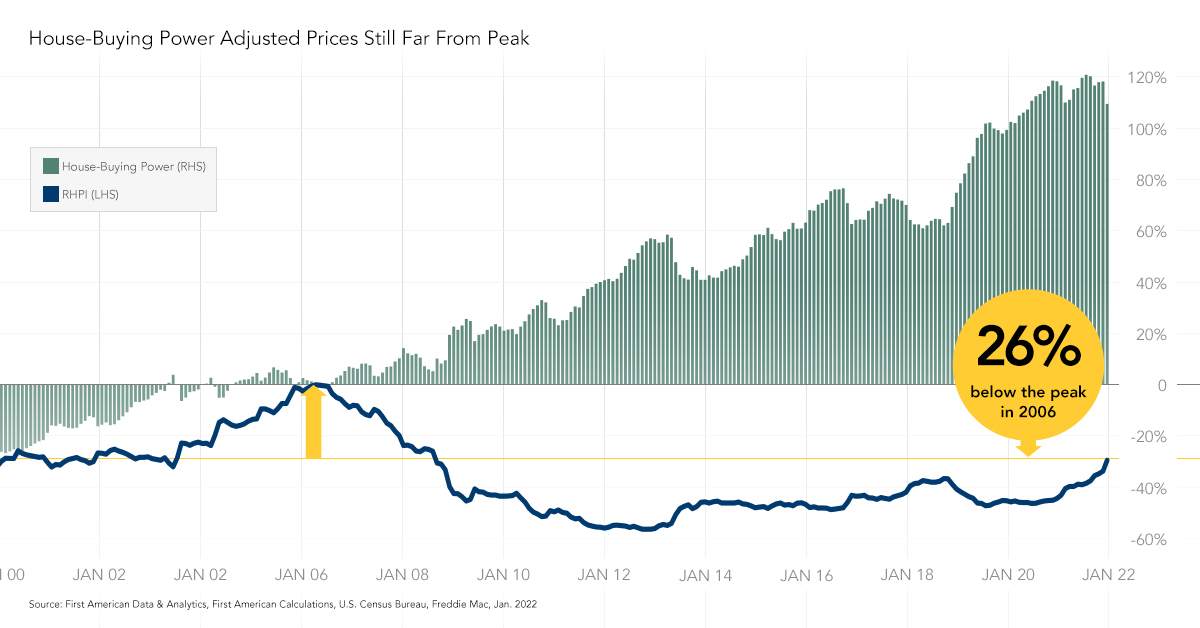

In the first report with 2022 data, the Real House Price Index (RHPI) jumped up by nearly 27 percent, the fastest growth in the RHPI since 2004. This rapid annual decline in affordability was driven by a 21.7 percent annual increase in nominal house prices and a 0.7 percentage point increase in the 30-year, fixed mortgage rate compared with one ...

Read More ›