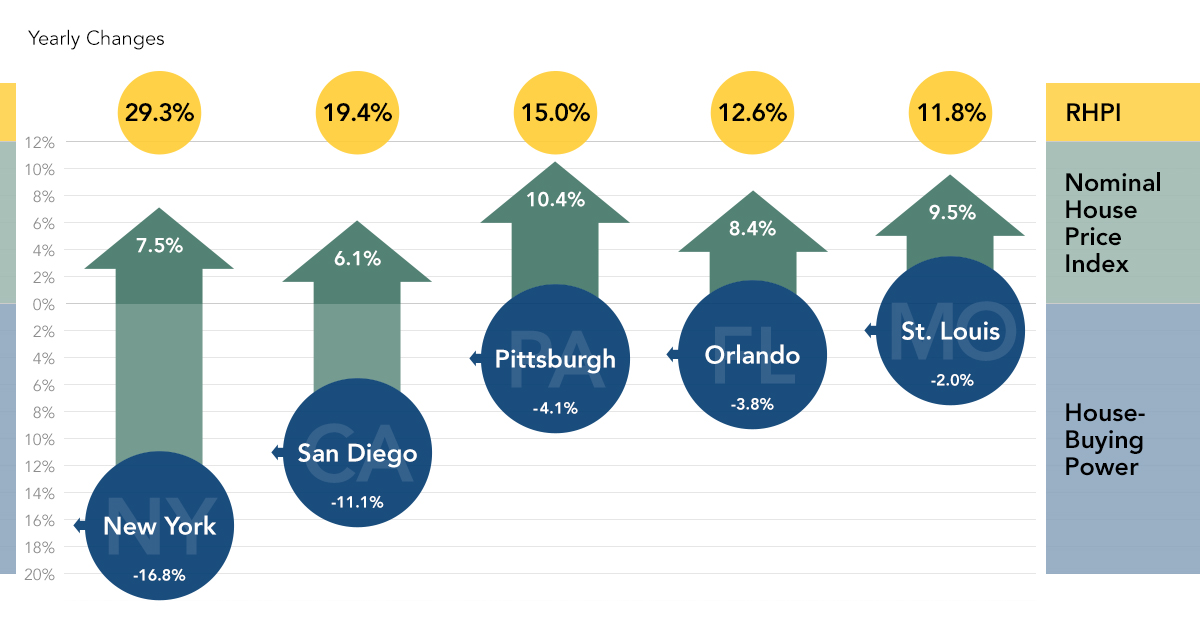

Where Housing Affordability is Declining the Most

By

Mark Fleming on August 24, 2020

The coronavirus pandemic continues to wreak havoc on global and domestic economies, yet housing has thus far managed an impressive V-shaped recovery. Housing’s strong rebound has been driven by several factors that existed before the coronavirus outbreak but have continued or even gained strength amid the pandemic. Mortgage rates are even lower ...

Read More ›

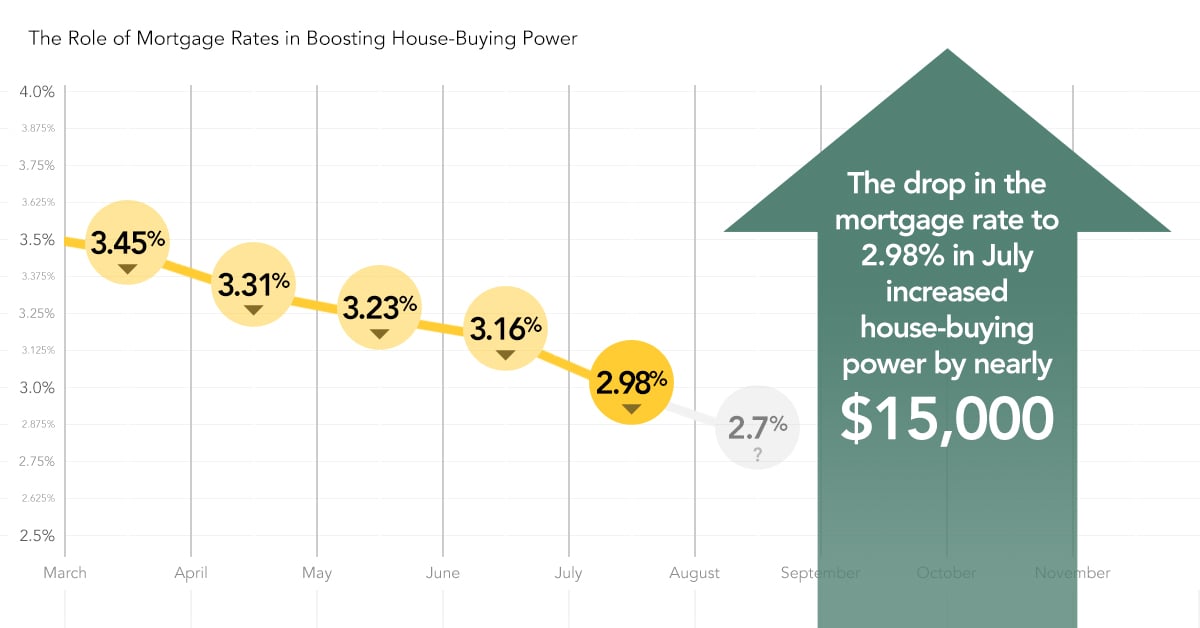

What the Historic Mortgage Rate Drop Means for Affordability

By

Mark Fleming on July 27, 2020

As the coronavirus pandemic continues to wreak havoc on global and domestic economies, housing has thus far proven resilient, managing a V-shaped recovery from the low point reached in April. The strong rebound is largely a result of two dynamics that existed before the pandemic and have continued or even gained strength in the last few months.

Read More ›

Will Low Mortgage Rates Prevent Decline in Affordability this Summer?

By

Mark Fleming on June 30, 2020

The economic fallout and impacts to the housing market from the pandemic appeared to peak in April. The number of existing-home sales fell 18 percent relative to March, housing starts fell 26 percent, and the supply of homes available for sale approached record lows. While historically low mortgage rates made it more affordable for those with ...

Read More ›

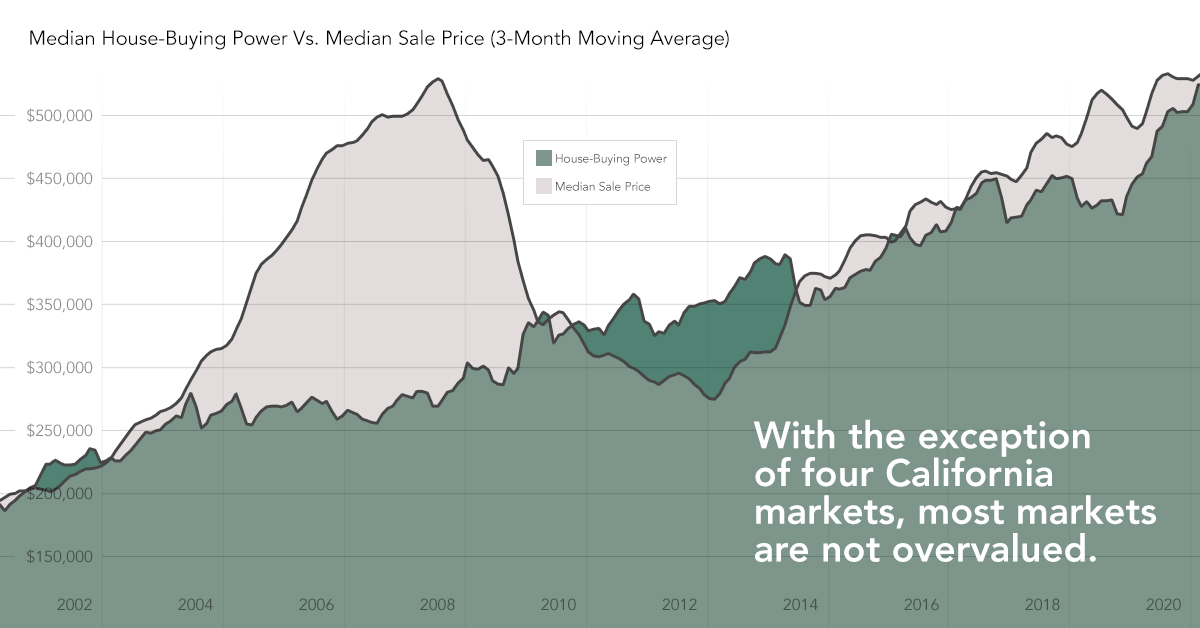

Why Housing Overvaluation is Not as Prevalent as Many Believe

By

Mark Fleming on May 22, 2020

In March, data began to reveal the depth of the impact from the pandemic on the housing market. The number of existing-home sales fell 8.5 percent relative to February, and the number of new listings continued to dwindle. While historically low mortgage rates make it more affordable for those with stable incomes to buy a home, tightening credit ...

Read More ›

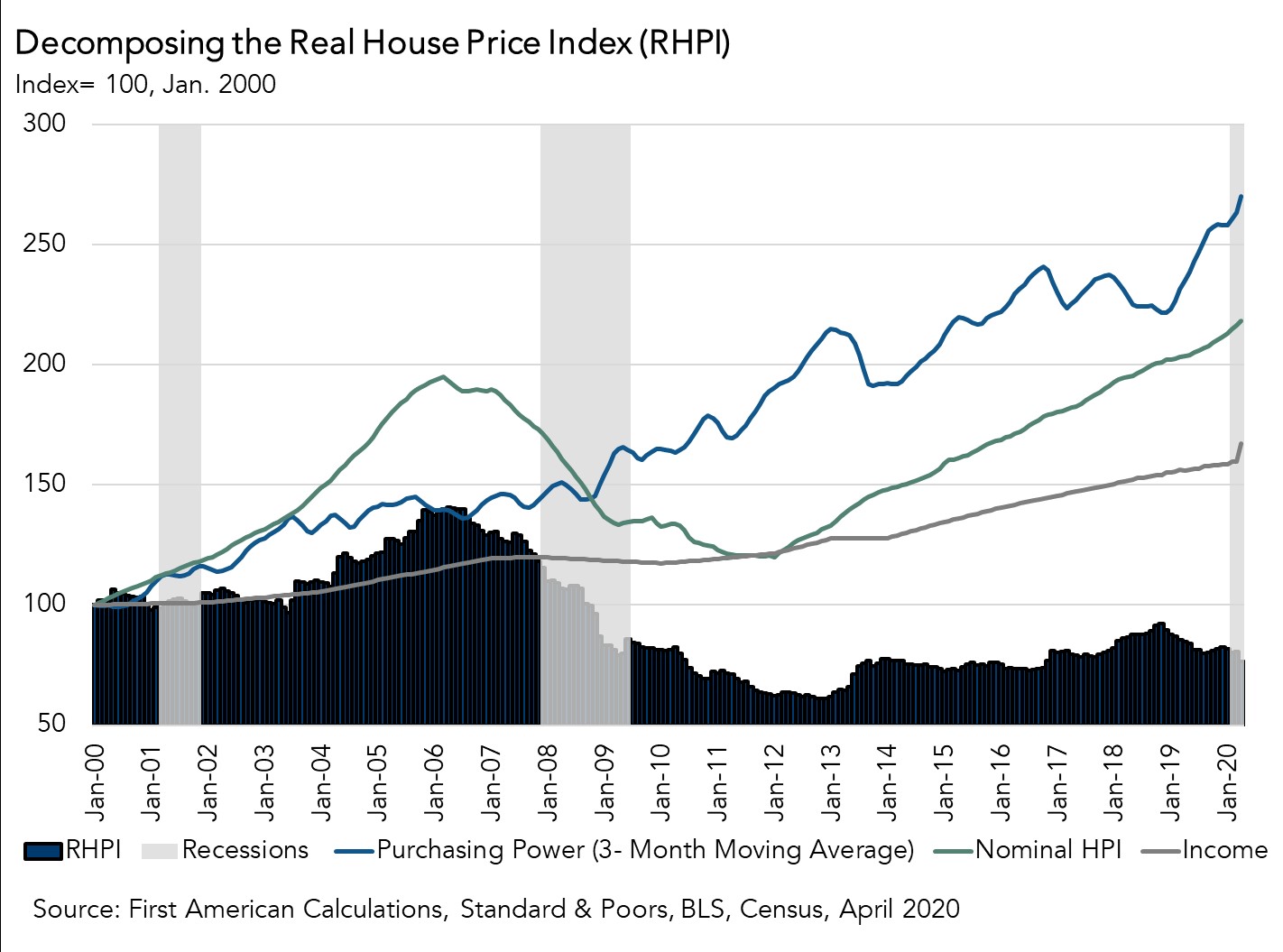

Has House Price Appreciation Reached a Tipping Point?

By

Mark Fleming on April 27, 2020

As the coronavirus outbreak continues to affect the domestic and global economy, the housing market has shown that it is not immune to its impact. In March, the number of existing-home sales fell 8.5 percent relative to February, and the number of new listings continued to dwindle. While mortgage rates have fallen due to the current economic ...

Read More ›

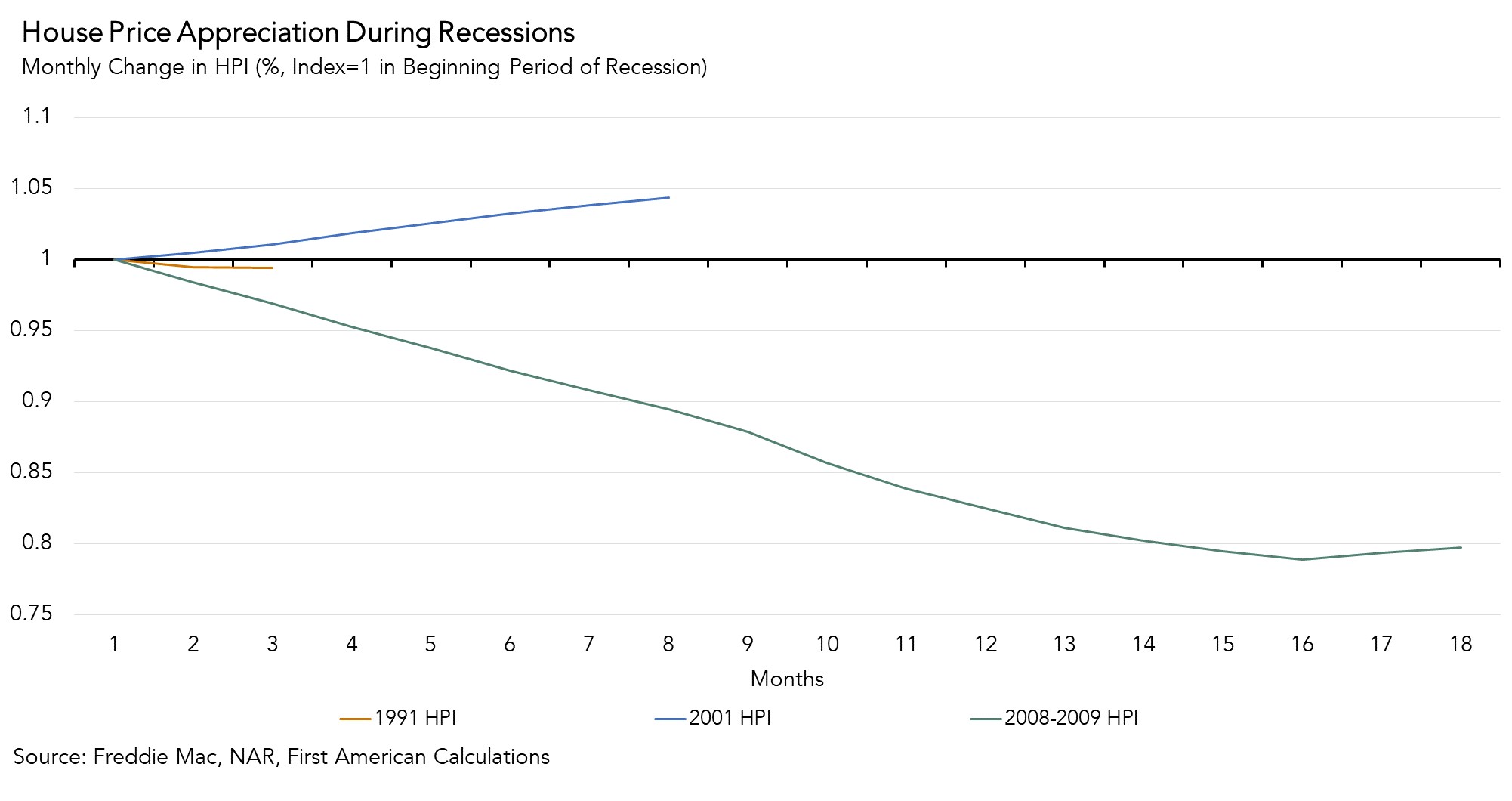

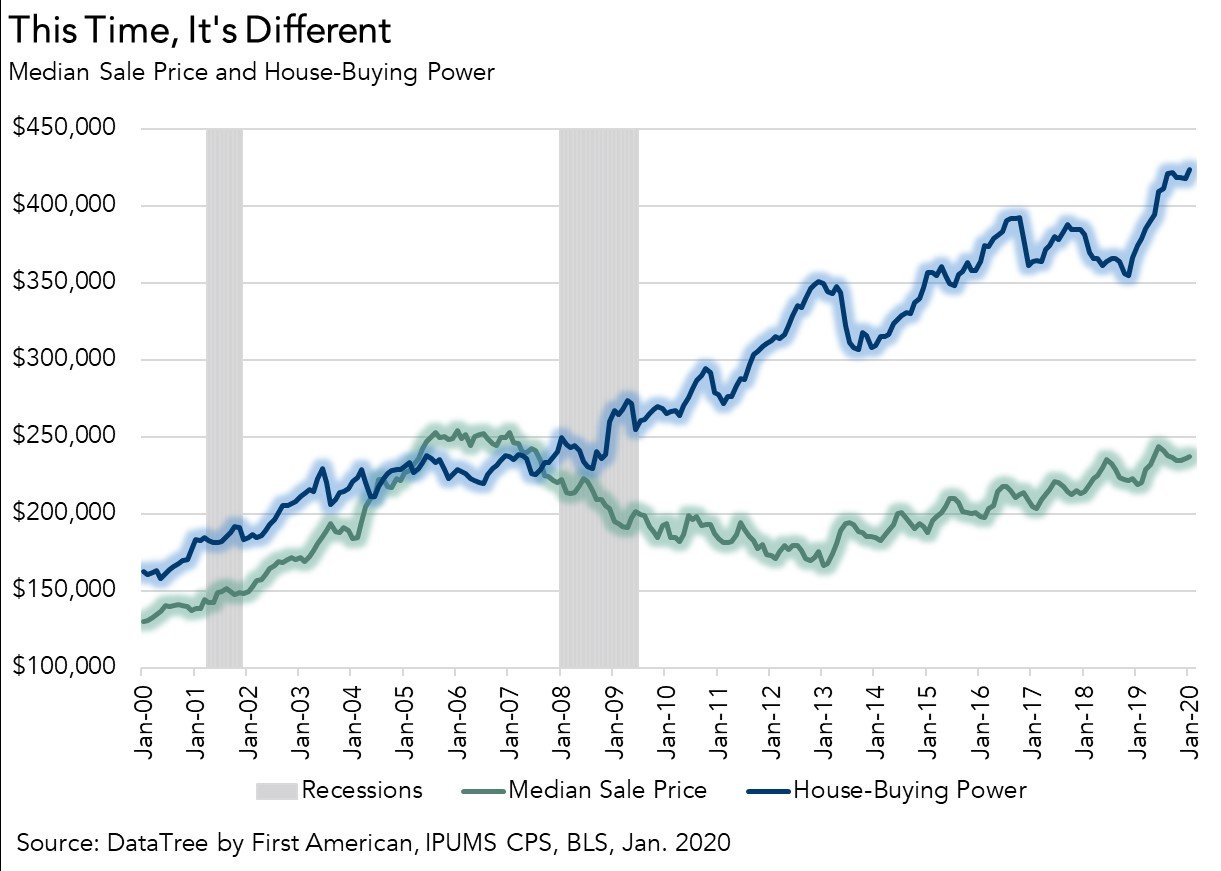

Why the Housing Market May Weather Coronavirus Impact Better Than the Great Recession

By

Mark Fleming on March 31, 2020

As we are all too aware, the coronavirus outbreak has taken hold of the domestic and global economy. The housing market is not immune to its impact but may be in a better position than many believe. Recent data shows that weekly unemployment claims soared to a record, which will, in turn, work to depress household incomes and consumer confidence. ...

Read More ›