Does Resurgent House Price Growth Signal a Bottom in the Housing Market?

By

Mark Fleming on July 31, 2023

In May, housing affordability fell relative to one month ago, as two of the three key drivers of the Real House Price Index (RHPI), nominal house prices and mortgage rates reduced house-buying power by 0.7 percent. Nominal house price growth ticked up 0.6 percent compared with one month ago, while the average 30-year, fixed mortgage rate increased ...

Read More ›

Have Existing-Home Sales Bottomed Out?

By

Mark Fleming on July 19, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, decreased modestly in June, and remains 2.8 percent lower than one year ago. Mortgage rates have risen substantially since the spring of 2022, and higher rates have a dual impact on sales ...

Read More ›

Why Higher Mortgage Rates Don't Always Lead to Declining House Prices

By

Mark Fleming on June 26, 2023

In April, housing affordability improved relative to one month ago, as two of the three key drivers of the Real House Price Index (RHPI), income and mortgage rates boosted house-buying power by 2.3 percent. Median household incomes increased by 0.1 percent compared with March, while mortgage rates dipped by 0.2 percentage points. Nominal house ...

Read More ›

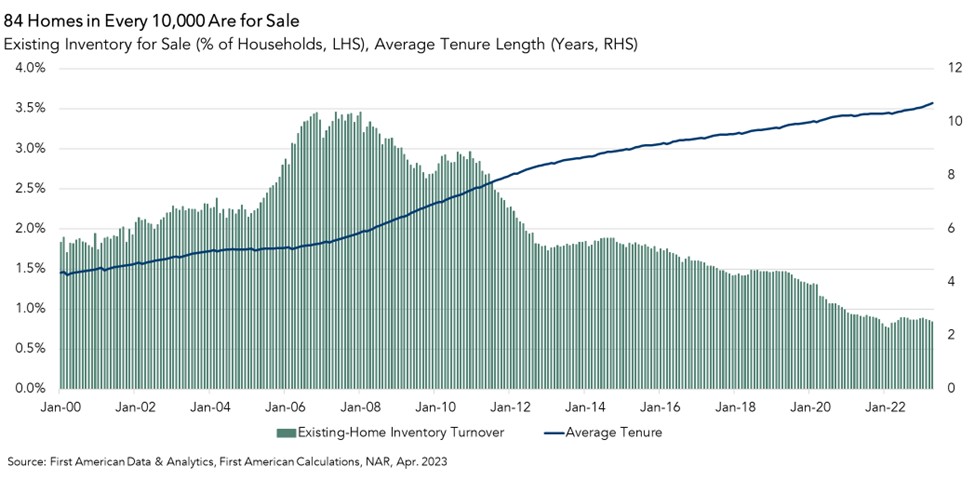

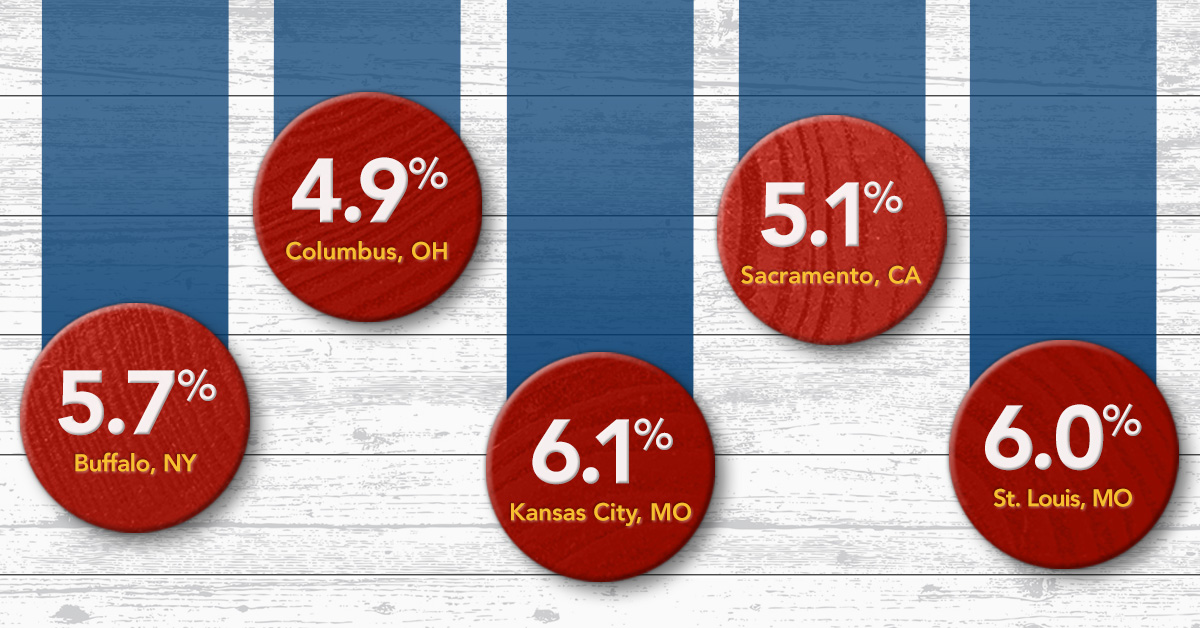

Housing Market Potential Increases, But Remains Restricted by Existing Home Supply

By

Mark Fleming on June 21, 2023

Our Potential Home Sales Model, which measures what a healthy market for home sales should be based on the economic, demographic and housing market environments, increased modestly in May, but is still down 5.7 percent from a year ago. The primary factor limiting housing market potential is existing homeowners staying put.

Read More ›

Seasonal Demand Drives Resurgent House Price Growth and Decline in Affordability

By

Mark Fleming on May 31, 2023

In March, housing affordability declined, snapping a four-month streak of increasing affordability. The decline in March occurred as two of the three key drivers of the Real House Price Index (RHPI), nominal house prices and mortgage rates, moved higher, decreasing house-buying power by 2.7 percent and dragging affordability down relative to one ...

Read More ›

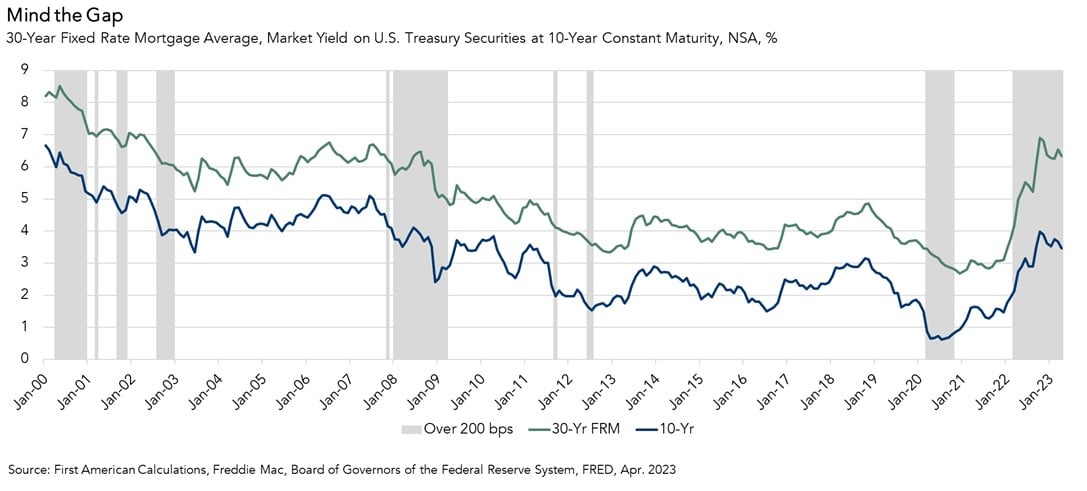

Mind the Gap Between Mortgage Rates and the 10-Year Treasury Yield

By

Odeta Kushi on May 24, 2023

The popular 30-year, fixed mortgage rate is loosely benchmarked to the 10-year Treasury bond. Since the end of the Great Recession, the 30-year, fixed mortgage rate has on average remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield. Yet, this spread is not always consistent. It usually widens during ...

Read More ›