Affordability Declined for Third Month in a Row

By

Mark Fleming on July 27, 2021

Housing affordability declined on a year-over-year basis for the third month in a row in May, following a two-year streak of rising affordability. The decline in May occurred even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of greater affordability relative to one year ...

Read More ›

Housing Supply Limiting Market Potential

By

Mark Fleming on July 16, 2021

Housing market potential strengthened modestly in June, increasing 0.2 percent compared with May, according to our Potential Home Sales Model. Potential home sales are nearly 17 percent higher than the pandemic-driven decline last June.

Read More ›

Is it a Good Time to Buy a Home?

By

Mark Fleming on June 28, 2021

In today’s housing market, the power is very clearly in the hands of the seller. In April, First American Data & Analytics’ nominal house price index increased 16.2 percent year over year, the fastest pace since 2005. Rapid appreciation is driving declines in affordability, despite rising incomes and lower mortgage rates. Nationally, according ...

Read More ›

Why Homebodies Versus Pandemic-Fueled Demand Will Determine the Outlook for Housing Market Potential

By

Mark Fleming on June 22, 2021

Housing market potential strengthened again last month, according to our Potential Home Sales Model, despite significant supply headwinds. In May, housing market potential increased 0.8 percent compared with April, and is now nearly 23 percent higher than the pandemic-driven decline last May. Relative to two years ago, housing market potential is ...

Read More ›

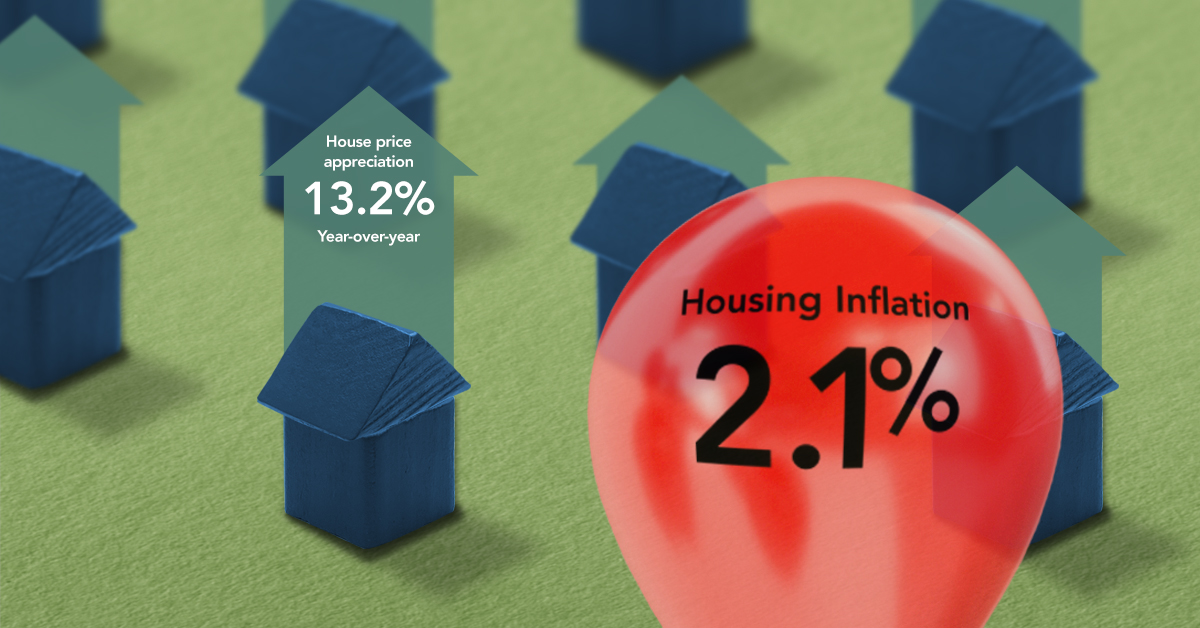

Housing Inflation is Not What You Think It Is

By

Mark Fleming on June 9, 2021

One of the most closely watched indicators of inflation, the Consumer Price Index (CPI), jumped 4.2 percent year over year this April. This is a faster pace than most economists anticipated, and was a result of base effects, combined with the numerous supply chain bottlenecks driving up prices as the economy reopens. One of the most important ...

Read More ›

Why Housing Affordability Sank for the First Time in Over Two Years

By

Mark Fleming on May 24, 2021

Housing affordability on a year-over-year basis declined in March for the first time since January 2019, ending a more than two-year streak of rising affordability. The long run of increasing affordability snapped, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of ...

Read More ›