One of the most closely watched indicators of inflation, the Consumer Price Index (CPI), jumped 4.2 percent year over year this April. This is a faster pace than most economists anticipated, and was a result of base effects, combined with the numerous supply chain bottlenecks driving up prices as the economy reopens. One of the most important components of the CPI, accounting for approximately one-third of the headline CPI and 40 percent of the core CPI (CPI minus food and energy prices), is housing. In a time of rapid house price appreciation, even reaching 13.2 percent year-over-year growth in March, it may be surprising to some that housing inflation was only 2.1 percent in April 2021, according to the CPI measure. How can that be?

“There is another way to look at housing inflation, one that measures how much home one can buy with the same income over time.”

A Penny for Your Rent Guesstimate

The housing market is divided into two – rented and owned housing. Figuring out the price of rented housing is simple – it is the amount paid every month by the tenant in the form of rent. The cost of owned housing is less straightforward. What the Bureau of Labor Statistics (BLS) is trying to measure with the CPI is the cost of “consuming” housing as shelter every month. That’s why home sale prices are not used. The BLS considers the home a real estate asset and therefore an investment, not a consumption good. Instead, the BLS uses an owner’s equivalent rent (OER). The BLS estimates the OER by asking homeowners how much they could charge to rent their home.

The problem with this method is that homeowners generally don’t know how much they could rent their home for because they are not participating in the rental market. Any such estimate won’t be entirely accurate, and, in fact, some research has shown that homeowners tend to underestimate rent appreciation during expansionary periods and overestimate it during recessionary periods. Furthermore, OER doesn’t change very much. The year-over-year growth in the OER in April was about 2 percent, which is unchanged from the previous three months. This is the reason that the housing component of overall inflation measured in the CPI is so stable. But, is that an accurate reflection of inflation in the housing market? Is there another way to think about owner-occupied housing inflation?

How Much Does A Homeowner Pay for Housing?

The price a homeowner pays for shelter can be calculated another way, without resorting to asking homeowners to calculate the potential rental income of their home. A homeowner, just like a renter, makes monthly payments, except those payments go to a mortgage company instead of a landlord. The monthly mortgage payment depends on the prevailing mortgage rate at the time of origination and the price of the home.

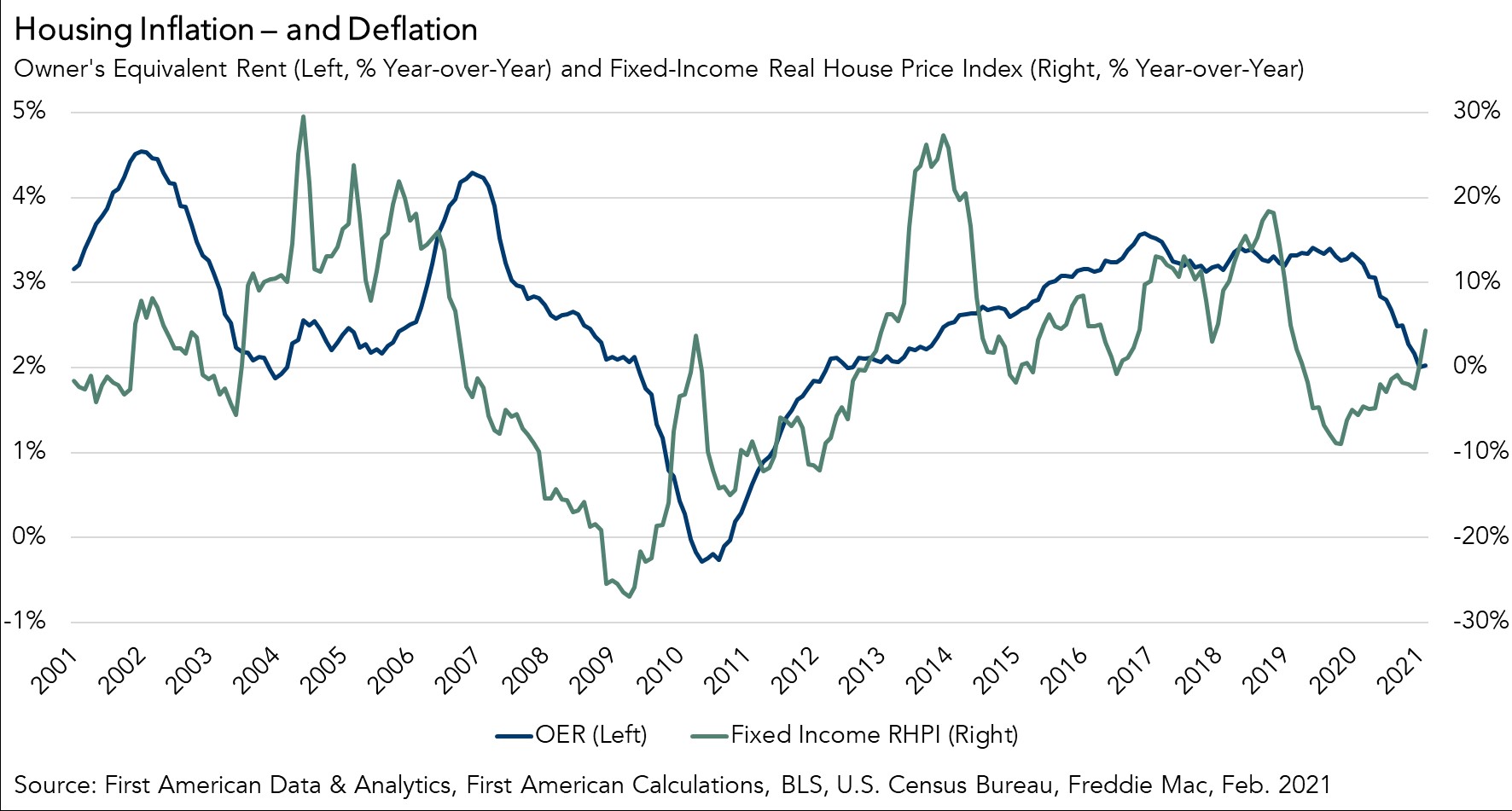

Using that information, an alternative measure to gauge owner-occupied housing inflation can be constructed from the Real House Price Index, which adjusts nominal house prices by house-buying power (how much home you can afford to buy given the prevailing mortgage rate and household income), if income is held constant. The result, graphed below, indicates that for much of 2019 and 2020, home buyers could afford more home on a year-over-year basis thanks to falling mortgage rates. The ability to buy more today than in the past with the same income is, in fact, deflationary. However, beginning in January 2021, housing inflation returned as mortgage rates began to increase.

It Always Comes Back to Buying Power

Housing is a major component of overall inflation. After all, shelter, whether rented or owned, is generally a household’s largest monthly expenditure. While owner-occupied housing inflation in the CPI is measured by asking the homeowner how much they would rent their home for, many homeowners don’t have an accurate answer to that question. There is another way to look at housing inflation, one that measures how much home one can buy with the same income over time. Inflation always comes back to buying power, and housing is no different.

Ksenia Potapov contributed to this blog post.