How Have the 2017 Tax Law Changes Impacted Real Estate Prices?

By

Odeta Kushi on May 13, 2019

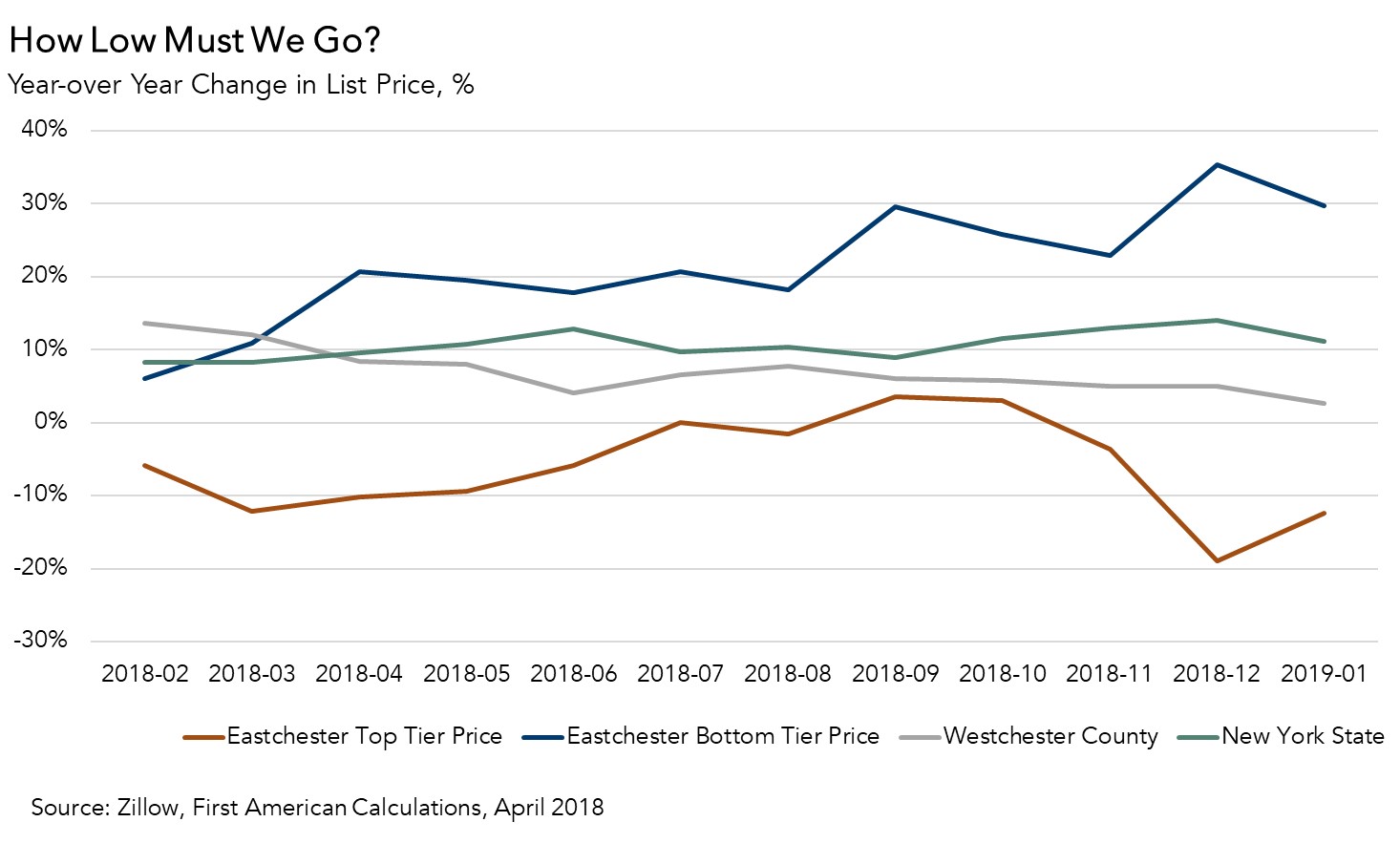

Enacted in 2017, the Tax Cuts and Jobs Act reduced tax breaks for homeowners. At the time, many in the real estate industry expected the changes to negatively impact the housing market, particularly in high-priced neighborhoods. The industry concern primarily focused on two specific changes included in the bill: the mortgage interest deduction was ...

Read More ›

Why Everything You Know About First-Time Home Buyer Affordability is Wrong

By

FirstAm Editor on May 8, 2019

We’ve published the findings from a new study that provides an in-depth look at the trends shaping affordability, specifically for first-time home buyers, titled “Why Everything You Know About First-Time Home Buyer Affordability is Wrong.” The study, developed by First American Chief Economist Mark Fleming and Deputy Chief Economist Odeta Kushi, ...

Read More ›

Six Cities Leading Shift Toward A Buyers' Market

By

Mark Fleming on April 29, 2019

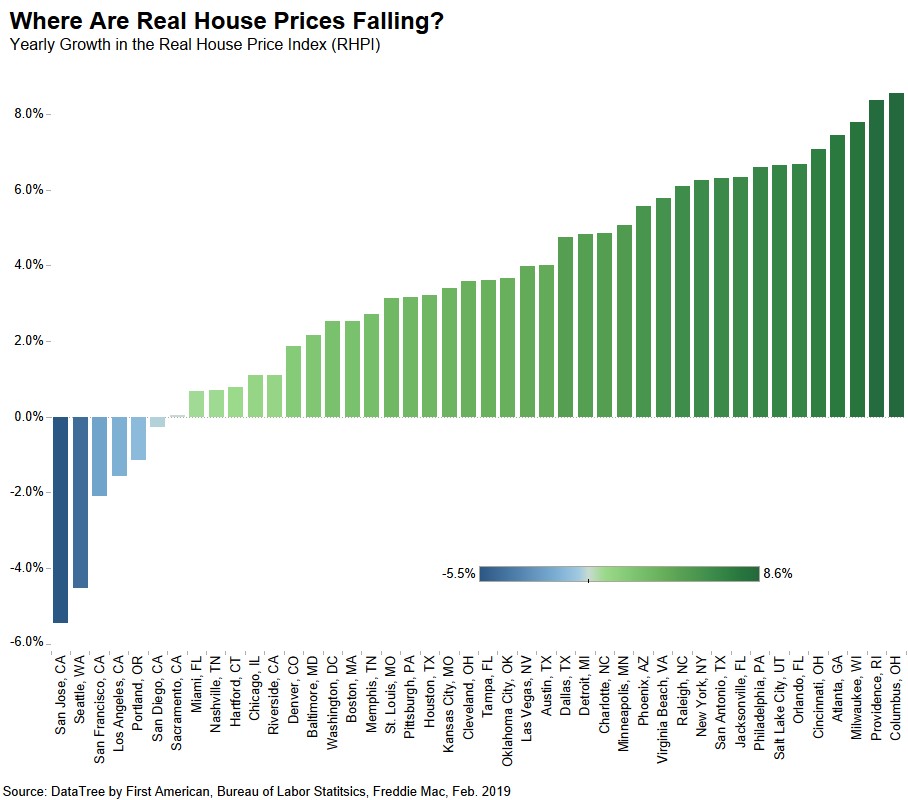

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income and unadjusted house prices – defined the housing market. These three factors are also the core elements of the Real House Price Index (RHPI). While household income rose steadily in 2018, rising mortgage rates offset any affordability benefit for home ...

Read More ›

Interview on CNBC: Discussing the Impact of Declining Mortgage Rates and Limited Supply on the Housing Market

By

FirstAm Editor on March 27, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC on Tuesday and discussed how the decline in mortgage rates over the last few months and continued tight housing supply are likely to impact the housing market.

Read More ›

Housing New Home Buying In The News Interest Rates Affordability

Three Reasons Home Buyers Have More Power This Spring

By

Mark Fleming on March 25, 2019

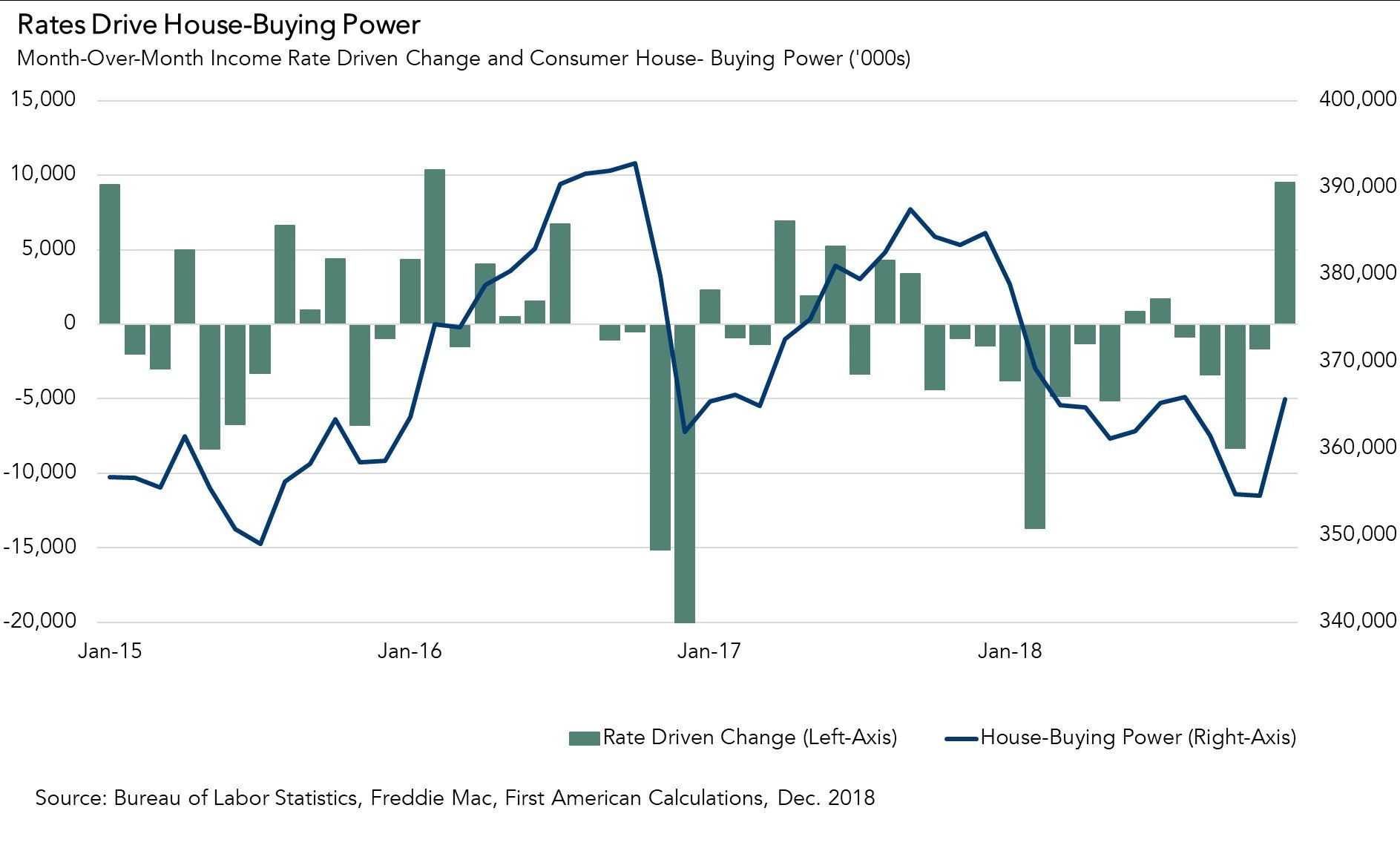

While 2018 was largely characterized by declining affordability, ending the year with a five percent yearly decline in house-buying power, this trend reversed sharply in early 2019. Moderating home prices, in conjunction with gains in household income and declining mortgage rates, boosted affordability for potential home buyers.

Read More ›

What Triggered the Biggest Increase in House-Buying Power in Five Years?

By

Mark Fleming on February 25, 2019

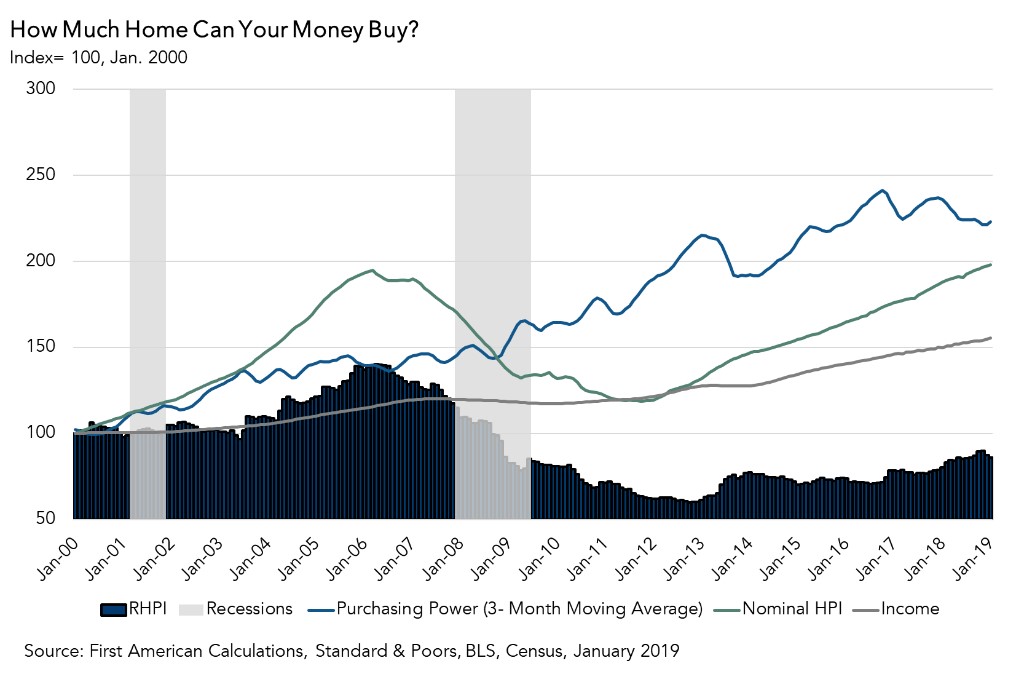

Housing affordability is a function of three economic drivers: nominal house prices, household income and mortgage rates. When incomes rise, consumer house-buying power increases. Declining mortgage rates or declining nominal house prices also increase consumer house-buying power. Our Real House Price Index (RHPI) uses consumer house-buying power ...

Read More ›