Interviews on NPR and Forbes.com: Discussing Millennial Homeownership and the 2019 Spring Home Buying Season

By

FirstAm Editor on February 6, 2019

First American Deputy Chief Economist Odeta Kushi provided perspective on millennial homeownership in an interview with National Public Radio and Chief Economist Mark Fleming’s expectations for the spring home buying season were featured in a Forbes.com article earlier this month.

Read More ›

Housing In The News Interest Rates Millennials Affordability

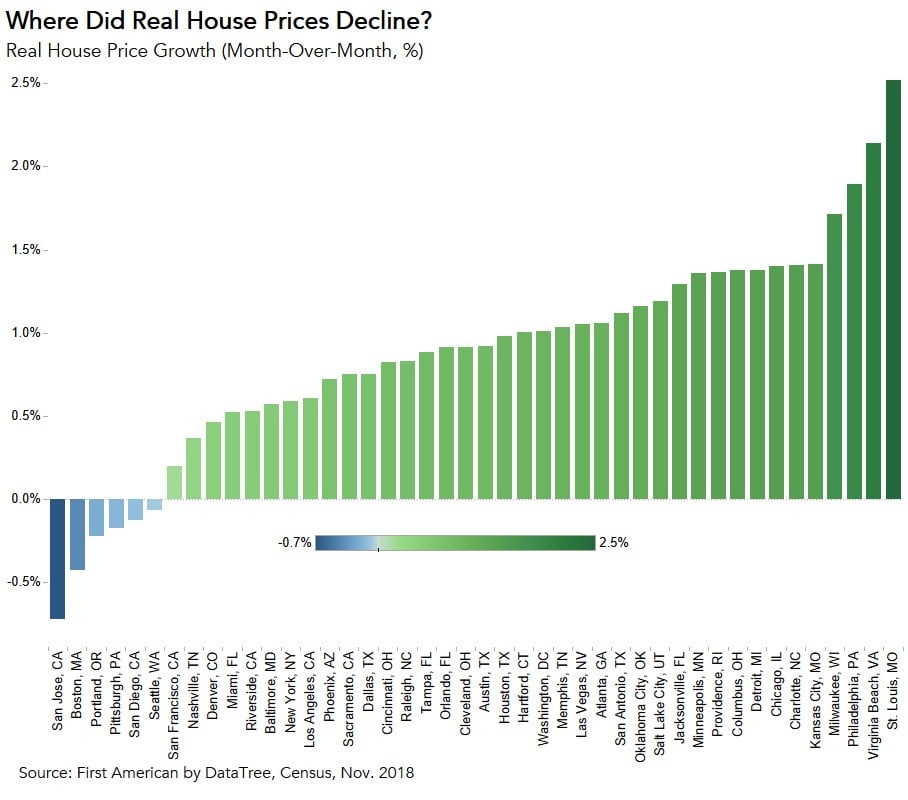

Where is the Housing Market Cooling the Most?

By

Mark Fleming on January 28, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income, and unadjusted house prices – defined the housing market. These three factors are also the core metrics that comprise the Real House Price Index (RHPI). November 2018 was no exception, as household income, mortgage rates, and the unadjusted house ...

Read More ›

Interviews on CNBC and Yahoo! Finance: Discussing the 2019 Mortgage Rate Outlook, Millennials and Student Debt, and Baby Boomers and Limited Housing Supply

By

FirstAm Editor on January 18, 2019

First American Chief Economist Mark Fleming was interviewed on both CNBC and Yahoo! Finance earlier this week and discussed the outlook for mortgage rates in 2019, the impact of student debt on millennial first-time home buyers and how baby boomers aging in place is limiting housing supply.

Read More ›

Housing In The News Interest Rates Millennials Affordability Baby Boomers

Interview on CNBC: Discussing the 2019 housing market outlook

By

FirstAm Editor on January 4, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and shared his perspective on today’s housing market and the outlook for 2019.

Read More ›

Housing In The News Interest Rates Millennials Affordability

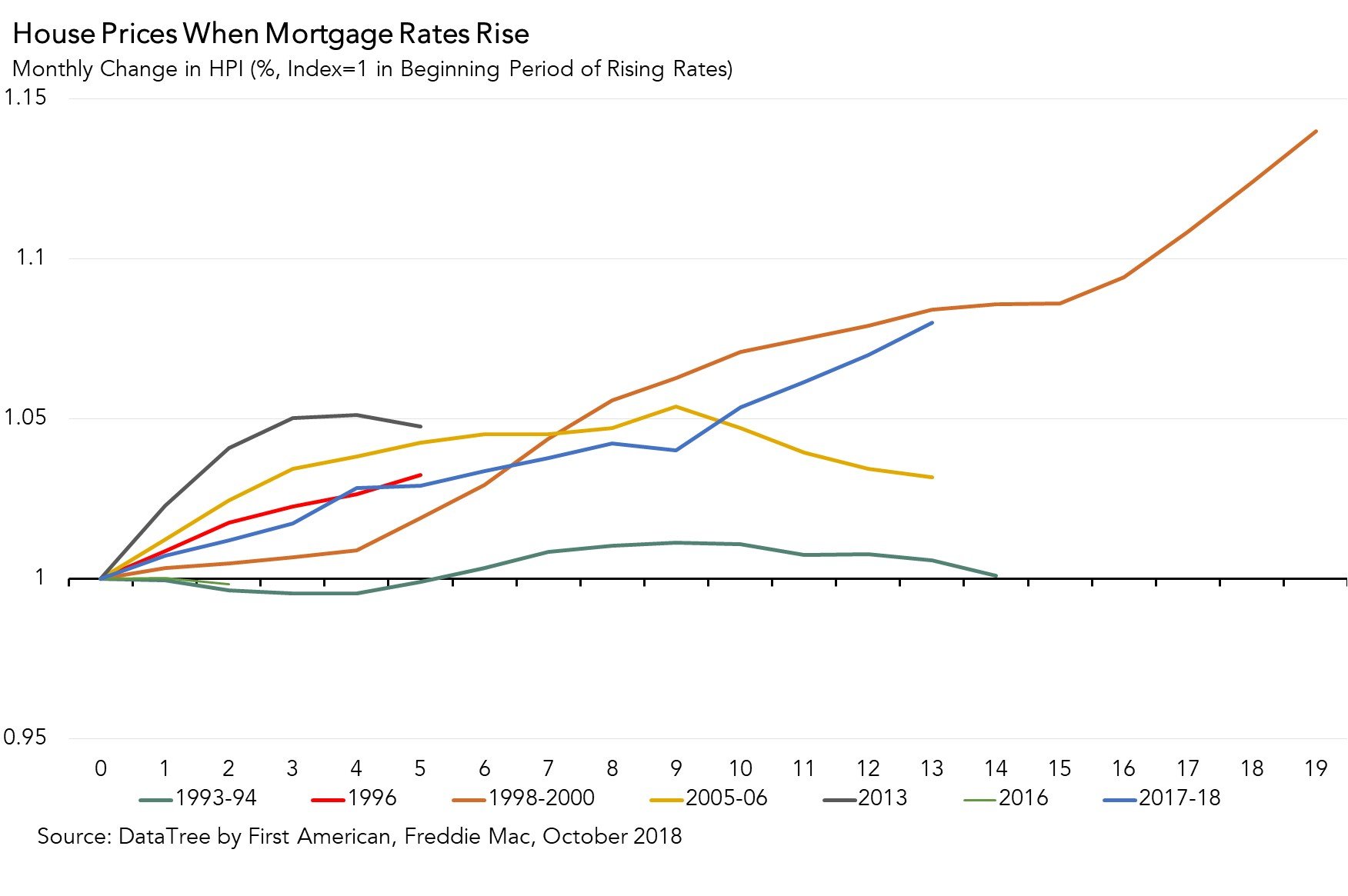

How Does a Strong Economy Slow the Housing Market?

By

Mark Fleming on December 21, 2018

For the second consecutive month, all three key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and the unadjusted house price index, increased compared with a year ago. The 30-year, fixed-rate mortgage and the unadjusted house price index increased by 0.9 percentage points and 7.3 percent respectively. Even though ...

Read More ›

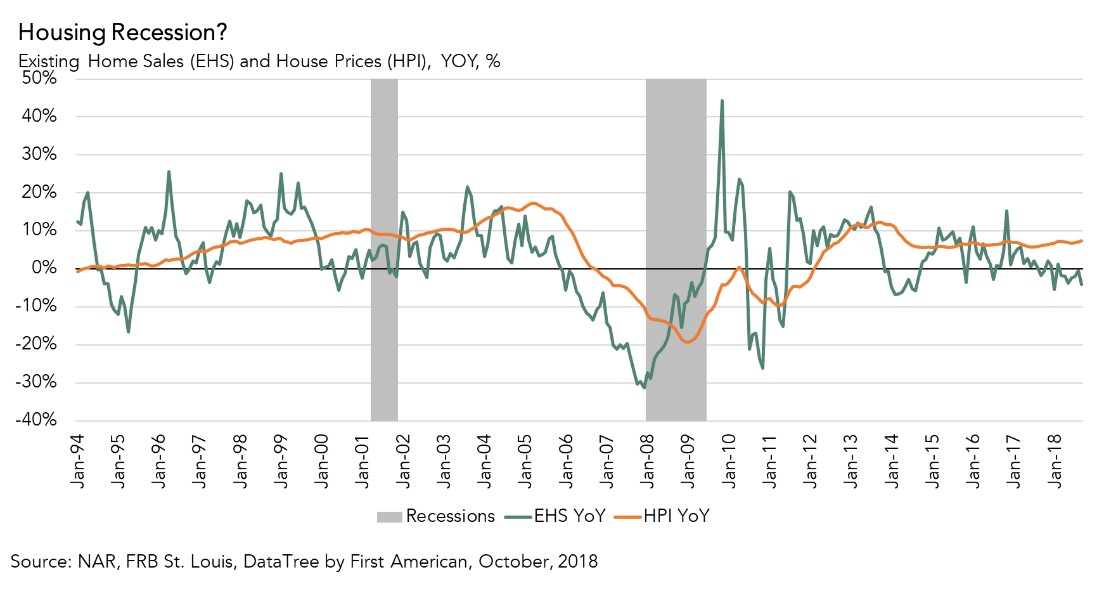

What Does an Inverted Yield Curve Mean for the Housing Market?

By

Mark Fleming on December 12, 2018

Last week, the yield curve inverted, meaning the yield on short-run Treasury bonds exceeded the yield on long-run Treasury bonds, which prompted increased speculation that a recession may be on the horizon. The speculation is rooted in the historical correlation between yield curve inversions and recessions, which have occasionally followed one to ...

Read More ›