The Real House Price Index (RHPI) measures affordability in the context of changes in consumer house-buying power, incorporating fluctuations in household income, mortgage rates and nominal house prices. In June, housing affordability declined on a year-over-year basis for the fourth month in a row, following two years of increasing affordability. The decline in June occurred even as two of the three key drivers of the RHPI, household income and mortgage rates, swung in favor of greater affordability relative to one year ago.

“The underlying fundamentals driving the housing market signal that booming house prices are poised to gradually moderate rather than bust.”

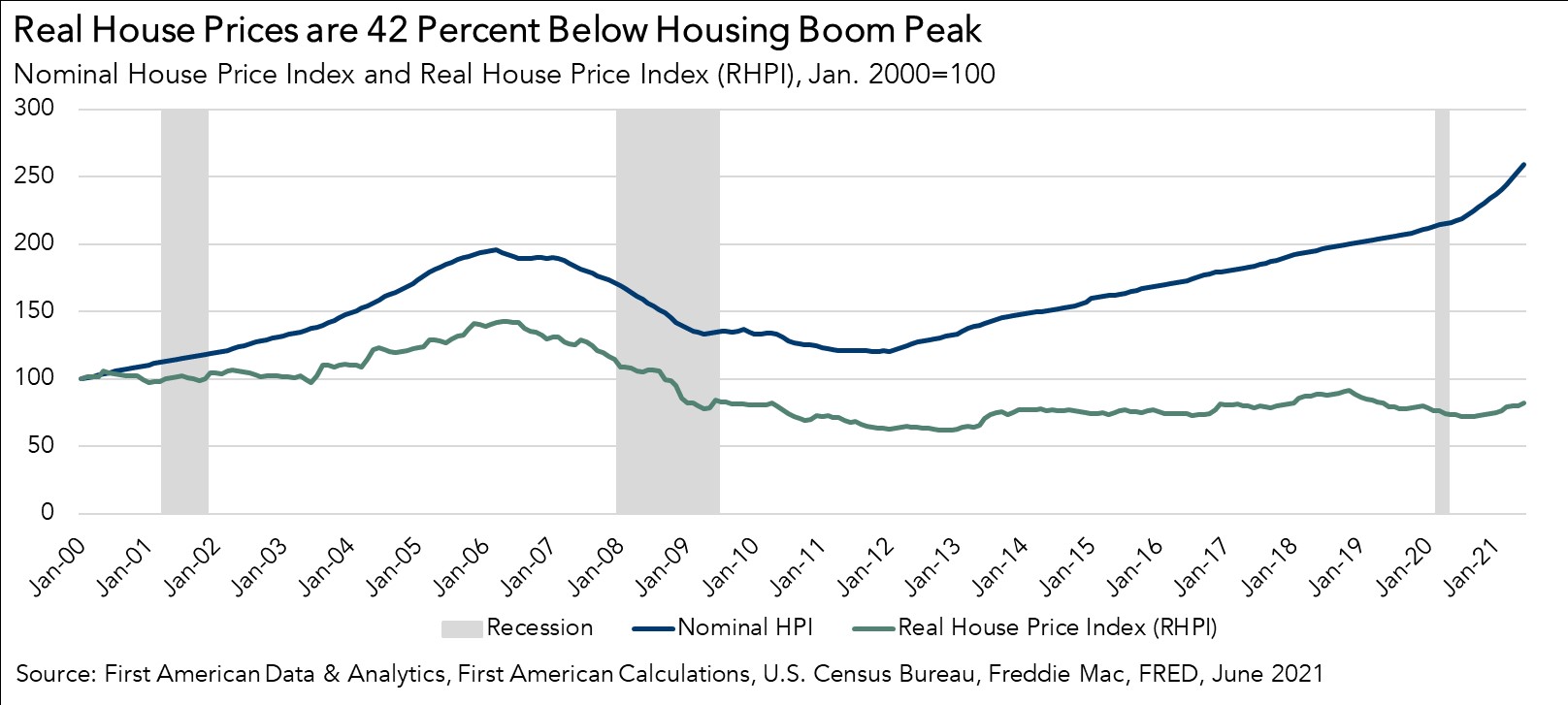

House-buying power, how much one can buy based on changes in income and interest rates, increased by 6.8 percent in June compared with a year ago, propelled by lower mortgage rates and higher household income. The affordability gain from increased house-buying power, however, was offset by the third component of the RHPI, nominal house price appreciation, which reached a record 19 percent compared with a year ago, eclipsing the record for price appreciation of 17.5 percent set in 2005. Indeed, nominal house prices in June were 32 percent higher than at the housing boom peak for prices in 2006, but that’s not the whole story.

Real House Prices are 42 Percent Below Housing Boom Peak

Nominal house prices are well above the housing boom peak, but real, house-buying power-adjusted house prices remain 42 percent below the 2006 housing boom peak. House-buying power has benefited from a long-run decline in mortgage rates and the slow, but steady growth of household income. Since the housing boom peak in unadjusted prices in 2006, the average 30-year, fixed mortgage rate has fallen by approximately 3.3 percentage points, from 6.32 percent to 2.98 percent. Over the same period, nominal household income has increased 55 percent. The dramatically lower mortgage rates and higher income levels mean home buyers in June had 129 percent more house-buying power than in 2006. House-buying power matters because people buy homes based on how much it costs each month to make a mortgage payment, not the price of the home.

What’s Different this Time?

Looking back at the housing boom in the mid-2000s, the rapid nominal price appreciation at the time was fueled by a surge in demand driven by wider access to mortgage financing. Various mortgage finance innovations allowed home buyers to borrow more at the same monthly payment to keep up with growing home values. The financial innovation increased house-buying power, which is one of the main reasons why house prices kept going up. Additionally, there was a lot of speculative buying and “fix-and-flip” home buyers driving house price growth.

The rapid house price appreciation in today’s housing market is largely the result of a historic supply shortage relative to strong demographically driven demand that is supported by traditional mortgage products with tighter underwriting. The supply of homes on the market remains extremely low, and the homes that hit the market sell very quickly (17 days on market in June compared with 24 days one year ago) – an indication that demand is outpacing supply. The low inventory, combined with near record low mortgage rates, millennials aging into their prime home-buying years and tighter mortgage underwriting, fuels price appreciation that is very different than the price appreciation during the housing boom.

Moderation, Not Bust

Real estate markets tend to move in cycles, but not all housing booms end in a housing bust. As record-setting price appreciation undermines affordability and buyers struggle to find something to buy with so little for sale, it’s natural to expect to see some moderation in price appreciation. As buyers pull back from the market and sellers adjust their price expectations, house prices will adjust, but the shortage of supply relative to demand will continue to keep house price appreciation positive. Today, the underlying fundamentals driving the housing market signal that booming house prices are poised to gradually moderate rather than bust.

For more analysis of affordability, please visit the Real House Price Index. The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of September 27, 2021.

Sources:

June 2021 Real House Price Index Highlights

The First American Real House Price Index (RHPI) showed that in June 2021:

- Real house prices increased 1.9 percent between May 2021 and June 2021.

- Real house prices increased 11.6 percent between June 2020 and June 2021.

- Consumer house-buying power, how much one can buy based on changes in income and interest rates, decreased 0.03 percent between May 2021 and June 2021, and increased 6.8 percent year over year.

- Median household income has increased 4.3 percent since June 2020 and 77.6 percent since January 2000.

- Real house prices are 18.1 percent less expensive than in January 2000.

- While unadjusted house prices are now 32.4 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 42 percent below their 2006 housing boom peak.

June 2021 Real House Price State Highlights

- The five states with the greatest year-over-year increase in the RHPI are: Arizona (+23.3 percent), Vermont (+21.4 percent), Nevada (+20.9 percent), Connecticut (+19.2 percent), and Rhode Island (+17.8 percent).

- There were no states with a year-over-year decrease in the RHPI.

June 2021 Real House Price Local Market Highlights

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are: Phoenix (+27.3 percent), Kansas City, Mo. (+22.6 percent), Las Vegas (+22.3 percent), Seattle (+20.5 percent), and Tampa, Fla. (+19.8 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, there were no markets with a year-over-year decrease in the RHPI.

About the First American Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American’s proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.

Disclaimer

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2021 by First American. Information from this page may be used with proper attribution.