Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

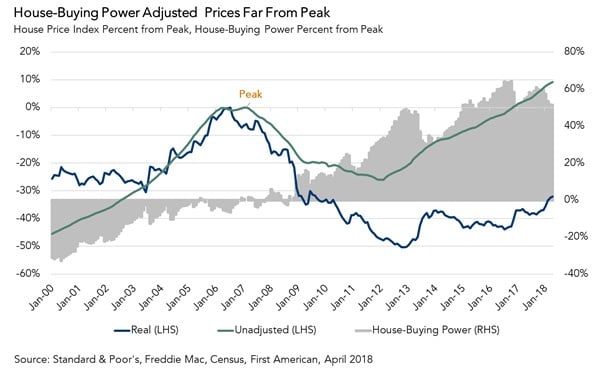

House Prices Continue to Rise, but House-Buying Power Still Near Historic Highs

By

Mark Fleming on June 25, 2018

The Real House Price Index (RHPI) views house prices in relation to consumer house-buying power, incorporating household income, mortgage rates, and an unadjusted house price index. When incomes rise, consumer house-buying power increases. When mortgage rates or house prices rise, consumer house-buying power declines.

Read More ›

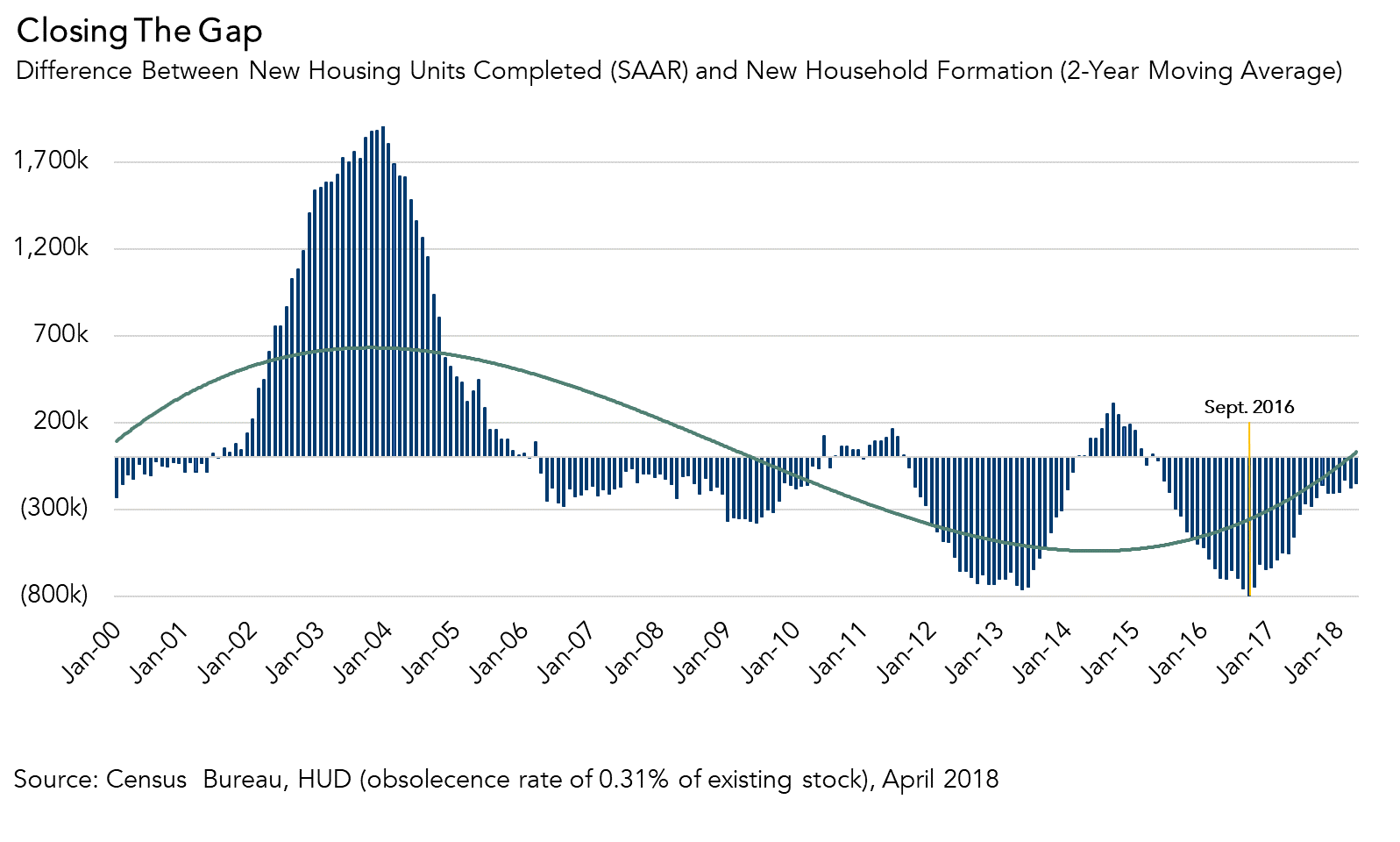

Mind the Gap…Between Household Formation and Home Building

By

Mark Fleming on June 20, 2018

Closing the Housing Stock Gap Today’s Census Bureau report sends an optimistic message about the housing market. Building permits increased 8.0 percent since this time last year, while housing starts rose 20.3 percent. The year-over-year increase in housing starts tells us that an increase in new housing supply is on the way. The pace of housing ...

Read More ›

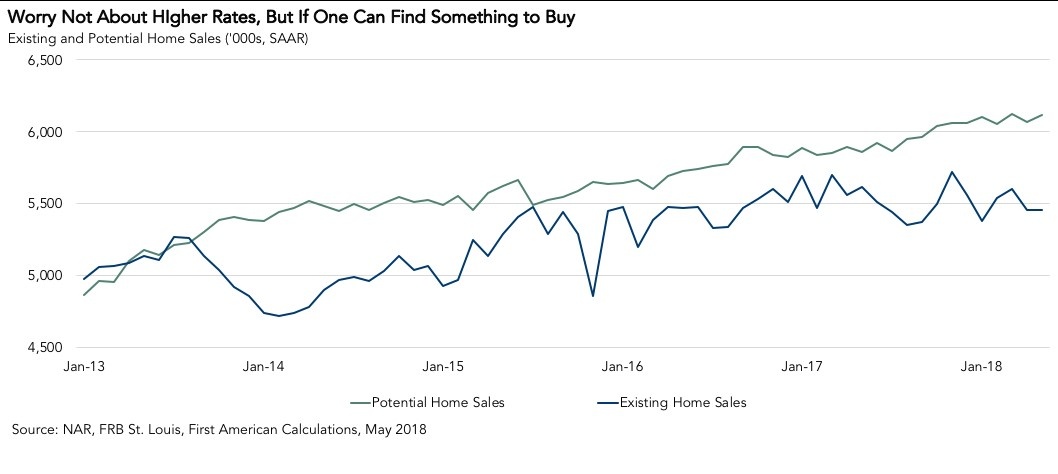

What's the Outlook for Housing Market Potential Amid Rising Mortgage Rates?

By

Mark Fleming on June 18, 2018

With the Federal Reserve Open Market Committee (FOMC) decision to increase the Federal Funds Rate last week, the prospect of higher mortgage rates remains top of mind among real estate professionals and continues to generate headlines. Yet, changes to the short-term rate matter little to the housing market.

Read More ›

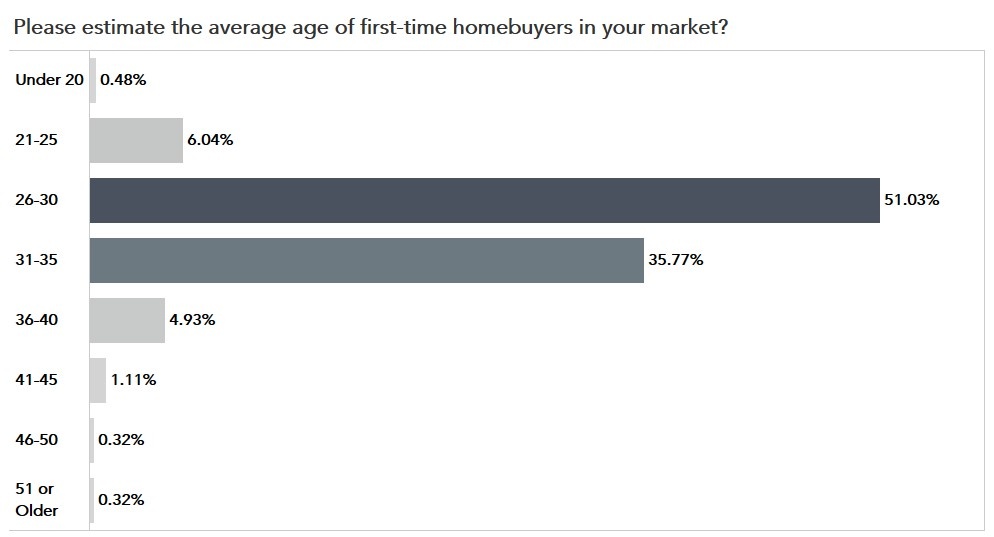

Will First-Time Home Buyer Demand Withstand Rising Rates?

By

Mark Fleming on June 12, 2018

Given the strong likelihood of rising mortgage rates in 2018, many savvy real estate market observers are curious how rising rates may impact demand, especially among millennial first-time home buyers. As part of our quarterly First American Real Estate Sentiment Index (RESI), we recently surveyed title insurance agents and real estate ...

Read More ›

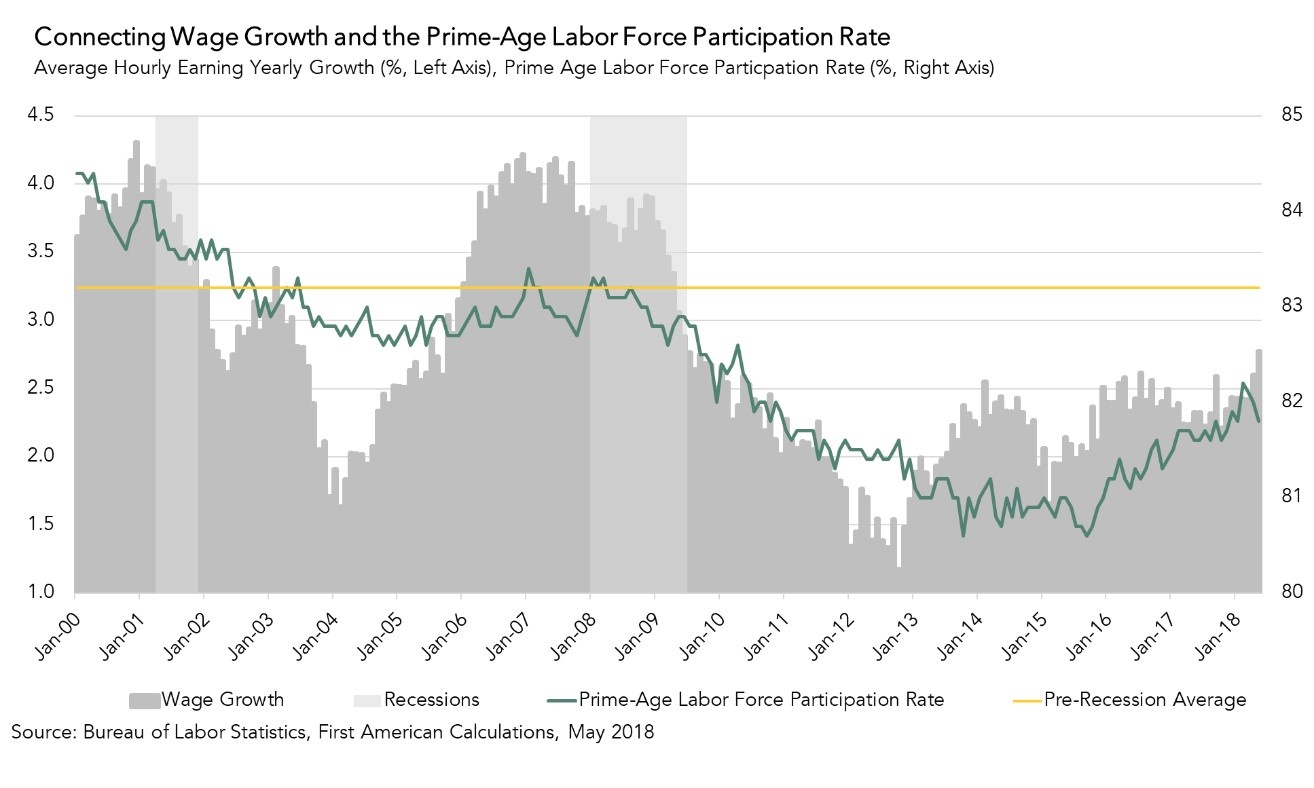

What Does the Prime-Age Labor Force Participation Rate Mean to Your Paycheck?

By

Mark Fleming on June 2, 2018

The Bureau of Labor Statistics’ employment situation report for May signals good news for the housing market, as the unemployment rate hits an 18-year low, and hourly wages continue to increase.

Read More ›

Why the Ability-to-Repay Rules are Like a Steering Wheel Lock

By

Mark Fleming on May 30, 2018

In January of 2013, the mortgage industry witnessed the birth of a new income-underwriting era. The Consumer Finance Protection Bureau (CFPB) published new requirements for mortgage lenders to carefully assess a consumer’s ability to repay their mortgage loan. The new standards were dubbed the “ability-to-repay” rules and were set to take effect ...

Read More ›