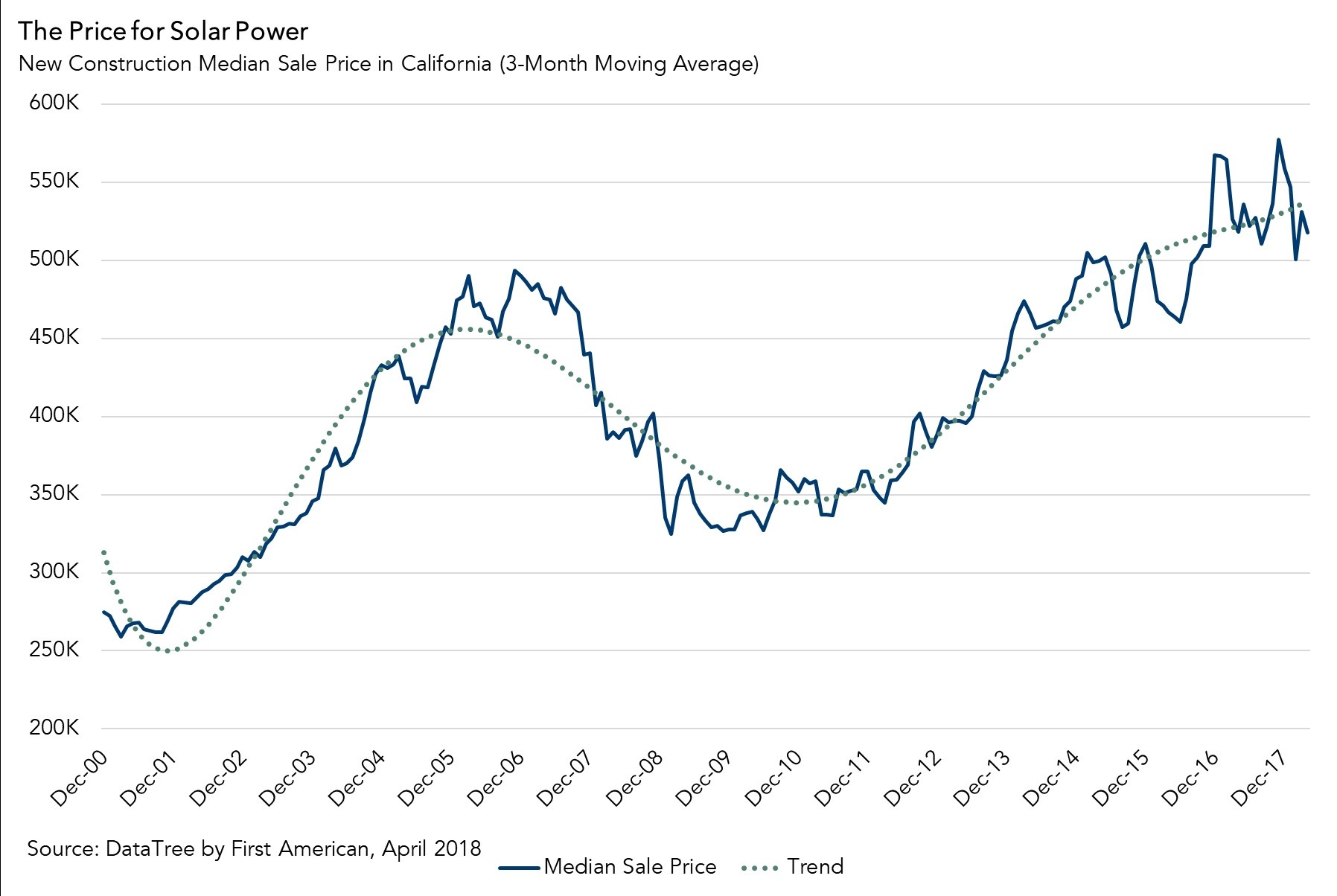

California moved to the center of the new residential construction solar system last week as it became the first state to mandate solar panels on new residential homes. The mandate is part of California’s “Energy Efficiency Strategic Plan,” which includes the goal that both residential and commercial construction be zero net energy by 2030. The jury is split as to whether the benefits of the new requirement will outweigh the costs. On one hand, the mandate will significantly expand mainstream use of solar power. However, it will add thousands of dollars to the cost building a new of home when the shortage of affordable housing is a significant concern in California. Clean energy advocates claim lower energy bills will more than offset the extra cost. We put this notion to the test.

“Buying a new home with solar panels adds some cost up front, but actually pays in the long run.”

According to data from DataTree by First American, the median cost of a newly constructed home in California in April 2018 was $570,250. Assuming a 20 percent down payment and a 30-year, fixed-rate mortgage at 3.92 percent, one’s monthly principal and interest payment should amount to $2,157. The mandate is projected to increase home building costs by an average of $9,500 per home. Adding the costs of the solar panels to the mortgage amount increases the monthly payment by $45 to $2,202. Yet, the solar panels are projected to reduce energy bills by $80 a month. So, our fictional home buyer actually benefits a net $35 per month. Over the course of a 30-year mortgage, the cost benefit analysis of the solar panel mandate produces savings of $12,600.

For those that are concerned about the additional cost, it’s important to note that only one percent of California’s total residences are new construction. So, 99 percent of California’s housing stock is not affected. Therefore, the impact of the solar panel mandate on the overall housing market in California is actually very small. Additionally, the $45 increase to the monthly mortgage payment is only two percent of the total monthly payment. In fact, buying a new home with solar adds some cost up front, but actually pays in the long run.

April 2018 Housing Starts Signal Optimistic Message for the Housing Market

For the month of April 2018, the new residential construction report shows that:

- The number of permits issued, a leading indicator of housing starts, increased by 7.7 percent year over year.

- Housing starts increased by 10.5 percent, compared with a year ago.

- The stock of housing units authorized to be built increased by 14.0 percent, and the number of housing units under construction also increased by 4.7 percent on an annual basis.

- The number of completed homes, which is additional new net supply added to the housing stock, increased by 14.8 percent compared with a year ago.

Chief Economist Analysis Highlights

- The annual increase in permits, housing starts, and completions sends an optimistic message for the housing market as it signals some relief for the housing shortage.

- In April, the overall pace of housing starts, at 1.29 million units, decreased 3.7 percent from the previous month. Based on the less volatile three-month moving average, the volume of total residential (single- and multi-family) housing starts is 14,000 less than March 2018 and 96,000 units higher than a year ago.

- Housing starts are an important source of future supply and, as we have previously discussed in our Real House Price Index (RHPI), the housing market is facing a supply constraint problem.

- The ratio of housing starts to households improved in Q4 2017 – increasing to 0.76. It is moving closer to the historical average of 0.9.

- An estimated seasonally adjusted annualized rate of 1.26 million housing units were completed in April, a 14.8 percent increase from the April 2017 figure of 1.22 million – a modest step toward producing enough housing to meet market demand.

What Insight Does Monthly Housing Start Data Provide?

Housing starts data reports the number of housing units on which construction has been started in the month reported, providing a gauge of future real estate supply levels. The source of monthly housing starts data is the “New Residential Construction Report” issued by the U.S. Census Bureau jointly with the U.S. Department of Housing and Urban Development (HUD). The data is derived from surveys of homebuilders nationwide, and three metrics are provided: building permits, housing starts and housing completions. Building permits are a leading indicator of housing starts and completions, providing insight into the housing market and overall economic activity in upcoming months. Housing starts reflect the commitment of home builders to new construction, as home builders usually don't start building a house unless they are confident it will sell upon completion. Changes in the pace of housing starts tells us a lot about the future supply of homes available in the housing market. In addition, increase in housing starts can lead to increases in construction employment, which benefits the overall economy. Once the home is completed and sold, it generates revenue for the home builder and other related industries, and is added to the housing stock.