Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

How Millennial Home Buying Expectations Unintentionally Reduced Loan Application Defect Risk

By

Mark Fleming on July 31, 2018

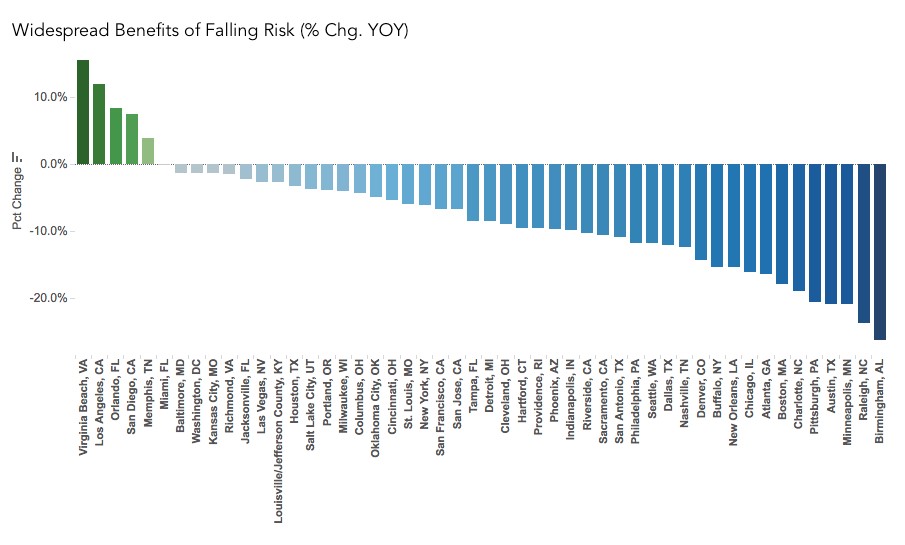

As the mortgage market has continued its transition away from refinances to a predominantly purchase-oriented loan market, the Loan Application Defect Index for purchase transactions has continued to decline, dropping 3.6 percent in the last month and 12.1 percent in the last year. This officially marks a six-month long decline in defect, fraud ...

Read More ›

The Top Five Cities for Consumer House-Buying Power

By

Mark Fleming on July 30, 2018

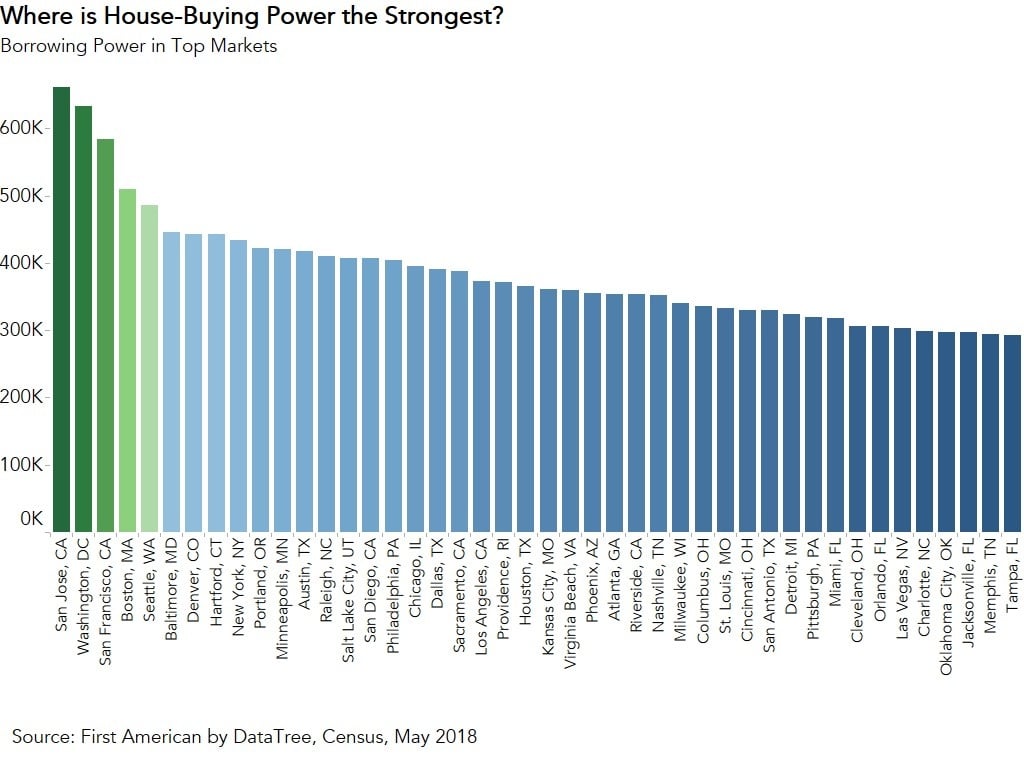

The three key drivers of the Real House Price Index (RHPI) are household income levels, the 30-year, fixed mortgage rate, and the unadjusted house price index. Changes to household income levels and the 30-year, fixed mortgage rate are considered together as consumer house-buying power. When household income rises and/or the mortgage rate falls, ...

Read More ›

Why are Existing Homeowners Rate Locked and Imprisoned?

By

Mark Fleming on July 20, 2018

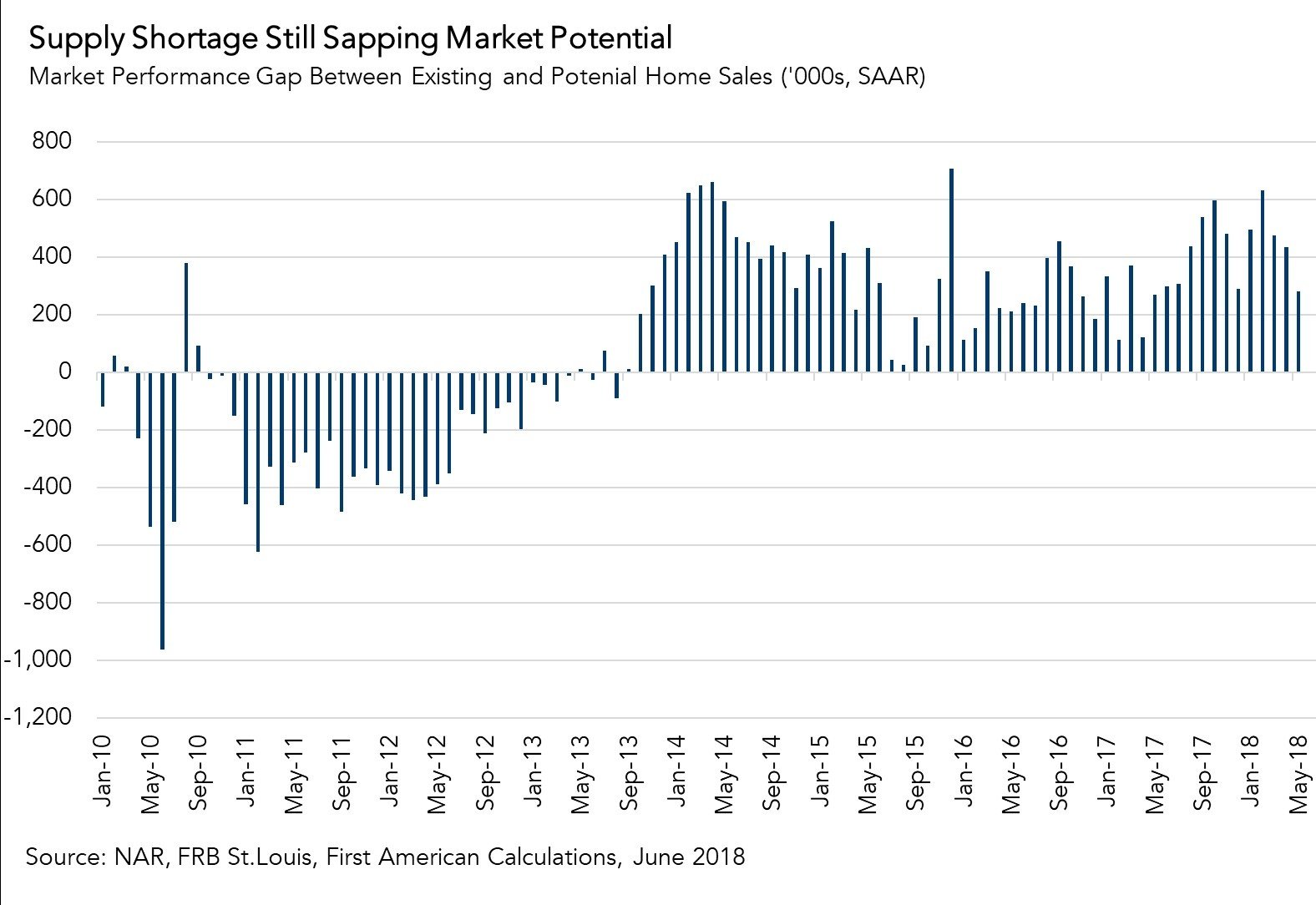

In June, the housing market continued to underperform its potential. Actual existing home sales are 4.2 percent below the market potential for home sales, according to our Potential Home Sales model, which estimates the expected level of existing-home sales based on market fundamentals. The market for existing-home sales is underperforming its ...

Read More ›

Are Home Builders Closing the Gap Between Housing Supply and Demand?

By

Mark Fleming on July 19, 2018

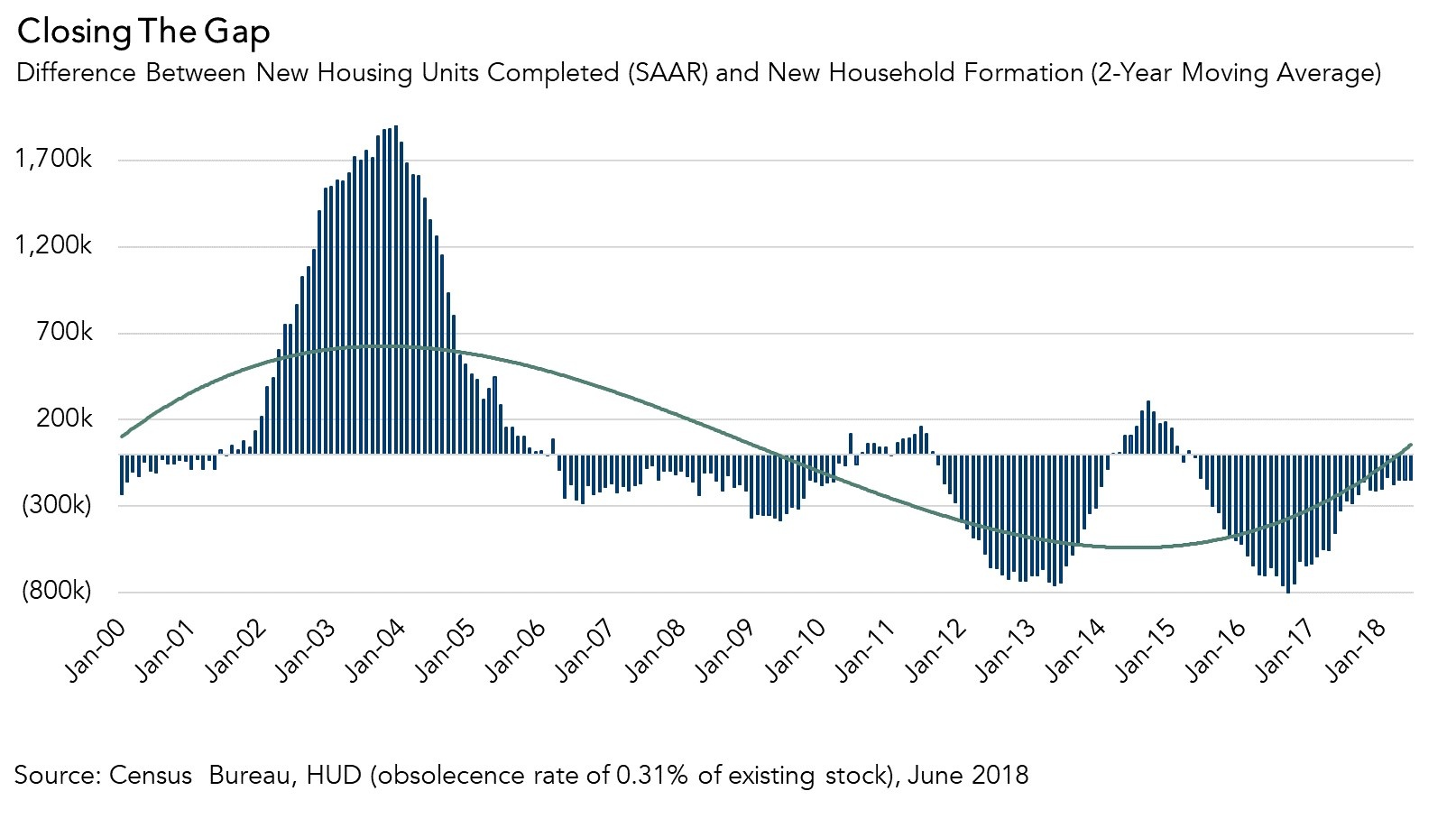

Yesterday’s Census Bureau report on housing construction bodes well for home buyers, as the pace of housing completions increased 2.2 percent over last year. The continued year-over-year growth in completions means more homes on the market in the short-term, offering some immediate relief in alleviating housing supply shortages.

Read More ›

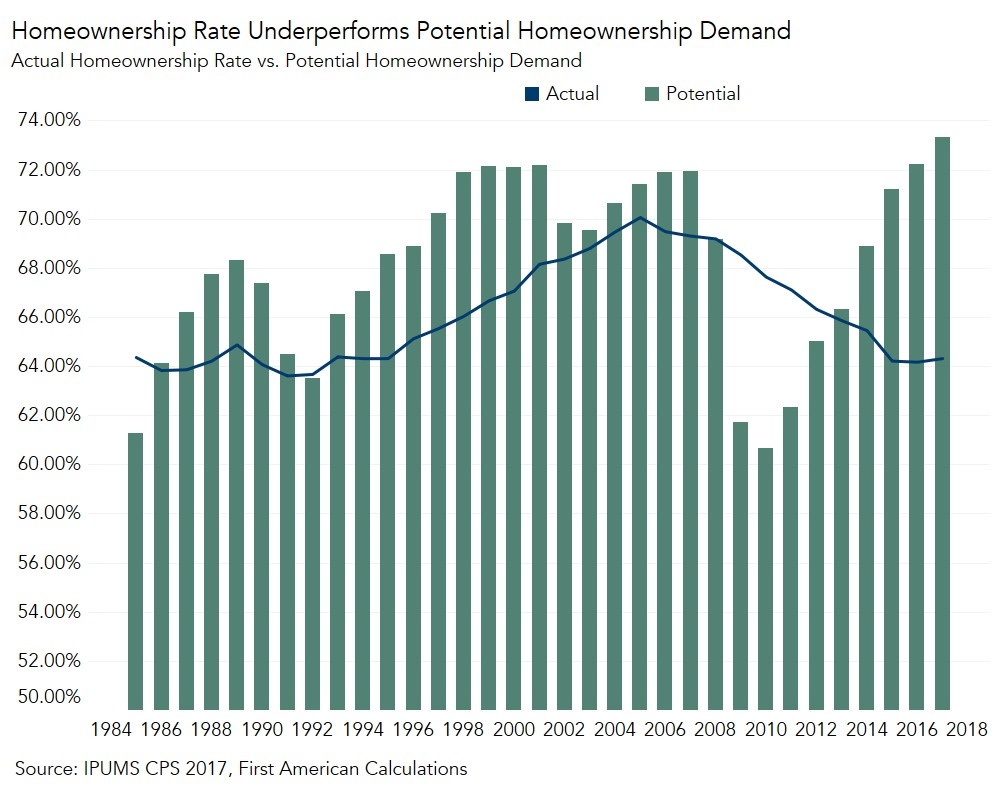

Potential Homeownership Demand Unfazed By Rising Rates

By

Mark Fleming on July 9, 2018

As we reflect on our country’s recent Independence Day commemoration, we find that the desire to achieve the American dream of homeownership still exists. Because, while the U.S. homeownership rate remains close to half-century lows, demand is strong, especially among millennials. In fact, results of our Real Estate Sentiment Index survey of title ...

Read More ›

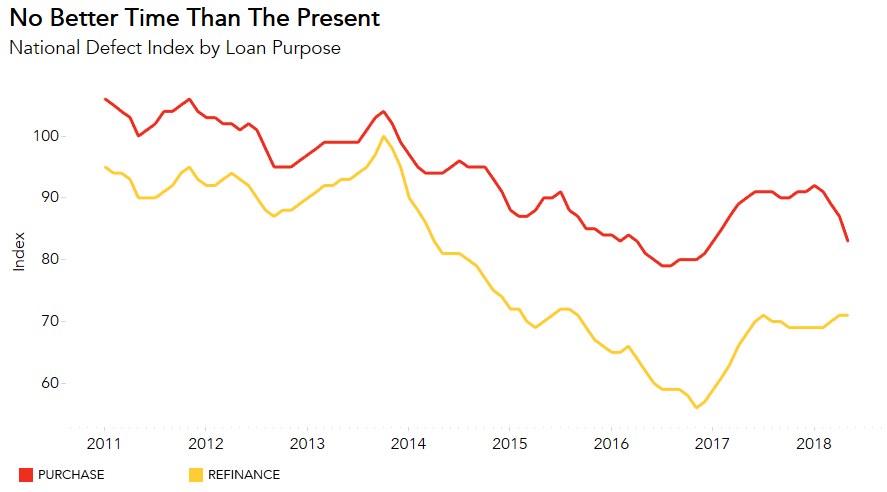

Good Timing: Loan Application Defect and Fraud Risk Drops as Home Purchases Take Higher Share of Mortgage Market

By

Mark Fleming on June 28, 2018

By now, everyone in the mortgage industry is aware that we are entering a market that will be dominated by purchase demand for the next several years. According to the latest Mortgage Bankers Association forecast, refinance transactions will make up 28 percent of total mortgages originated in 2018 and is forecasted to drop to 23 percent by 2020. ...

Read More ›