Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

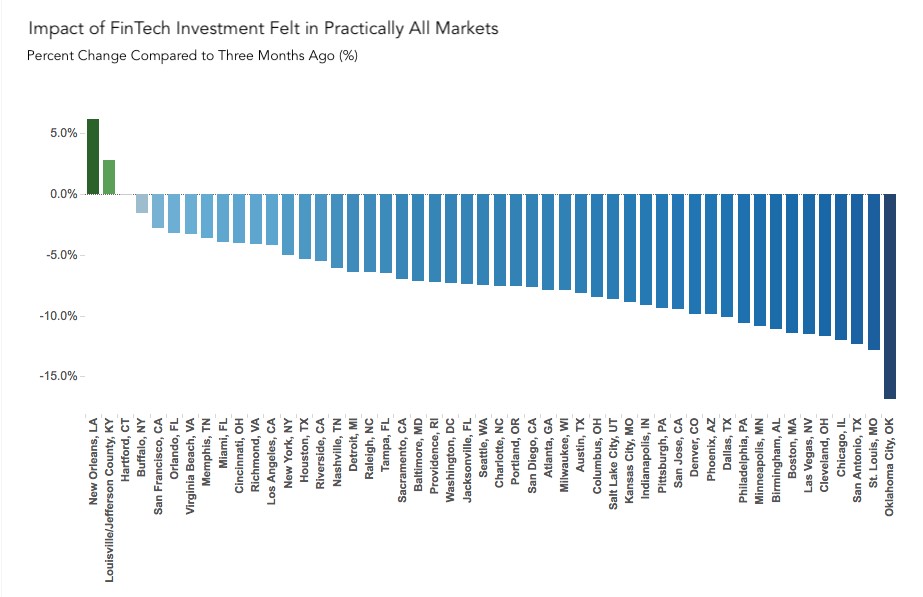

Impact of FinTech Investment Felt in Nearly All Markets

By

Mark Fleming on August 31, 2018

The Loan Application Defect Index for purchase transactions continued its downward trend, declining 1.3 percent in July compared with the month before, the seventh consecutive month defect risk in purchase transactions have fallen. Yet, is declining loan application misrepresentation, defect and fraud risk isolated to a few markets or is the trend ...

Read More ›

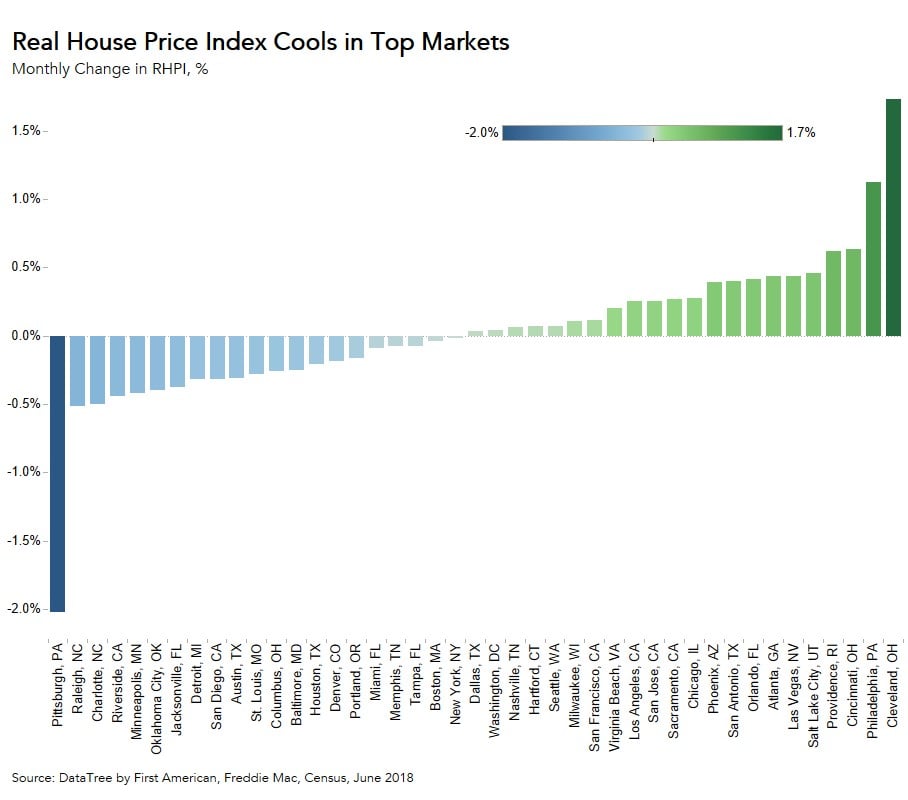

Has House Price Appreciation Reached a Tipping Point?

By

Mark Fleming on August 27, 2018

House price appreciation remains on a tear, as unadjusted home prices nationwide increased by 7.3 percent compared with a year ago and are now 1.3 percent above the housing boom peak in 2006, according to DataTree by First American. The U.S. economy continues to perform well, as the current economic expansion reaches record levels, prompting some ...

Read More ›

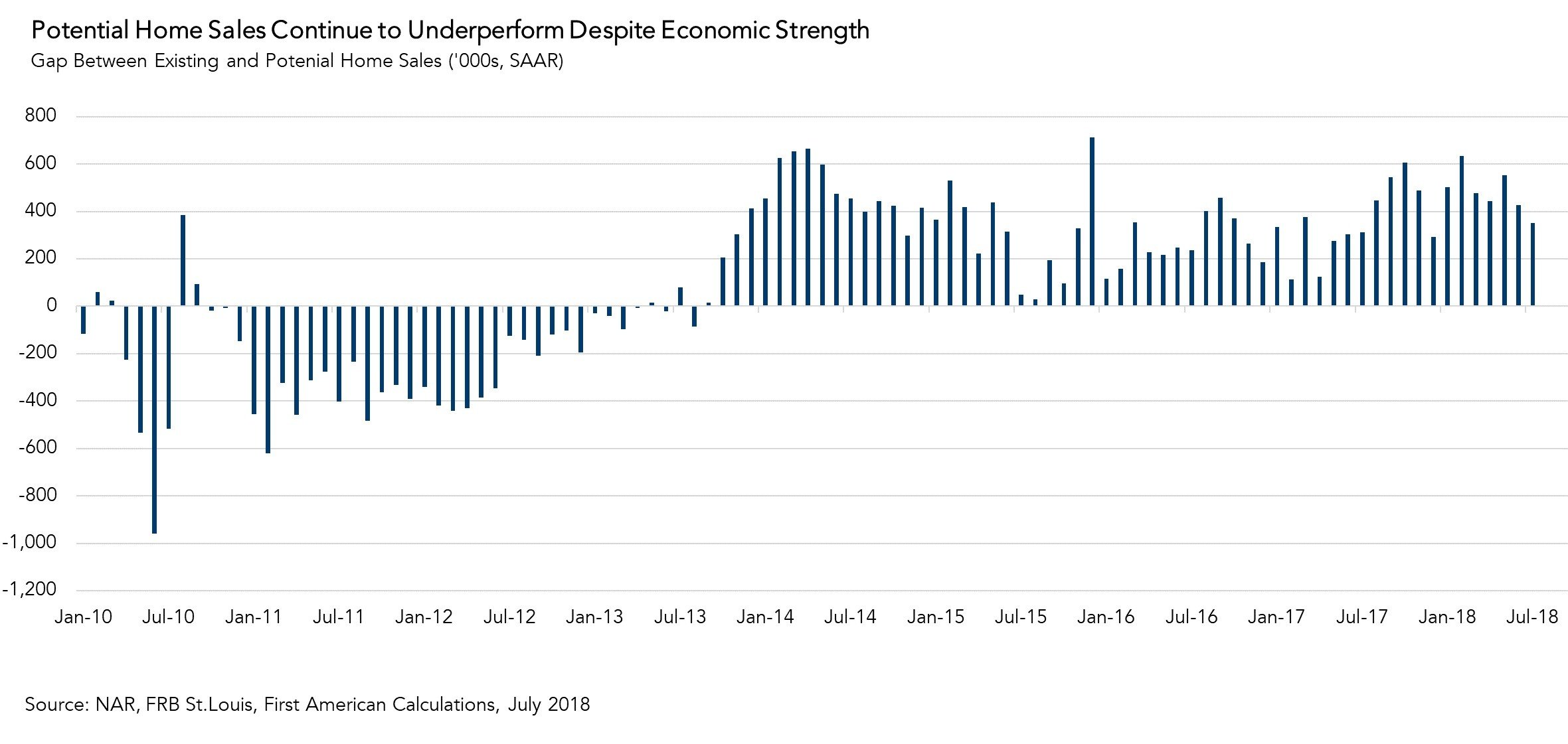

Why Hasn’t Economic Momentum Lifted Home Sales?

By

Mark Fleming on August 21, 2018

The U.S. economy remains on an impressive growth streak. Last month, the Commerce Department reported that the gross domestic product, the broadest measure of goods and services produced in the economy, grew at a 4.1 percent annualized rate in the second quarter, the strongest pace of growth since 2014. The economy has added jobs every month for ...

Read More ›

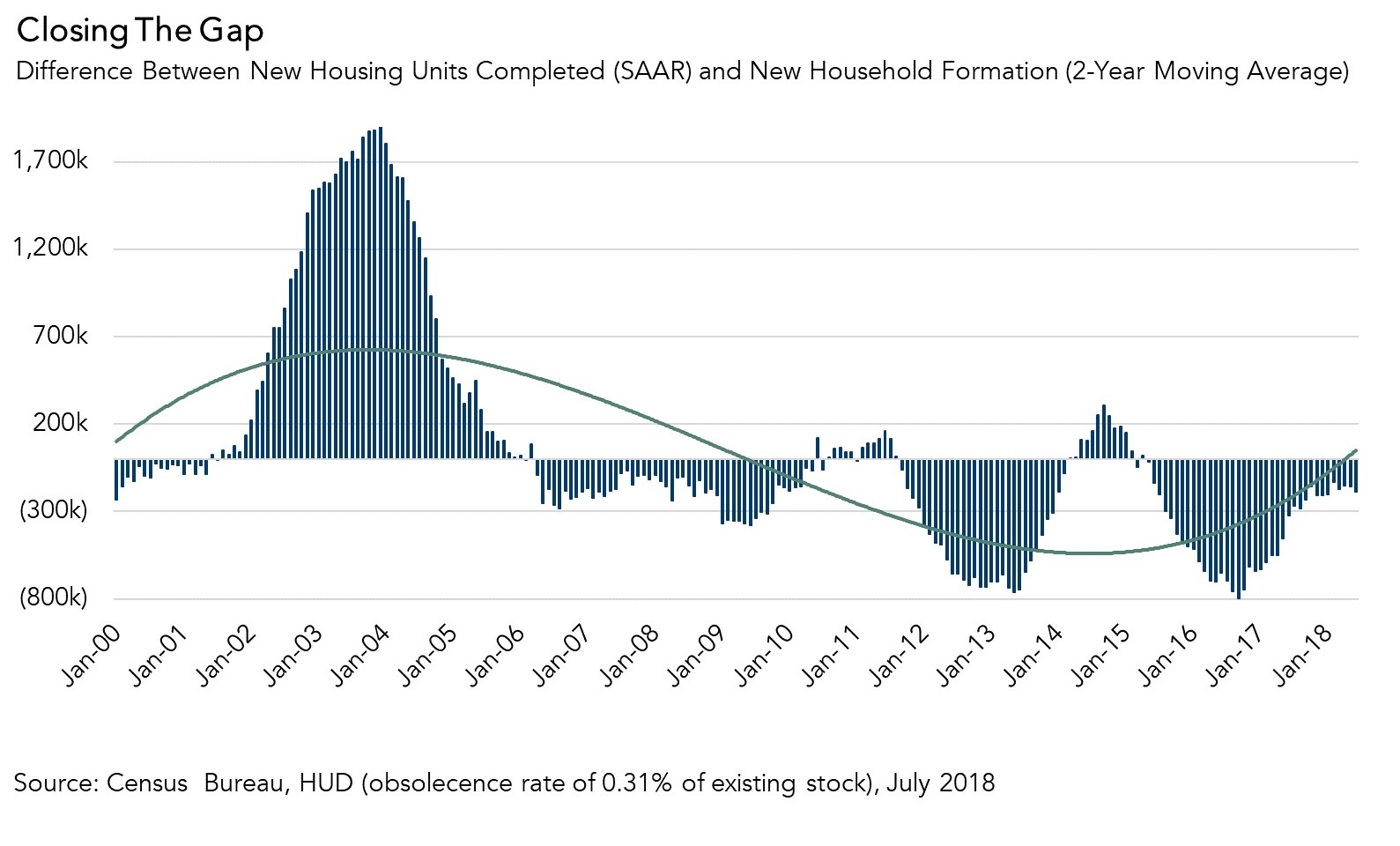

Did July Housing Starts Signal More Housing Supply for Home Buyers?

By

Mark Fleming on August 17, 2018

The short answer is yes. Home buyers looking for more housing supply to choose from can take heart, as Thursday’s Census Bureau report on housing construction showed builders are starting work on additional housing, inching closer to balancing inventory with demand.

Read More ›

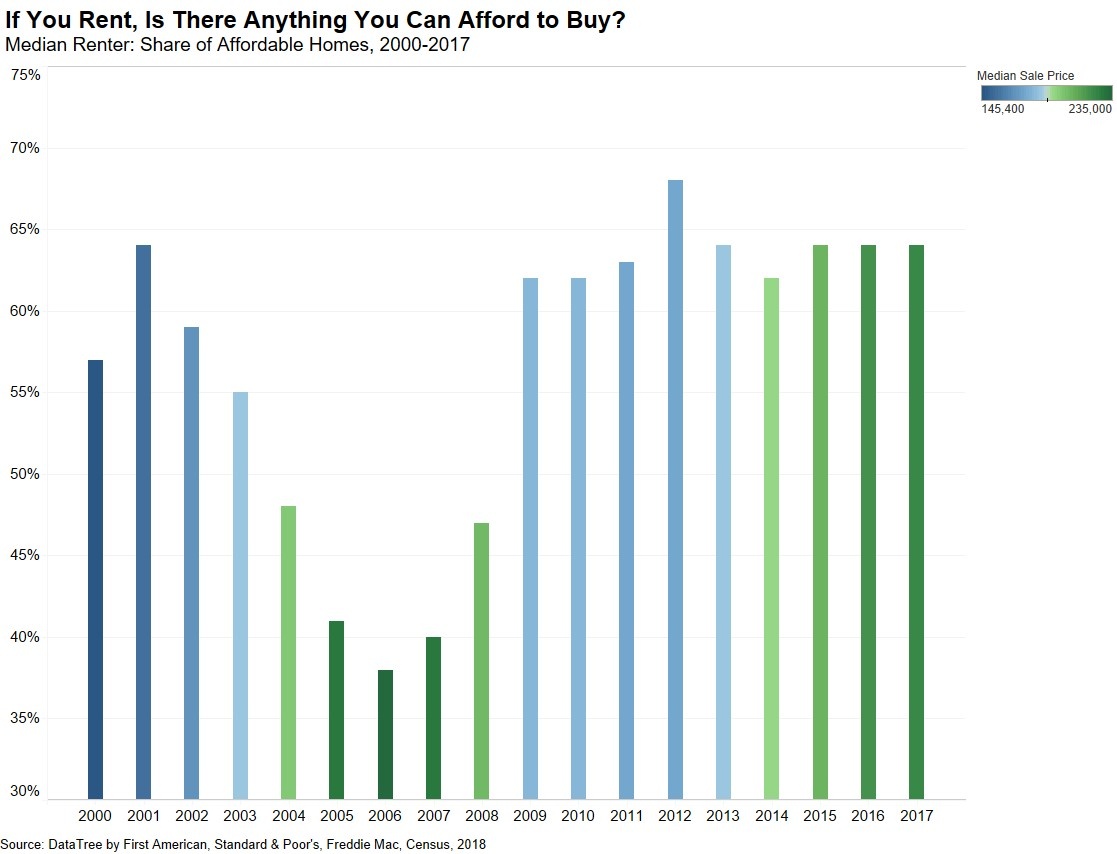

Why Renter House-Buying Power is the Key to Understanding Housing Affordability

By

Mark Fleming on August 6, 2018

With unadjusted house prices recently eclipsing their 2006 housing boom peak, housing affordability is a concern in the industry and for potential home buyers. Existing home owners, by definition, can afford one so, when we are speaking about housing affordability, it is really a conversation about first-time home buyers.

Read More ›

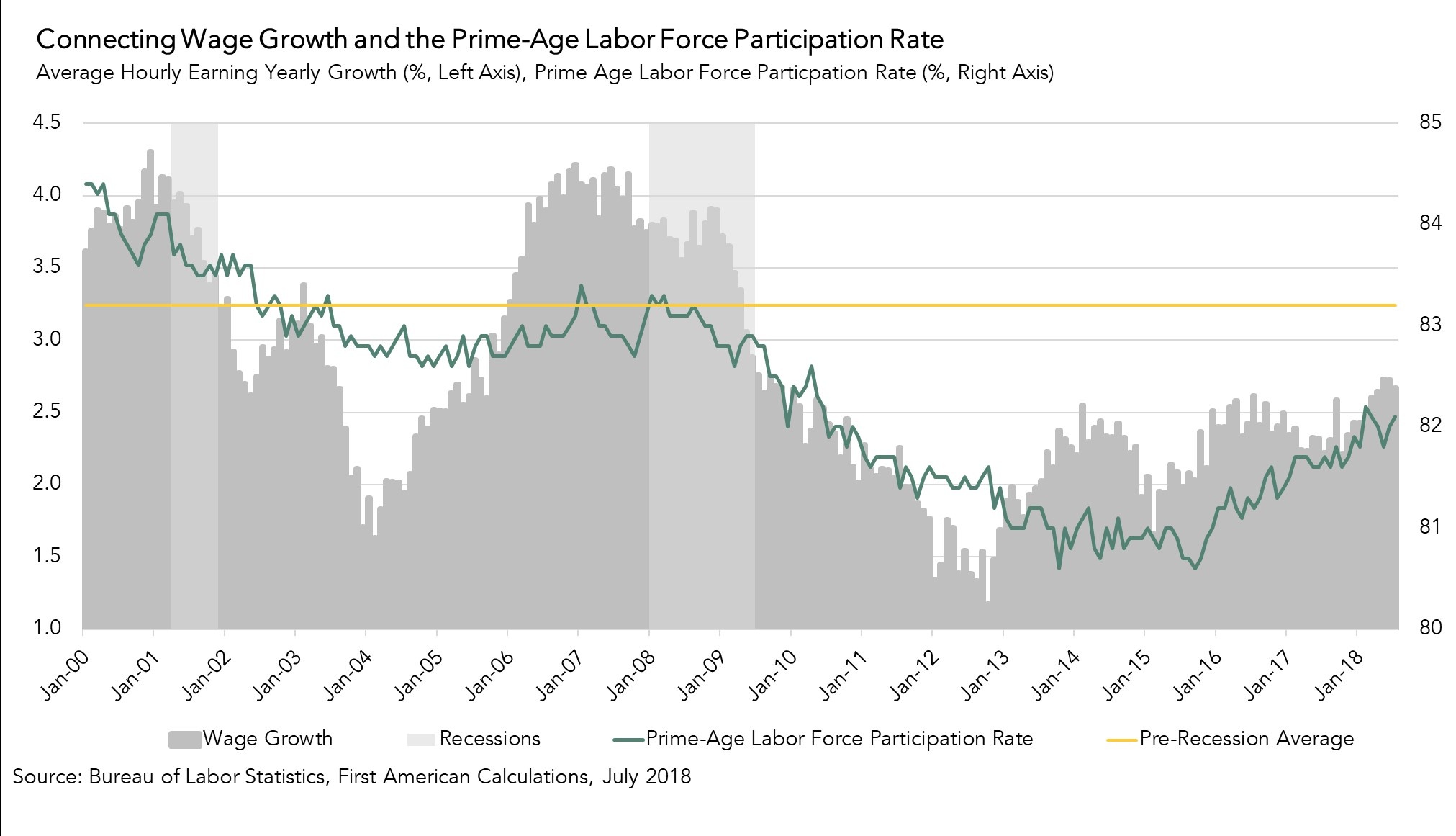

Will Wage Growth Signal Relief for Potential Home Buyers?

By

Mark Fleming on August 3, 2018

Home buyers should feel a bit more confident today after the Bureau of Labor Statistics’ employment situation report for July stated that the unemployment rate edged down to 3.9 percent, and hourly wages continue to increase. House price appreciation has exceeded wage growth for 6 years, so ongoing increases in wage growth could translate into ...

Read More ›