Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

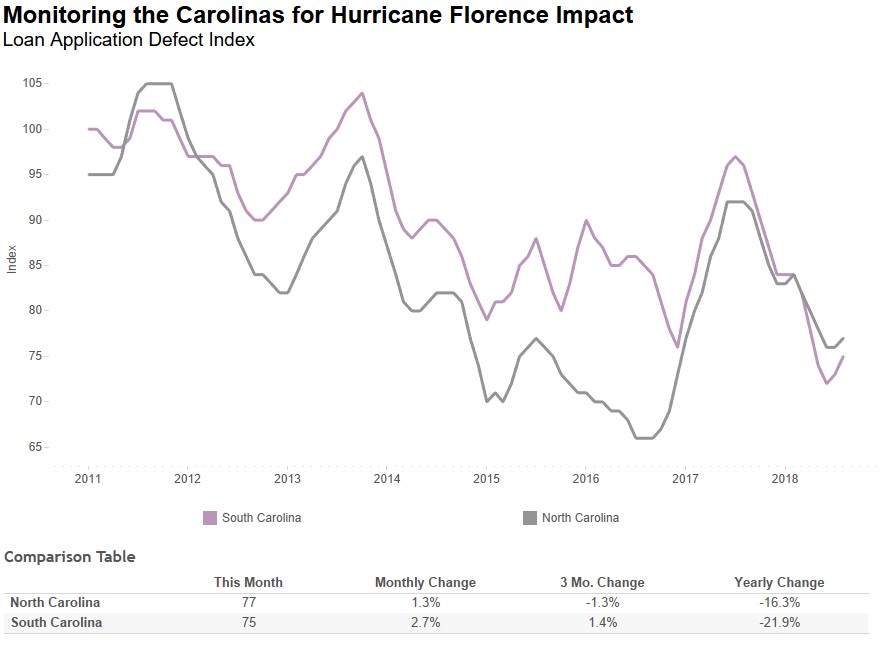

Do Hurricanes Influence Mortgage Fraud Risk?

By

Mark Fleming on September 26, 2018

Following seven straight months of declining defect risk, the Loan Application Defect Index for purchase transactions remained the same in August compared with the month before. Year over year, the Defect Index for purchase transactions decreased 13.2 percent as compared to August 2017. The Defect Index for refinance transactions is the same as ...

Read More ›

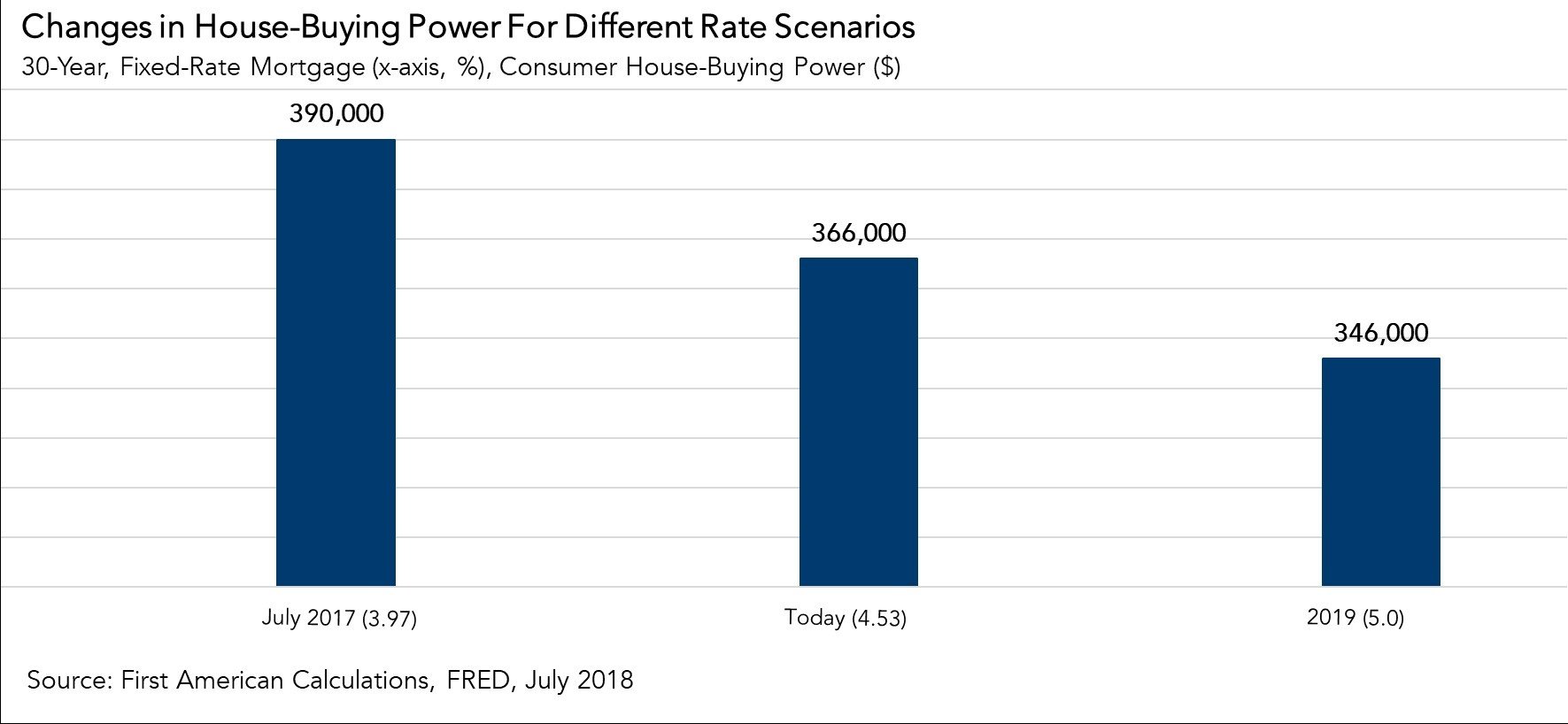

How Will Rising Mortgage Rates Impact Housing Affordability in 2019?

By

Mark Fleming on September 24, 2018

The Federal Open Market Committee (FOMC) meeting is just around the corner and a rate hike is almost certain, according to experts, which will trigger conversations about rising mortgage rates across the housing industry. While changes to the federal funds rate won’t necessarily spur further increases in mortgage rates, mortgage rates are expected ...

Read More ›

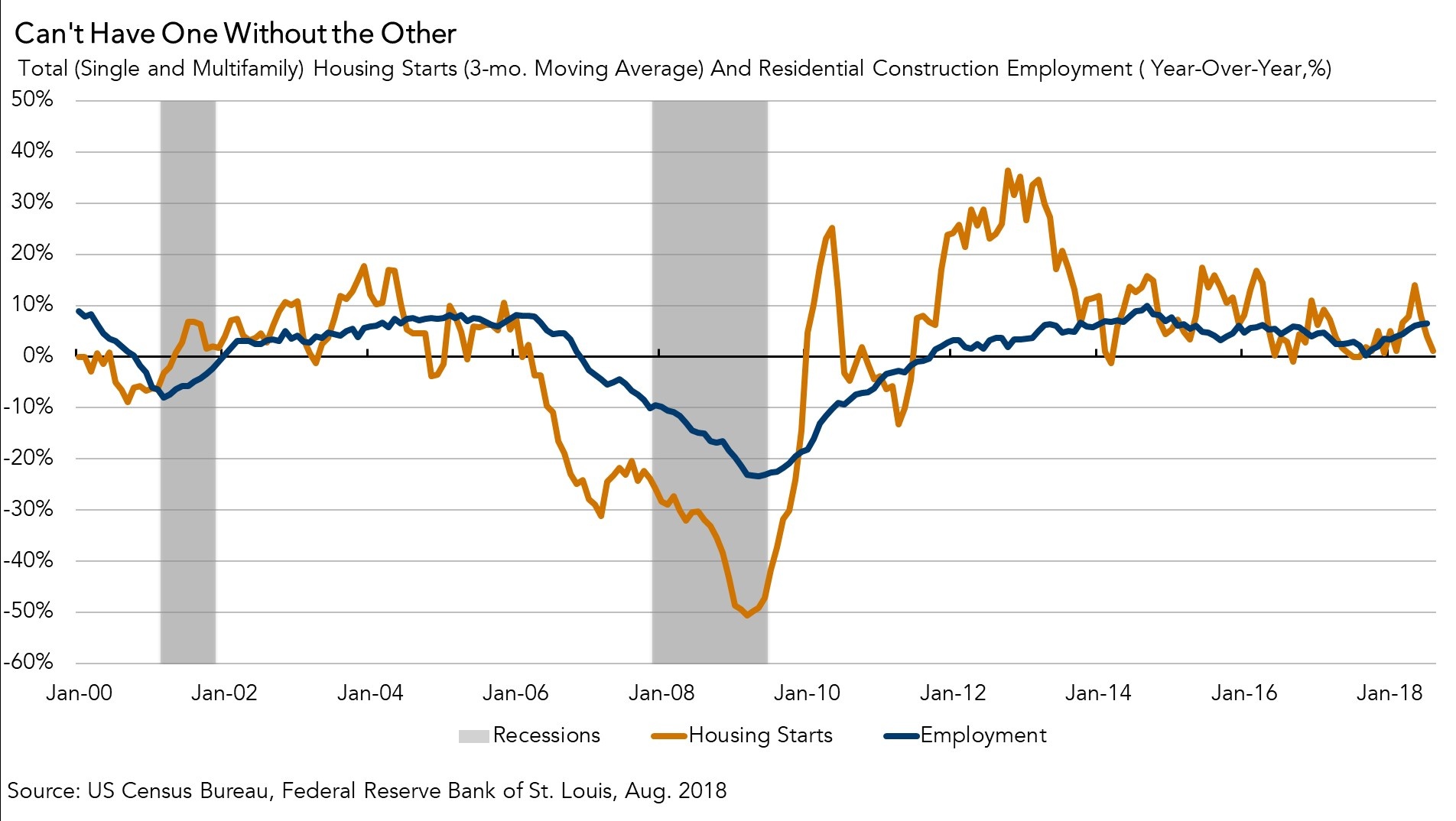

How Hurricane Florence May Impact the Housing Market

By

Mark Fleming on September 20, 2018

Yesterday’s Census Bureau report for August is an indication of strength for the housing market. While the number of permits issued, which can signal how much construction is in the pipeline, decreased by 5.5 percent, home building rose in August as housing starts increased 9.4 percent compared with a year ago. The growth in housing starts is ...

Read More ›

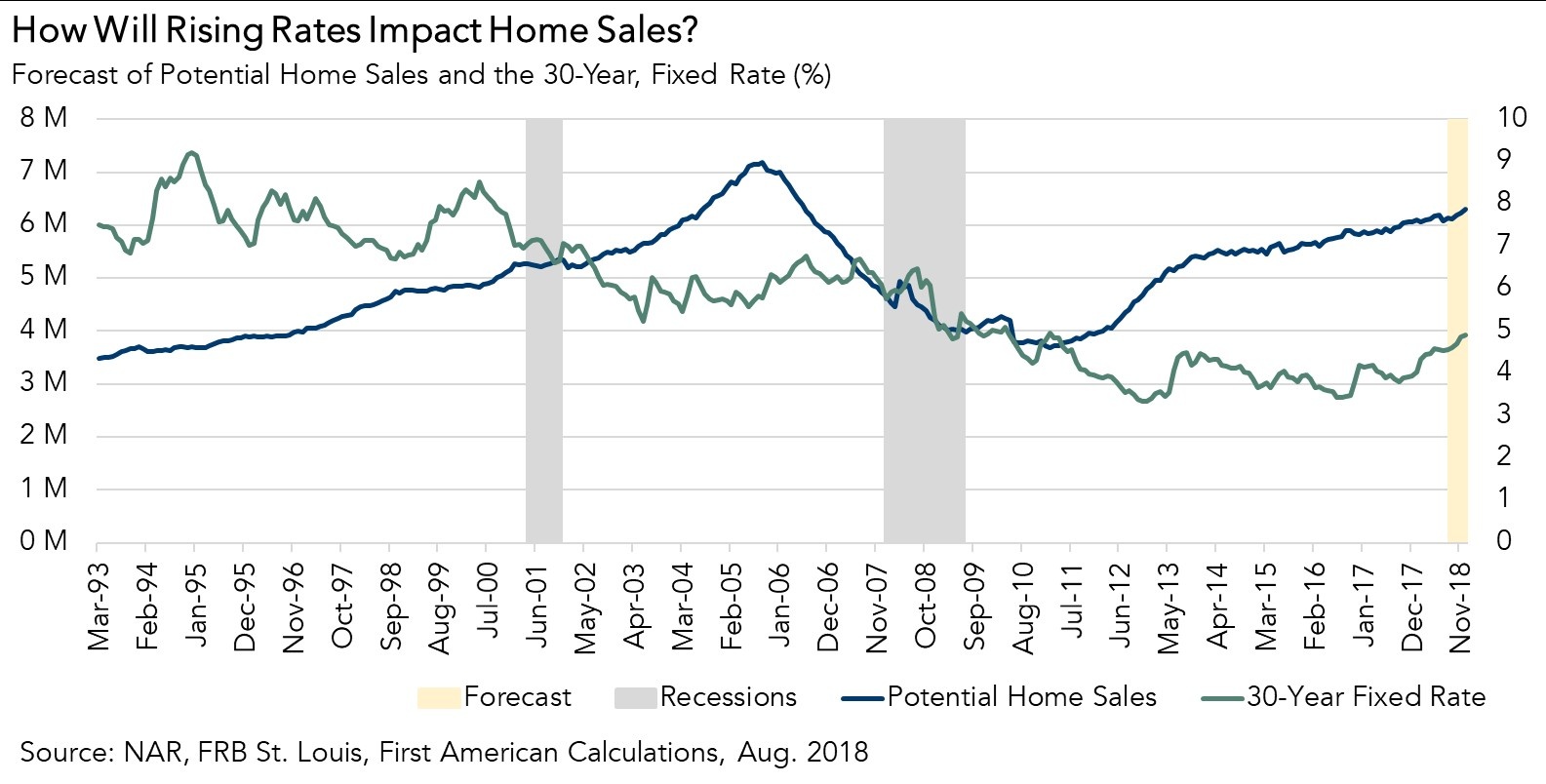

How Will a Potential September Rate Hike Impact Existing-Home Sales?

By

Mark Fleming on September 18, 2018

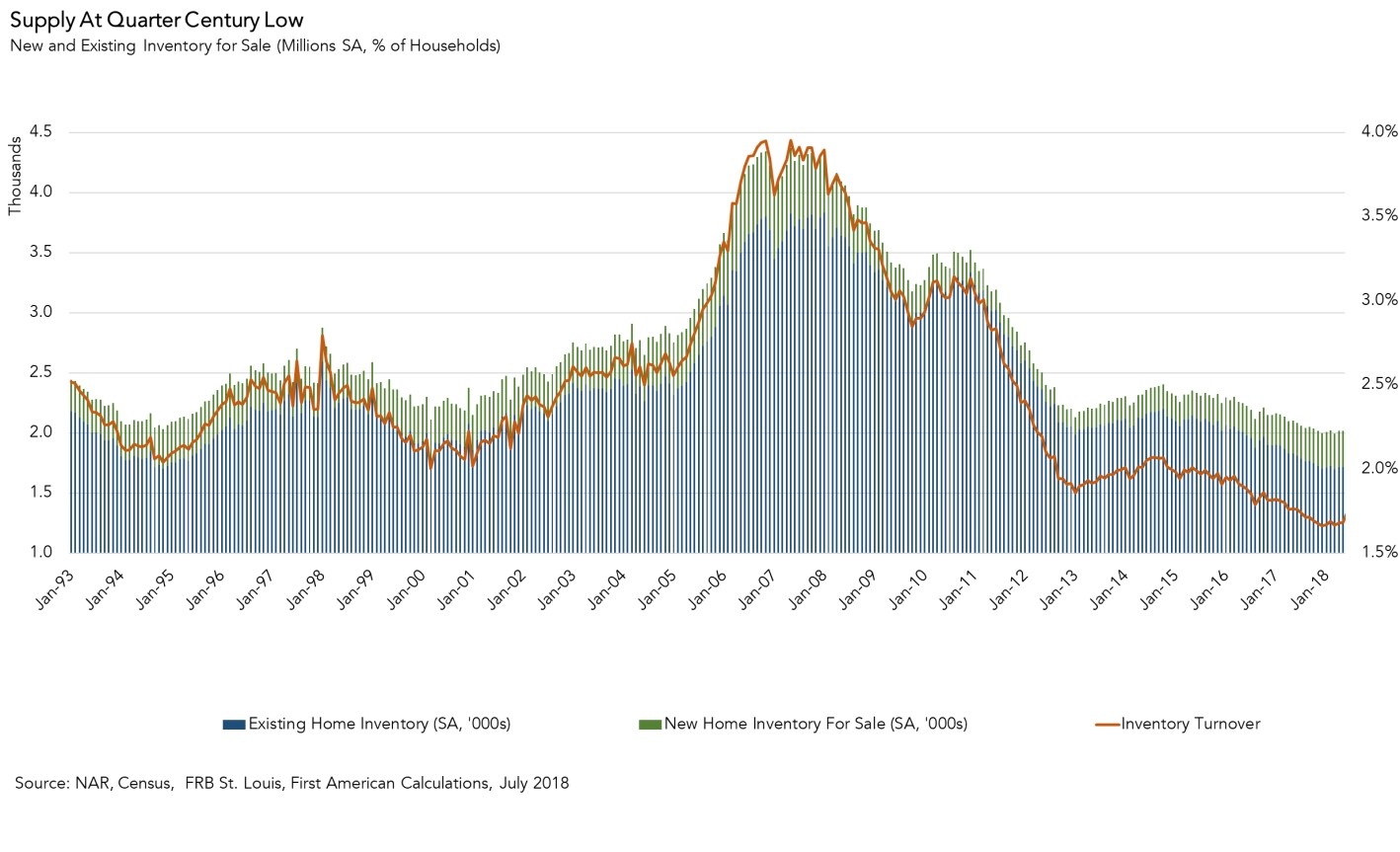

In August, the housing market continued to underperform its potential. Actual existing-home sales are 6.5 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support more than 400,000 more home sales at a seasonally adjusted annualized rate (SAAR). Severe supply shortages ...

Read More ›

Does Rising Housing Inventory Signal the Beginning of a Buyer’s Market?

By

Mark Fleming on September 17, 2018

Last month, we noted in our latest Real House Price Index (RHPI) report that house price appreciation may be slowing. According to our RHPI, 21 cities experienced a monthly decline in their real, consumer house-buying power-adjusted price level. One reason for the price appreciation slowdown is that 21 of the 50 largest cities in the U.S. ...

Read More ›

Interest Rates Mortgages Real House Price Index Affordability Housing supply

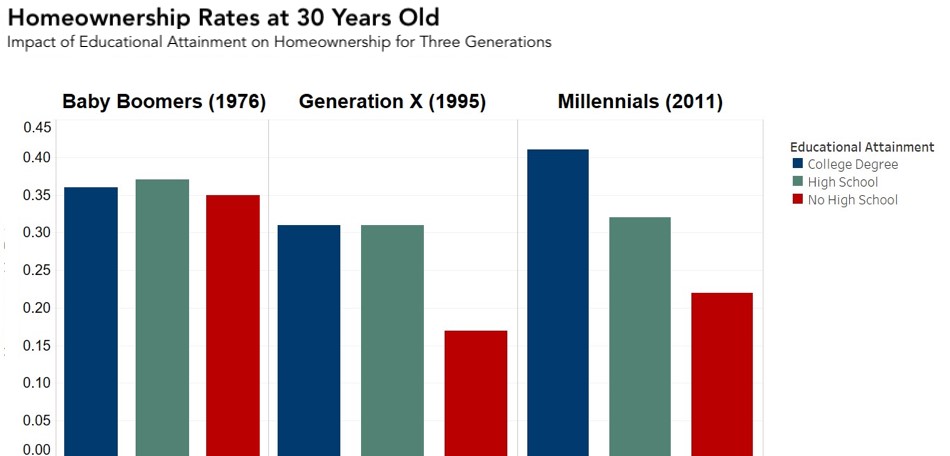

Why Education is the Best Investment for Homeownership

By

Mark Fleming on September 7, 2018

Whether students are beginning middle school or their last year of college, back-to-school season is here. Although many students may grimace when they hear “back to school,” they won’t regret pursuing a higher education as adults as they compete for well-paying jobs and one day, hopefully, buy a home.

Read More ›