Closing the Housing Stock Gap

Today’s Census Bureau report sends an optimistic message about the housing market. Building permits increased 8.0 percent since this time last year, while housing starts rose 20.3 percent. The year-over-year increase in housing starts tells us that an increase in new housing supply is on the way. The pace of housing completions, at a 1.29 million seasonally adjusted annualized rate (SAAR), is particularly important as it brings new supply that can offset current housing shortages.

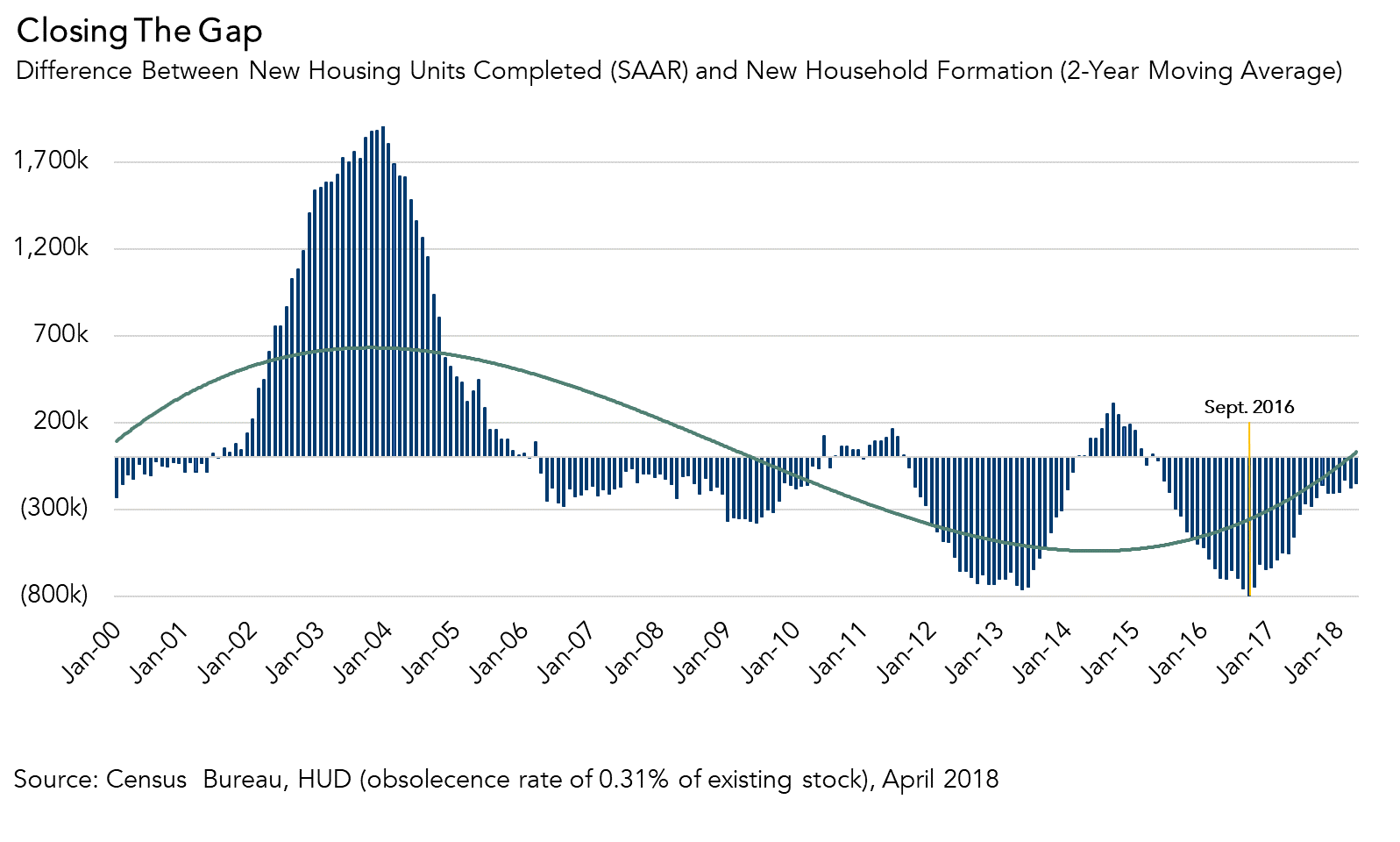

Housing demand has significantly outstripped supply since 2007, but that gap seems to be closing. We estimate that nearly a million households were created from April 2017 to April 2018, adding to the demand for housing. Helping meet that demand were the 873,000 new housing units completed – the net number of units completed when accounting for single-family dwellings, apartments, manufactured homes and obsolescence. This leaves a shortage of just over 150,000 units today, representing an almost three-year low in the gap between housing supply and demand.

Looking back, the United States entered the economic crisis with a surplus of housing. That surplus reached its peak of nearly two million units in 2004, which put downward pressure on prices. Due to the large surplus, building slowed substantially and inventory began naturally lessening. Once inventory was substantially reduced, however, building did not increase in time to meet new demand and the pendulum swung the other way. By September 2016 the nation had a housing deficit of nearly 800,000 units – the widest gap between housing completions and household formation in the past 18 years. In that context, the current shortage of 150,000 units represents a major improvement in closing the housing stock gap and meeting the growing demand for shelter.

New supply added to the housing stock continued to impress in May with a 10.4 percent year-over-year increase in completions. As builders start work on additional housing, we will inch closer to balancing inventory with demand. But with millennials entering household formation age and baby boomers living longer and more independently than ever, builders will remain under pressure to keep up with the growing demand.

May 2018 Housing Starts

For the month of May 2018, the new residential construction report shows that:

- The number of building permits issued, a leading indicator of housing starts, increased by 8.0 percent year over year.

- Housing starts increased by 20.3 percent, compared with a year ago.

- The stock of housing units authorized to be built increased by 8.2 percent, and the number of housing units under construction increased by 5.3 percent on an annual basis.

- The number of completed homes, which is additional new net supply added to the housing stock, increased by 10.4 percent compared with a year ago.

Chief Economist Analysis Highlights

- The annual increase in permits, housing starts, and completions signals relief from the housing shortage and sends an optimistic message about the housing market.

- In May, the overall pace of housing starts, at 1.35 million units, is a 5.0 percent increase from the previous month. Based on the less volatile three-month moving average, the volume of total residential (single- and multi-family) housing starts is 18,000 more than April 2018, and 167,000 units higher than a year ago.

- Housing starts are an important source of future supply as the housing market continues to face a supply constraint problem. (The supply constraint was discussed in our Real House Price Index (RHPI)).

- An estimated seasonally adjusted annualized rate of 1.29 million housing units were completed in May, representing a 10.4 percent increase from the May 2017 figure of 1.16 million – a modest, yet important, step toward producing enough housing to meet market demand.

What Insight Does Monthly Housing Start Data Provide?

Housing starts data reports the number of housing units on which construction has been started in the month reported, providing a gauge of future real estate supply levels. The source of monthly housing starts data is the “New Residential Construction Report” issued by the U.S. Census Bureau jointly with the U.S. Department of Housing and Urban Development (HUD). The data is derived from surveys of homebuilders nationwide, and three metrics are provided: building permits, housing starts and housing completions. Building permits are a leading indicator of housing starts and completions, providing insight into the housing market and overall economic activity in upcoming months. Housing starts reflect the commitment of home builders to new construction, as home builders usually don't start building a house unless they are confident it will sell upon completion. Changes in the pace of housing starts tells us a lot about the future supply of homes available in the housing market. In addition, an increase in housing starts can lead to increases in construction employment, which benefits the overall economy. Once the home is completed and sold, it generates revenue for the home builder and other related industries, and is added to the housing stock.