Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Will Rising Mortgage Rates Slow Sales?

By

Mark Fleming on December 22, 2021

In November 2021, housing market potential decreased modestly month-over-month to a 6.26 million seasonally adjusted annualized rate (SAAR), according to our Potential Home Sales (PHS) model. Housing market potential in November increased 7.2 percent compared with one year ago and remains significantly higher than the pre-pandemic level. Demand ...

Read More ›

Why House Prices Still Have Room to Run

By

Mark Fleming on November 30, 2021

According to the Real House Price Index (RHPI), which measures housing affordability in the context of changes in consumer house-buying power, affordability in September declined to its lowest level since 2008. Two of the three components of consumer house-buying power swung toward declining affordability. Record nominal house price growth and ...

Read More ›

Why Housing Market Potential Keeps Rising

By

Mark Fleming on November 22, 2021

In September 2021, existing-home sales increased to a 6.29 million seasonally adjusted annualized rate (SAAR). Prior to the pandemic, the housing market had not reached this sales pace since 2006. We may see another strong month in October, as housing market potential increased 10.3 percent compared with one year ago to 6.27 million (SAAR), ...

Read More ›

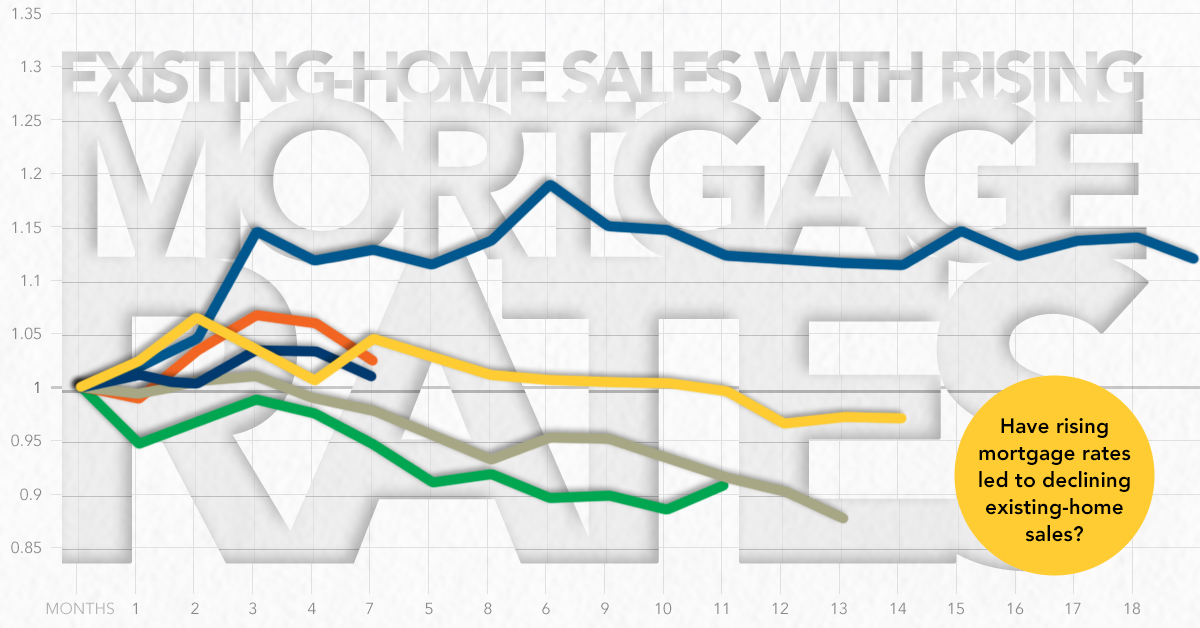

How will the Housing Market Fare as Rates Rise?

By

Mark Fleming on November 12, 2021

In the month of October, the average 30-year, fixed mortgage rate increased to its highest level since March of this year – 3.07 percent. For context, the historical average of the 30-year, fixed mortgage rate dating back half a century is 7.8 percent. In the history of recorded data on the 30-year fixed mortgage rate, it has never been as low as ...

Read More ›

How Will Rising Mortgage Rates Impact House-Buying Power?

By

Mark Fleming on October 26, 2021

In August, year-over-year nominal house price appreciation reached 20.7 percent, the third consecutive month it has set a new record. According to our Real House Price Index (RHPI), which measures housing affordability in the context of changes in consumer house-buying power, incorporating changes in household income, mortgage rates and nominal ...

Read More ›

Do Rising House Prices Help or Hurt the Housing Market?

By

Mark Fleming on October 15, 2021

Housing market potential strengthened modestly in September, increasing a 0.4 percent compared with August, according to our Potential Home Sales Model. The slight increase means that on a year-over-year basis, housing market potential is now nearly 9 percent higher than in September 2020, when the housing market’s summer rebound was accelerating, ...

Read More ›