Key Points: Assumable debt accompanies a property at sale and can be one way to complete a transaction when other forms of credit are scarce or costly. Assumable is typically more attractive when outstanding interest rates on mortgages are lower than prevailing rates for new loans. Though assumable debt use is currently lower than in the years ...

Read More ›Assumable Debt Poised to Boost Nascent CRE Recovery

CRE X-Factor: The Commercial Real Estate Refinancing Market is Stabilizing

Key Points: CRE refinance volume has declined from a post-pandemic peak but, despite higher interest rates, is stabilizing. Dollar volume of hotel refinancings is a bright spot but being driven by larger loan sizes rather than more refinance transactions, and growing hotel refinance sizes are being driven primarily by larger CMBS. Though CMBS ...

Read More ›The Commercial Real Estate Metric Signaling Confidence is Returning to the Market

It’s been a challenging two and a half years for the commercial real estate (CRE) industry, but data points are gradually emerging that indicate we may be at or past a trough in market activity, at least for some asset classes. The Mortgage Bankers Association’s (MBA) second quarter release of CRE lending activity showed that commercial loan ...

Read More ›Have Multifamily Cap Rates Peaked?

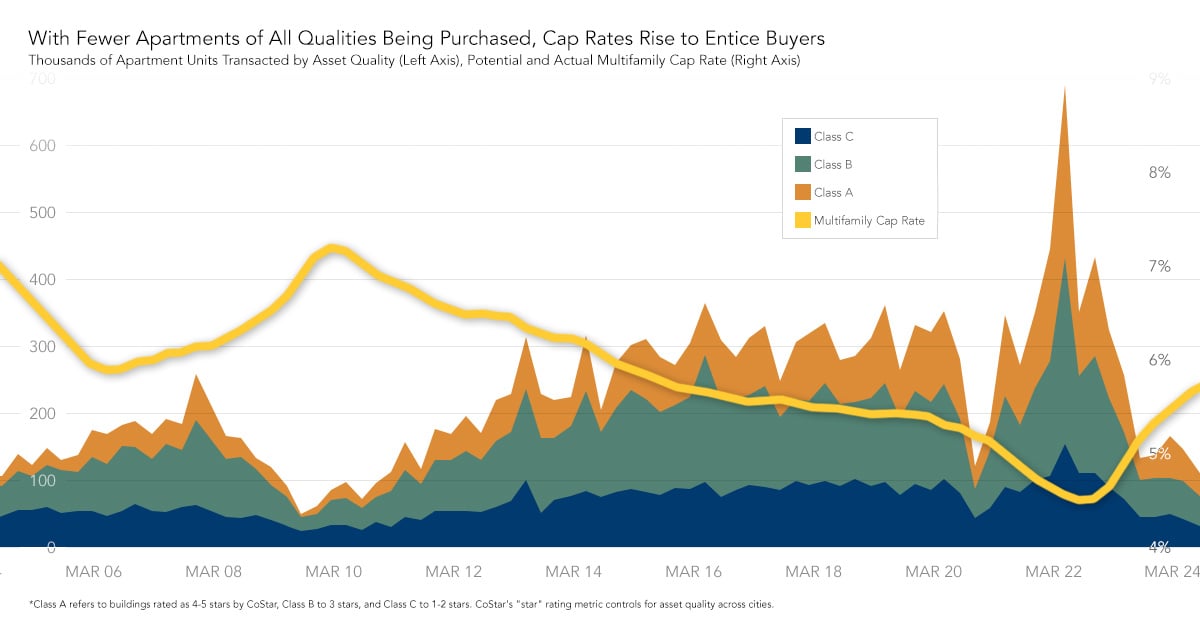

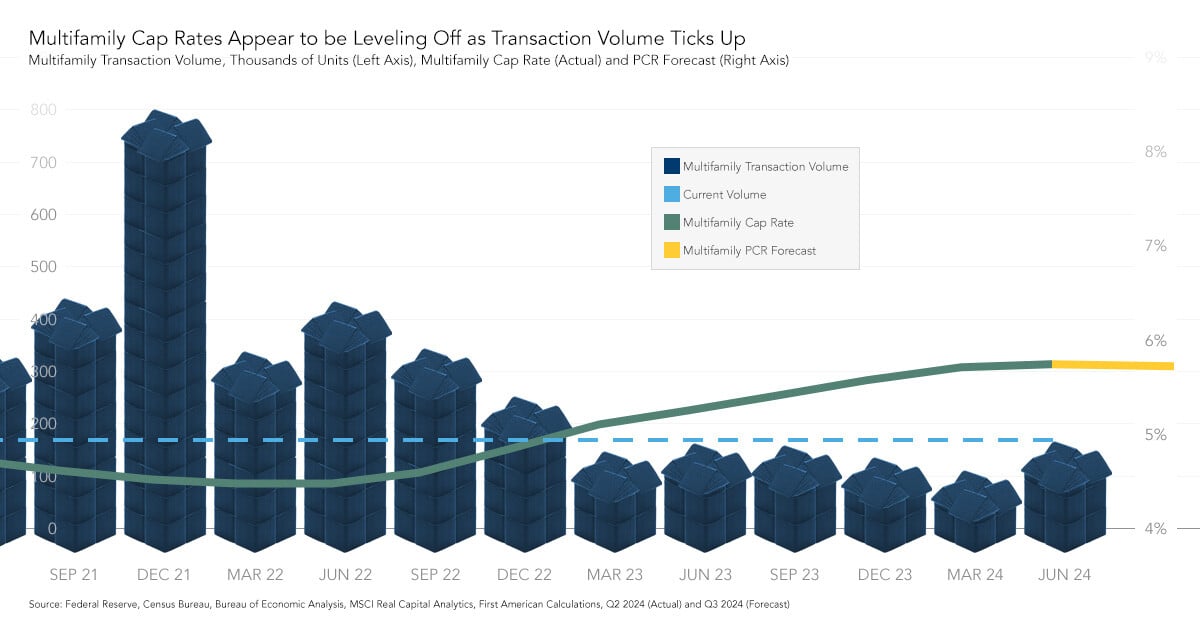

The last three and a half years have been a whipsaw of a ride for the multifamily market. Following the surge in leasing demand during the pandemic, demand to own apartment buildings boomed, which drove transaction volume to record highs. Shortly thereafter, the Federal Reserve began raising interest rates to combat inflation that turned out not ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

CRE X-Factor - Why Retail Real Estate Has Overcome the “Death of the Mall”

Retail properties have been a relative bright spot in a commercial real estate (CRE) market that’s otherwise been disrupted by higher interest rates. Though there are lots of different types of retail properties, they all share one thing in common: their success is driven in part by strong consumer retail spending. But, beyond the strength of the ...

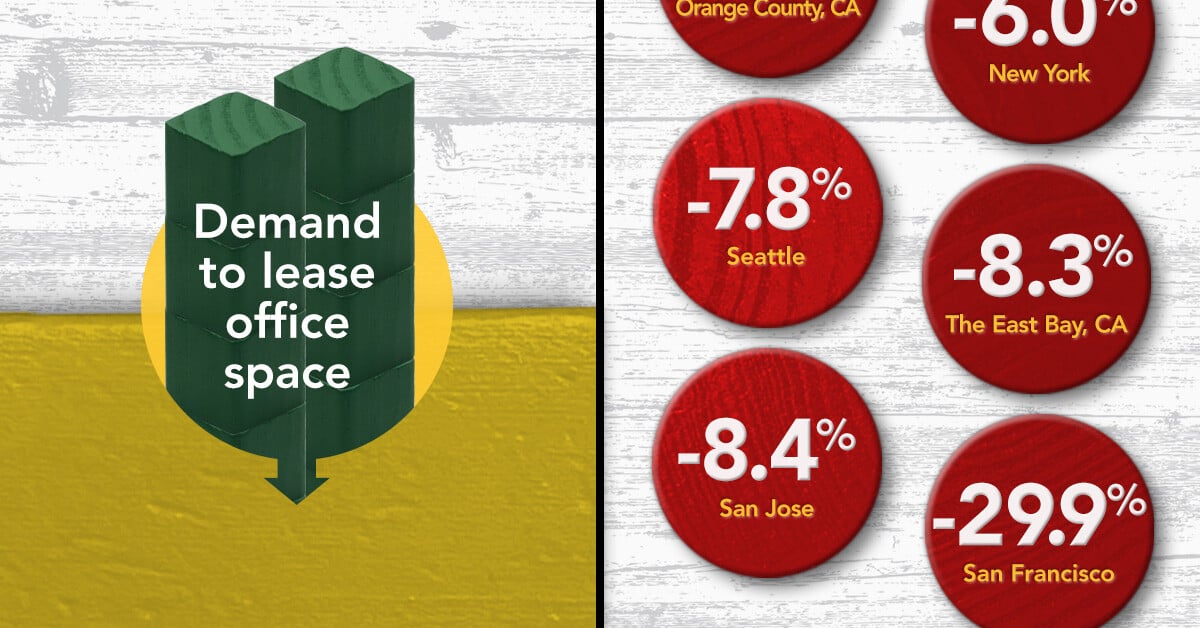

Read More ›The Great Office Downsizing Isn’t Over

It’s no secret that office properties are, on average, struggling more than other property types. With tenants requiring less office space than they did only a few years ago, office prices are down by approximately 50 percent in urban locations, compared to pre-pandemic levels. The main driver behind this trend is now a familiar story – remote ...

Read More ›CRE X-Factor - How Deep Will Office Demand Contraction Get?

The rapid and broad adoption of remote work spurred by the pandemic allowed people to work in residential space, instead of office space, at a scale unimaginable just a few years ago. This dramatically reduced the demand for office space, with particularly steep contractions in some markets. While the final depth of this demand contraction remains ...

Read More ›The Geometry of Apartment Prices: When Down Is Still Up

There weren’t many apartment units purchased in the first quarter of this year. In fact, purchases of multifamily properties dropped to the lowest levels observed since the early days of the pandemic four years ago. One clear contributor to this decline is the increased cost of capital – interest rates are considerably higher than they were ...

Read More ›CRE X-Factor - Multifamily Transaction Volume is Down, but is there a Hidden Urbanization Trend?

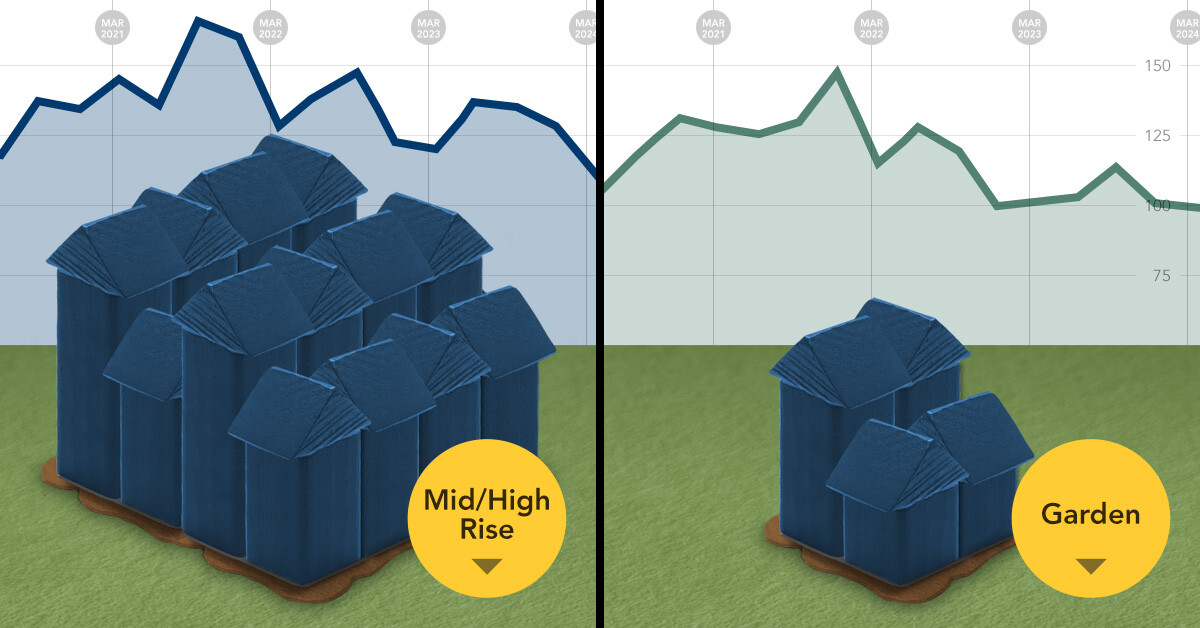

Multifamily transaction volume in the first quarter of 2024 hit the lowest levels observed since the early days of pandemic quarantines. In a recent blog post, we analyzed what types of units were trading in terms of unit quality – that is, Class A, B or C [1]. In this X-Factor, we’ll examine multifamily transaction volume, but from different ...

Read More ›What’s that Apartment Building Worth? Fewer Multifamily Transactions Drive Market Uncertainty

It’s hard to know what apartment buildings are worth nowadays. With multifamily transaction volume at its lowest point in four years, comparable transactions, or “comps”, which are often used as a reference point to estimate value, are few and far between. The limited availability of comps increases the uncertainty of property valuation estimates. ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

-1.jpg)

.jpg)

.jpg)