The recent rise in long-term interest rates suppresses commercial real estate (CRE) transaction volume in two primary ways. First, higher long-term interest rates typically lead to higher CRE mortgage rates, which make CRE deals less profitable. Lower prospective returns on CRE deals incentivize buyers to wait on the sidelines until prices fall further. Second, higher rates on Treasury securities provide investors with a fixed-income investment alternative to CRE, which also makes it easier for buyers to wait for prices to fall further. In this month’s X-Factor, we’ll investigate how these trends arrest deal flow, and what upcoming debt maturities can tell us about the pace of price discovery.

“While property prices are already falling, the meaningful amount of high-LTV debt that will come due between now and 2025 means that, absent interest rate cuts, price discovery, which at least for now equates to price declines, will likely continue for the next two-to-three years.”

Is the Market Conceding to “Higher for Longer”?

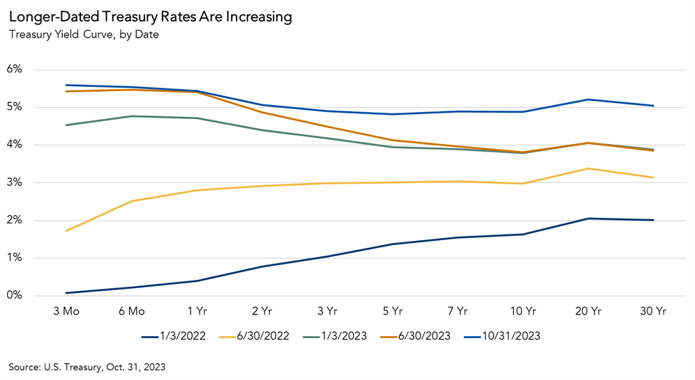

Yield curve inversion is a peculiar phenomenon. It occurs when short-term interest rates on Treasury securities move above long-term rates, which means investors are willing to accept lower rates of return in exchange for tying up their money for longer. It almost doesn’t make sense, unless the market expects a downturn in the near future that could lead to the Federal Reserve (Fed) cutting short-term interest rates.

For this reason, yield curve inversions are often seen as leading indicators for recessions.

But what if there’s no recession? Then the Fed has less incentive to cut short-term rates. Inversions can only revert in one of two ways: short-term rates must fall, or long-term rates must rise. If the Fed were to have limited incentive to cut rates for the foreseeable future, then only rising long-term rates could bring about a yield curve reversion or, more comically, “un-inversion.” This is what’s happened since this summer, leading to a flattened yield curve.

What’s the Alternative?

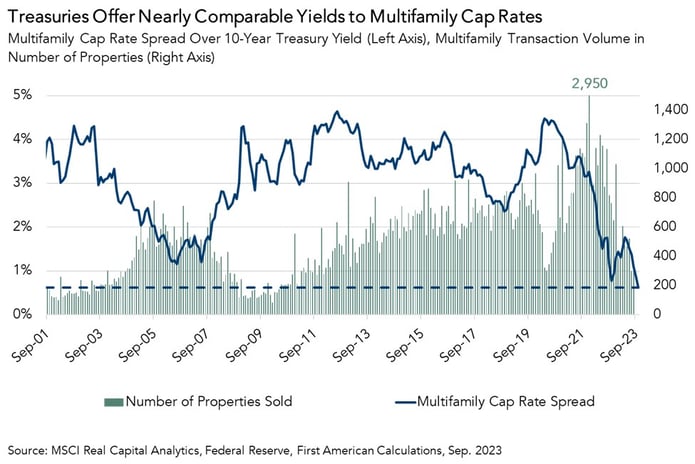

Some consider CRE investments to be “bond-like,” in that both bonds and CRE investments pay the investor some amount of income over time. From this perspective, the cap rate on a building is similar to the coupon rate on a bond. While there are some notable differences between bonds and CRE – you can’t raise the rent on bonds, bonds don’t appreciate in value if held to maturity, and you generally don’t buy bonds with leverage – Treasury bonds nevertheless offer a low-risk alternative to CRE investors who are willing to trade capital appreciation now in exchange for reliable income while they wait for property prices to fall further.

When comparing two income-oriented investments, investors will often look at the spread, or difference, between the yields. Treasury yields have increased more quickly than multifamily cap rates, bringing the spread between multifamily cap rates and the 10-Year Treasury yield to an all-time low. As long as this spread remains low, investors will be more likely to substitute prospective multifamily investments with Treasury securities or other fixed-income substitutes. Why take on the risk of a CRE investment when the “risk-free” alternative yields almost as much return?

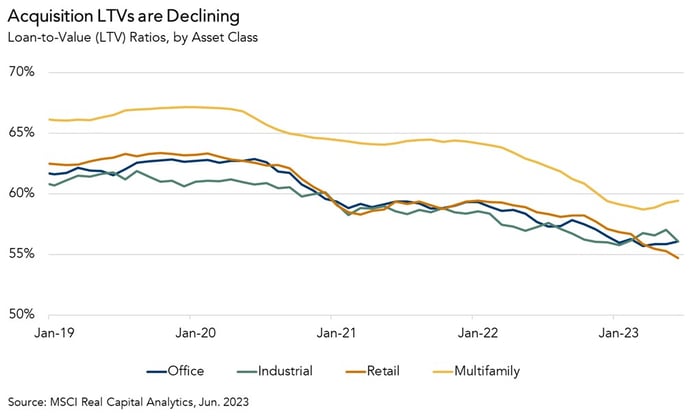

Declining Loan-to-Value Ratios Will Lead to Lower Returns

Deals that are closing right now are using less debt. Loan-to-value (LTV) ratios have declined by approximately 5 percent compared to early 2021, when interest rates were still low. Using less debt means that investors are using more of their own money, or equity, to purchase properties. More equity and less debt generally translates into lower returns on CRE investments, since the cost of equity – which is equivalent to the opportunity cost associated with an investor’s decision to tie up their own money for a period of time on one particular investment and not another – is almost always higher than the cost of borrowing. Lower prospective returns on CRE, due to higher equity requirements, is yet another factor suppressing the demand to own commercial properties and, in turn, commercial transaction volume.

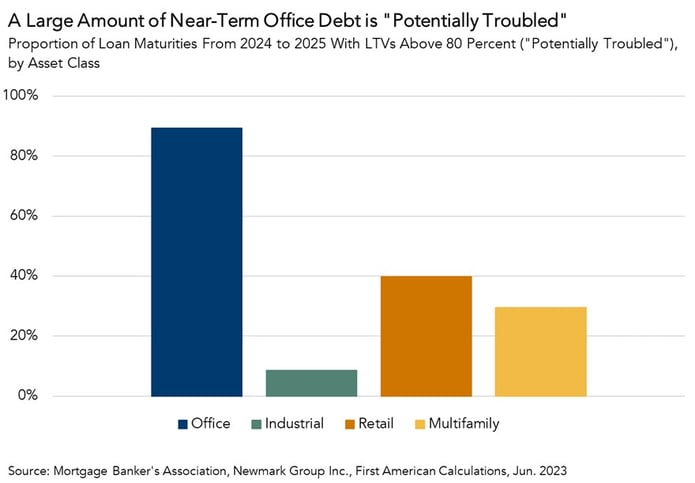

Troubled Mortgages Will Take Time to Work Out

With higher interest rates, larger equity requirements, and the availability of fixed-income investment alternatives, what has to budge before buyers come back to the market in greater numbers? Put simply, property prices have to decline far enough to offset the factors that are currently driving lower returns on commercial properties. While there are different estimates of the size of this gap in price expectations between buyers and sellers, the reality is that many sellers will only sell cheaply enough for buyers to come off the sidelines when they are forced to by their own debt maturing, due to a lack of decent refinancing alternatives.

There will be two major consequences for asset classes with a greater amount of “potentially troubled” debt coming due in the next two years. First, more troubled debt translates to longer adjustment periods for prices, since workouts, restructurings and foreclosure sales all take time. Second, asset classes with a greater proportion of troubled debt maturities are more likely to have larger price declines when transactions do materialize.

So, What’s the X-Factor?

Lower prospective returns on CRE decreases the demand to purchase investment properties. Similarly, higher yields on Treasury bonds increases their attractiveness to CRE investors as an alternative. In order to see increased transaction volume, the prospective returns on CRE investments relative to low-risk alternatives would need to increase. Higher interest rates, slower rent growth, and lenders’ terms are all fundamentally outside of an investor’s control, which leaves price paid for a property at the onset of an investment as one of the few knobs that can be turned to increase a deal’s profitability.

While property prices are already falling, the meaningful amount of high-LTV debt that will come due between now and 2025 means that, absent interest rate cuts, price discovery, which at least for now equates to price declines, will likely continue for the next two-to-three years.